Blain: Cutting Rates Is Now “About As Relevant As Painting A Sinking Ship”

Authored by Bill Blain via MorningPorridge.com,

Lots of interesting moments yesterday…

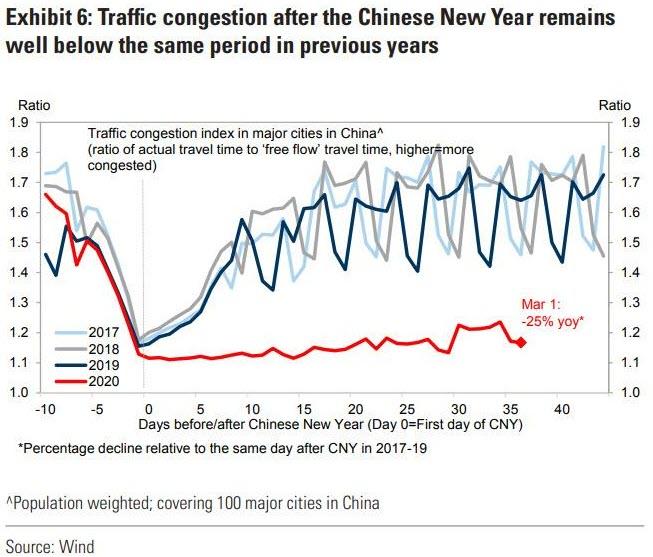

The bear market rally probably didn’t persuade anyone the coronavirus crisis is over – but a few will wonder if we’ve passed “the end of the beginning” stage..! Time to stop the panic, and focus on timing for the upside? For instance, there are a surprising number of articles saying manufacturing production is recovering rapidly in China – although the same weather satellites I mentioned yesterday do show rising NoX levels, but they are still massively lower than they should be, inferring Chinese industry is about 50% of where it was this time last year!

A number of market talking-heads are saying there is no reason there should not be a swift V shaped recovery from this crisis – but I think they underestimate timing effects on sentiment, confidence in central bankers to keep juicing markets, and on supply chain resilience. Long-term, I reckon the global economy will emerge stronger, but timing is rather in the hands of “what the virus does next,” than the hopes of market sages! (Hopes are never a good strategy.) Perhaps we do get recovery, but I expect the second leg, the upward V, will be jerky and disjointed as more bad, and good, news emerges and is digested.

How @Starbucks, @Apple, and other businesses are operating in #China during the #coronavirus outbreak $SBUX $AAPL pic.twitter.com/iDSMK0dRC0

— Eunice Yoon (@onlyyoontv) March 5, 2020

Its never as simple as we hope…

Markets also took some reassurance on the Chinese pledging $16 bln to fight the virus, and the American’s nearly $ 8bln – its clear East and West are taking the disease seriously. Read some of the articles about how bad it’s been in Wuhan, and it’s quite distressing.

However, the real issue is what are governments and central banks going to do about addressing the economic issues and damage?

Tuesday’s 50 bp emergency Fed cut conclusively demonstrated monetary policy is not going to address a global supply shock.

Solving the Coronovirus shock effects is going to be about practical politics and fiscal policy. Investors want to see what Governments are going to do in terms of hard dosh and real support being put on the table. Interest rates at zero are as relevant as painting a sinking ship.

This is the major reason I’m negative on Europe at the moment. The ECB under Lagarde is trying to join the 21stCentury, and realises that tinkering with rates and even QE is not the solution. It requires Fiscal policy to juice decaying economies. But fiscal spending is a government political decision. The ECB does not have any political mandate, and in any sane world will never be given one. Her best hope is for the ECB to support nations calling for the rules to be eased to allow fiscal policy – it won’t help Italy was the fist to the lending window, but even Berlin is making positive noises about combatting the effects of the virus.

The issue for markets remains recessionary threats, and these are multiple. One of the major ones is the prospect of an escalating cascade of defaults as companies start to go to the wall triggering wider financial contagion on the back of broken supply chains and lost orders.

I wasn’t that surprised UK Regional Zombie Airline Flybe finally went to the wall last night – Coronavirus was but the final nail in its coffin.

However, what does its collapse say about the UK’s Government intervening across business (and especially SMEs) to stop them going bust over Coronavirus fears? I am heartened to read new BOE Governor Andrew Bailey is greatly in favour of SME support to get them through the crisis. (I’ve decided I like Bailey – anyone who is a target of the self-confabulated Gina Miller is a friend of mine!)

But letting Flybe go bust raises a host of issues. For a start, I can’t believe the Boris government is using the excuse it can’t bail out Flybe because we are still subject to EU rules. FFS! This means the government could not cut domestic passenger taxes – which would have saved the airline, nor can they make it an emergency loan of £100mm. Both would upset Yoorp. Apparently!

There is a great argument to be made that Flybe is vital to UK infrastructure. If you want to fly from any of the regions to another you really have had no alternative. Driving is an option – if you fancy hours stuck in jams caused by our decaying infrastructure – and don’t even suggest the railways.

I’m particularly peeved about Southampton. The railway to anywhere is just appalling. The roads are most blocked – they are converting the motorways into “Smart Motorway” death-traps. And now the airport is closed – over 95% of the flights were Flybe.

Here is a great Business Investment Idea: Buy Southampton Airport

Let me tell you a story. A few years ago we were in Frankfurt on business. It was a Thursday night, and we were having dinner with German clients. I decided to fly directly home to Southampton the following morning, while Jimbo was going to Heathrow. But something came up, and we were both needed back in the office. It was too late to change flights. My flight to Southampton was 20 mins after the Heathrow flight. When I landed at Southampton, I walked across and caught the train to London Waterloo, and then the tube to the office. I arrived 30 mins before Jimbo who’d caught the earlier Heathrow flight.

There is a message in that story. Southampton airport is empty. It lies at the hear of Southern England in one hours drive of 20 million affluent people. It was a small airport under Flybe. It could be massive.

(And if you are wondering why there is a blue Spitfire on the Photo this morning, its because the guard plane at Southampton is a model of the original prototype Spit that first flew from the Airport in 1936!)

Back in the USSR USA

Meanwhile, the other big story this morning is the market not taking fright at the likelihood Joe Biden will win the Democrat Nomination, and even could/might win against Trump. That was utterly inconceivable just a week ago… All Trump had to do was wait for the Democrats to lose the election.

But a week is a long time in politics!

With the prospect of slower flatline growth or a weaker economy into the 3rd/4th quarter – timing and recessions are the secret of all good comedy – Trump could face a real battle with Biden. You might have expected the market to react badly to the prospect of a Biden win, but even health stocks went higher..

Over the next few days I’m looking for pro and con arguments on what a Democrat Win in November will do the global economy.

Tyler Durden

Thu, 03/05/2020 – 11:20