UBS Contemplating Mega-Merger With Credit Suisse; Would Be Biggest Bank Deal Since Financial Crisis

Tyler Durden

Mon, 09/14/2020 – 11:20

Swiss financial blog Inside Paradeplatz first reported that the chairmen of Swiss banking giants UBS and Credit Suisse are exploring the possibility of a merger that would presumably fuse the two Swiss banking behemoths into a European giant with enough heft to go toe-to-toe with JPM. The news was picked up early Monday morning by Bloomberg, which reported that the project, nicknamed “Signal”, is being pushed by Axel Weber, the chairman of UBS, who is working on the deal in partnership with Urs Rohner, his counterpart at UBS.

Weber has reportedly discussed the idea with Swiss Finance Minister Ueli Maurer, and an agreement could happen by early next year, according to the original report.

However, Wall Street analysts have responded to the report of what wold be the biggest banking merger since the financial crisis with skepticism. The creation of such a massive Swiss national champion would seemingly cut against European regulators’ push to shrink its megabanks.

Andreas Venditti, an analyst at Vontobel, warned that executing such a transaction would be “difficult”: “Regulation would be the biggest hurdle in my eyes” because requirements are tougher the larger an institution is, Venditti said, adding he doesn’t think a deal is likely.

Expanding on this notion, a team from Bank of America published a note to clients on Monday exploring the finer points of a UBS-CS tie up. While BofA banking analyst Alastair Ryan, seconded Venditti’s skepticism, he managed to see at least one scenario that might lead to regulators’ giving their blessing to a deal.

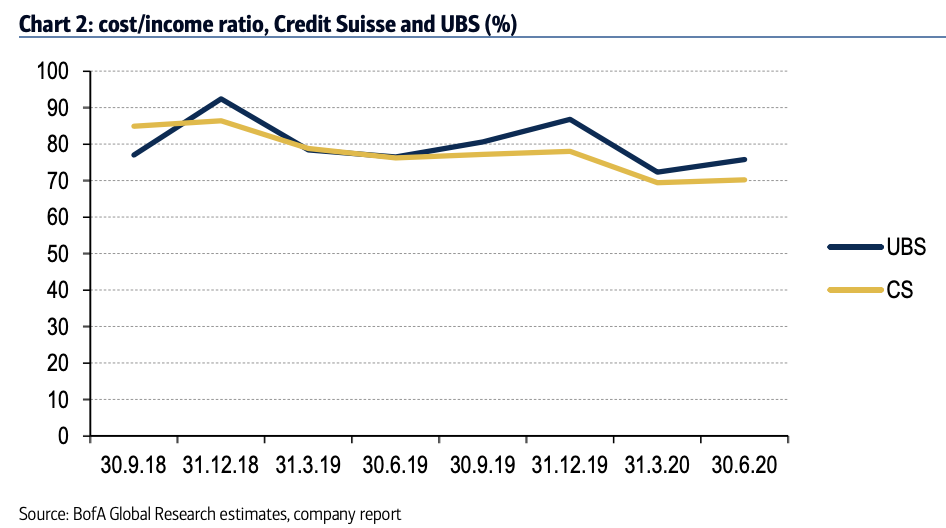

However “material” cost synergies and increased scale of a combined bank were identified by Ryan as the two primary benefits for shareholders.

But in a year that’s seen i-banking trading revenues soar, Ryan warned that building scale in their investment banks would “not be welcomed by the market or Swiss authorities”. But, on the other hand, a “larger wealth platform could accelerate the shift from their investment banks competing in the institutional big-balance-sheet areas of FICC and equities” while also speeding up the transition to predominantly focusing on wealthy clients’ capital market needs.”

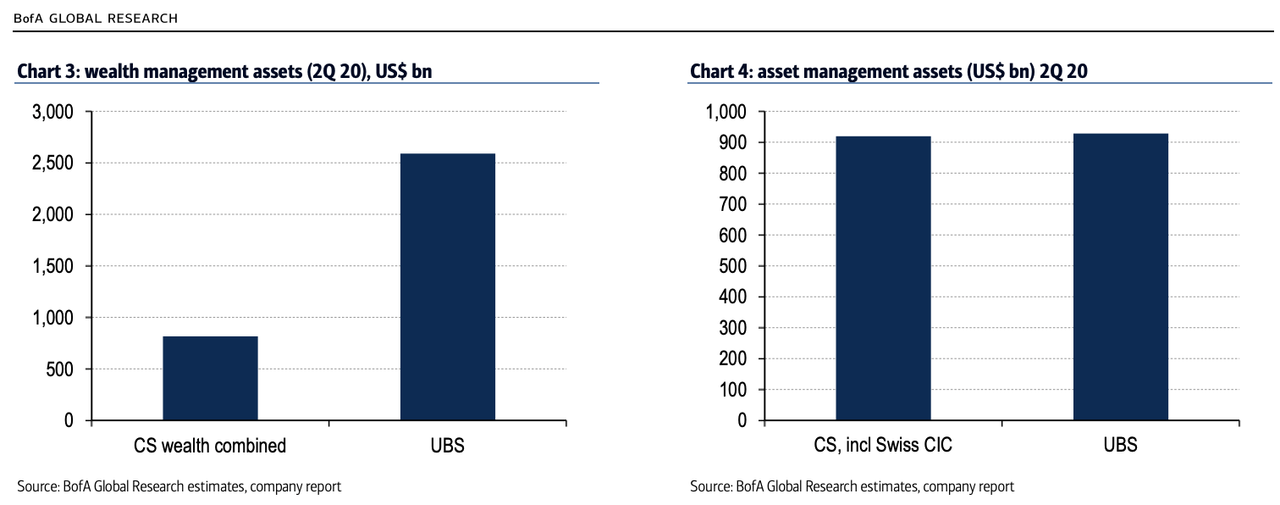

UBS has a slight edge over CS in terms of its wealth management business, but in terms of total AUM, the two are on roughly equal footing.

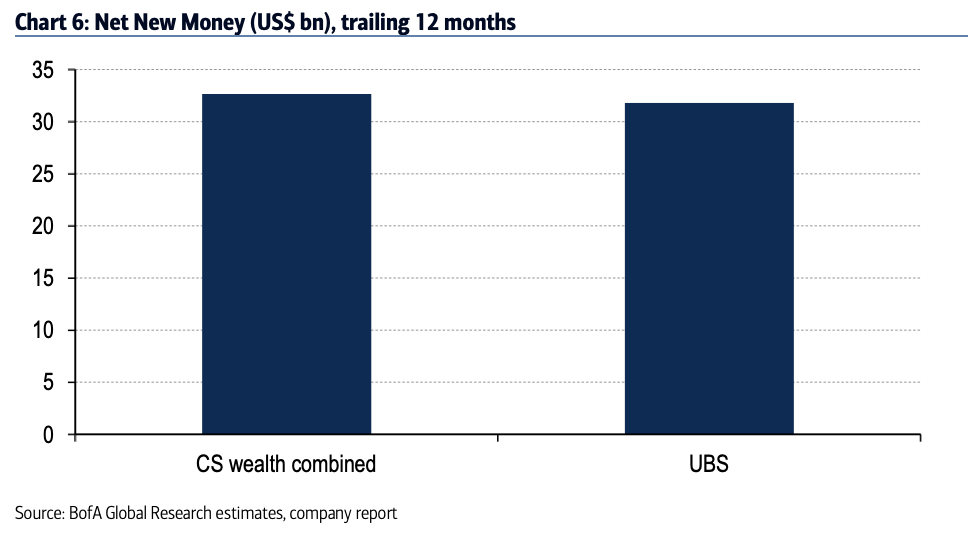

Though CS has seen slightly more growth in its asset-management business over the past 12 months.

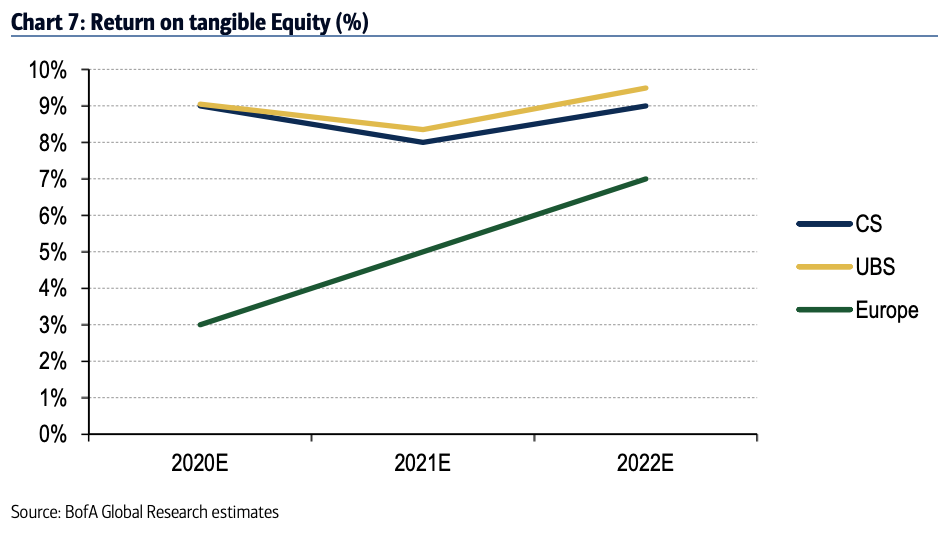

The focus on managing money and tending to wealthy clients’ capital-market needs has pushed the two banks’ toward a “more acceptable” return on equity.

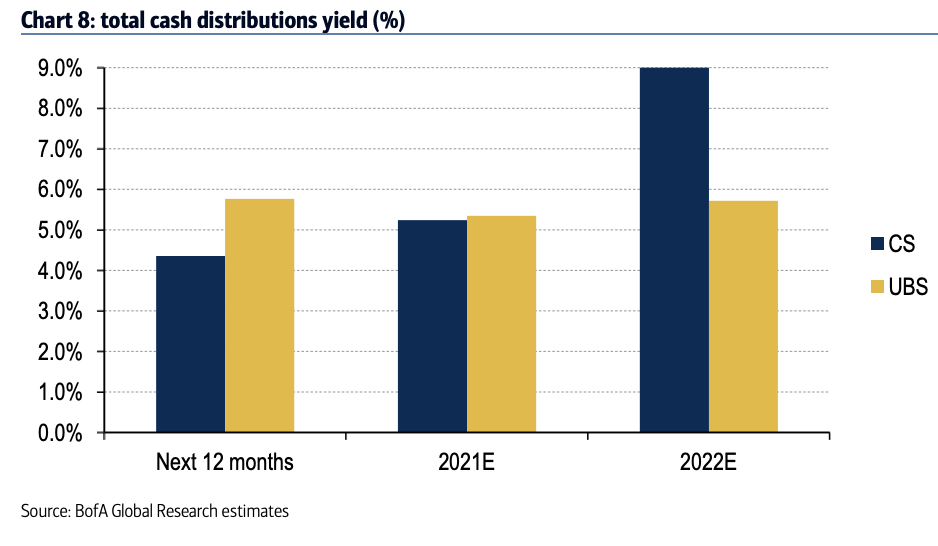

While BofA expects cash distributed to shareholders (via buybacks and dividends) to climb.

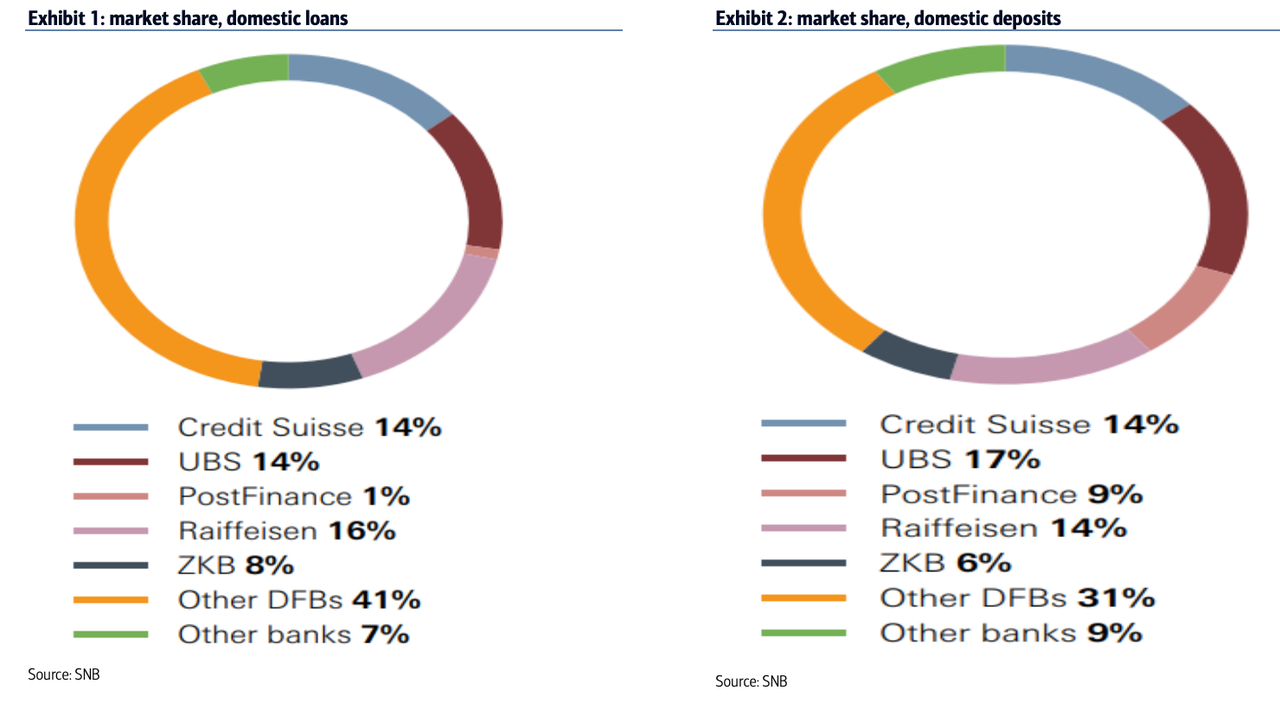

A tie-up would also put both banks well ahead of all regional rivals when it comes to serving the financial needs of Swiss companies and people.

Both Credit Suisse and UBS have recently seen change at the top. Back in February, Credit Suisse CEO Tidjane Thiam was caught up in a corporate espionage controversy that scandalized the European banking community and exposed what some called the “banker surveillance state”. UBS is in the middle of a leadership transition of its own, with former ING Groep NV head Ralph Hamers set to take over from longtime leader Sergio Ermotti in November – a transition that was first announced months ago (Ermotti is set to become chairman of Swiss Re next year after leaving UBS).

Bottom line: investors would probably cheer a merger between the two banks, but the “cost synergies” will also lead to more layoffs, and an even more concentrated entity at the top of Swiss banking. A combined entity would probably need to sell off some of its investment-banking business lines to make such a deal palatable to Swiss regulators.