“This Is Astounding”: China Is Snapping Up Most Of The World’s “Missing” Barrels Of Oil

Tyler Durden

Tue, 12/08/2020 – 21:45

In almost every oil cycle, the market is confronted with the problem of “missing barrels”, or the gap between the change in inventory implied by global supply-demand balances on the one hand and the observed change in inventory levels by commercial and government entities (adjusted for floating storage and oil in transit) on the other hand.

As the Oxford Institute for Energy Studies writes in a report published today, based on IEA global oil balances, the surplus during the first three quarters of 2020 averaged around 4.4 mb/d, with the surplus in the first half of 2020 reaching a record level of 7.6 mb/d due to the severity of the demand shock and the break-up of the OPEC+ agreement in March. This implies an inventory increase in H1 2020 of 1,390 million barrels (mbbls), before declining by 194.2 mbbls in Q3.

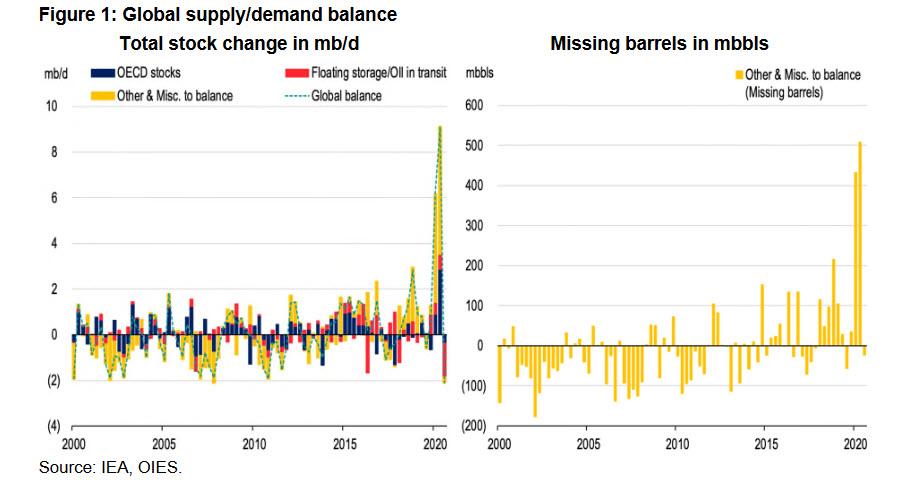

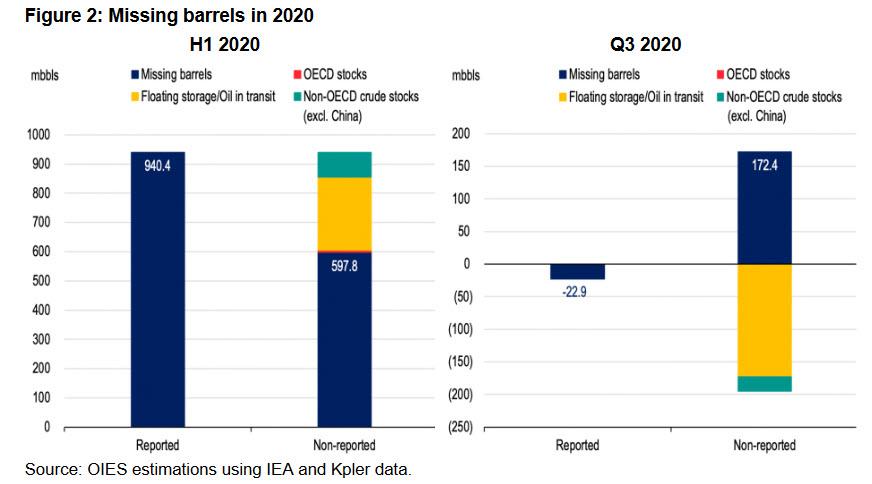

According to the IEA, out of the total stockbuild in the first half of the year, total OECD stocks accounted for 344.3 mbbls or 25% of the total increase, floating storage and oil in transit accounted for 105.3 mbbls or 8% of the total increase and the remaining 940.4 mbbls or 68% of the total increase to balance is essentially unaccounted for including changes in non-reported stocks in OECD and non-OECD areas that the IEA labels as “Other & Miscellaneous to balance” (as shown in Figure 1).

The volume of missing barrels in H1 2020, the OIES writes, “is the largest ever recorded gap between observed and implied stocks since at least 1990, being three times larger than previous historical downcycles such as in H1 1998 and more recently the H2 2018 downturn and nearly 10 times larger than the imbalance of H2 2008 in the aftermath of the global financial crisis.”

The “missing barrels” problem can arise due to a number of factors. The most obvious reason is that models could be generating “artificial barrels” by underestimating demand and overestimating supply. The severity of the oil crisis in 2020 due to the global coronavirus pandemic led to the break of some key relationships (for instance between economic growth and oil demand) and models had to be calibrated to account for the severity of the shock (for instance, including indicators of the severity of restrictions across countries).

Another factor is the coverage and quality of data on stocks. The reason for this is that very little publicly reported, accurate information exists for oil stocks outside of the United States. And yet the US oil stocks many not be an accurate reflection of the world situation. This observation increasingly holds as demand growth has shifted from OECD to non-OECD, especially given the key role that China is playing in global crude demand. In this latest cycle, China’s position as a key equilibrating mechanism was further highlighted as it absorbed surplus barrels from all over the world as it took advantage of relatively cheap crude to fill its large and growing storage capacity.

To put this in perspective, OIES utilized crude inventory and fleet metrics data from Kpler and attempted to identify some of the missing barrels implied from IEA balances. As Figure 2 shows, even accounting for additional floating storage and oil in transit (+250.4 mbbls), as well as OECD and non-OECD crude stock changes excluding China (+85.2 mbbls), all of which are not previously reported by IEA, we are still missing 597.8 mbbls or 64% of the total missing barrels in H1 2020. This issue becomes more complex in Q3 2020 for which the IEA balances imply a 194.2 mbbls deficit of which 171.3 mbbls are accounted for and 22.9 mbbls are missing. Kpler data, however, show a much larger draw of floating storage, suggesting one (or a combination) of three possibilities: the actual deficit is much larger than estimated by the IEA (by about 150 mbbls); there was a large build in non-OECD stocks, or the implied market surplus in H1 2020 was overestimated and carried over. Indeed, a large build in unaccountable stocks in Q2 2020 followed by a draw in Q3 2020 suggests that barrels were stored and drawn in places where they currently cannot be tracked.

The China Conundrum

The issue of “missing barrels” has long plagued Chinese data, but much like in the rest of the world, has become more pressing and perplexing in 2020. Net crude imports in the year-to-October averaged 11.09 mb/d, rising from 2019 levels by over 1 mb/d and maintaining their 2019 growth rates. According to the OIES report, “this is astounding given that economic activity has been considerably weaker and runs have averaged 13.3 mb/d in the first ten months of 2020, growing by an impressive 0.47 mb/d, but still lower than the 0.82 mb/d increment seen over the same period last year.”

Put simply: the data suggest China has overbought crude to put in storage.

But the key question is, how much has gone into storage and perhaps more critically, how much is likely to come back out?

In response to this rhetorical question, the Oxford Institute authors notes that assessing how much crude has gone into storage has become both an art and a science, given the limited official data. When looking at implied stockbuilds (i.e deducting crude used for refinery runs from the sum of domestic production and net imports), in the year-to-October, China has stored on average 1.6 mb/d, or a staggering 488 mbbls of crude.

While it has been clear that large volumes of crude oil have headed to China, judging by port congestion at Chinese shores, differentials and benchmarks, such volumes seem overstated as they would have likely led to tank tops earlier this year. According to OIES estimates, China had close to 1,100 mbbls of crude storage capacity at the end of 2019 (that’s over 1.1 billion and far, far more than Cushing and the US Strategic Petroleum Reserve). Assuming a roughly 60% utilization rate, crude stocks would have reached 650-680 mbbls. A build of an additional 500 mbbls, even when taking into account 250 mb of new tank space added over the year, would have overwhelmed China’s storage capacity leading to a slowdown in crude arrivals already earlier this year.

And even though imports into China are slowing somewhat and storage utilization rates are likely at over 75% currently, there are signs of a recovery in crude buying for early 2021. It is therefore useful to look more closely at implied stockbuilds.

First, many crude balances for China do not account for crude losses during the refining process or burnt at the field, which between 2000 and 2017, according to the National Bureau of Statistics, have averaged 0.30 mb/d8. In the five years prior to 2017, losses in refining increased to average 0.35 mb/d, so when deducting these losses, the implied stockbuild for the year-to-date falls to an average 1.3 mb/d, or just over 375 mbbls. While this is still a monumental build, it is more plausible.

At the same time, Chinese demand could also be underestimated. China’s independent refiners have been infamous for tax evasion and especially between 2016 and 2018 were estimated to have underreported refining throughputs by 0.3-0.8 mb/d10. So historically, Chinese crude demand has been understated. The shift to new tax reporting practices in early 2018 have limited the independents’ ability to under report runs, although a number of them subsequently turned to misrepresenting their product output. In late 2020, following an announcement by Shandong officials that they will be levying a windfall tax this year, which is based on product output, the independents may be resorting to some under reporting again, although any such volumes are likely small, given that China’s demand is recovering slowly and product tanks are also estimated to be two-thirds full. Some combination, therefore, of underestimated demand and crude in storage suggests that China could well be responsible for as much as half of the missing barrels and that these are indeed “real.”

The next question is then, how likely are these barrels to be drawn down, and will they weigh on Chinese imports?

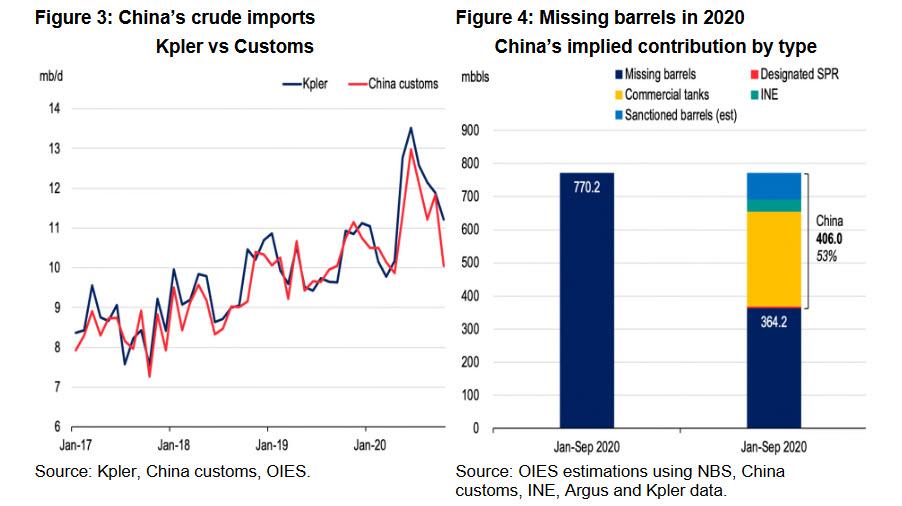

Roughly a third of these volumes could have gone into bonded tanks. When looking at China’s crude imports, there is a discrepancy between waterborne flows as assessed by Kpler and arrivals reported by customs data, with assessed arrivals higher than customs data by 0.47 mb/d for the year-to-October (Figure 3). In previous years, the difference in assessed volumes and customs data were smaller, mostly due to discrepancies between the timings of arrival and discharge, alongside some crude going into bonded tanks.

This year, the discrepancy is more substantial and points to a large accumulation of crude in bonded tanks, which are not consistently counted as imports. Not only has the INE increased its storage capacity this year, with its tanks holding 34 mb of crude at the end of October according to the exchange but sanctioned barrels may have also gone into bonded tanks. For example, in the year-to-October, Kpler estimates point to 0.15 mb/d of Iranian crude going to China (compared to 75,000 b/d recorded by customs) as well as 0.21 mb/d of Venezuelan crude flowing to the country (although customs have reported no Venezuelan crude going into China). Theoretically, then, at the end of October, China had accumulated as much as 85 mb of Iranian and Venezuelan crude in bonded storage tanks over the course of the year, although some of these will have likely been drawn down by refiners, and if they have not been yet, they will be.

But that still leaves over 200 mbbls of crude in storage, of which only a fraction is likely to return to the market. This is because these volumes have gone into both commercial and strategic petroleum reserve (SPR) tanks that are used as buffer, both for refiners’ forward cover and strategic reserves. China has a small number of designated SPR tanks of close to 400 mbbls, that are likely 300 mbbls full, with Argus estimating 32 mbbls of fills this year alone (see Figure 4). At the same time, the government has been leasing out commercial tank space for its SPR programme, as the construction of dedicated SPR sites has been slow. But even with close to 150 mbbls of commercial tanks that are widely assumed to be leased out to the SPR, the SPR program only meets around 40 days of import cover (as 90 days at current import volumes would imply over 1,000 mbbls).

In addition, China’s refiners are mandated to hold 15 days of forward cover, which, for a system of close to 19 mb/d of nameplate capacity, means almost 300 mbbls of forward cover. Indeed, part of the increase in import licences awarded to non-state refiners this year was intended for them to build up their crude stocks while prices remain at relatively low levels.

In sum, when taking into account the crude requirements of storage tanks at the various ports and other commercial sites as well as pipeline fills, the crude requirement for China’s oil system is massive. As a result, most of the crude flowing into China this year has helped meet these needs. All in all, we estimate China now holds close to 1,000 mbbls in storage, which is roughly 90 days of its import needs, with capacity by year end reaching 1,300-1,400 mbbls. The good news for markets is that only a small part of these barrels will be drawn down, but the bad news is that China’s future stockpiling needs are now shrinking.

This is not to say that China’s crude imports will fall: with over 1 mb/d of new refining capacity starting up over the next two years, refiners will continue sourcing crude as refining throughputs continue to rise and as new plants require operating stocks. Moreover, additional infrastcuture including tanks and pipelines will need filling. But over the next two years, incremental demand for strategic stocks will slow, and crude imports will become more closely aligned with refiners’ needs.

Conclusion

The large accumulation of barrels in China suggests that “artificial” or “imaginary” barrels, as a result of imprecise measurement of global oil supply-demand balances, are not the only explanation to the missing barrels question. Indeed, even though China’s crude balances are riddled with inconsistencies, it is clear that the country has amassed large volumes of crude this year — potentially close to 400 mbbls — which have contributed both to the country’s strategic reserves and commercial forward cover. At the same time, Chinese demand may well be underestimated given refiners’ tax avoidance practices. So, as global supply and demand numbers get adjusted with the arrival of new information — which likely includes other Asian countries for which both demand and storage estimates are imperfect — the volume of missing barrels will shrink further, if indeed half have ended up in Chinese storage tanks and are unlikely to be released back into the market. In addition, some of the missing barrels are a result of unobservable barrels in important consuming centers and perhaps also stocks held at the distribution level and by final end consumers.

As the Oxford researchers conclude, “the complexities of global crude balances, despite the important contribution made by new technologies, highlight the ongoing challenges facing OPEC+ in estimating how long it will take to rebalance the market. In addition to the uncertainties surrounding the demand outlook in these unprecedented times, assessing the extent and nature of buffers in the system has become more complicated.”

The question is whether going forward, OPEC+ can afford to ignore non-OECD stocks? And if these stocks are being stored for strategic purposes and the bulk of these stocks will not be released back into the market, does targeting non-OECD stocks really matter for oil policy purposes? Should we exclude years of elevated stocks from the averages or have these become main features of the new cycles and the adjustment process? As we enter 2021 in an environment of extremely depressed oil demand, these questions will become more pressing.