“Gridlock = Goldilocks” Means The Second Wave Of 2020 QE Has Begun

Tyler Durden

Fri, 11/06/2020 – 17:20

Gridlock = Goldilocks.

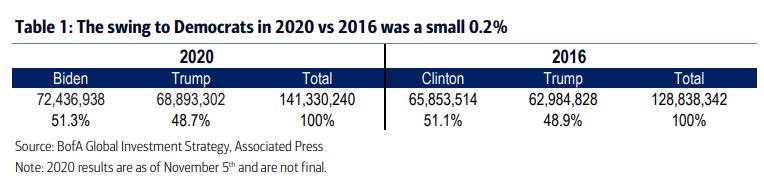

That’s how BofA CIO Michael Hartnett summarizes his big picture view of the post-election market, writing that while the 2020 election saw a small 0.2% electoral “swing” to Democrats, Republicans are likely hold Senate which is the most important result for investors as it means lack of “Blue Wave”, which also likely means no tax hikes, no $3 trillion fiscal excess, no MMT, no disorderly rise bond yields.

It also means much more central bank action is coming in lieu of a “big” fiscal deal, which as McConnell hinted earlier today, is simply not coming any more, or in other words…

Gridlock = QE

Basically, according to Hartnett less fiscal stimulus means either

- more monetary easing,

- weaker US dollar,

- most likely both;

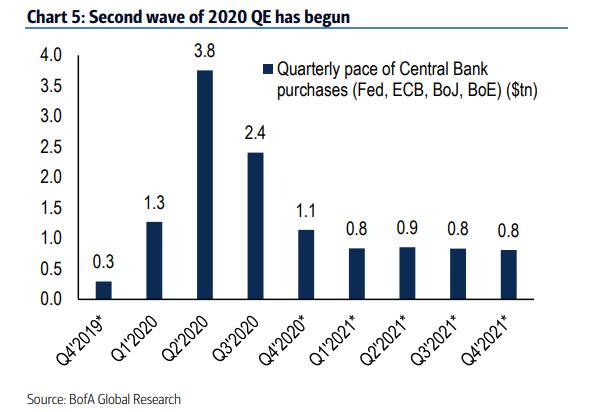

Indeed, the second wave of central bank easing is already underway with new announcements by RBA/BoC/ BoE…

… meaning financial asset purchases of $1.1tn in Q4’20 and $0.8tn in Q1’21 are set to rise.

This according to BofA, is “QE unambiguously bullish for deflation assets” even as China tech stocks are coping with higher rates.

This was obvious in the post-election price action:

- Bitcoin surges >$15000 (2x YTD)

- 30-year US Treasury yield plunge to 1.5%, but does not break key resistance level,

- bull market leadership of credit & tech close to all-time highs (e.g. LQD, NDX) and China tech maintains bid despite Ant Group IPO postponement;

- weak US$ (DXY testing 92 floor) & global cyclicals bid (EEM, HYG);

- no bid for distressed cyclicals (banks, energy).

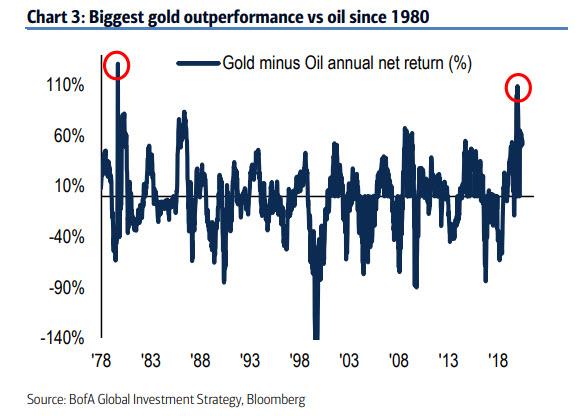

And then there is the best deflation (or is that inflation) hedge of all: gold. Not only is gold the best performing asset class of 2020 (ex cryptos of course)…

… but the price of gold just scored the best outperformance vs. oil price in 2020 biggest since 1980.

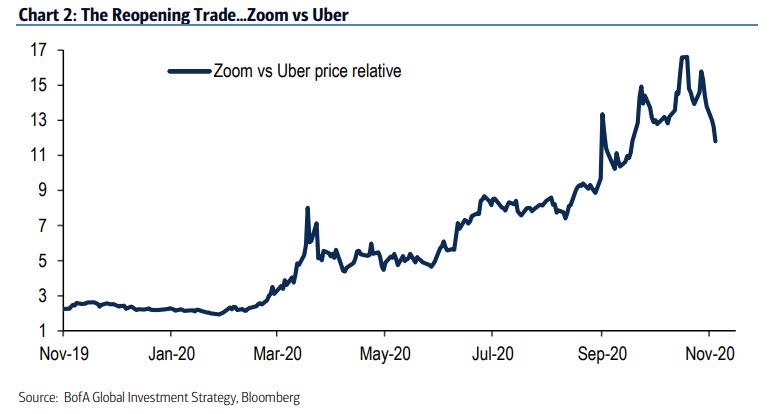

So what about the reflation rotation – is that dead? Well, according to BofA, yes… for the time being: global macro data has leveled off after V-shaped recovery even though high household savings + inventory restocking strong enough backdrop to boost “global cyclicals” (e.g. HY bonds & EM) & “reopening cyclicals” (e.g. Zoom vs Uber).

But one key catalyst is missing: a global vaccine/US fiscal stimulus needed before “distressed cyclicals” catch bid (e.g. banks/energy.

Putting all this together leads to the following “absolute” view: according to BofA, the surge of IPOs, SPACs, M&A, bond issuance, US housing, narrow leadership are all classic “toppy” signs… but the combo of political/fiscal gridlock and “whatever-it-takes” central bank liquidity means the bank’s Q4 SPX 3300-3600 range “more likely broken on upside.” Still, Hartnett says that he “remains sellers-into-strength and into a likely vaccine in coming months.”

As for the “relative” view, Hartnett is a buyer of global cyclicals (e.g. EM) and reopening trades on the positiveve impact from rates maxing out relative to the positive impact from cyclical EPS cyclical just beginning.

Why? Because the secular themes are very inflationary:

- “smaller world” (China war, reshoring),

- “bigger government” (monetary/fiscal intervention),

- “dollar debasement” (digital currencies);

… but above all, the key driver to rotation out of growth and into value remains Treasury yields (in Q4 GT30 staying >1.5%, in 2021 GT30 >2%).