Bank Of Japan Is Now The Biggest Owner Of Japanese Stocks With $434 Billion Portfolio

Tyler Durden

Mon, 12/07/2020 – 19:25

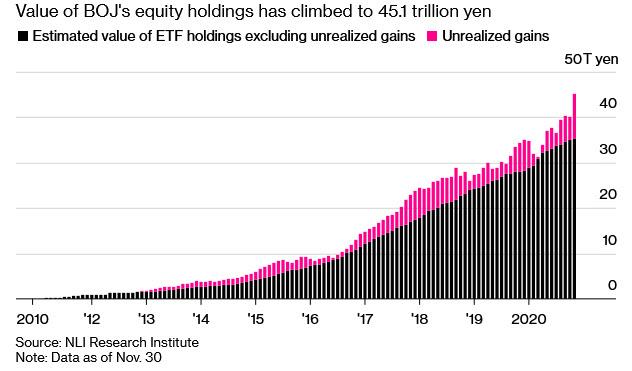

The Japanification of Japan continued to boldly go where no other central bank lunatic has gone before, with this surreal one-way voyage crossing a historic milestone in November when according to estimates by Shingo Ide, equity strategist at NLI Research Institute, the Bank of Japan – which unlike most developed central banks long ago dropped any pretense of not manipulating equity markets and has been buying ETFs and REITs for over a decade – took over as the biggest owner of the nation’s stocks, with the total value of its holdings climbing above a record 45 trillion yen.

On the back of massive ETF purchases to prop up the Japanese stock market amid the pandemic this year combined with subsequent valuation gains, the value of the BOJ’s Japanese equity portfolio has hit 45.1 trillion yen, $434 billion, in November.

That, according to Bloomberg, marks the first time that the central bank’s holdings have eclipsed those of the other Japanese market whale, the world’s largest pension fund the Government Pension Investment Fund, whose equity holdings Ide estimated at 44.8 trillion yen last month.

What this also means is that by matching the purchases of the country’s largest pension fund, the BOJ is effectively backstoping the country’s retirement system which would be insolvent had the BOJ not propped up the country’s equities which is where a substantial portion of retirement “wealth” is parked since JGBs yield next to nothing.

To be sure, regardless of which Japanese whale is bigger, the massive presence of these two public entities in public “capital markets” (where independent price discovery no longer exists) has raised concerns over their influence on market prices. The combination of “a state-run institution, the BOJ, and the country’s representative public pension fund, the GPIF, buying up local equities feels distorted,” said Satoshi Okumoto, chief executive officer at Fukoku Capital Management, quoted by Bloomberg. We are confident that Satoshi realizes that without the “distorted” buying by these institutions, the Nikkei and Topix would be a fraction of its current value… and he would most likely be out of a job.

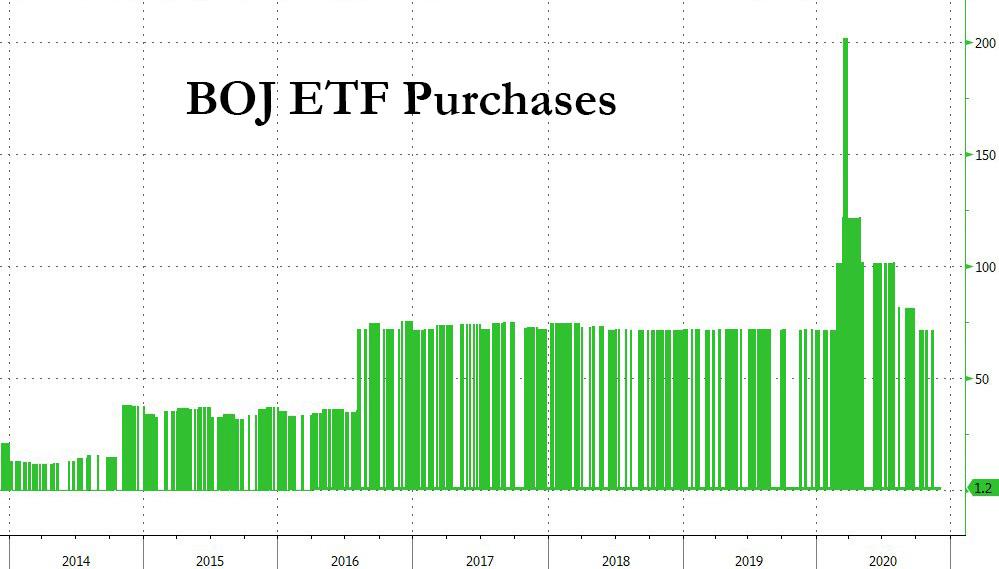

Realizing that allocating capital to Japan’s zero-yielding bonds is a losing proposition, the GPIF increased its equity market presence in 2014 when it doubled its allocation target for local stocks to 25% as part of an effort to increase returns through a shift into riskier assets. The BOJ’s ETF purchases started in earnest in 2010 (the BOJ had been purchasing equities previously as well but with nowhere near the same “dedication”) and accelerated later as part of Governor Haruhiko Kuroda’s unprecedented stimulus package aimed at revitalizing the economy.

As shown below, the BOJ further ramped up its support program this year as the coronavirus outbreak sent equity markets tumbling, saying in March it could potentially purchase 12 trillion yen worth of Japan ETFs this year, double its annual target. After a few months of heavy buying the pace has slowed back down, and it’s likely the total for 2020 will fall short of the new theoretical limit, although we are confident the BOJ will more than make up for it over the long-term.

Even at the current pace, however, “the gap between the BOJ and GPIF’s stock holdings will widen further,” according to NLI’s Ide, especially if share prices continue to rise: the benchmark Topix climbed 11% in November while the Nikkei 225 Stock Average surged 15% in its best month since 1994. That pushed unrealized gains on the BOJ’s stock purchases to over 10 trillion yen at one point in November, according to Ide.

Amusingly, Japanese strategists took time to remind readers that central banks never sell the stocks they have bought: “The BOJ has never taken profits on its holdings and only continues to build its holdings in ETFs,” said Takashi Ito, a strategist at Nomura. The GPIF, meanwhile, “has to sell equities when prices are high to adjust the weight of stock holdings within its portfolio.”

Yet as the BOJ loads up on even more stocks, it “could face more scrutiny” over whether it needs to continue buying equities when prices are elevated like they are presently, said NLI’s Ide. BOJ Governor Kuroda has repeatedly said that the ETF purchases are needed as part of monetary stimulus to reach the BOJ’s inflation target, an excuse which in light of events in the past decade is as laughable as it is stupid now that even shoeshine boys know that the only mandate central banks have is to make sure stocks never drop and the business cycle remains dead.