Platts: 5 Commodity Charts To Watch This Week

Tyler Durden

Mon, 11/02/2020 – 14:15

Via S&P Global Platts Insights blog,

A triple bill of European power and gas market trends, kicks off this edition of Commodity Tracker ahead of S&P Global Platts Analytics’ Virtual Client Seminar, London. Our news and pricing editors also look at the plight of Australian refineries, and developme nts in the met coal market amid high Chinese steel output.

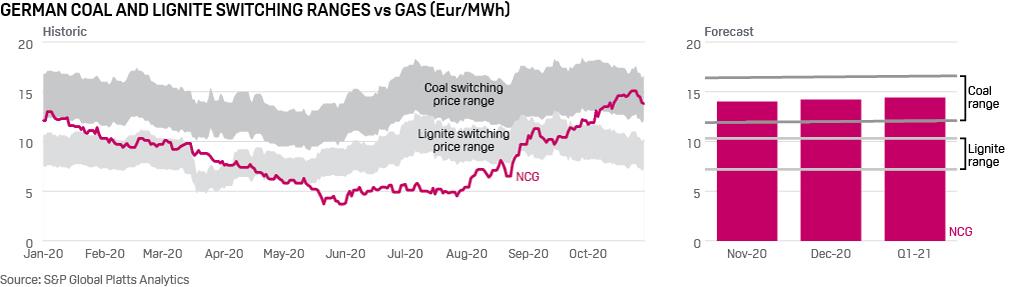

1. After lignite, coal increasingly in the money in Germany

What’s happening? Recent movements in commodity prices have consolidated the trend that emerged in September, when high gas prices brought German lignite back in the money, and have also started to shift the outlook for coal plant: the most efficient are now moving ahead of mid-level gas ones in the supply stack.

What’s next? The improved outlook for coal plants translates into a month-on-month uplift of 25% in S&P Global Platts Analytics’ forecast for coal generation across western Europe over the winter, with limited upside risk at this point given the recovery in French nuclear and above-average European hydro stocks, but material risks to the downside. The announcements of new coronavirus-related restrictions in France, Italy, Belgium and Germany at the end of the October could lead to power demand losses that are likely to affect coal dispatch more than gas or lignite, with the easing of tightness in the European coal supply fundamentals offering limited support to balance it.

2. EU CO2 caught between short-term fundamentals, long-term reform

What’s happening? The EU carbon price fell to a four-month low of Eur22.88/mt Oct. 28. The recent weakness was driven by worries over demand due to the renewed coronavirus lockdowns across Europe, which dragged the wider energy complex lower, as well as strong carbon auction supply from governments in the fourth quarter.

What’s next? Traders will be watching closely this week to see if the lower prices attract buyers back into the market, with carbon still caught between short-term weak demand and expectations of longer-term tighter supply as Europe pushes for stronger emissions targets out to 2030. Seasonal factors could also come to the fore, with any arrival of colder winter weather likely to provide support for power, generating fuels and carbon.

3. European gas markets eye second coronavirus wave, LNG availability

What’s happening? European spot natural gas prices hit all-time lows in the aftermath of the first wave of coronavirus, with storage availability easing intense pressure on consumption demand. According to Gas Infrastructure Europe, gas storage facilities were 70% full at the time, climbing to 95% as of late October.

What’s next? With tightened lockdowns introduced many major European economies including the UK, Germany and France, a second wave of coronavirus could again hit European gas prices, but this time without storage availability to support them. Meanwhile, LNG procurement will also be a factor to watch, with questions around the US’ ability to supply marginal demand in both Europe and Asia through the northern hemisphere winter.

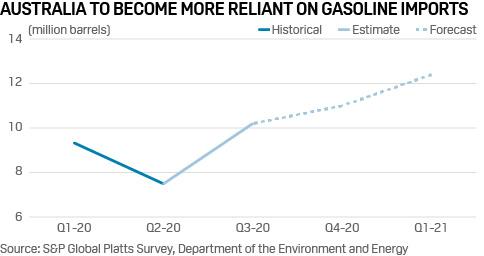

4. Australian refinery troubles to reverberate in regional trade flows

What’s happening? Australian refineries are feeling the squeeze due to long-term competition from large-scale Asian and Middle-Eastern facilities, and reduced mobility this year due to the global pandemic. BP Australia said Oct. 30 it would shut its 146,000 b/d Kwinana refinery in Western Australia and convert it into a fuel import terminal. Ampol, formerly Caltex Australia, is undertaking a “comprehensive review” of its 109,000 b/d Lytton refinery, and Viva Energy’s 120,000 b/d Geelong refinery is also under review.

What’s next? Australia is expected to become even more reliant on Asian oil products, and Asian fuel exporters including Malaysia’s Petronas, South Korea’s SK Energy and GS Caltex said they aim to boost oil product exports to consumers in Oceania. On the flipside, crude oil exports from Malaysia, could take a hit as Australian buyers of its light sweet crude grades struggle to run their refining operations. Australia’s light sweet crude imports from Malaysia, one of its major oil suppliers, is expected to tumble to around 22 million barrels for the full year, down 33% from 2019, according to Singapore-based low sulfur crude traders and Australian fuel distributors surveyed by S&P Global Platts.

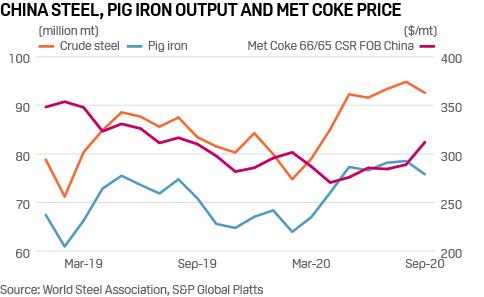

5. Met coal lifts as Chinese steel output rises, outlook uncertain

What’s happening? Chinese steel and pig iron production has risen since the second quarter of 2020 on higher demand from infrastructure and construction, supported by stimulus measures. Met coke prices in China have rebounded since April, with export pricing tracking domestic demand from steelmakers, even as demand fell outside China following coronavirus restrictions in India, Brazil and Europe.

What’s next? China’s steel output growth may have peaked in September, with expectations that further increases to rates may be limited as stimulus eases and winter limits construction. Met coke prices remain high as China may stabilize at higher rates of steel production. Chinese coke exports are unlikely to attract growing interest at current prices due to currently lower seaborne coking coal prices and potential for major producers in Colombia and Poland to increase coke supplies into the Americas, Europe and India. An uncertain outlook for steel demand and prices outside China on the lingering effects of the coronavirus may limit forward demand.