US Bankruptcies Are Already At 10-Year High As Pandemic Takes Its Toll

Tyler Durden

Fri, 08/14/2020 – 12:50

Gold and silver sold off when Russia announced that it had an effective vaccine for coronavirus. This plays into the myth that a cure for COVID-19 will cure the economy. But, as SchiffGold.com notes, there is plenty of evidence suggesting the damage to the economy is deep and will likely have long-lasting impacts even when the pandemic is in the rearview mirror.

We’ve reported on a number of these signs.

-

There is an increasing number of mortgage delinquencies.

-

There is a rising number of over-leveraged zombie companies.

-

And a tsunami of defaults and bankruptcies are on the horizon.

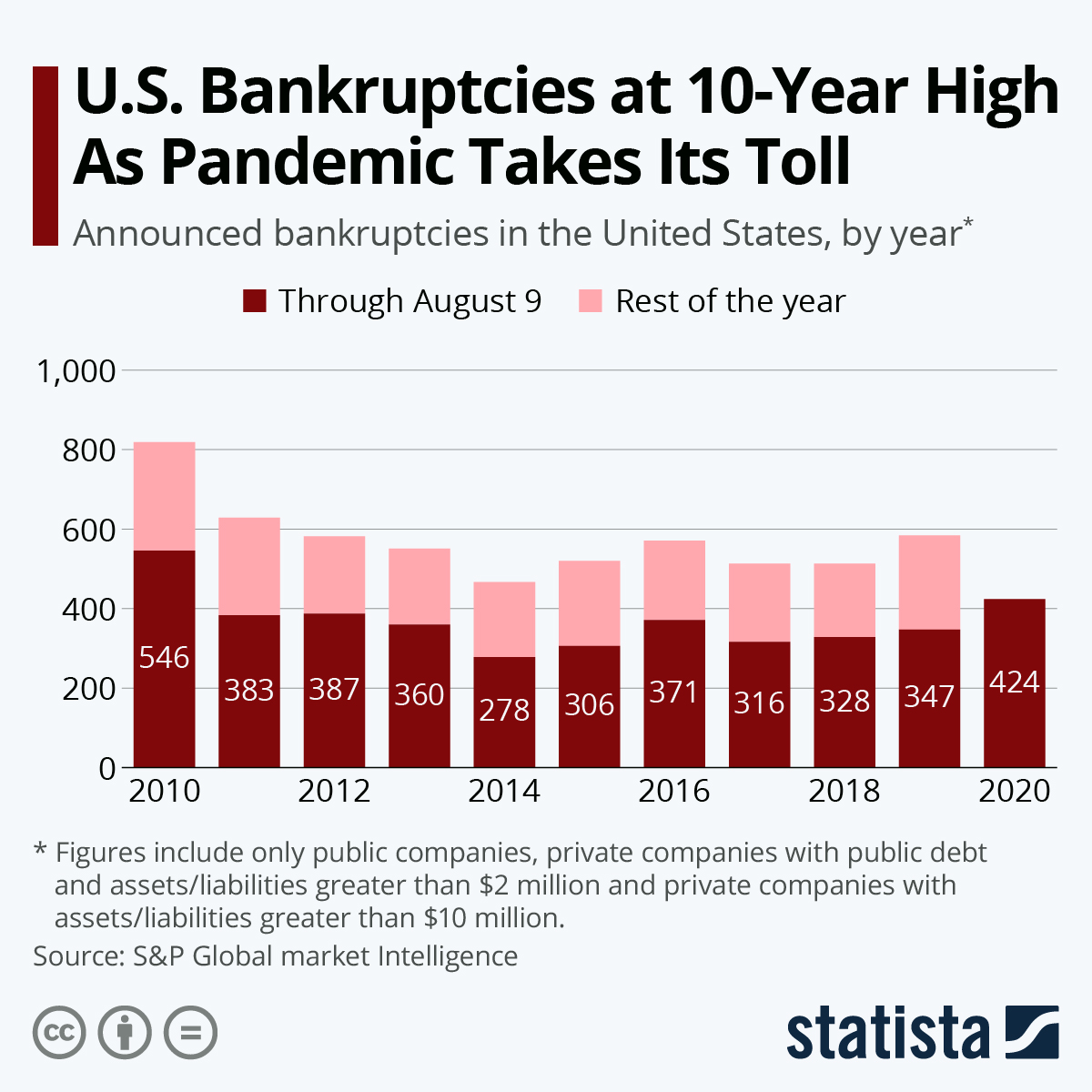

In fact, bankruptcies are already on track for a 1o-year high.

You will find more infographics at Statista

According to S&P Global Market Intelligence, 424 companies had filed for bankruptcy as of Aug. 9.

This exceeds the number of bankruptcy filing for any comparable period since 2010.

S&P Global Market Intelligence’s bankruptcy analysis includes public companies or private companies with public debt. Public companies included in the list of companies with public debt must have at least $2 million in either assets or liabilities at the time of the bankruptcy filing. In comparison, private companies must include at least $10 million.

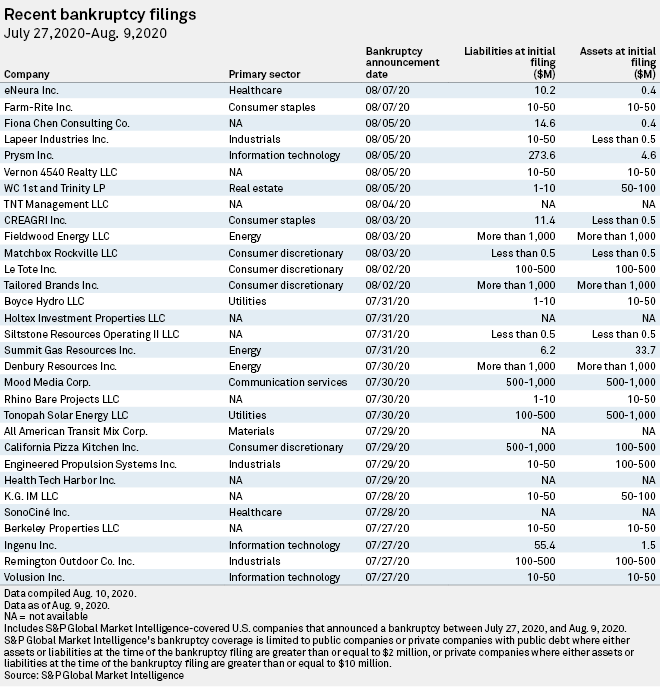

Recent filings include Men’s Wearhouse owner Tailored Brands Inc.; Prysm Inc., a company that develops large display screens; oil driller Fieldwood Energy Inc.; and Summit Gas Resources Inc., which acquires, explores and develops domestic onshore natural gas reserves.

Just between July 27 and Aug. 9, 31 companies filed for bankruptcy.

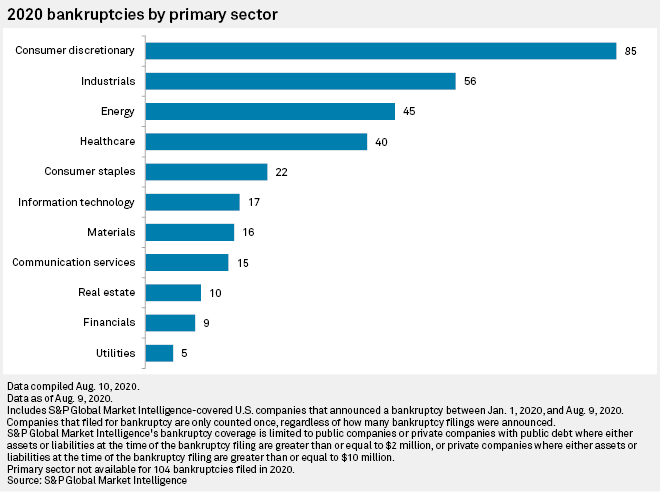

Bankrupcies have impacted most sectors, but consumer-focused companies have been hardest hit. According to S&P Global Market Intelligence, 100 consumer companies have already filed this year, including big retailers such as Ascena Retail Group Inc., J.Crew Group Inc., Lord & Taylor LLC, J. C. Penney Co. Inc. and Neiman Marcus Group Inc.

Melanie Cyganowski, a partner at New York-based law firm Otterbourg, said in an email to S&P Market Intelligence that the pandemic has impacted companies in virtually every sector, saying the “economic impact is deep and far-reaching.”

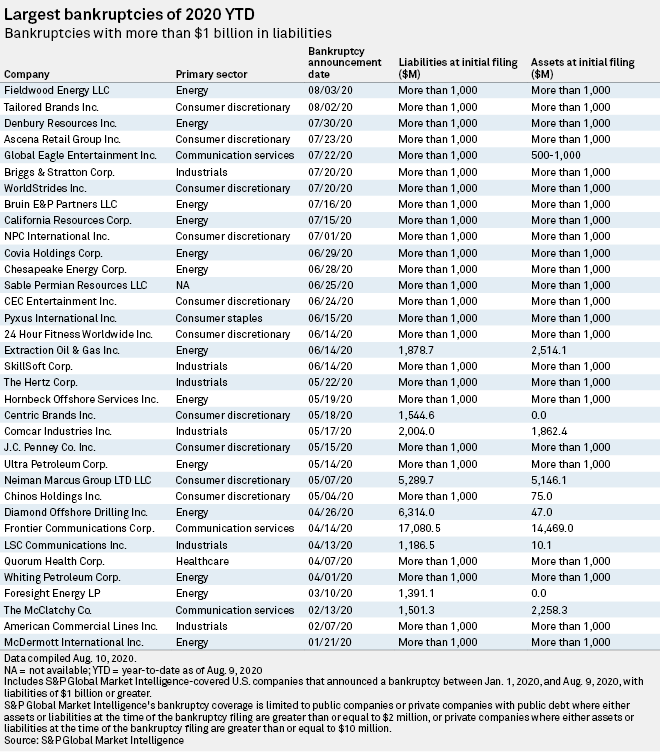

Thirty-five bankrupt companies reported more than $1 billion in liabilities.

Analysts say they expect the pace of bankruptcies to continue, with retail and small businesses facing the most pressure.

John Blank, chief equity strategist for Zacks Investment Research, told S&P Market Intelligence that “brick-and-mortar retail is not gonna work out,” adding that airlines and regional banks with overexposure to retail could “blow up” without government assistance.

This further undermines the narrative of a quick “v-shaped” economic recovery. Even with a cure for the coronavirus tomorrow, the economic impacts will likely drag on for months, if not years.

And yet, most of the mainstream still seems convinced that with a little more stimulus and a coronavirus vaccine, everything will be just fine. But as we’ve said over and over, curing the coronavirus won’t cure the economy. And the government “help” is only making things worse in the long-run.