Halfway Between The Gutter & The Stars

Tyler Durden

Thu, 09/24/2020 – 13:20

Submitted by The Swarm Blog

Early July, I posted an article entitled It is All About Waves – Tech Stocks and The Log-Periodicity Power Law Singularity Model, explaining that for years physicists have worked on intriguing models designed to detect speculative financial bubbles and predict their end date. An ambitious project.

Since then, I have read many sarcastic comments on blogs or social media about the LPPLS model, and even econophysics as a scientific discipline.

How Nature Works

Somehow, the name “econophysics” can be misleading, as it is an interdisciplinary axis of research that was put forward by physicists like Per Bak or Didier Sornette. The study of complex systems has implications in almost every branch of science (e.g. seismology, cosmology, climatology, biology, anthropology, sociology, economics), and what is striking is the fact that so many systems exhibit very similar patterns also known as self-organized criticality. If humans are part of nature, then it seems legit to assume that their complex interactions obey to natural laws.

Thinking outside the box has always been essential, including for scientists or traders. While most economists postulate how the economy is supposed to work, and then built beautiful but meaningless theoretical frameworks on top of that, physicists like Bak argue that the right intellectual approach is to understand how nature works first, before trying to build any predictive model.

The LPPLS model is all about that. When a financial market is overwhelmingly dominated by a narrative, with all participants sharing the same opinion, then it tends toward a form of swarm intelligence, a singularity. But such a state is highly unstable and the system because vulnerable as there is no support since all investors have capitulated.

Researchers like Sornette have shown that such moments are characterized by typical patterns like an acceleration of fluctuations, as the fight between bulls and bears is getting fiercer.

What the Roller Coaster Is Telling Us

While one could argue that US stock market has been overvalued since 2015, the premise of the mania started in 2018. But, the stress provoked by the Fed balance sheet normalization and the fears of a trade war with China led to a severe correction during Fall 2018.

Since 2009, investors knew that the central banks could intervene if necessary. And this is what happened at the end of 2018. The Fed ended the normalization process, they started the “non-QE” REPO injections a few months later, and Donald Trump promised “a huge trade deal” with China. While many investors had turned bearish in December 2018, those actions led to a big short squeeze during the following months.

The aggressive rebound of 2019 was a massive positive feedback loops for participants as they got the confirmation that the Fed would do “whatever it takes” to support capital markets.

What happened during the first half of 2020 can be seen as a “bis repetita” event, but on a larger scale. Speculative behavior had started a few months before the end 2019, and things got worse in January and February with media talking about “the unstoppable tech bull run”.

The Covid-19 sell-off was a bigger test for the “Fed put” narrative (aka “stocks only go up”). However, despite a short but intense period of stress, many participants did not sell that much as they knew that central bankers might act quickly. And they were right, the trillion dollars stimulus and the infinite QE programs led to an even bigger bounce. In other words, another positive feedback loop.

As retail investors massively entered in the market after March, it seems legit to think that we had finally reached the final stage of a speculative mania that many people had expected for years. During August, the last bears capitulated, and everyone turned bullish on equities as it looked like “stocks would not go down again”.

Said differently, the dominant narrative has won the intersubjective war. However, this was not good news for bulls.

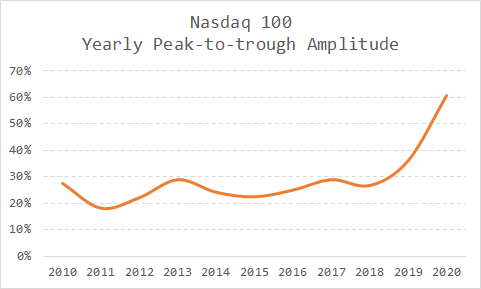

From a statistical perspective, long-term fluctuations have accelerated, as evidenced by the peak-to-trough log variation of the Nasdaq (see chart above). Somehow, it tells us that the market was exhibiting the patterns described by Sornette and other econophysicists.

Simulations and Results

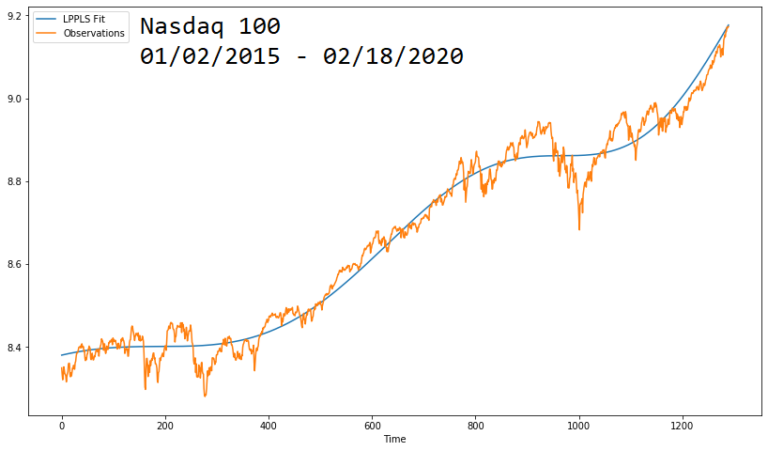

Even though tech valuations were already rising to the Moon at the beginning of 2020, it is interesting to note that the LPPLS model did not suggest the bubble had accelerated at a critical rate in February, and thus did not expected a near-term crash. The February-March sell-off was actually caused by an external factor: the pandemic and lockdowns in major countries all over the world.

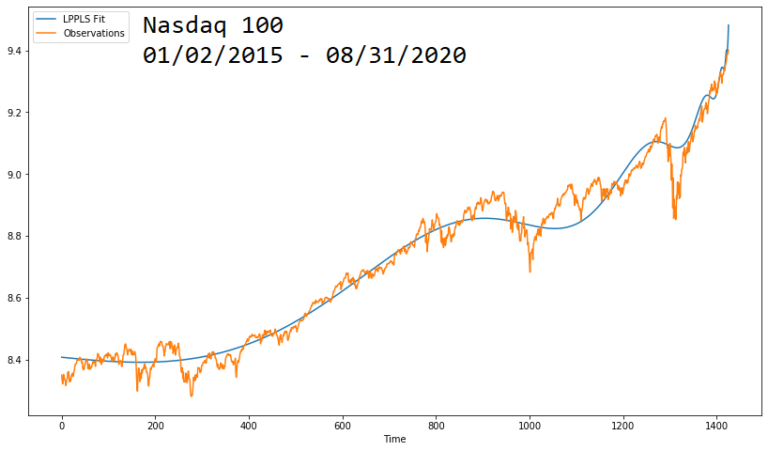

When I ran the LPPLS model in July, it suggested that the Nasdaq was driven by euphoria since March, expecting a crash “by the end of the summer” (i.e. mid-September). I decided to run it again at the end of August as I felt that the bull run had accelerated, and the conclusion was that the market could crash “any time”.

Therefore, the recent sell-off on tech that started on September 3 should not come as a surprise. This sudden move was not cause by any external event or any news, but by pure endogenous causes (i.e. large participants starting to sell). And this is what the LPPLS model told us.

What’s Next?

At this stage, the key question for everyone is, will the market crash more severely soon?

People might have noted that there is a strong support force on the market. This could be explained by the fact that the retail army seems to have regarded this correction as screaming-buy opportunity, opening new record positions on out-of-the-money short-term call options, and exacerbating the impact of the so-called gamma squeeze.

While some professional investors have turned more cautious, with CTAs exhibiting net short positions, the Fed has just decided to step in so as to try to stop the selling forces a few weeks before the election. If you are not convinced, then how do you explain the 17 media interventions of Fed speakers this week?

Even if the Fed put has always been the major pillar of the dominant narrative, other catalysts like “vaccine optimism”, “V-shaped recovery optimism”, or “trade deal optimism”, have significantly weakened. Thus, all that remain in this happy bull’s world is the intersubjective trust in the Federal Reserve ability to magically inflate equities.

One Flew Over the Cuckoo’s Nest

To conclude, I would like to remind that the prediction of the LPPLS was right, as the bull run ended at the beginning of September.

Has the trend been broken? I think it has, as the market is struggling to come back to all-time highs. More interestingly, the Nasdaq has made new lows almost every week since the end of August, suggesting that finally the powerful bullish trend was not invincible (Do you agree Dave Portnoy?).

Of course, the action of the Fed will be decisive for the evolution of the market until the end of the year (or at least until November 3).

But the thing is, it is a bubble. And like all bubbles in human history, it will pop. And there will be no happy ending.

No need to be a rock-star physicist to understand that.