Connecting The Dots: How SoftBank Made Billions Using The Biggest “Gamma Squeeze” In History

Tyler Durden

Sun, 09/06/2020 – 13:35

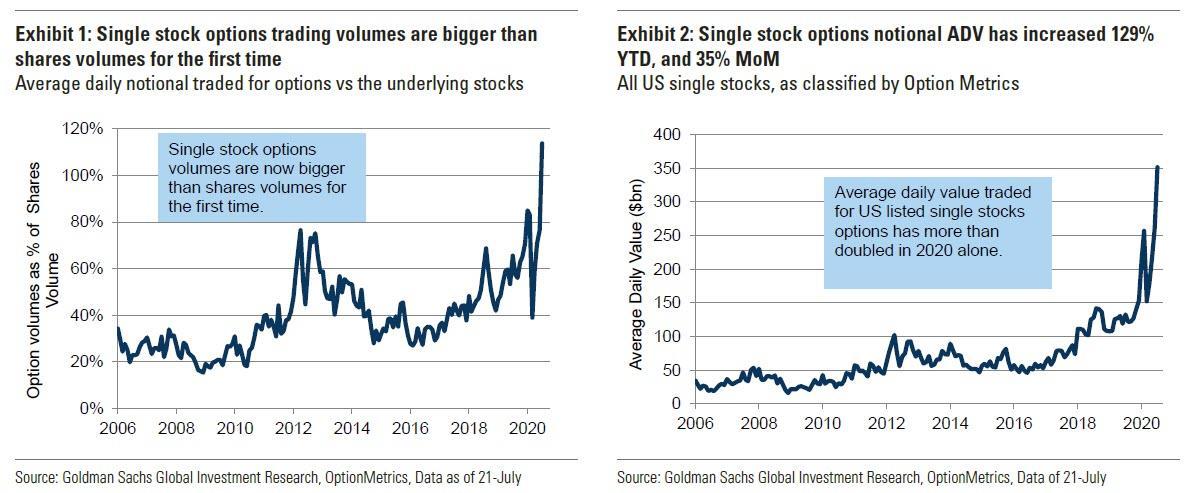

It was back in July when we first reported that Goldman had observed a “historic inversion” in the stock market: for the first time ever, the average daily value of options traded has exceeded shares, with July single stock options volumes hitting 114% of shares volumes.

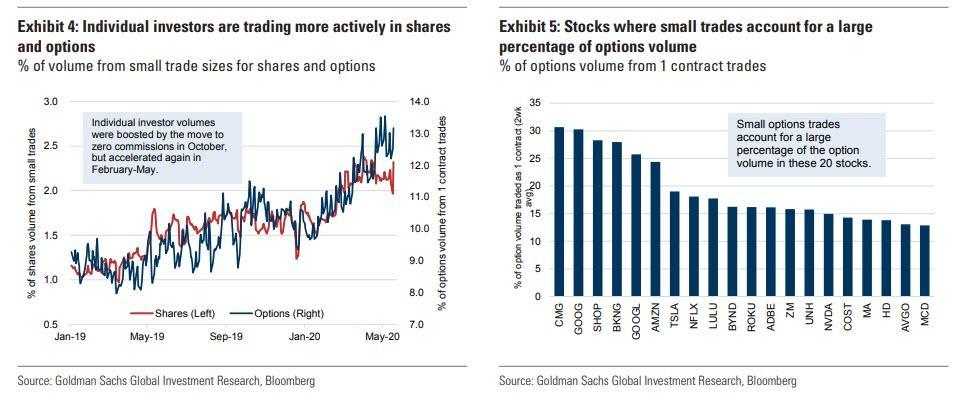

This followed a May report in which we discussed “how retail investors took over the stock market”, pointing out the “recent surge in options trading – which has far more impact on market flows due to embedded leverage” and cited Goldman data which showed that “individual investor active trading is playing an increased role in market volatility, particularly in select stocks. In the shares market, 2.3% of all volume is made up of trades for $2,000 or less. The increase in small trades has been even more notable in the options market, where 13% of all trades are for 1 contract.”

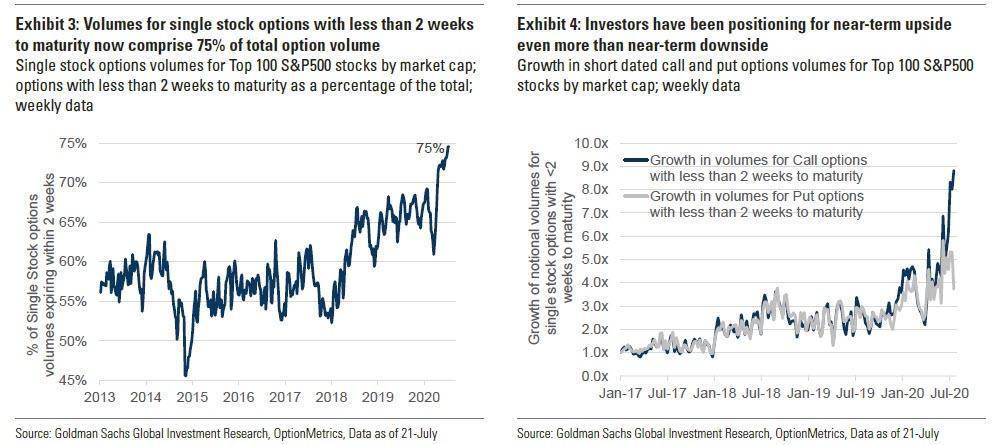

We also pointed out that “a significant portion of this increase has been driven by higher volumes in short dated contracts, as investors are literally using massive leverage to wager on near-term momentum moves such as those often highlighted OTM calls traded in Tesla stock.”

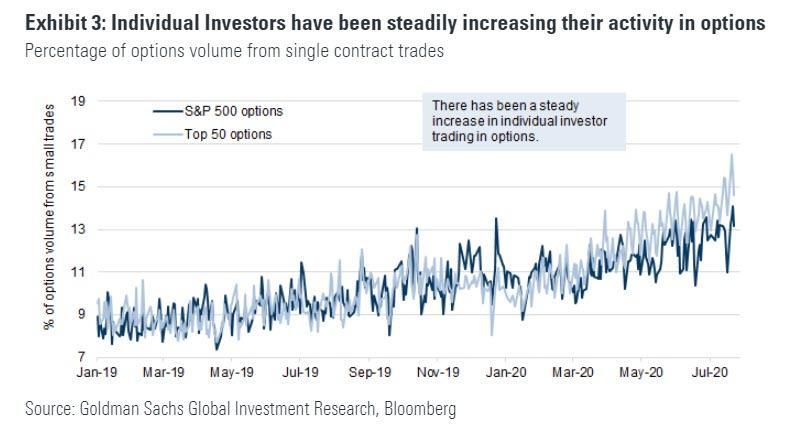

The last clue that an entire generation of investors were flooding into options (read calls) was the surge in individual investor option activity in both the top 50 and the top 500 US names, which has continued a steady climb since the start of the year.

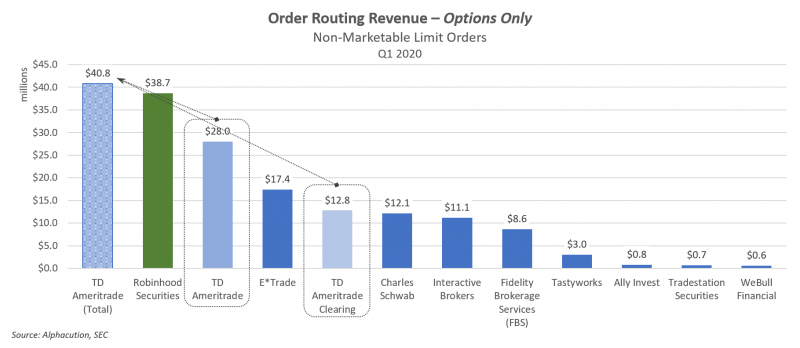

To be sure, this option frenzy was a goldmine for retail brokerages such as Robinhood, Schwab and Etrade, which reported options trading activity surging 129% YTD (up 35% from June levels), which helped explain why various HFT outfits are paying so much to frontrun Robinhood option trades.

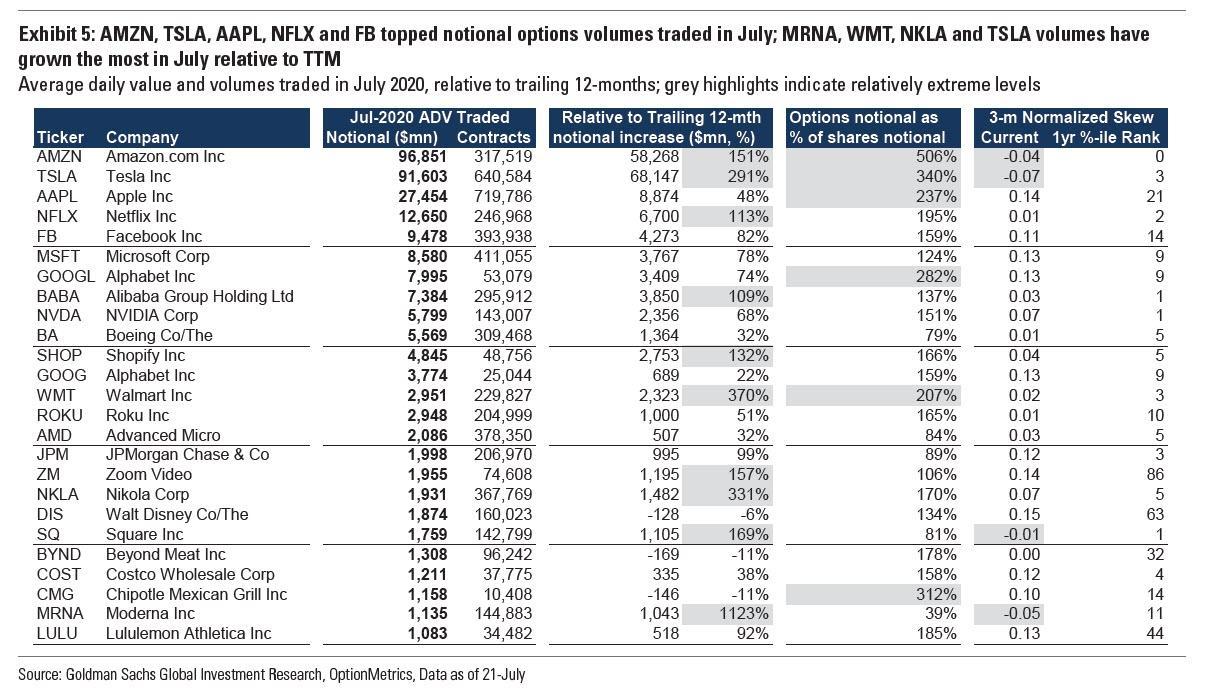

Finally, we also pointed out where the option trading footprint was largest, and not surprisingly we showed that options volumes had been driven higher by an increase in trading in many of the large market cap names. AMZN, TSLA, AAPL, NFLX and FB had the highest volumes in July. Among the top 25 underliers with high notional volumes, MRNA, WMT, NKLA and TSLA saw the biggest jump relative to the prior 12-months.

Also of note, bullish sentiment in a number of names as indicated by options market skew, was at extremely high levels. Three-month normalized put-call skew in AMZN, TSLA, SQ and MRNA had declined to below 0 as of two months ago, a striking development because as Goldman notes, “negative skew is a relatively rare statistic for large cap names such as AMZN (where three month skew is currently at all-time lows), implying crowding in long AMZN calls.”

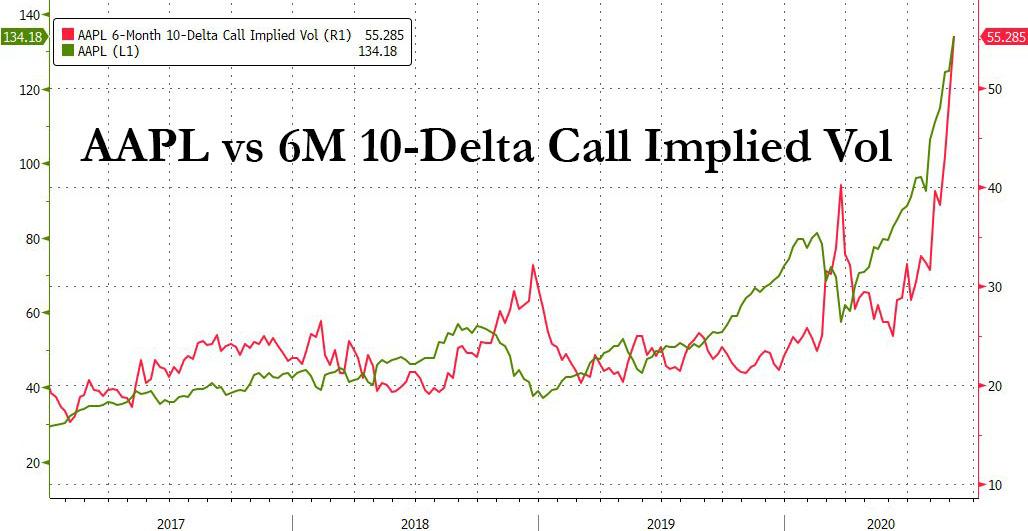

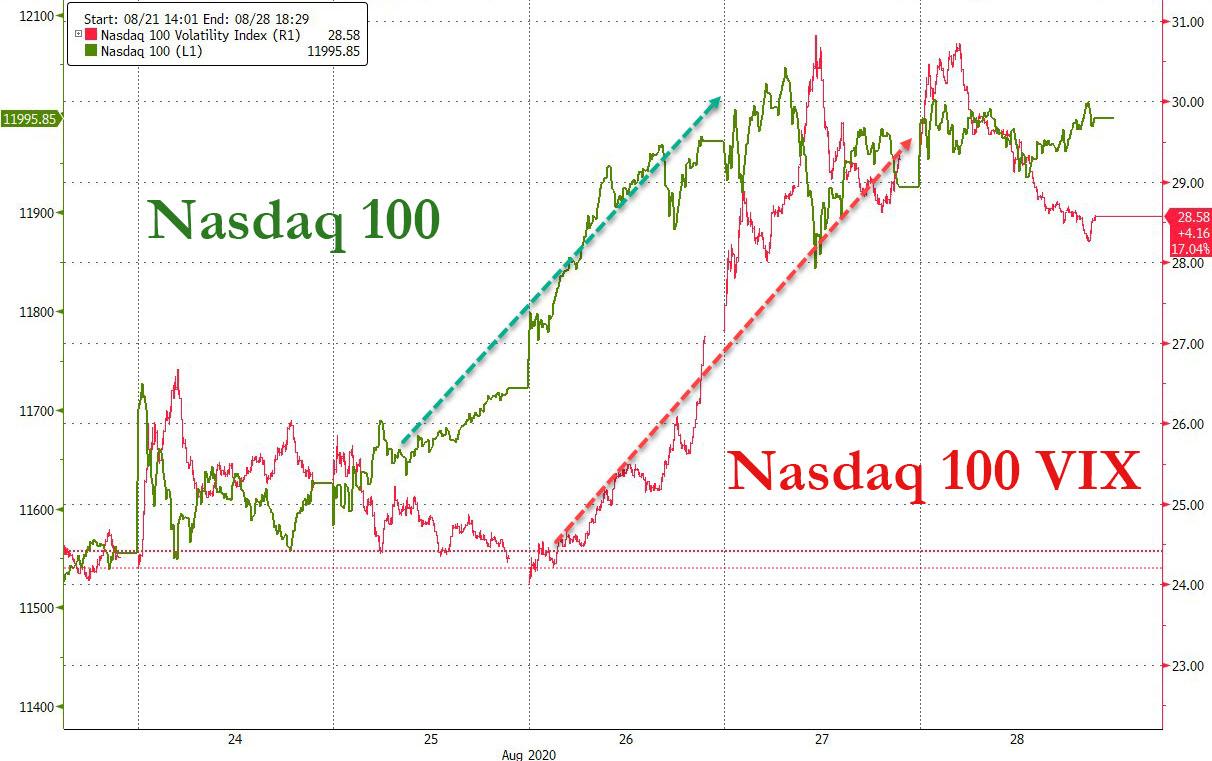

Fast forward to last week when we first showed that these trends had accelerated to an unprecedented degree, and the implied vol among some of the giga-cap names such as Apple had exploded to record levels even as the stock was trading at all time highs and sporting a market cap of $2.2 trillion…

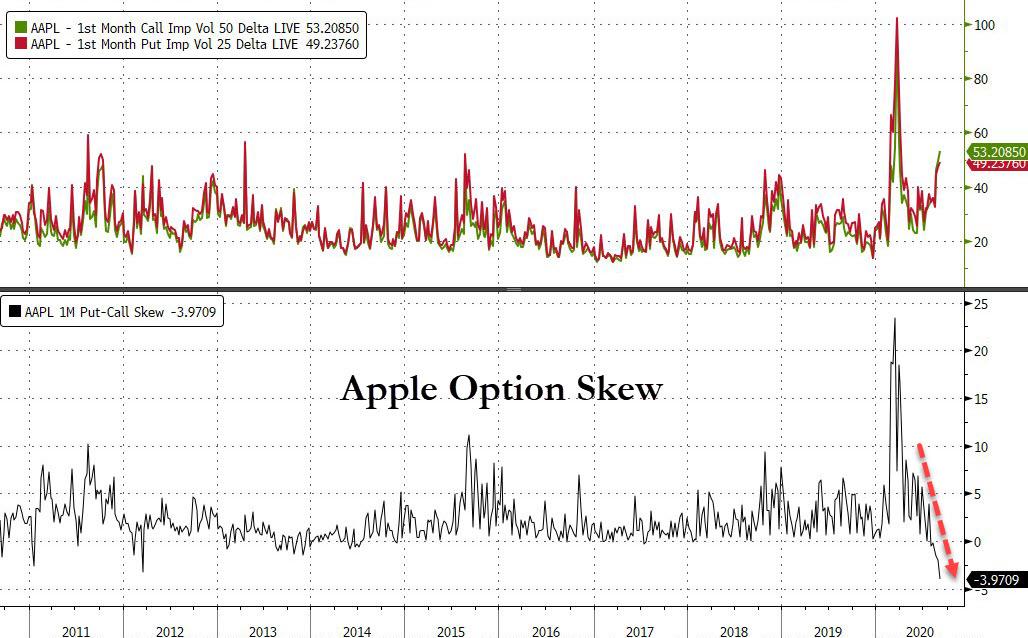

… while the plunge in option skew, first highlighted in July, had also hit unprecedented levels.

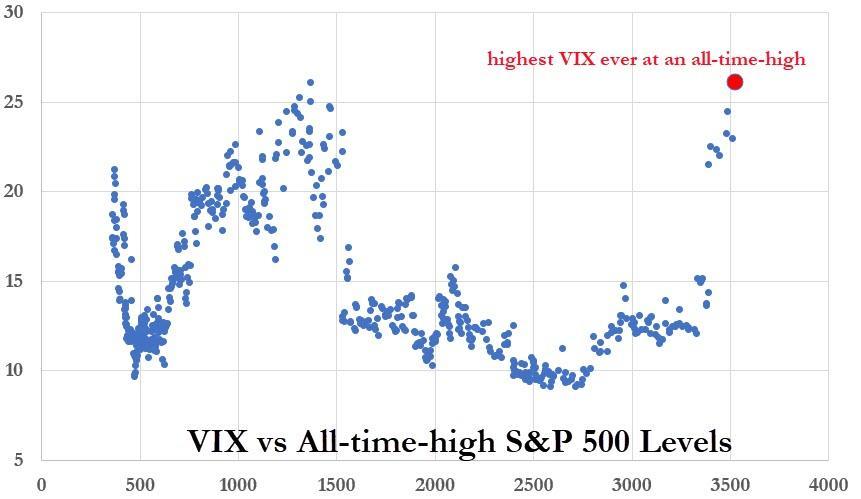

These bizarre trends, where one or more players where furiously buying calls and pushing both the implied vol and gamma (in both single stocks and the broader market) ever higher while dealers were caught short gamma and were forced to chase stock prices to obscene levels, creating a feedback loop where the more calls were bought the higher the underlying stock price surged, leading to even more call buying and the paradox of a record high vix at an all time high in the S&P500 (in fact the last time we had observed such a confluence was the day the dot com bubble burst)…

… led us to explain last Wednesday that “an epic battle was raging beneath the market surface” where as Nomura’s Charlie McElligott said that “street-wide, Dealers are short Gamma / short Calls off the back of the MASSIVE upside premium buyer (as in BILLIONS spent) who has been in the market over the past month or so in a number of mega-cap single-name Tech cos.”

Putting it all together, we said that “a combination of market euphoria, free options trading, and most importantly, few market-makers have sparked the fire” indicating that a key player in all this was indeed retail investors. We then added that it also meant that “a few large funds understood this and have added fuel to the fire by pushing implied higher and higher and putting further pressure on the likes of Citadel and Goldman. With this process helping drive names like Apple and Tesla, this also makes sense why Breadth has been so terrible.”

The punchline, for all those who had been looking at the market action in recent weeks in stunned silence, was that “while most of the market is fading lower we are seeing a battle between a few big hedge funds and banks who are getting shorter and shorter gamma.“

* * *

Then all the pieces fell into place last Thursday when we first reported that contrary to expectations that the furious melt up of July and August was solely due to a buying frenzy among retail speculators, the identity of the “mystery marketwide call buyer” – or “nasdaq whale” as he was later dubbed – was none other than SoftBank and its founder, Masa Son. This is what we said:

It is hardly unreasonable to imagine SoftBank, the “brains” behind such catastrophic investments as WeWork,

WireFraudWireCard, and countless other failed “unicorns” would desperately try to Volkswagen not just a handful of tech names, but the entire market in the process. After all, Masa Son is desperate to deflect attention from the fact that as we put it last October, ” SoftBank is the Bubble Era’s “Short Of The Century.” And if there is one thing that can salvage the Japanese VC titan’s reputation it is a second tech bubble which blows out the valuation of his countless (otherwise worthless) investments…

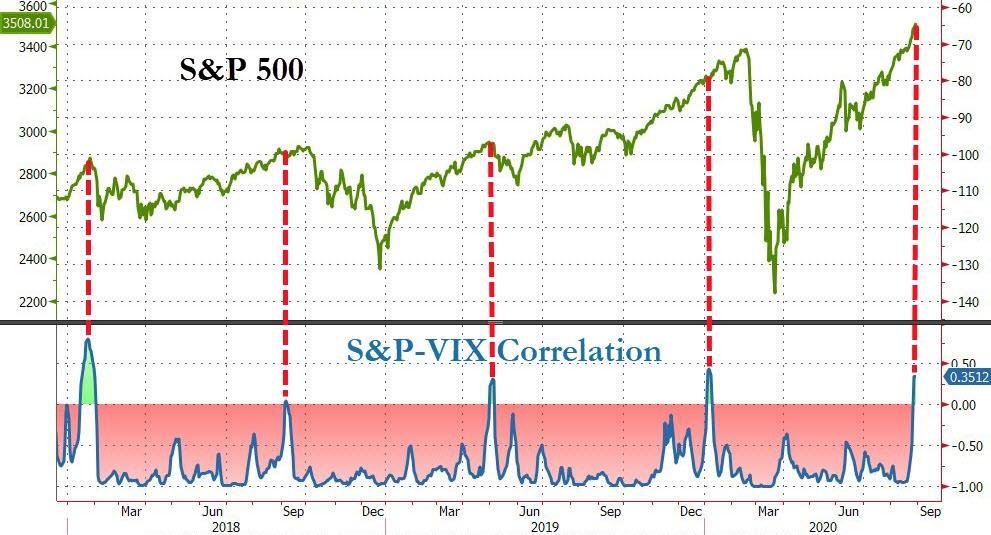

One day later both the FT and the WSJ confirmed that it was indeed SoftBank which was using a “positive gamma” strategy of buying up single name stocks, which it then propelled higher by buying calls in the same stock, if not sparking then certainly accelerating the gamma feedback loop which we first described last Tuesday before the SoftBank presence was reported in “A Classic Feedback Loop”: Why Everyone Is Chasing The “Gamma Crash Up” as both single name implied vol and the overall VIX surged alongside stocks (resulting in a historic inversion in the S&P-VIX correlation)…

… sending both the FAAMGs, the Nasdaq and the S&P500 to all time highs.

In retrospect it should have been obvious not just to us but everyone what was going on.

After all, it was in early August that we first learned that for the first time SoftBank was targeting investments of more than $10 billion in public stocks as part of a new asset management arm, far exceeding the initial holdings that founder Masayoshi Son outlined to shareholders in the company’s latest earnings call, and a break from the company’s strategy of investing in private names.

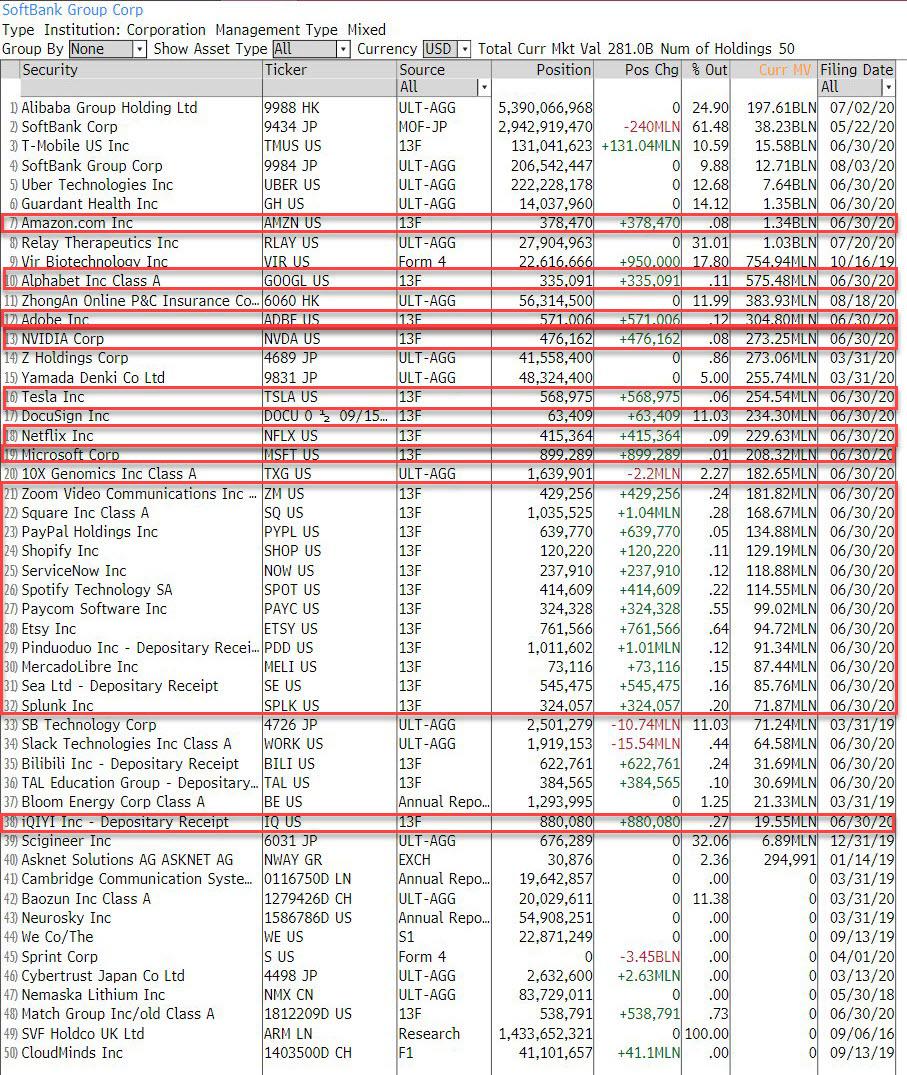

None of this was a secret, because on Aug 11, Son said SoftBank had acquired major holdings in not only the FAAMG stocks but some of the highest beta, “story” tech names.

Of course, the biggest hint was Bloomberg’s report in mid-August that SoftBank’s “investments were made using financing structures that can prevent SoftBank from showing up in public records as a direct shareholder.” Because why hide its footprints if it wasn’t engaging in a trade that would spark a historic surge in the very same public names it had just purchased, and which would gradually seep over to the broader market, sending the S&P to a record high of 3,580 just a few days ago.

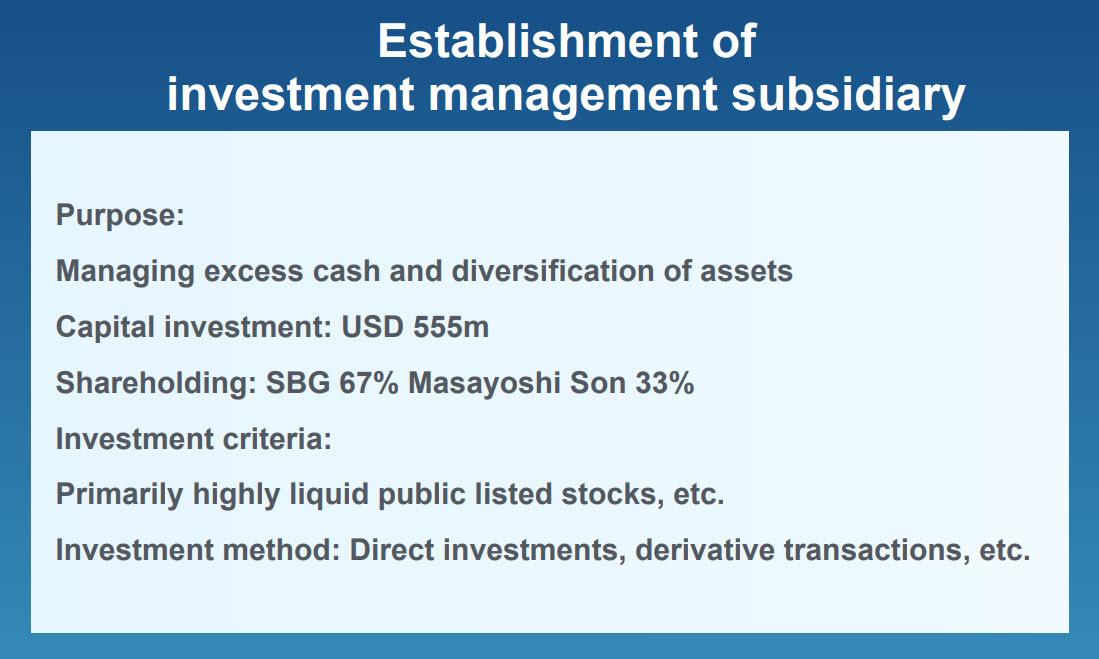

Incidentally, deep inside the company’s latest quarterly report on page 68, SoftBank revealed that it has established an “investment management subsidiary” whose purpose was to manage excess cash (i.e., Treasury operations) and diversification of assets and which would consist “primarily of highly liquid public listed stocks” where investments would either be direct of via “derivative transactions.“

There was also another reason why Masa Son desperately felt the need to spark a massive ramp in public stocks (conveniently taking place at a time in the year when markets were especially sleepy, during the vacation breaks of August): having seen his reputation and credibility crushed after the WeWork and WireFraud fiascos, the new unit reflected Son’s revived ambitions to secure tens of billions in fresh outside capital after the bombing of the second Vision Fund. And what better way to do it than to show a remarkable return on his brand, spanking new investments in public FAAMG stocks:

The founder had said in May that SoftBank was unlikely to secure outside investors for a second Vision Fund after problems with the first. But in the upbeat financial results Tuesday, Son expressed readiness to accelerate a companywide shift from telecom to investing. “Our strategy hasn’t changed,” Son said. “We still plan on unicorn hunting with Vision Fund two, three and so on.”

Which brings us to the “brains” behind the strategy, which we now know is Akshay Naheta, a SoftBank senior vice president in Abu Dhabi, who is the head of SoftBank’s new asset management team (i.e., the brand new team investing in public companies) and who was hired in Jan 2017 from the London-based Knight Assets which he founded, and where he focused on “arbitrage and value investing.”

Remarkably, Knight’s investments had generated a staggering IRRs of 112.5% annually since its 2011 launch (and didn’t charge a management fee at that), and one wonders just how much of the fund’s impressive performance was the result of similar gamma loops. One also wonders why Akshay would leave what was arguably one of the best performing buyside platforms last decade?

And where did Akshay learn the tools of the trade? Why at that “pristine” bank which has “never” had any legal issues or record criminal and civil settlements: Deutsche Bank, where Naheta was Head of Principal Strategies, “responsible for proprietary trading and structured deals, managing risk across various asset classes globally.”

Surely this financial wizard is a Wharton grad – after all for him to have such phenomenal “deep value” investing acumen, he must have learned from the best. Wrong: the SoftBank gamma guru graduated from MIT with an M.Sc in Electrical Engineering and Computer Science in 2004, following an undergrad from the University of Illinois at Urbana-Champaign where he graduated with a B.S., highest honors, in, drumroll, Electrical Engineering.

If JPM’s Bruno Iskil was the London whale, perhaps we should now call Askhay the “Gamma whale.”

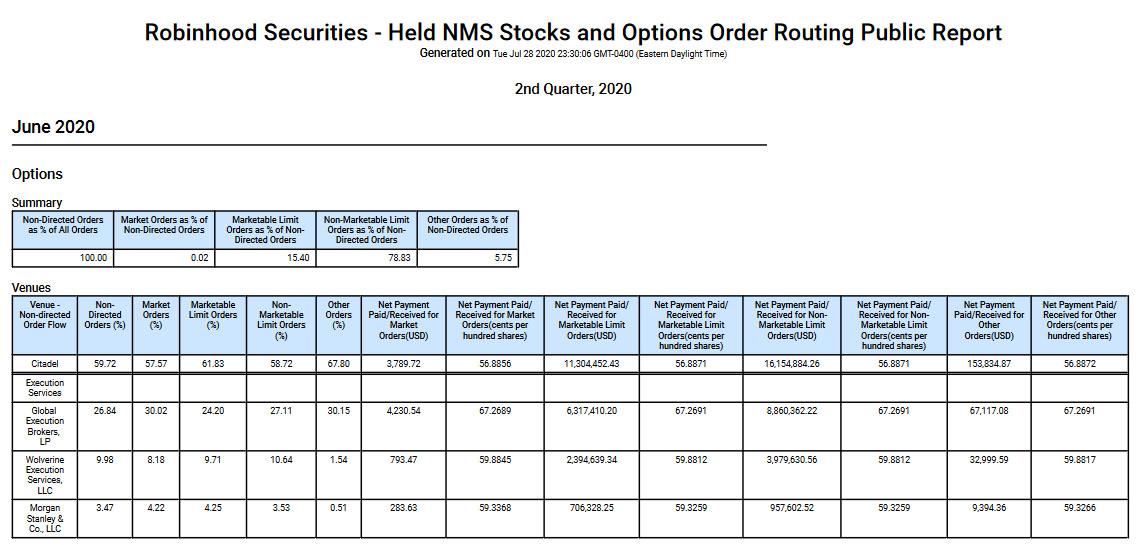

One almost wonders how much of a role in the marketwide gamma that flooded across markets in the past month did this computer science expert relegate to HFTs, whose momentum buying he knew would be sparked the moment SoftBank indicated it was splurging on calls across the most popular tech names, especially with HFTs frontrunning similar call buying over at retail frenzy ground zero, Robinhood, which made a killing in option trading payment for orderflow in June according to its 606 Report. We can only imagine what July and August will look like.

Conveniently, Askhay had Robinhood to help him, because having observed the furious retail call buying which we described from May across July (see above), Askhay realized that all he needs to do is pour a little extra gasoline on the fire, show a few outsized trades to the HFTs which would then unleash a cascade of call buying on their own, resulting in massive – and free – leverage of SoftBank’s own call buying trade.

Incidentally, Askhay was also the brains behind another infamous SoftBank trade: the $1 billion “structured equity” trade in WireCard. In a nutshell the trade consisted of a €900MM investment from SoftBank Investment Advisors in April 2019, at which time SoftBank said it would pursue a “strategic co-operation agreement” with Wirecard giving the impression that one of the world’s most powerful technology investors was forging a deep business relationship with the German company and inspiring confidence in its shares. But the day after SoftBank formally signed the strategic tie-up with Wirecard in September, SBIA cut its exposure to the German payments group through a sale of new bonds exchangeable for the payments company’s stock. As the FT reported, “Bankers at Credit Suisse sold the €900m debt instrument to a broad group of investors, which essentially allowed SBIA to fund its entire investment without putting in a cent of its own money, while also gaining tens of millions of upfront cash profits.”

And speaking of German companies (and frauds), we find it rather remarkable that some of the most prominent Deutsche Bank traders are now at SoftBank. Yes, there’s Akshay triggering the biggest gamma squeeze in history, but we learned in 2018 that Colin Fan, former co-head of Deutsche’s investment bank who made MD at 28, and one-time head of Deutsche’s trading business had also joined SoftBank, where he was reunited with Rajeev Misra, Deutsche’s former head of global credit trading (he oversaw a team of credit traders whose bet against the U.S. subprime mortgage market was chronicled in The Big Short), and the current head of Softbank’s $100BN Vision Fund.

Other Deutsche Bank alumni, Nizar Al-Bassam, Michele Faissola (who was implicated in the death of DB’s senior risk manager, William S. Broeksmit, who was found dead in 2014 after committing a still unexplained suicide) and Wayne Grigull, work for or advise (Faissola is an advisor) Centricus Advisors (formerly known as F.A.B. Partners) and helped the Vision Fund raise its Saudi money. Many worked together at Merrill Lynch before joining Deutsche Bank. As EFC noted some time ago, “they have history.”

Keeping a close eye on these former Deutsche Bankers, now at SoftBank, is imperative.

* * *

Which brings us to what is perhaps the last loose end: how much money did Akshay – and SoftBank – make using this strategy? According to the FT, SoftBank is currently sitting on unbooked profits of about $4 billion. This is roughly the same amount as SoftBank has risked by spending on call premiums over the past few months – as it built up a massive position equivalent to roughly $30 billion in notional exposure – resulting in a 100% gain in just a few months.

Of course, as we noted yesterday, despite being exposed as the fund behind the market’s bizarre August moves, implied vol has yet to drop which means that SoftBank is likely still in the trade and has yet to take a profit…

… or that dealers have not yet figured out a proper strategy to hammer implied vol. One thing that is certain is that it is only a matter of time before dealers, who were counterparties to the SoftBank trade and are likely nursing billions in losses (assuming they didn’t delta-hedge all of their exposure) will do everything in their power to punish the Japanese conglomerate. And even if they did fully delta-hedge their outlier gamma exposure, now that the FAAMG rally has broken, the precipitous ramp observed on the way up is about to reverse as dealers start dumping the stocks they had to buy as gamma spiked, leading to a mirror image of the melt up trade. In short, while SoftBank may have made a 100% profit, unless it somehow unwinds this trade asap, it risks losing not only all of its gains but also suffer material losses that would eat into the option premium and would then also hammer the value of its underlying stock investments.

The bottom line is that as one unnamed trader quoted by the FT said, “it’s just a levered punt on the market. The whole strategy is just momentum buying.“

Well of course it is, but it had not only the benefit of massive leverage, but also timing, striking just as there was virtually nobody in the market to take the opposite side of the trade while piggybacking on a call-buying frenzy among the retail community, something any trader with a background in HFT/market structure inefficiencies such as a Akhsay would be well aware of.

The only question we have now is what happens to SoftBank – whose reputation for foolhardy leeroy jenkins-tyle investments with little to no diligence but merely seeking to manipulate the market with its size and scope precedes it, once the momentum reverses, and after hunting dealers with a max painful gamma squeeze, dealers now return the favor.

The answer: probably not much – recall that the BOJ is now the biggest investor in Japan’s ETFs, and with SoftBank widely held not only by Japan-focused ETFs but also by Trust banks through which the BOJ operates, it is safe to say that the Japanese central bank is one of the top investors in SoftBank, if not bigger even than Masa Son himself with his 21% holding.

Add the fact that Japan’s pensioners via the GPIF are among the top investors in SoftBank (which among other thing, means that the fate of Japan’s pension funds is now directly tied to the performance of AAPL and TSLA calls), not to mention that the world’s largest sovereign wealth fund, the Norges Bank is also a top 15 investors…

… and it is clear that nothing bad can ever happen to SoftBank – even if this particular momentum trade were to crash and burn – simply because a failure of this particular “Nasdaq whale” would be far too systemic, causing massive losses among both sovereign wealth fund and central banks, and it would promptly receive a bailout from the BOJ, something we first suggested last year.

When is the BOJ’s bailout of Softbank?

— zerohedge (@zerohedge) September 5, 2019

In fact, the fact that SoftBank is now too big to fail is – in our view – the true reason behind Masa Son’s unprecedented gamma gamble: after all if the trade succeeds Masa wins, if the trade loses it is the merely taxpayers that lose (as they always do in the end)… something which apparently was not lost on Akshay himself:

This is why capitalism is breaking down! Our future includes a significant increase in taxes to counter these government-backed bailout policies at any sign of “trouble”. The Fed’s policies have exacerbated inequality and tensions in the social fabric. https://t.co/H8UmloRhhK

— Akshay Naheta (@Akshay_Naheta) July 5, 2020