Druckenmiller Warns Electoral ‘Blue Wave’ Will Hurt Stocks Long-Term, Gold Will Be Higher

Tyler Durden

Tue, 10/27/2020 – 13:55

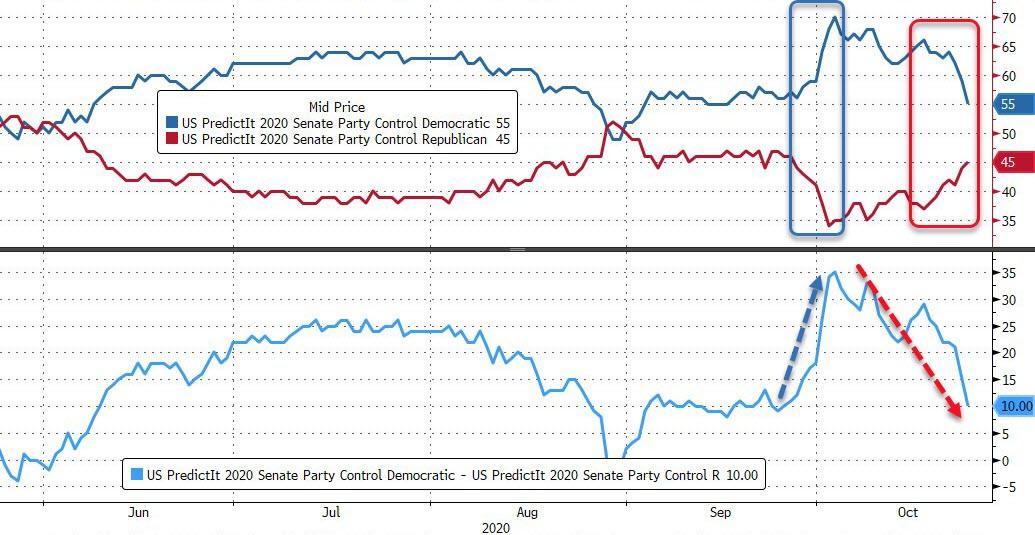

Late on Sunday we were among the first to observe that “Odds Of A “Blue Wave” Tumble, Hammering Risk.”

And BofA was worried, because since online odds still have a Biden victory as virtually assured, the reason for the slide in the chart above is the sudden surge in doubt that Democrats will wrest control of the Senate. Only without the Senate, the key anchor of the “stimulus” and “reflation” trades is gone.

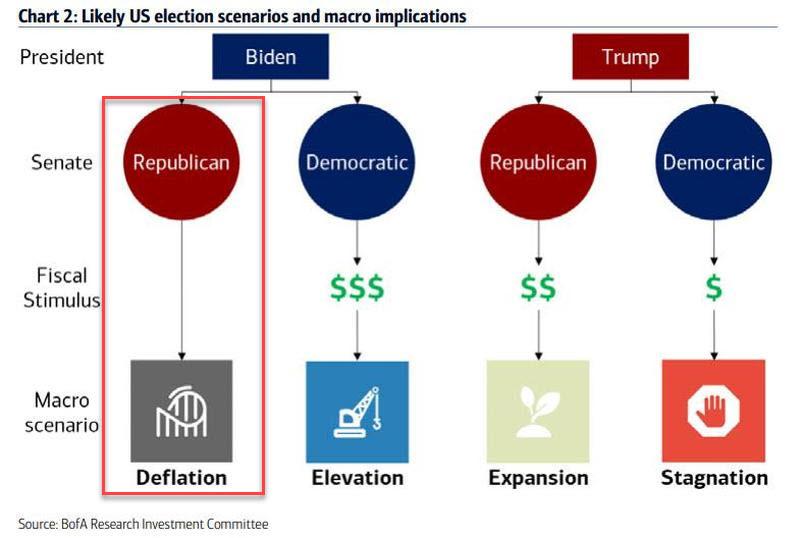

In fact, according to BofA the only scenario worse than a Trump presidency and a Democratic Congress (which results in Stagnation), is a Biden presidency and a GOP Senate, which would lead to Deflation. This is how the bank described this particular scenario:

President Biden + Republican Senate = Bearish Gridlock

If Republicans retains the Senate they are very likely to block further stimulus under a Democratic President, which BofA says would be bearish for economic growth, corporate profits and financial markets (but it would be bullish for more stimulus from the Fed). In any case, as BofA sarcastically puts it, “after $21tn of monetary & fiscal stimulus in 2020, $0 of follow-on support would be deflationary.”

Indeed, political parties historically have used obstructionist tactics when out of power to thwart key legislation, most often through the “rediscovery” of commitments to “fiscal discipline”. As an example, BofA cites the budget austerity during 2012-2015 as a major reason for the slow economic recovery.

Such a scenario would mean a deflationary reset, as “investors should prepare for lower returns and higher volatility. Raise cash and buy Treasuries, munis, and high-quality corporate bonds.”

Then, earlier this week, JPMorgan flipped the latest Wall Street narrative – the one where a Joe Biden victory and a Blue Sweep would be the best outcome for stocks – on its head, instead now suggesting that a Trump victory is the “Most Favorable Outcome”, and would push the S&P to 3,900.

Goldman then jumped on the bandwagon, warning that a Blue Sweep is no longer guaranteed.

But, even if a ‘blue wave’ does occur, billionaire investor Stan Druckenmiller warns that the specter of higher taxes and inflation will be a drag on equities in coming years.

Speaking at the Robin Hood Investors Conference, the infamous short-seller warned:

“We have borrowed so much that I’m skeptical that three to five years out that equities will give us any kind of return.”

He does see one asset higher, however, predicting that in four years, inflation will top 4%, gold prices and bond yields will be higher, and the U.S. unemployment rate will be about 7%.