The Mother Of All Stock Market Bubbles

Tyler Durden

Sun, 10/25/2020 – 10:40

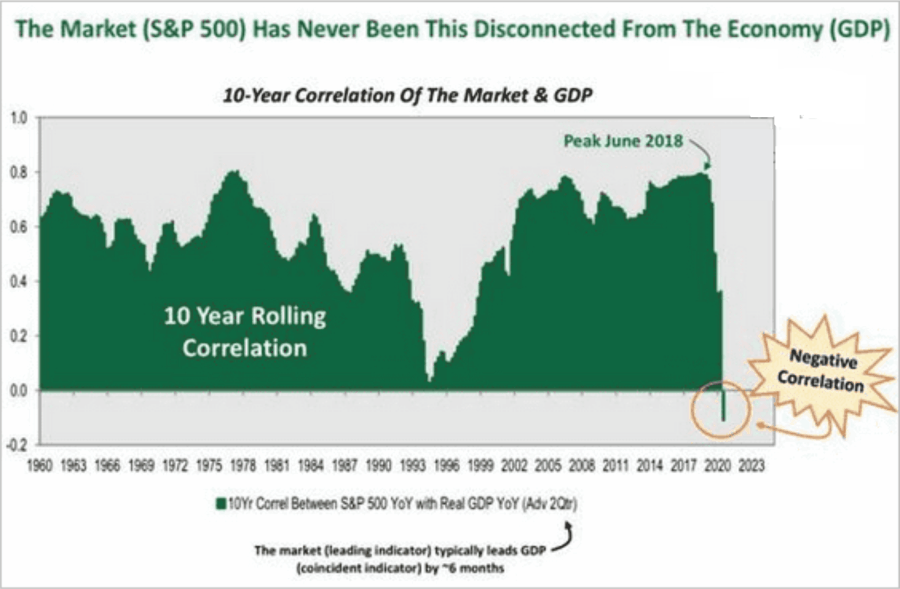

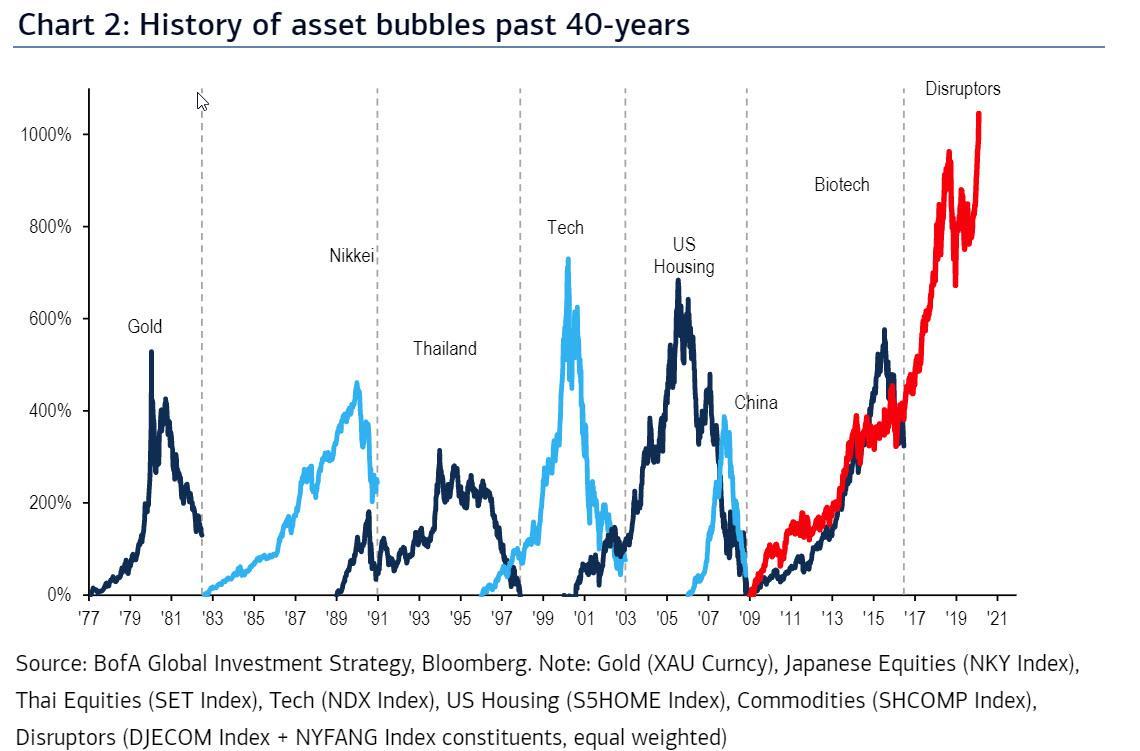

Never before in US equity market history was there as great a disconnect between economic reality and equity prices as now…

At a time of economic collapse and likely protracted US Depression, market valuations are at or near all-time highs.

David Stockman explained some of the extremes in a period he called “outright fiscal insanity.”

Count the ways:

-

Amazon, a company that didn’t exist pre-1994 is “43% of the S&P 500 consumer discretionary index.”

-

“Nearly two-thirds of the market is underperforming so far this year.”

-

“Year-to-date, only one in three stocks is actually in the green.”

-

“One in five stocks is down 50% or more from its all-time high.”

-

“The five largest stocks in the S&P 500 have a combined market cap that equals that of the ‘smallest’ 389 stocks.”

-

“Apple, Amazon, Microsoft, and Google—four companies—have a combined market cap (over $6 trillion) that is greater than the GDP of every country in the world, minus the US and China.”

-

“Tesla, having surpassed Walmart (with one-twentieth of the revenue!), has become the ninth-largest stock in the US.”

All of the above give new meaning to the term surreal.

If a Hollywood script writer presented the above scenario to a producer for filming, it would either be accepted as science fiction or rejected outright as too unrealistic. Who’d believe it?

Under these conditions, it’s impossible to invest wisely because markets are dominated by speculative excess — riverboat gambling replacing what sound investing used to be.

No matter which wing of the US one-party state wins control of the White House and/or Congress, nothing will change — things more likely to worsen until an inevitable day of reckoning arrives.

Stockman asked:

“How could the S&P 500 be trading at its highest multiple in 70 years when the growth rate of corporate earnings has been sinking for more than two decades?”

“The recent S&P index value implies a PE multiple of 36.8X—a place the S&P 500 has never been before.”

“The forward PE is now above the record high reached during the dot-com madness at the” end of the 1990s.

In calendar year 2020, corporate earnings crashed. They’re “23% (below) their 2019 peak.”

Yet market valuations are at levels that suggest double-digit earnings growth ahead — despite evidence indicating protracted economic Depression, mass unemployment, along with reduced business and consumer spending.

In today’s world gone mad, what was unimaginable during my long ago boyhood, adolescence and youth is happening in real time.