By David Smith

By David Smith

Failure to “Plan Your Work” and “Work Your Plan” (for some absolutely mission-critical perspectives on this read our co-authored book, Second Chance: How to Make and Keep Big Money from the (in-play) Gold and Silver Shock-Wave.

Focus on the main premise of positioning, avoiding too much in one investment (unless highly researched and a good fit your plan) – and having an exit strategy if you’re wrong. Don’t let greed catch you by the throat.

Becoming part of “the crowd.” At some point during the moonshots you must follow the wisdom sent to Luke Skywalker from Obi Wan Kenobi as he honed in his rockets onto the galactic starship for the final drive. “Luke, turn off your targeting computer.” The “experts have infused with you and you’re now totally responsible – win, lose, or draw. You have become liberated from what Bruce Lee called “the classical mess” – hidebound, restricted, limited ways of decision-making.

It’s called a “paper profit” for a reason. It’s not really yours until you offset the position and either sequester it in savings or move into another, hopefully deeply undervalued, underappreciated asset.

Trying to get “the last one-eighth.” Jesse Livermore underscored this. Reflect deeply, then act on his seminal work “Reminiscences” The “animal spirits” of traders will be out in full force until all buyers have been satiated. Don’t be the last buyer.

Failure to ask “How Much is Enough.” You must begin to address this question now – not in the heat of battle. Meditate on the answer? Watch how a piece of bark or a Japanese candle floats downstream (your opportunity) and does not return?

Failure to see that this is (by definition) a one-time “Singularity.” Perhaps with each commodity acting on its own metrics/timing – what I refer to as “golden popcorns.”

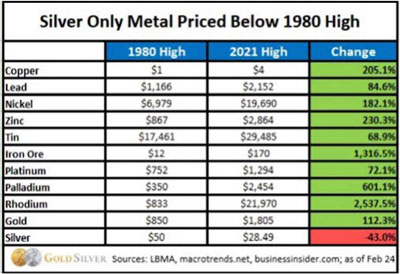

Why are not the other commodities covered in this essay mentioned in the report’s title? Because while each and every one has “super-spike” potential, I firmly believe that silver, which will spike somewhere in this continuum, offers the largest potential percentage rise of them all!

What if we are on the cusp of an “economic singularity”?

“… in which the laws and bedrock beliefs that formed the foundation of international economic order for decades, breaks down, with unknowable consequences. “If a central bank’s foreign reserves (i.e. Russia’s $630B) can be blocked/frozen, “Barring gold, these assets are someone else’s liability – someone who can just decide they are not worth holding.” -Doomberg. (The SWIFT expulsion and confiscation of assets without due process…)

Luke Gromen, of the macroeconomic research firm FFTT sums it up:

“There are very few moments in history when you want to own gold, but during those moments, gold is about all you want to own.”

In my strongly considered opinion — from the position of having continuously observed, researched and participated in these markets since 1974 — that “moment” is just about here…

Not getting through the “All assets are (currently) in collapse” mode. In this transformation back to some predictability you must adroitly and with controlled emotion readjust our “reset” ourselves.

“… the economy is already in recession. The Fed’s own data shows GDP growth went negative in 1Q22. And it’s barely positive thus far in 2Q22. Even if the Fed massages the data to insure we don’t see two quarters of negative GDP growth, the reality is that the markets are telling us a recession is here now.” -Gram Summers

Lest you persist in believing that gold is destined to remain in stupor, consider that underplaying the tectonic drivers pressuring its sooner-rather-than later upside breakout; or much worse, wait until it actually happens (!) you will need to Act.

Jim Rickards’ analytical mastery has identified both the ready acceptance of other non-Western countries to buy it (thereby decreasing dependence on a dollar-first profile, as well as the post-Invasion Swiss refineries’ movement back to “neutrality” in accepting Russian gold for refining, to back its digital and commodity trading scheme.

In summation, Rickards says:

No one of these stories will quickly spike the price of gold. Still, all of them reveal the shape of things to come. They all point in the direction of more reliance on gold as a form of money, and the diminution of the role of the dollar in a global monetary system. Think of these developments as straws in the wind. You know the storm won’t be far behind.

Closing considerations and thoughts:

- Study charts of the last two secular “boom vs. echo” uranium bull runs, a phrase coined by Marin Katusa, for important similarity price action clues, as other commodities cycle through their own “Super Spike” thesis from David Forest.

- The most profitable of these spikes may turn out to be quicker boom to echo events – shorter than the market expects as the narratives change, and transition into nanotechnology, DNA storage, zero gravity formulations, and heaven knows what else.

- Seek to at all times remain more calm than the rest of the investing herd.

- Consider that the unusual upcoming parabolic markets will be much more unpredictable than more staid linear methodologies.

- A best guess on the upcoming order of this build out? Uranium-REE. Wheat. Copper-Nickel. Gold-Silver; Digital Miners.

- At the end of what may have become the largest single commodities – miners, Senior-Juniors re-alignment in our lifetimes, please don’t be left saying “Please, lord, if you’ll just give me one more bull run, I promise not to screw it up!”

For 8 years, I (David H. Smith), Senior Analyst at The Morgan Report, LODE Digital Silver and Gold Ambassador, and frequent Contributor to The Prospector News, have enjoyed interacting with the rapidly expanding audiences from Money Metals Exchange and associated contributing sites, including three of the most widely read, Bob Moriarty’s 321gold.com and goldseek/silverseek.com as we keep working to build out our unique yet similar paths to financial success we all seek. BEST!

David H. Smith is Senior Analyst for TheMorganReport.com, a regular contributor to MoneyMetals.com as well as the LODE digital Gold and Silver Project. He has investigated precious metals’ mines and exploration sites in Argentina, Chile, Peru, Mexico, Bolivia, China, Canada and the U.S. He shares resource sector observations with readers, the media, and North American investment conference attendees.

Become a Patron!

Or support us at SubscribeStar

Donate cryptocurrency HERE

Subscribe to Activist Post for truth, peace, and freedom news. Follow us on SoMee, Telegram, HIVE, Flote, Minds, MeWe, Twitter, Gab, What Really Happened and GETTR.

Provide, Protect and Profit from what’s coming! Get a free issue of Counter Markets today.

Why Most Investors Will Miss Out on the Upside Silver Breakout … and Impulse Leg Moonshots: Part II