After Crushing Its Clients, JPMorgan Now Sees 50% Chance Of Zero Rates This Year

After telling its clients again, and again, and again to short US Treasury, it’s time to call it: anyone who listened to JPMorgan has been quietly taken to one of the hundreds of portable crematoriums in Wuhan and even more quietly disposed of.

Starting in January…

… then continuing in early February…

… and again just last week…

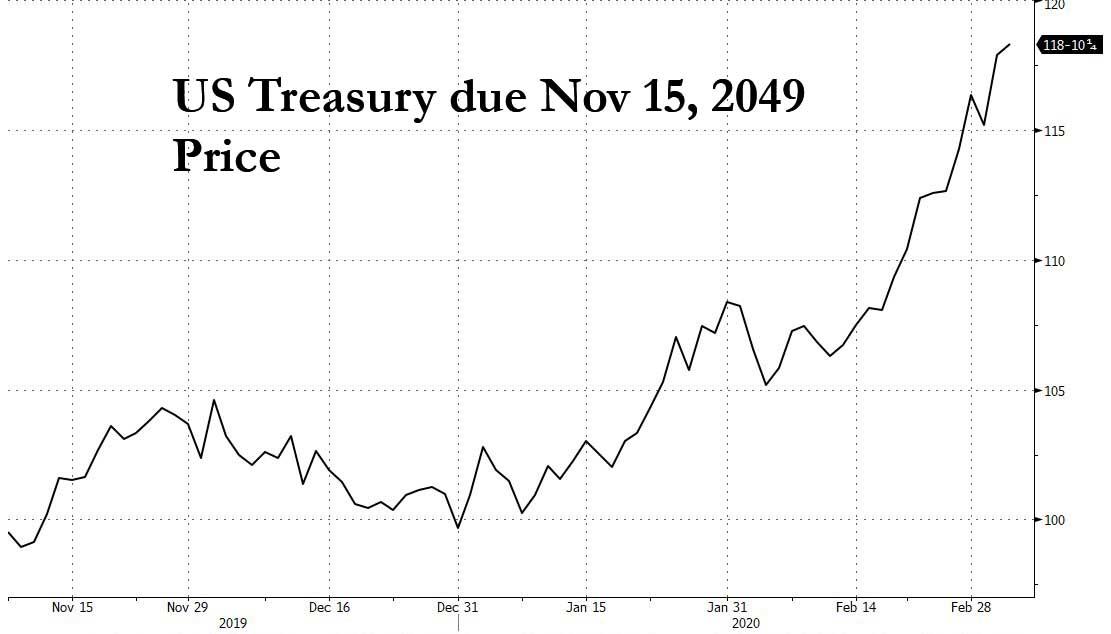

… JPM went on a crusade against rates, and lost in epic fashion, with the 30Y going parabolic during JPM’s relentless shorting campaign and printing today at all time highs.

So what does JPM do after the Fed admitted that any hopes for a mean-reversion are dead and buried, and rates are only going lower from this point on as the world sinks into the Japanification “NIRP trap”? Why it is kind enough to tell all those who listened to it and shorted bonds that its economics team now sees a 50% change that rates return to zero this year (with money markets now signaling ZIRP may be hit as soon as June).

Yet even in crushing defeat, JPM refuses to admit, well, defeat, and in a note published overnight by JPM’s economist and research teams and titled “Could US Treasury yields hit zero?“, and despite saying there is now a 90% chance of a recession, the bank – which until just a few weeks ago was praising the state of the US economy – is quick to point out that “this is not our base-case view, and our US rates team is forecasting 10-year US Treasury yields to reach 1.30% by mid-year 2020 and 1.60% by year-end.”

Oh ok. Unfortunately, with all of its rates clients now broke, it wasn’t exactly clear who, if anyone, will benefit from the bank’s “tremendous insight” and continued optimism about the future even as the entire world now sinks into an imminent virus-led recession.

The full note, for anyone who actually cares and wants to be put money that this time, finally, JPMorgan may be right, is below:

Could US Treasury yields hit zero?

A special message from Joyce Chang, Chair of Global Research As 10-year US Treasury yields reached an all-time record low of 1.09% on March 2nd, this report references J.P. Morgan’s latest global research on the risks and implications of returning to the zero lower bound. More of our research offerings can also be found on J.P. Morgan Markets.

In mid-January, we argued that low real interest rates are the preeminent macroeconomic challenge of our time as bond yields have been falling across the world for 40 years to historical lows, accelerating after the 2008 Global Financial Crisis. When we published our report posing the question, “What if US yields go to zero?”, the 10-year US Treasury yield stood at 1.80% (see J.P. Morgan Perspectives, What if US yields go to zero?, 16 January 2020). Weeks later, as fears of COVID-19 spreading to the rest of the world have intensified, 10-year US Treasury yields reached an all-time record low of 1.09% on March 2nd. Market pricing has shifted to reflect negative financial market feedback channels and sentiment effects, with many risk markets experiencing their worst drawdown in a decade over the past week. Last week, Fed Chair Jerome Powell implicitly acknowledged that current Fed policy may no longer be appropriate and a return to the zero lower bound must now be considered among the Fed’s appropriate policy responses to the outbreak. Our US economics team is forecasting that today’s emergency 50bp ease will be followed by another 25bp cut in April. We are also penciling in a 25bp rate cut from the Bank of England (BoE) at its March 26th meeting at the latest. Rates markets are pricing in an even greater “pandemic pivot” with the terminal Fed funds rate reaching ~50bp by mid-2021. Outside of the US, the market now prices two 25bp cuts from the BoE, while the Reserve Bank of Australia (RBA) has just eased by 25bp. EM central banks will remain accommodative, with at least 13 (out of 22) EM central banks easing this year. One of the recurring themes in optimal monetary policy near the zero lower bound is that when growth risks occur with policy rates within the neighborhood of zero, then the central bank should act early and aggressively. Our US economics research team sees a 50% chance that policy rates return to zero this year. To be clear, this is not our base-case view, and our US rates team is forecasting 10-year US Treasury yields to reach 1.30% by mid-year 2020 and 1.60% by year-end.

An update of our US recession probability framework based on market pricing as of today finds that rate markets are now implying that something that looks like an average US recession is at a very high 90% likelihood scenario even though we have not altered our full-year US growth forecast that dramatically. The US economy will avoid recession in 2020, but J.P. Morgan economics research now forecasts a 1Q20 stall in global GDP growth, representing the first time global growth has stalled outside of a recession. Our US economics team now expects growth of 0.5% in 1H20, followed by a rebound to 2.25% in 2H20 for a full-year forecast of 1.4% growth. However, given the rising risk of a return to the zero lower bound this year, we include a round-up of the reports published on this topic over the past few months as well as links to flagship publications, PowerPoint and video summaries.

Translation: we were catastrophically wrong about everything, so after you are done calculating your losses for listening to us and shorting the 30Y, here are all our reports on the topic which, you guessed it, were dead wrong too. You can use them for kindling in case you can’t afford to heat your house next winter.

Oh, and before we forget, that’s the real reason why he is richer than you.

Tyler Durden

Wed, 03/04/2020 – 11:25