By Brad Polumbo

By Brad Polumbo

Successful residents of high-tax states are in for an ugly surprise if new tax legislation passes in Congress. Democratic legislators are currently proposing a multi-trillion-dollar tax hike to raise revenue for a massive welfare and climate change spending plan. Proposed tax hikes include raising the corporate tax rate, higher taxes on cigarettes and vaping products, raising the capital gains tax rate, and higher individual income tax rates.

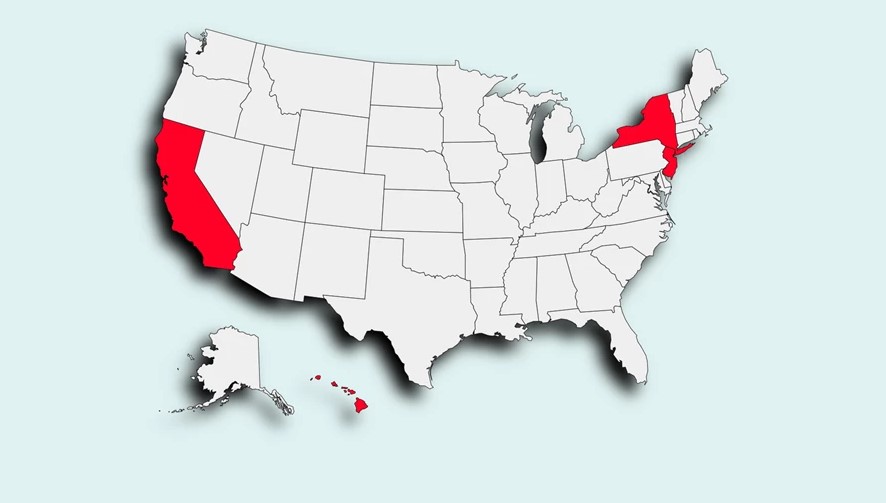

On the last front, the proposed income tax increase would apply to income over $400,000 for an individual and raise the rate from its current 37 percent to 39.6 percent. The proposal also includes a 3 percent surcharge on all income above $5 million. The tax hikes could push Americans in states like New York, California, New Jersey, and Hawaii up to nearly 60 percent top income tax rates.

“For New Yorkers earning more than $5 million, the combined city, state and federal tax rate would skyrocket to 61.2% under the House plan,” Fox Business reports. “The combined rate in California, meanwhile, would spike to 59.7%, while the wealthiest individuals living in New Jersey could pay a rate as high as 57.2%. In Hawaii, the combined marginal rate would be an estimated 57.4%.”

Democrats' tax plan could push combined rates up to 60% for wealthy New Yorkers, Californians https://t.co/40JTwZlEut

— FOX Business (@FoxBusiness) September 16, 2021

That’s right: High-earning residents of these states could end up paying nearly 60 percent tax rates on their income earned above a certain level. That’s an obscene and fundamentally unfair level of taxation. But such punitive levels of taxation are also highly impractical and certain to have adverse economic consequences.

For one thing, successful residents can simply move to another state. It is only the combination of high federal income taxes and high state-level income taxes that leads to these combined rates of nearly 60 percent. Yet some states, such as New Hampshire and Florida, have no income tax at all.

We’ve already seen an exodus of wealth, people, and major businesses from states like California, and that trend will only accelerate if taxes are sent even higher by this new plan. It’s only logical: states that heavily tax something are discouraging it, while states that don’t tax it at all are welcoming it. Why would anyone want to discourage income-earning?

Punitive taxation has ramifications for more than just the high-earning individuals and families directly impacted by higher tax rates. If they leave the state, they take with them jobs, investment funds, and spending that would otherwise go back into their communities.

It’s true that not all high-earners will flee states with these punitively high taxes. Some, for a variety of reasons, will stay. But even for these individuals, the high tax rates will backfire, because they’ll create perverse incentives and discourage economic activity above a certain level.

Why?

Well, people make economic decisions “on the margin.” What this means is that they evaluate each additional hour worked on the basis of whether the potential benefits exceed the costs. Then, they work up until the point where the costs begin to exceed the benefits.

When the government applies 60 percent tax rates to income above a certain point, it drastically reduces the benefits of additional labor subject to that tax. Yet the costs of working remain the same. As a result, far less economic activity will happen beyond that threshold.

Think about it like this. A successful entrepreneur founded a restaurant and when it did well, opened up two other locations. Does he add a fourth or rest on his laurels?

Well, if he will only get to keep 40 percent of the income he earns from new locations, because he’s now already making $400,000, he probably won’t bother to expand. Who would want to work more and hustle harder only to hand over 60 cents of every dollar to the government? This economic disincentive hurts more than one entrepreneur—it means jobs never created, customers never satisfied, income never earned, and a community never enriched.

Another problem with highly progressive tax rates is that they discourage economic investment. The same “rich” citizens who would face these 60 percent tax rates are those who would otherwise save and invest that money into the economy. (Rather than simply spend it as low-earners tend to do). As the economist Ludwig von Mises put it, “Progressive taxation of income and profits means that precisely those parts of the income which people would have saved and invested are taxed away.”

Ultimately, 60 percent tax rates are confiscatory, unfair, and economically indefensible. If Congress’s new tax hikes come through, successful residents in high-tax states will be placed in a terrible position. Luckily, they have the option to move to less hostile states. Don’t be surprised when many take it.

Source: FEE.org

Like this story? Click here to sign up for the FEE Daily and get free-market news and analysis like this from Policy Correspondent Brad Polumbo in your inbox every weekday.

Brad Polumbo (@Brad_Polumbo) is a libertarian-conservative journalist and Policy Correspondent at the Foundation for Economic Education.

Become a Patron!

Or support us at SubscribeStar

Donate cryptocurrency HERE

Subscribe to Activist Post for truth, peace, and freedom news. Follow us on Telegram, HIVE, Flote, Minds, MeWe, Twitter, Gab, Ruqqus, and What Really Happened.

Provide, Protect and Profit from what’s coming! Get a free issue of Counter Markets today.

New Plan Would Push Top Tax Rate to Almost 60 Percent In These 4 States