November Payrolls Huge Miss At Just 245K Jobs Added, Unemployment Rate Falls To 6.7%

Tyler Durden

Fri, 12/04/2020 – 08:33

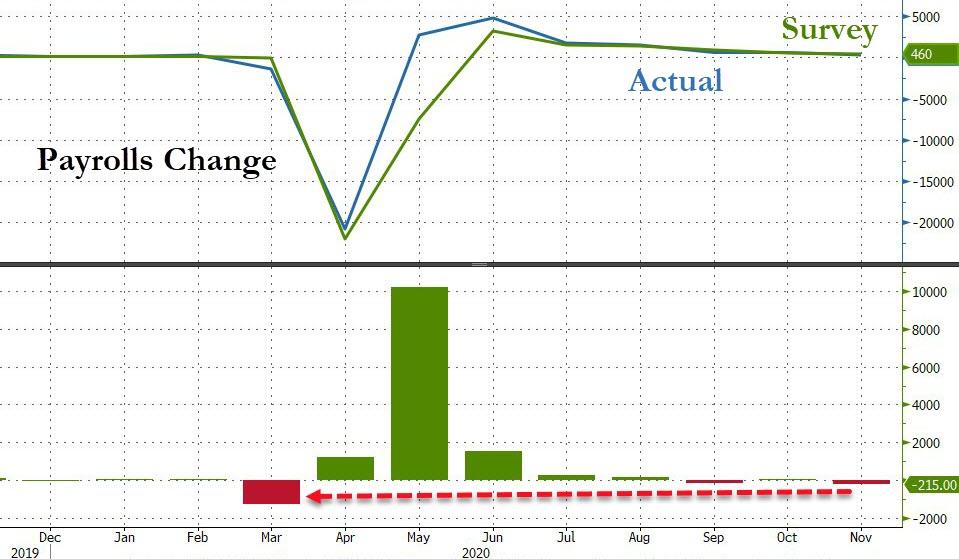

As noted earlier in our preview, consensus expected a return to weakness in the labor market as surging Covid-19 case counts have led to to a return of lockdown measures, which explicitly means less hiring and sure enough moments ago the BLS reported that in November, a paltry 245K jobs were added, a huge miss to the 470K expectation and a sharp drop from the 610K revised October print. In fact, this was the lowest monthly addition since the April crash.

At 215K, this was the biggest miss to expectations since March.

The change in total nonfarm payroll employment for September was revised up by 39,000, from +672,000 to +711,000, and the change for October was revised down by 28,000, from +638,000 to +610,000. With these revisions, employment in September and October combined was 11,000 more than previously reported. Notable job gains occurred over the month in transportation and warehousing, professional and business services, and health care. Employment declined in government and retail trade.

Confirming the labor picture is getting uglier, the household survey actually declined showing the number of employed people falling in November, by 74,000.

As noted earlier, the biggest hit was in retail trade, as retailers have been crushed due to covid, resulting in a loss of 35,000 retail jobs, “reflecting less seasonal hiring in several retail industries” according to the BLS. Additionally, government employment declined for the third consecutive month, decreasing by 99,000 in November. A decline of 86,000 in federal government employment reflected the loss of 93,000 temporary workers who had been hired for the 2020 Census. Offsetting the contraction in government, private payrolls rose by 344,000, missing economists’ median estimate of 540,000.

Despite concerns about the energy sector, prints were solid, with oil and gas extraction payrolls rising 3,700 from a year earlier:

- Gasoline stations payrolls rose 800 in Nov. after rising 3,000 in Oct.

- Pipeline transport payrolls fell 200 in Nov. after were unchanged 0 in Oct.

- Petroleum and coal payrolls fell 1,200 in Nov. after unchanged

Bad weather also had an impact with workers unable to work due to bad weather at 60,000 in November, which however was below the historical average for Nov. which is 74,000 employees. Also notable: 345,000 people who usually work full-time could only work part-time due to the weather last month.

And another ominous development showing the scarring of the labor market and broader economy: the number of people on temporary layoffs declined to 2764K from 3205K, while the number of long-term unemployed ticked up, which means that most people who found jobs returned to jobs they were furloughed from earlier in the year.

In total, the number of people who have been out of work for 27 weeks or more increased by 385,000 to 3.9 million, now accounting for 36.9% of the total unemployed.

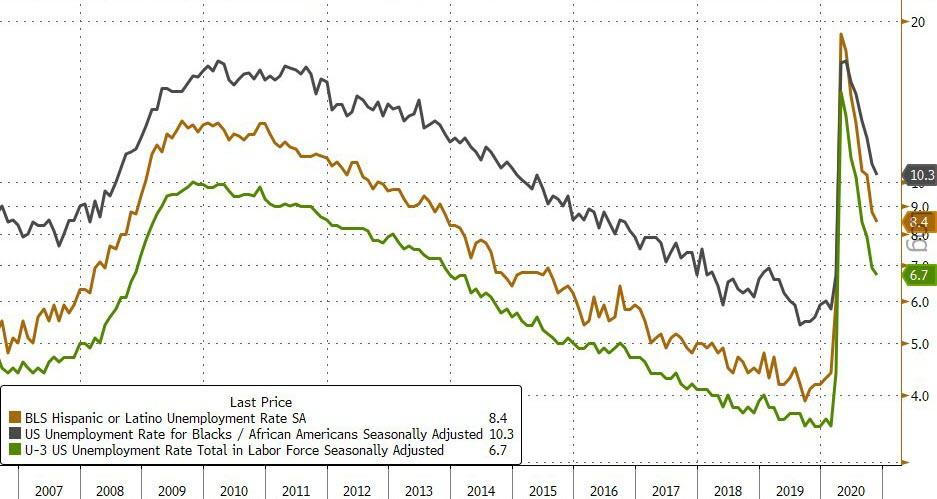

The unemployment rate continued to slide, dropping from 6.9% to 6.7%, with unemployment rates for blacks and hispanics also dropping to 10.3% and 8.4% respectively.

That said, the size of the labor force shrank from 160.9MM to 160.5MM in November, so the drop in the unemployment rate isn’t all good news.

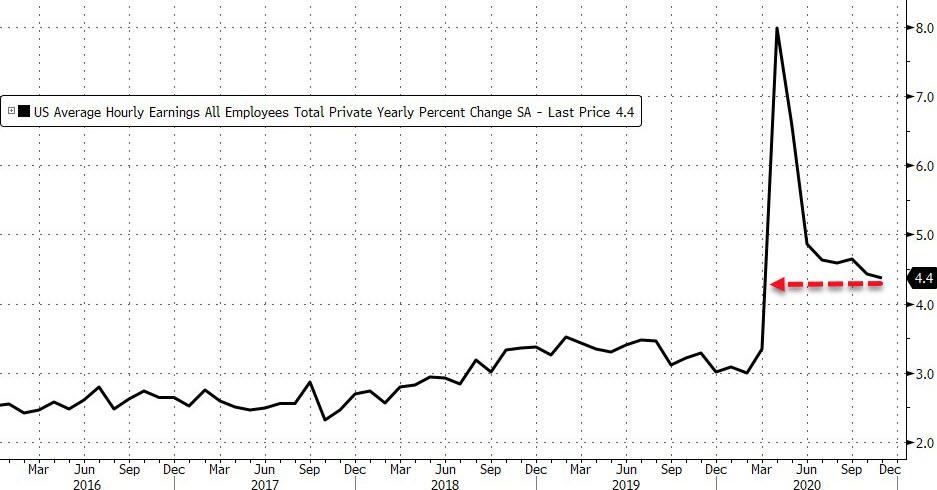

Average hourly earnings were flat, with the November print at 4.4% unchanged from the revised 4.4% in October (formerly 4.5%). This number remains largely skewed to higher earning jobs as lower paying workers have been largely fired. The average workweek was flat at 34.8 Hours; in line with estimates.

The labor force participation rate also ticked down, to 61.5% from 61.7%. A year ago it was 63.2%. Some of this might be folks giving up on looking for work given the state of the Covid-19 economy.

The household survey provided some new additional data:

- In November, 21.8% of employed persons teleworked because of the coronavirus pandemic, up from 21.2% in October. These data refer to employed persons who teleworked or worked at home for pay at some point in the last 4 weeks specifically because of the pandemic.

- In November, 14.8 million persons reported that they had been unable to work because their employer closed or lost business due to the pandemic–that is, they did not work at all or worked fewer hours at some point in the last 4 weeks due to the pandemic. This measure is little changed from October. Among those who reported in November that they were unable to work because of pandemic-related closures or lost business, 13.7 percent received at least some pay from their employer for the hours not worked, up from 11.7 percent in October.

- About 3.9 million persons not in the labor force in November were prevented from looking for work due to the pandemic. This measure is up from 3.6 million in October.

A breakdown of jobs by sector is below:

- Employment in transportation and warehousing rose by 145,000 in November but is 123,000 below its February level. In November, employment rose by 82,000 in couriers and messengers and by 37,000 in warehousing and storage.

- In November, employment in professional and business services increased by 60,000, with about half the gain occurring in temporary help services (+32,000). Job growth also occurred in services to buildings and dwellings (+14,000).

- Health care added 46,000 jobs in November, with gains occurring in offices of physicians (+21,000), home health care services (+13,000), and offices of other health practitioners (+8,000). Nursing care facilities continued to lose jobs (-12,000).

- Construction gained 27,000 jobs in November, but employment is 279,000 below its February level. In November, employment rose in residential specialty trade contractors (+14,000) and in heavy and civil engineering construction (+10,000).

- In November, manufacturing employment increased by 27,000. Job gains occurred in motor vehicles and parts (+15,000) and in plastics and rubber products (+5,000).

- Financial activities added 15,000 jobs in November. Gains occurred in real estate (+10,000) and in nondepository credit termediation (+8,000). Financial activities has added 164,000 jobs over the past 7 months, but employment in the industry is 115,000 lower than in February.

- Employment in wholesale trade continued to trend up in November (+10,000) but is 281,000 lower than in February.

- Government employment declined for the third consecutive month, decreasing by 99,000 in November. A decline of 86,000 in federal government employment reflected the loss of 93,000 temporary workers who had been hired for the 2020 Census. Employment in local government education continued to trend down (-21,000).

- In November, retail trade lost 35,000 jobs, reflecting less seasonal hiring in several retail industries. Employment decreases occurred in general merchandise stores (-21,000); sporting goods, hobby, book, and music stores (-12,000); electronics and appliance stores (-11,000); and health and personal care stores (-8,000). By contrast, furniture and home furnishings stores and automobile dealers added 6,000 jobs and 4,000 jobs, respectively.

- Employment in leisure and hospitality changed little in November (+31,000) but is down by 3.4 million since February. Arts, entertainment, and recreation added 43,000 jobs in November, while employment in food services and drinking places changed little (-17,000).

A visual summary of changes by industry:

Jeffrey Rosenberg, a senior portfolio manager at BlackRock Inc., said on Bloomberg TV that one takeaway of this report is:

“It’s a reminder of how important the fiscal policy response needs to be, given the surge that we’re seeing across the nation in the pandemic.”

So on one hand, the slowdown in hiring is certainly a warning sign for lawmakers, and potentially could give them greater incentive to get a stimulus deal, which has pushed the 10Y yield to session highs. On the other hand, the lack of a fiscal stimulus response is bullish for stocks as it means that the Fed will have to get involved again, something stocks clearly realize with futures virtually unchanged since before the print.