Predicting The Price Of Gold

Tyler Durden

Mon, 08/10/2020 – 21:15

Authored by Ritesh Jain via WorldOutOfWhack.com,

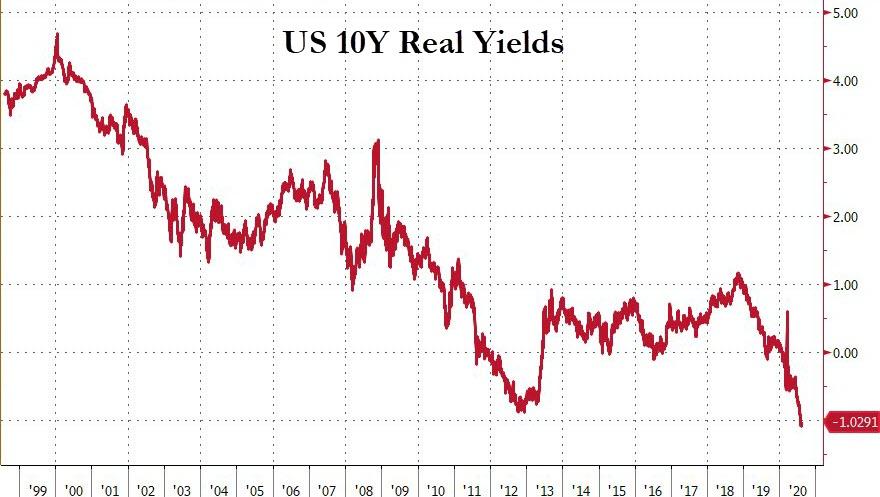

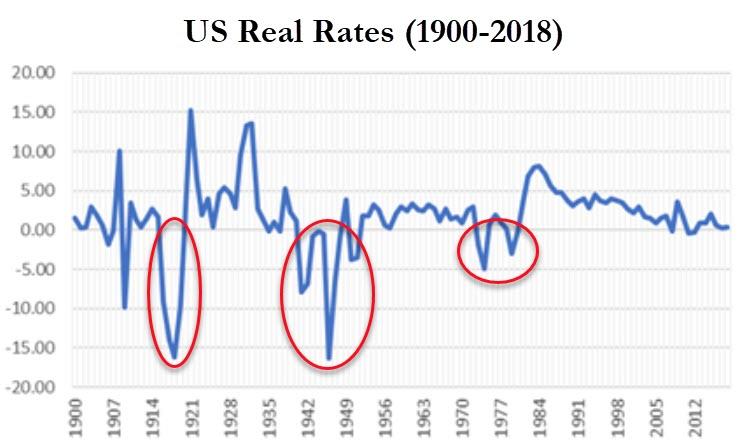

Real Rates (Inflation-Nominal rates) are currently at -1% levels and it seems they may go down even lower. But they have been negative before during the 1940s in the post WW2 Era and in the 1970s STAGFLATION.

Decline in real rates sometimes can be a deliberate policy to reduce the Debt burden of govt because the real value of debt falls with rising negative real rates. The policy of negative real rates is always preferred over the bitter pill of allowing companies to go bust.

The US policy response post-COVID has been to print loads to money to reliquify the banking system and avoid defaults. With the rate of US M2 growth reaching 23%, and no chance of increase in policy rates in next couple of years the real rates can fall further in coming years.

US real yields collapse as specter of inflation returns

Source: Bloomberg

When real rates decline, gold’s value tends to go up more because GOLD is a perpetual Zero coupon bond and holding Zero coupon asset with limited supply is better than holding negative real rate asset like US treasury whose supply is unlimited by issuance.Negative real rate also mean that you need to be an asset owner to maintain the purchasing value of depreciating paper currency.

I strongly believe that we are like ( 1942-51 ) headed to -3% to -4% real rates and if that is the expectation on real rates is there a way of mathematically finding the value of GOLD in that environment?

While I was grappling with the question of having an input (-3 to -4%) value but not the output i.e value of GOLD at that level of negative real rates, there came along an article from the Bloomberg columnist on this subject.

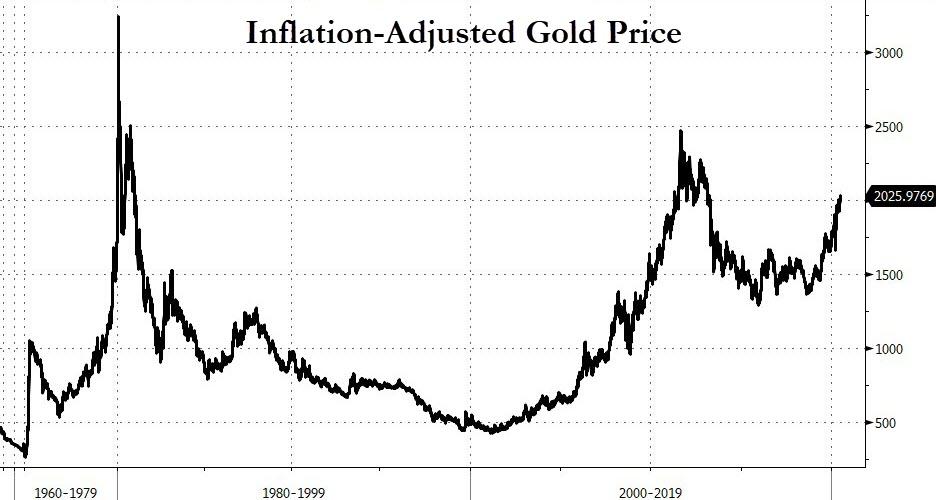

[ZH: we note that during the late ’70s negative real yield period, gold soared above $3,000 on an inflation-adjusted basis]

The analysis by Ven Ram (Currency and rates strategist for Bloomberg’s Markets) shows that the duration of gold is 17 when interest rates go up and 20 when yields trend lower, suggesting that the second derivative of the shift in rates is alive and kicking. Back in 2018, Pimco found a duration of almost 30.

Gold has been on a tear this year, having surged 35% in response to a 120-basis point slump in real interest rates. Other catalysts include low global yields; erosion of confidence in global fiat money in general and a weaker dollar in particular; unbridled global monetary and fiscal stimulus; investor purchases through exchange-traded funds in response to uncertainty about the evolution of the pandemic.

However, the outlook for gold gets murky once it goes to around $2,500 an ounce. Beyond that level, it would imply a massive plunge in real rates and an even sharper rally in breakevens than what we have already seen.

Correlations suggest these factors would also imply a big decline in nominal 10-year yields, which currently sit near 0.50%. Such a move would essentially mean the markets are pricing in a depression-like scenario. Should it play out, the study indicates gold may be propelled toward $3,000 should real yields slump to -3.15%.

Given that gold has a longer duration than linkers, the metal offers a balance sheet-economical way to hedge against inflation.

Conclusion

We believe that US is going to have real rates south of -3% and the time period it is analogous to is the 1940s when real rates averaged -3.14%.

On this basis we believe that gold may reach levels of $3000 and go even higher if real rates go below -4%.