Futures Rebound To Record High As Crude Spikes Ahead Of Jobs Report

Tyler Durden

Fri, 12/04/2020 – 08:05

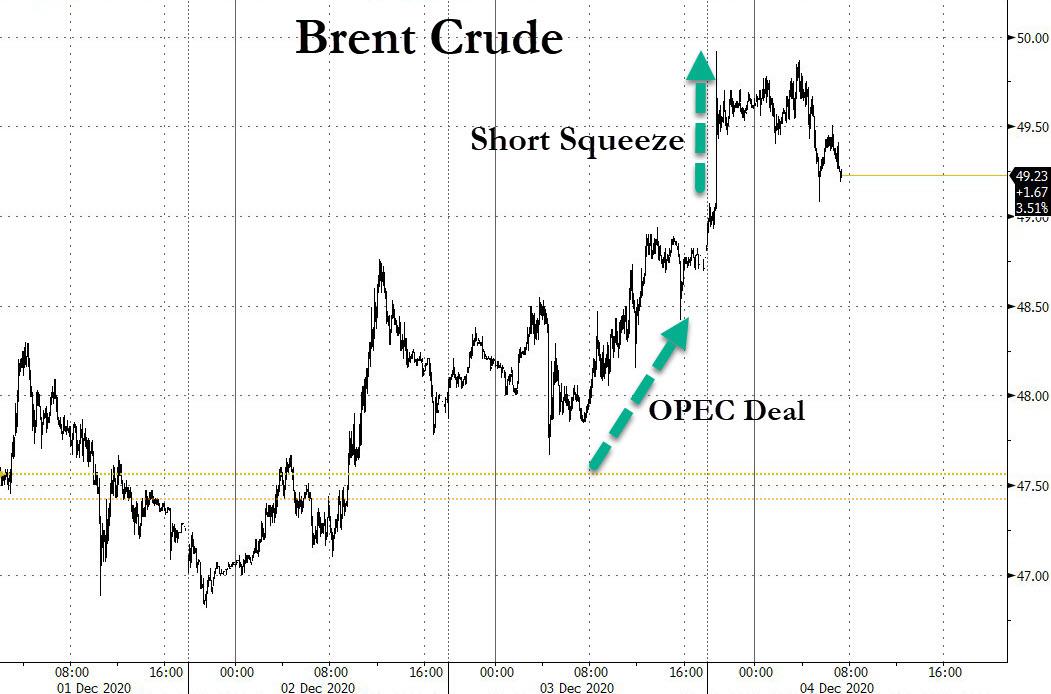

Another day, another record high in the S&P, with S&P futures rising as high as 3,680 and up 0.3% last, as investors await the November payrolls data which is expected to show a +470K print, a sharp slowdown from October’s +638K due to the spike in covid cases and the return of lockdowns (full preview here). The dollar continued to slide, hitting a fresh 2.5 year low, headed for its biggest weekly decline in five, while Treasury yields nudged higher; but the highlight of the session was the sudden short squeeze in oil just before 9pmET which sent Brent to nearly $50, a nine-month high after Thursday’s OPEC+ deal.

Shares of U.S. carriers and cruise lines including American Airlines, Norwegian Cruise Line and Carnival Corp were up between 2% and 3.3% in premarket trade. Pfizer fell 0.8%, extending declines from the previous session when it flagged challenges in supply chain for raw materials used in its COVID-19 vaccine. Oil majors Exxon Mobil Corp and Chevron Corp rose about 1.5% each, boosted by a rise in crude prices as major producers agreed on a compromise on supply.

Despite a late Thursday wobble which sent stocks tumbling after Pfizer warned it was behind schedule on its 2020 vaccine deliveries, futures stabilized and were supported by renewed optimism that a fiscal stimulus bill was imminent as a bipartisan, $908 billion coronavirus aid plan gained momentum in the U.S. Congress after conservative lawmakers expressed their support.

“Positive vaccine and fiscal progress” will outweigh near-term uncertainties for rallying stock markets, according to Mark Haefele, chief investment officer at UBS Global Wealth Management.

Monetary stimulus is coming too: the Fed also expected to tweak guidance on its asset-purchase scheme later this month and expand the maturity of its purchases, while the ECB will likely increase its bond buying by at least €500BN next week.

“We expect major central banks to remain very accommodative over the coming quarters as output remains below its pre-crisis level – and well below its pre-crisis trend – and inflation remains subdued,” said Elia Lattuga, co-head of strategy research at Unicredit. In short: buy everything.

The MSCI index of world shares ticked up 0.17% to within a fraction of the previous day’s record high. It is set for a fifth straight week of gains, which have seen it surge 15%.

In Europe, the Stoxx 600 rose 0.3%, with energy companies leading the index higher; U.K. equities outperformed as negotiators edged closer to a Brexit trade agreement. German industrial orders rose 2.9%, more than the 1.5% expected, in October raising hopes the manufacturing sector in Europe’s biggest economy started the fourth quarter on a solid footing during a second wave of the COVID-19 pandemic.

Earlier in the session, Asian shares hit a new record high overnight as the MSCI Asia Pacific Index added 0.5%. MSCI’s broadest index of Asia-Pacific shares outside Japan rose 0.82%, surpassing its Nov. 25 high, led by gains in the tech sector. Japan’s Nikkei dipped 0.22% on profit-taking. China’s Shanghai Composite closed fractionally in the green, with Chinese consumer stocks including liquor producers rallying on Friday as investors rotate from energy stocks and financials in search of companies that are seen to have better growth potential. A sector gauge for consumer staples gained as much as 2.6%, best on CSI 300 Index and poised to close at a fresh record high. Energy and financials are the worst performers among all 10 industry groups on CSI 300 on Friday; they were among most favored stocks in past month.

In rates, treasury yields were higher across the curve after climbing during European morning amid measured gains for risk assets. Yields are higher by 2bp-3bp from 10- to 30-year sectors, steepening 2s10s by more than 2bp, 5s30s by more than 1bp; the 10Y year around 0.93% is ~9bp higher on the week, most of which occurred on Dec. 1 as fiscal stimulus talks gained momentum; it peaked at 0.964% on Dec. 2. That said, price action was minimal on low volume during Asia session following Thursday’s late-day gains on report Pfizer cut vaccine rollout target. German government bond yields ticked down to -0.557%.

The big overnight move was in the commodity complex, where oil prices got an additional lift after OPEC and Russia agreed to reduce their deep oil output cuts from January by 500,000 barrels per day despite failing failed to find a compromise on a broader and longer-term policy. OPEC+ agreed to cut production by 7.2 million barrels per day, or 7% of global demand from January, compared with current cuts of 7.7 million barrels per day. Late in the Thursday session an unexpected spike higher in Brent sent the benchmark just cents away from $50.

In Fx, the broadly upbeat mood saw the U.S. dollar continue to lose ground to its major peers. “One of the elements of the better news we are getting, for instance the vaccine, is to increase the attraction of risky assets and that reduces the appetite for the U.S. dollar,” said Eric Brard, head of fixed income at asset manager Amundi. The euro was among the top performers, along with Scandinavian currencies; the common currency advanced a fourth day versus the dollar to a fresh 2020 high of $1.2177. The pound rose 0.2% to $1.3475, a shade below recent one-year highs, with traders hoping for a trade deal between the European Union and Britain.

Michel Barnier, the EU’s chief negotiator, said it was an important day in the talks as he left his hotel in London, while his planned update for national envoys to the bloc was cancelled due to “intensive negotiations”, an EU spokesman said. According to Reuters, a negotiated deal was “imminent” and expected before the end of the weekend, barring a last-minute breakdown in talks, an official with the bloc told Reuters. But a British minister said the talks were in a difficult phase.

The yen weakened after reaching a two-week low Thursday while the Australian and New Zealand dollars retreat from multi-year highs on unwinding of long positions ahead of U.S. employment data. Meanwhile, emerging markets continued their gains. The Mexican peso, Brazilian real, Turkish lira, South African rand, Russian rouble and Polish zloty have all jumped 7% to 11% over the past month, adding to 5%-12% leaps in China, Taiwan and Korea’s currencies since June.

Today’s jobs report will show that job gains probably slowed to 475,000 in November from 638,000 the month before according to economists. The unemployment rate is expected to nudge down to 6.8%. But the data only reflect through mid-month, meaning jobs lost to subsequent lockdowns won’t show.

Looking to the day ahead, the main highlight will be the aforementioned US jobs report for November. Other data highlights however will include German factory orders for October, along with the November construction PMIs from Germany and the UK. In the US, there’s also data on October’s trade balance and factory orders. On the central bank front, we’ll hear from the Fed’s Bowman and Kashkari, along with the BoE’s Saunders and Tenreyro.

Market Snapshot

- S&P 500 futures up 0.3% to 3,675.25

- MXAP up 0.5% to 194.11

- MXAPJ up 0.8% to 641.77

- STOXX Europe 600 up 0.2% to 392.46

- German 10Y yield fell 0.4 bps to -0.56%

- Euro up 0.2% to $1.2166

- Italian 10Y yield fell 3.0 bps to 0.491%

- Spanish 10Y yield fell 0.7 bps to 0.064%

- Nikkei down 0.2% to 26,751.24

- Topix up 0.04% to 1,775.94

- Hang Seng Index up 0.4% to 26,835.92

- Shanghai Composite up 0.07% to 3,444.58

- Sensex up 0.9% to 45,047.89

- Australia S&P/ASX 200 up 0.3% to 6,634.10

- Kospi up 1.3% to 2,731.45

- Brent futures up 1.4% to $49.39/bbl

- Gold spot little changed at $1,841.90

- U.S. Dollar Index down 0.2% to 90.57

Top Overnight News from Bloomberg

- Hungary’s prime minister said he won’t end his block on the European Union’s $2.2 trillion budget and coronavirus-rescue package unless Brussels relents in tying spending to upholding democratic values, denting hopes for a deal at a summit next week

- Germany agreed to extend a backstop for commercial credit insurers by six months to keep trade flowing and prevent bankruptcies as the economy is hit by a second wave of the coronavirus pandemic

- Bank of England policy maker Michael Saunders said there’s some room to cut interest rates further and bond buying by itself may not be the best option

- The U.K. Treasury is getting almost 10 billion pounds ($13 billion) a year in interest on its own debt under the Bank of England’s bond-buying plan

- Chart patterns, including the so-called inverted hammer and the Elliot Wave, show the euro is likely to breach the all-important $1.25 level. The currency is also being buoyed by a vote of confidence in the European Union’s timely response to the pandemic, as well as a revival in reflation trades that have kept the dollar under pressure

Global market snapshot courtesy of Newsquawk

Asia-Pac bourses traded mixed following a similar performance stateside where stock markets stalled after notching fresh record levels, amid tentativeness heading into today’s NFP data and with a bout of pressure before the Wall St closing bell after Pfizer cut its vaccine rollout targets for this year by half due to supply chain issues, although it still expects over 1bln doses rolled out in 2021. ASX 200 (+0.3%) was positive as financials lead the mild gains across cyclicals but with upside capped after weaker than expected retail sales data and as the mining sectors reversed yesterday’s outperformance. Nikkei 225 (-0.2%) was pressured as exporters suffered from recent currency inflows and with participants awaiting PM Suga’s press conference in which he is expected to discuss measures against the coronavirus, while KOSPI (+1.3%) resumed its outperformance with the index and its largest-weighted constituent Samsung Electronics extend on record levels as the tech giant continued to benefit from the firm outlook for the chip industry. Hang Seng (+0.4%) and Shanghai Comp. (+0.1%) were lacklustre after another consecutive liquidity drain by the PBoC and after the US added four Chinese companies to the Department of Defense blacklist for alleged ties with the Chinese military which include SMIC, CNOOC, China Construction Technology Co. and China International Engineering Consulting. Conversely, the latest reports surrounding Huawei were of a more constructive nature with the US reportedly in talks with Huawei’s CFO on resolving criminal charges which would allow her to return home from Canada for admitting wrongdoing and after Japanese chipmaker Kioxia received permission from the US to export some products to Huawei, while Chinese stocks then pared losses in late trade. India’s NIFTY (+0.8%) also gained overnight after the RBI rate decision in which the central bank kept rates unchanged as unanimously expected but also maintained its accommodative stance and announced quasi-measures to support stressed sectors. Finally, 10yr JGBs eked minimal gains with initial support after recent upside in T-notes, weakness in Japanese stocks and the BoJ’s presence in the market for JPY 540bln of 5yr-25yr JGBs, but with advances limited by a gravitational pull towards the key 152.00 level.

Top Asian News

- Malaysia’s Top Pension Fund Sees Minimal Hit From Extra Outflows

- Strongest Taiwan Dollar Since ‘97 Shows Central Bank Easing Grip

- Qatar Says Doesn’t Plan Normalization With Israel For Now

- Next Digital Soars in Hong Kong After Jimmy Lai’s Arrest

In Europe, major bourses trade with modest gains across the board (Euro Stoxx 50 +0.2%) following a lukewarm cash open, and with positive Brexit newsflow briefly feeding impetus to risk appetite as an EU official stated that a Brexit trade deal is “imminent” and expected by the end of the weekend barring a last-minute breakdown in discussions. That being said, markets now await the UK’s take on the state of talks to see if this optimism is reciprocated or downplayed, whilst reports overnight suggested negotiations took a step back, and France reaffirmed that it will veto an unsatisfactory proposal. Nonetheless the region was provided with a lift on the headlines, although EZ indices have since pared back the move, whilst the FTSE 100 outpaces peers with added tailwinds from the post-OPEC crude rally (see Commodities section), which sees Oil & Gas clearly outperforming. Delving deeper into sectors, the overall picture is mostly positive as with some cyclical sectors towards to the top of the board, albeit sectors do not provide a clear risk profile as Retail, Financials and Chemicals reside at the bottom of the pile. The Travel & Leisure sector meanwhile remains a gainer, underpinned by vaccine euphoria whilst a positive Fraport (+3.6%) broker move lends a hand. Elsewhere, Cineworld (-10%) plumbed the depths at the open as Warner Bros plans to debut movies online and in cinemas simultaneously next year, thus providing less incentive for consumers to step into cinemas. Finally, AstraZeneca (+1.2%) is firmer with some pointing to the Pfzier vaccine rollout target cut as a positive for the UK pharma giant’s candidate.

Top European News

- ECB Seen Extending and Boosting Stimulus to Battle Longer Crisis

- Asda Mulls Sales of Gas Stations to EG Group Amid Mega Buyout

- EU’s Barnier Not Returning to Brussels, Sky’s Rigby Says

- Defiant Orban Says Hungary Won’t Blink in EU Budget Standoff

In FX, it would be far too premature to draw any conclusions or contend that the tide has turned for the Greenback, but it has pared declines and the DXY is holding above a fractionally higher 90.538 low compared to yesterday’s 90.504 base amidst tentative recovery gains. However, the Buck’s mini revival owes much to weakness or a loss of momentum elsewhere and it remains on the back foot against certain major and EM currencies, such as the Pound, Euro and Yuan. Ahead, NFP may provide the Dollar with more lasting or sustained respite, but only if the BLS report is bad and sparks a pronounced risk-off market reaction, perversely – for a full preview of the jobs release see the Newsquawk Research Suite. Back to the index, and a subsequent fade from 90.729 leaves the DXY meandering around 90.600.

- GBP/EUR/CNH – As noted above, all bucking the broad trend as Cable rebounds firmly from a stop-fuelled drop towards 1.3300 and Eur/Gbp recoils from a fix-related pop above 0.9065 on the back of reports via an EU official intimating that a trade deal with the UK is ‘imminent’, barring a last minute breakdown in discussions. Cable retested offers into 1.3500 in response, albeit somewhat belatedly awaiting any rebuttal from the UK side, while the cross is back under 0.9050 and perhaps wary about the prospect of France pouring cold water on the seemingly very positive update. However, the Euro is eyeing Thursday’s apex vs the Dollar circa 1.2175 and the offshore Renminbi has tested 6.5150 compared to the PBoC’s 6.5507 midpoint fix for the Cny to set fresh multi-year peaks.

- NZD/AUD – The Kiwi has lost its admittedly loose grip on the 0.7100 handle against its US counterpart and a bit more traction vs the Aussie as Aud/Nzd consolidates above 1.0500 and Aud/Usd retains 0.7400+ status even though retail sales rose slightly less than forecast in October.

- CAD/CHF/JPY – Relatively strong and perhaps psychologically significant retracements in crude prices (WTI and Brent beyond Usd 46/brl and Usd 49/brl respectively) could be keeping the Loonie propped on the 1.2850 axis before the Canadian-US jobs data showdown, while the Franc is still hovering close to 0.8900 and Yen sticking in close proximity to 104.00, albeit off best levels.

In commodities, WTI and Brent futures are firmer after OPEC+ ministers agreed to increase production by 500k BPD beginning in January. The ministers will meet each month to assess market conditions and decide on further production adjustments for the following month with further adjustments not to exceed 500k bpd, while they agreed to extend compensation cuts to the end of March. Although the decision at face value seems to be sub-par vs. expectations heading into the meeting, the consensus reached among producers for policy flexibility in the upcoming months has provided the crude markets with impetus, with oil ministers stating that upcoming meetings will not necessarily only take decisions on production increases, but could also decide on output decreases, if the market requires it. WTI Jan and Brent Feb have waned off best levels in recent trade, with no crude-specific headlines or developments to prompt the modest pullback, but more-so a pullback in risk. Nonetheless, the former holds onto its USD 46/bbl handle (vs. low USD 46.61/bbl) and the latter north of USD 49/bbl (vs. low 48.84/bbl). Elsewhere, precious metals are uneventful with spot gold and silver contained under 1850/oz and above USD 24/oz respectively. In terms of base metals, Dalian iron ore prices hit a record high to notch its fifth week of gains, bolstered by China’s demand, Vale’s guidance cut and the softer Dollar, whilst LME copper meanwhile hit eight-year highs.

US Event Calendar

- 8:30am: Change in Nonfarm Payrolls, est. 475,000, prior 638,000

- 8:30am: Unemployment Rate, est. 6.75%, prior 6.9%

- 8:30am: Average Hourly Earnings MoM, est. 0.1%, prior 0.1%; YoY, est. 4.2%, prior 4.5%

- 8:30am: Trade Balance, est. $64.8b deficit, prior $63.9b deficit

- 10am: Factory Orders, est. 0.8%, prior 1.1%; Factory Orders Ex Trans, prior 0.5%

- 10am: Durable Goods Orders, est. 1.3%, prior 1.3%; Durables Ex Transportation, est. 1.3%, prior 1.3%

- 10am: Cap Goods Orders Nondef Ex Air, est. 0.7%, prior 0.7%; 10am: Cap Goods Ship Nondef Ex Air, prior 2.3%

DB’s Jim Reid concludes the overnight wrap

Happy Friday to all and hope you had a good week. Last night saw Jim attend a client virtual wine-tasting event in New York, which was streamed direct to his Surrey house via Zoom. Don’t ask me how it worked since I haven’t done one either, but because of this he asked me yesterday afternoon if I could step in to send out this morning’s email. As it happened, yesterday was also my birthday, and for the first time in my career I didn’t take it off work, so this request came as something of an unexpected present. Given the alarm clock I had to set this morning however, I may have learnt my lesson for next year.

While I was celebrating my birthday, markets were also celebrating as US equities looked set to rise to fresh all-time highs on hopes of a stimulus package in the coming days. However, late in the session a Dow Jones report came out saying that Pfizer expected to ship only half the amount of Covid-19 vaccines it had originally planned for this year because of supply-chain issues, which shone a light on some of the potential obstacles to vaccine distribution there’s likely to be in as production is scaled up massively.

As a result, the S&P 500 ended up falling slightly by the close (-0.06%), even as the NASDAQ (+0.23%) inched to a new record, with the stimulus talks giving added life to the cyclical trade as Consumer Durables (+2.03%) and Energy (+1.07%) were among the best performing sectors in the S&P. In terms of the latest details there, momentum continues to gather on the bipartisan stimulus deal that the Democratic leadership supported yesterday. Republican Senator Romney, part of the group that proposed the new bill, noted that they’re “getting more and more support from Republicans and Democrats”, even though Majority Leader McConnell has yet to voice his support for the bill. McConnell would need to agree to bring any vote to the floor of the Senate, but said he was “heartened” that Democratic Leadership was stepping away from the $2.4 trillion from late October.

The prospects of further stimulus gave support to inflation expectations, with US 10yr breakevens reaching a fresh 18-month high yesterday of 1.87% yesterday. Sovereign bond yields fell back on both sides of the Atlantic however, with yields on 10yr Treasuries (-3.0bps), bunds (-3.7bps) and gilts (-3.2bps) all moving lower. The other big move yesterday was the continued fall in the dollar, which reached a fresh 2-year low yesterday as both the euro (+0.24%) and the pound sterling (+0.64%) rose to their own 2-year highs against the greenback.

Speaking of deals, this morning both Brent Crude ($49.65/bbl) and WTI Oil ($46.39/bbl) reached their highest levels since the pandemic began after the OPEC+ group reached an agreement to roll back production cuts in 2021 more gradually than before. They’ll raise production by 500,000 barrels a day in January, which is a quarter of what would have occurred under the prior plan, and ministers are expected to consult monthly on next steps.

Overnight in Asia, equity markets have moved slightly lower for the most part, with the Nikkei (-0.30%), the Hang Seng (-0.09%) and the Shanghai Comp (-0.37%) all losing ground. The exception was the KOSPI, which saw a +1.26% advance, which came alongside a strong outperformance for the South Korean Won as well, which is up +1.25% against the US Dollar this morning. US futures are also pointing to a positive performance, with the S&P 500’s up +0.20%.

With equity futures indicating today could see fresh highs in the US, you might recall that Jim’s chart of the day on Wednesday looked at the fact that the S&P 500 CAPE ratio has just gone above 1929 levels. He’s already had a lot of emails on this, so yesterday he did another on the same theme (link here), graphing CAPE levels against real total returns over the decade ahead. Previous market valuation peaks saw future 10yr real returns broadly flat or negative, with 2007 being the main exception given the strong rally in the post-GFC years. So if history is to be relied upon the current point doesn’t bode well for returns over the next decade.

On the coronavirus, Italy reported a record number of deaths themselves (993), compared to just under 970 on a day back in March. Daily infection numbers are also continuing to rise globally, albeit with wider testing, as worldwide cases rose by over 700,000 yesterday for the first time. In terms of lockdowns and restrictions, Sweden announced that upper secondary schools would be closed for a month as the country moves to tighten restrictions. And after Germany and Spain extended measures on Wednesday, Greece extended their lockdown another week yesterday. From the US, we had confirmation from Dr Fauci that he will continue on at the National Institutes of Health under President-elect Biden’s administration.

Looking ahead now, the Brexit negotiations are likely to remain in focus today with both sides locked in last-minute talks ahead of the year-end deadline to the transition period. As of yet, there’s no sign of a deal being reached, and Sky’s Sam Coates reported a UK government source saying that the talks took a “turn for the worse” yesterday afternoon, while the FT reported that British officials had accused the French of making last minute demands. So it’s quite possible that the talks will continue through today into the weekend as the two sides seek agreement on the long-standing issues of fishing, the level playing field, and governance arrangements.

Should the talks end up going into next week, there’ll likely be a further round of obstacles to contend with, since Commons Leader Jacob Rees-Mogg announced yesterday that the UK government intended to reject the House of Lord’s amendments to the controversial Internal Market Bill on Monday, which took out the parts of the bill that breached the Brexit Withdrawal Agreement and created a major controversy when they were announced. If the Commons re-inserts those clauses next week, that is likely to be seen by the EU as a hostile act that breaches an agreement the two sides have already reached, particularly given it’s been reported by the BBC that the UK Finance Bill expected next week might similarly contain clauses breaching the Withdrawal Agreement. Irish foreign minister Coveney has tweeted that “a 2nd piece of legislation deliberately breaching WA & Int law, will be taken as a signal that U.K doesn’t want a deal.” So definitely worth keeping an eye on the progress of both those bills.

Attention later today will also be on November’s US jobs report, which is expected to show the slowest pace of monthly job growth since the pandemic, with DB’s US economists forecasting payrolls growth of +500k (vs. +475k consensus). Although they think this should be enough to see the unemployment rate fall to 6.8%, they say it’s also worth keeping an eye out for the broader U-6 measure of labour underutilisation, which is likely to better reflect the labour market’s underlying health. One piece of good news however yesterday were the weekly initial jobless claims for the week through November 28. They came in at a better-than-expected 712k (vs. 775k expected), marking an end to 2 consecutive weekly increases in the numbers.

The main data releases yesterday were the services and composite PMIs from around the world. In the Euro Area, the composite PMI was revised up from the flash reading to 45.3 (vs. flash 45.1), while the UK also saw a decent upward revision to 49 (vs. flash 47.4), even if that still left it in contractionary territory. Over in the US, the ISM services index came in at 55.9 (vs. 55.8 expected), though this was the second consecutive monthly decline in the reading.

To the day ahead now, and the main highlight will be the aforementioned US jobs report for November. Other data highlights however will include German factory orders for October, along with the November construction PMIs from Germany and the UK. In the US, there’s also data on October’s trade balance and factory orders. On the central bank front, we’ll hear from the Fed’s Bowman and Kashkari, along with the BoE’s Saunders and Tenreyro.