Republicans Spark Sentiment Slump In Early November As ‘Hope’ Is Hammered

Tyler Durden

Fri, 11/13/2020 – 10:08

Preliminary November sentiment from University of Michigan’s survey, was expected to rise very modestly from October with expectations expected to print marginally lower. However, UMich sentiment slumped across the board with headline sentiment slipping from 81.8 to 77.0 (82.0 exp)

-

Current economic conditions index fell to 85.8 vs. 85.9 last month

-

Expectations index plunged to 71.3 vs. 79.2 last month

Now that is not a ‘v’-shaped recovery…

Source: Bloomberg

The outcome of the presidential election as well as the resurgence in covid infections and deaths were responsible for the early November decline.

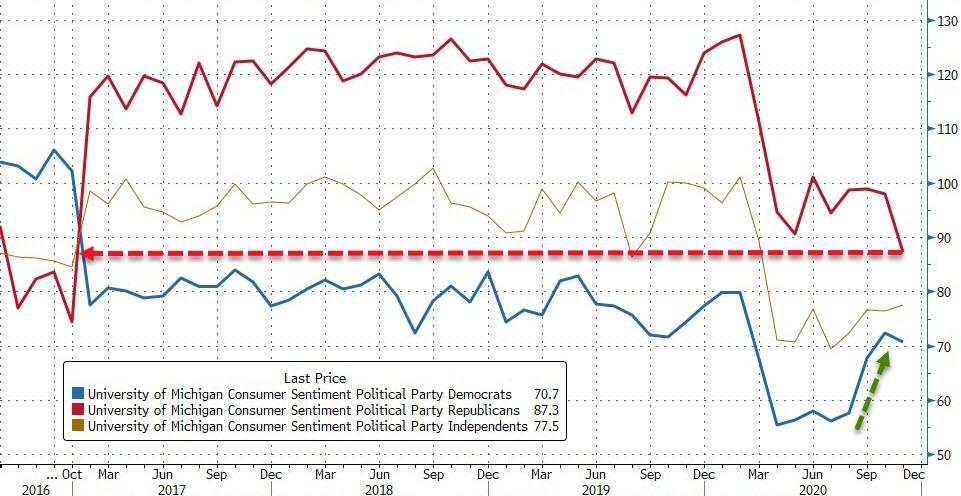

Republicans dominated the slump in sentiment, tumbling to pre-Trump levels…

Source: Bloomberg

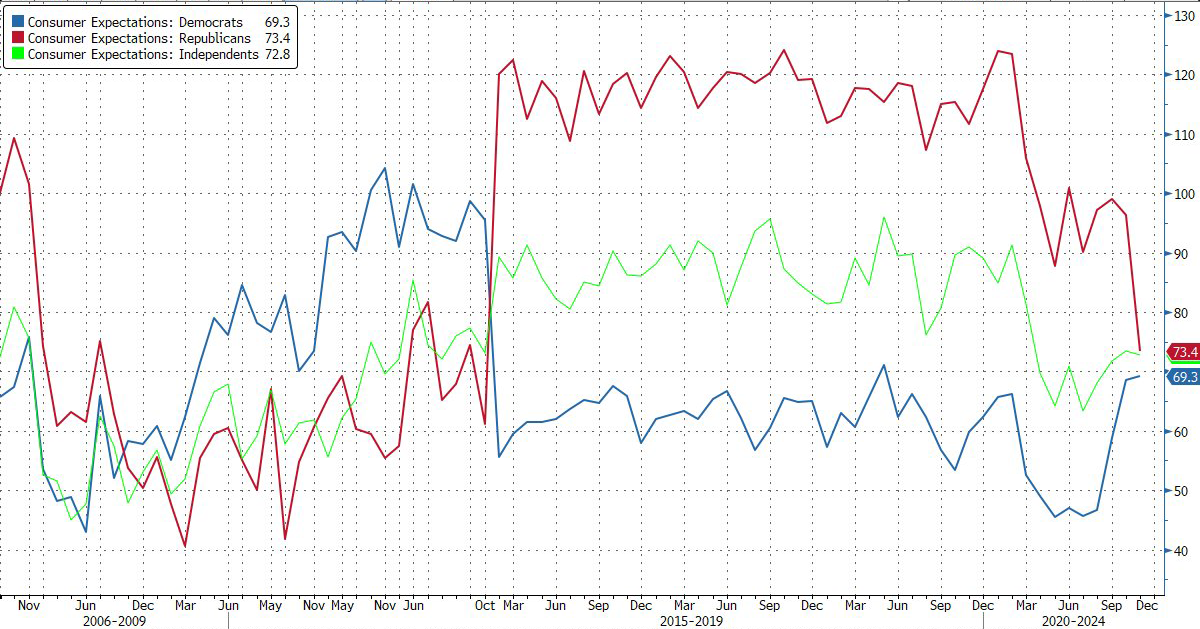

As UMich writes, interviews conducted following the election recorded a substantial negative shift in the Expectations Index among Republicans, but recorded no gain among Democrats.

It is likely that Democrats’ fears about the covid resurgence offset gains in economic expectations: 59% of Democrats reported that their normal life had changed to a great extent due to the coronavirus compared with just 34% among Republicans. The gap in expectations closed somewhat due to the coronavirus and the partisan shift in expectations that began well before the election. Note that Republicans now voice the least favorable economic expectations since Trump took office, and Democrats have voiced more positive expectations (see the chart below).

In the months ahead, the partisan gap is likely to enlarge, although the gains will be limited until a potential vaccine is approved and widely distributed.

Buying conditions for vehicles and large household durables edged upward in early November due to more favorable views among households with incomes in the top third, while modest declines were recorded among households with incomes in the bottom two-thirds.

Net declines in household incomes were reported in early November for the first time since March 2014, with the largest net declines reported by lower income households and those aged 65 or older.