US Services PMI Disappoints In September, “Risk Tilted To Downside In Coming Months”

Tyler Durden

Wed, 09/23/2020 – 09:55

Following a mixed picture from European PMIs (EU Composite lower, manufacturing gains as services slump back into contraction), analysts were expecting a similar picture in the US for preliminary September data, with Market PMI Manufacturing accelerating and Services slowing, and that is what printed.

-

Markit US Manufacturing 53.5 vs 53.5 exp vs 53.1 prior – 20-month high

-

Market US Services 54.6 vs 54.7 exp vs 55.0 prior – 2 month low

Notably this is happening as US Macro data is rolling over aggressively…

Source: Bloomberg

The US Composite PMI remains above Europe’s but both are starting to lag as Services’ hope starts to fade…

Source: Bloomberg

Commenting on the flash PMI data, Chris Williamson, Chief Business Economist at IHS Markit, said:

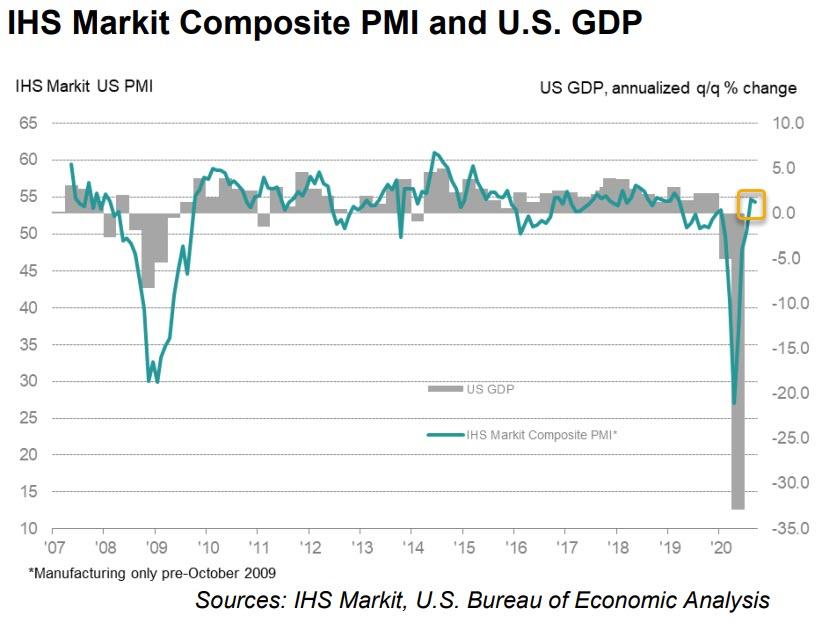

“US businesses reported a solid end to the third quarter, with demand growing at a steepening rate to fuel a further recovery of output and employment.

“The survey data therefore add to signs that the economy will have enjoyed a solid rebound in the third quarter after the second quarter slump.

“The question now turns to whether the economy’s strong performance can be sustained into the fourth quarter. Covid-19 infection rates remain a major concern and social distancing measures continue to act as a dampener on the overall pace of expansion, notably in consumer-facing services. Uncertainty regarding the presidential election has also intensified, cooling business optimism about the year ahead. Risks therefore seem tilted to the downside for the coming months, as businesses await clarity with respect to both the path of the pandemic and the election.”