Janet Yellen: Too Dumb To Stop

Tyler Durden

Tue, 12/08/2020 – 21:25

Authored by Economic Prism’s MN Gordon, annotated by Acting-Man’s Pater Tenebrarum,

Autographing Funny Money

The United States Secretary of the Treasury bears a shameful job duty. They must place their autograph on the face of the Federal Reserve’s legal tender notes. Here, for the whole world to witness, the Treasury Secretary provides signature endorsement; their personal ratification of unconstitutional money.

Janet Yellen – first she got to print a lot of funny money, now she gets to autograph it. The Titanic meanwhile finds itself in uncharted waters and rumor has it that there may be icebergs lurking not too far from here. [PT]

If you recall, Article I, Section 8, of the U.S. Constitution empowers Congress to coin money and regulate its value. What’s more, Article I, Section 10, specifies that money be coined of gold and silver and cannot be bills of credit.

Indeed, paper dollars are illegal money per the U.S. Constitution on two counts. First, they’re issued by the Federal Reserve. Second, they are bills of credit with no ties to gold or silver.

This critical defect does not register even a passing concern for most Americans. But it should. Because illegal money – like paper dollars – has its deficiencies. Mainly, it’s prone to gross over issuance for political means. Thus, as it funds the unlimited growth of government, its payment quality grows evermore suspect.

Without question, illegal money has a whole host of problems. And the woman who will soon be autographing the illegal money – Biden’s nominee for Treasury Secretary, Janet Yellen – will further stimulate these problems.

Deceptive and Cruel

Janet Yellen, if you don’t remember, was Chair of the Federal Reserve from 2014 to 2018. She will be only the second bureaucrat to be both Fed Chair and then Secretary of Treasury. The first was G. William Miller, way back when Jimmy Carter was President. Miller was a poor steward of the dollar. Inflation went off the Richter scale on his watch.

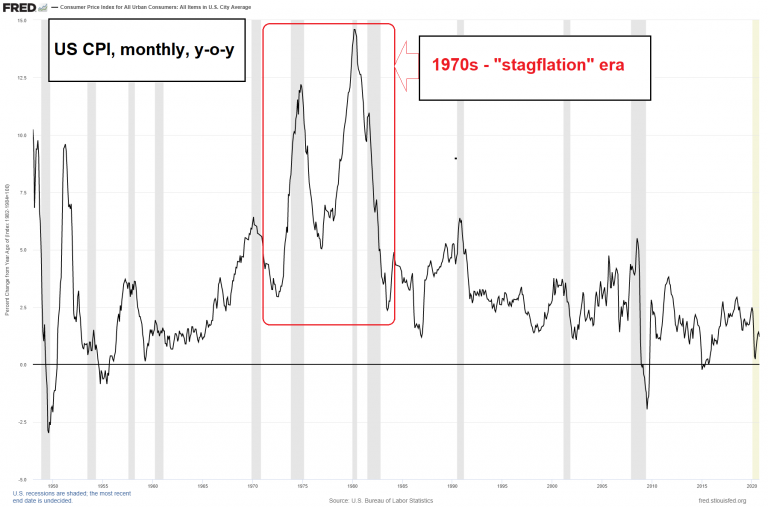

The Miller years were quite a harrowing time with respect to galloping price inflation. The extent to which Miller can be blamed is debatable – the event was a co-production cooked up by an entire gaggle of loopy bien-pensants over the years. They were just as arrogantly confident in their prescriptions as their successors deciding today’s policies are. [PT]

Yellen, like Miller, will have the unique opportunity to authorize the money she previously issued. The consequences could be equally destructive for the dollar. They may even be worse.

Prior to her time as Fed Chair, Yellen held various positions with the Federal Reserve over a 20 year run. We don’t really know much about what she actually did. But, at a minimum, she participated in an era of unprecedented Fed activism.

Certainly, Yellen has spent hours squinting at aggregate demand graphs while contemplating how monetary policy can be twisted to boost spending. She also believes monetary policy is a moral issue.

In fact, back in 1995, at a Federal Open Market Committee meeting, Yellen argued in favor of allowing inflation to exceed inflation targets for moral reasons. The Economic Policy Journal offers the following account:

“Ms. Yellen told the committee that ‘the moral’ of all this is ‘that the Fed should pursue multiple goals.’ She said that ‘when the goals conflict and it comes to calling for tough trade-offs, to me, a wise and humane policy is occasionally to let inflation rise even when inflation is running above target.’”

Remember, inflation acts as a hidden tax on savers. It devalues the purchasing power of their savings. Ask any retiree living on a fixed income or a hardworking prudent individual skimping to squirrel away some nuts for retirement. Policies of inflation are not wise and humane; they are deceptive and cruel.

Janet Yellen: Too Dumb To Stop

After all these years Yellen still thinks she knows best. That she is the true arbiter of morality. Guided by silly academic models she thinks she is helping people when she is really hurting them.

Fiscal and monetary policies over the last 40 years have been characterized by increasingly extreme intervention. Over this period Yellen and other central planners have pursued inflationism as a means to perpetually stimulate demand.

The Fed creates the illegal money. The Treasury authorizes it. And the economy adjusts accordingly. Business transactions are made with the illegal money. Private and public buying and selling is conducted with it. All commerce is settled with it.

The over-issuance of illegal money has warped and distorted the economy… delivering extreme riches to asset holders while leaving the vast majority of wage earners with empty pockets. Alas, Yellen is too dumb to stop. In a Tweet following the announcement of her nomination, she wrote:

“We face great challenges as a country right now. To recover, we must restore the American dream—a society where each person can rise to their potential and dream even bigger for their children. As Treasury Secretary, I will work every day towards rebuilding that dream for all.”

But what will Yellen, as Treasury Secretary, really do to restore the American dream? Will she start new companies that employ people? Will she create more high paying jobs?

No, she won’t – because she can’t. Starting companies that create high paying jobs, and produce goods people demand, is out of the realm of what a Treasury Secretary can do. But what Yellen can do is work in concert with the Fed and Congress to authorize vast amounts of illegal printing press money.

It may be an overused cliché and who knows if it was really Einstein who said it, but in this case it certainly fits. [PT]

Should Yellen follow the path of 1980 through 2019 and inject new credit into the financial system, we will see further inflation of financial assets. Should Yellen follow the CARES Act model and send checks directly to the people, consumer prices will inflate. Perhaps she will be compelled by her high morality to do both.

Regardless, Yellen will not be up to the task of returning reverence and trust to the dollar. And without that, there is little hope of restoring the American Dream.