Stocks & Oil ‘Dead Bat Bounce’ On Fiscal Dreams, But Credit Crash Continues

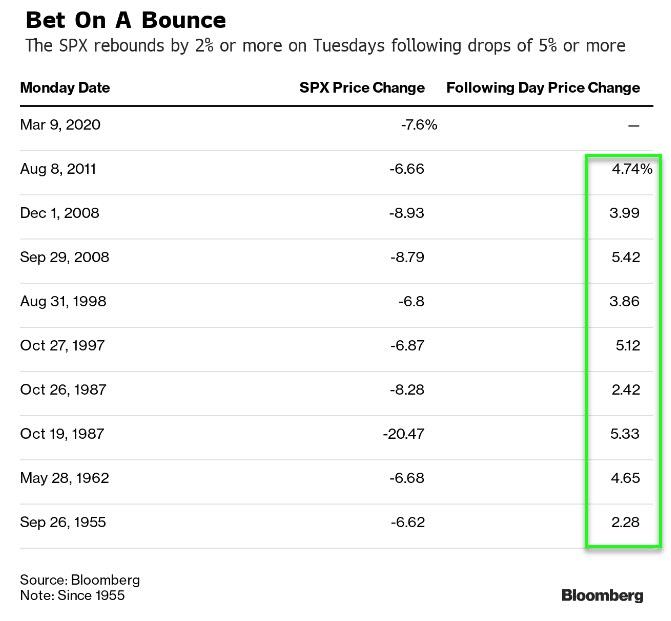

A Bounce today was expected… as Bloomberg details, prior to Monday’s steep decline, the S&P 500 had plunged by 5% or more to start the week on nine occasions since 1955.

On each of the following Tuesdays, the benchmark bounced back by 2% or more, data compiled by Bloomberg show.

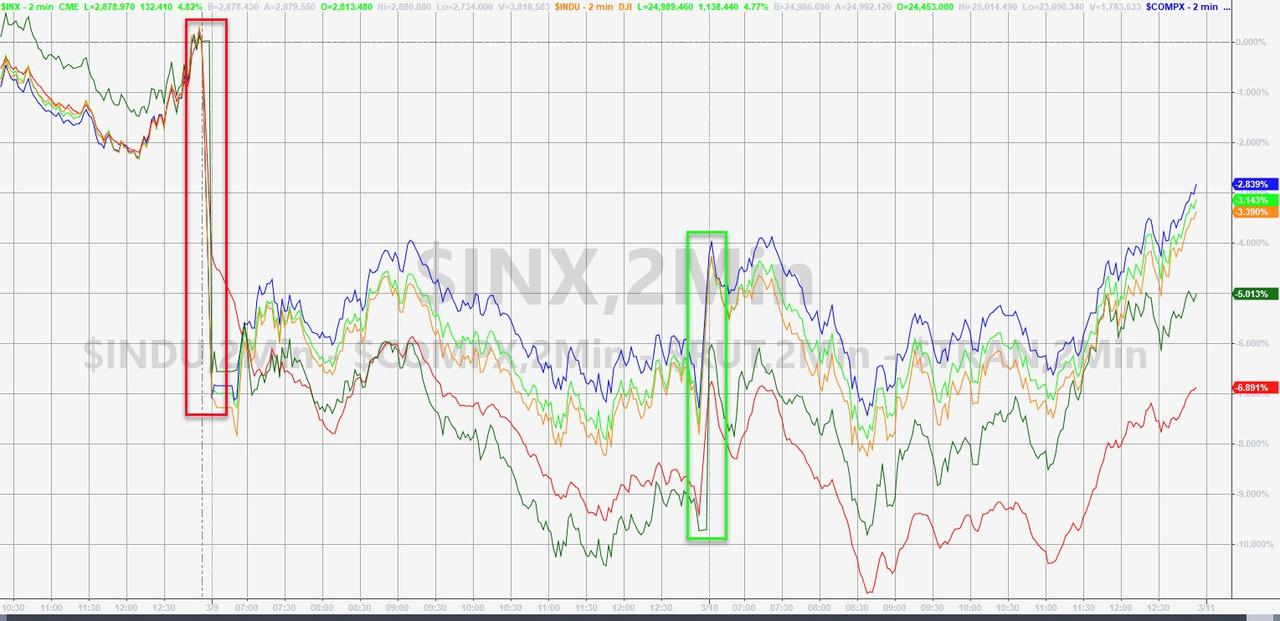

Which means that a red close for stocks today would have been unprecedented in market history (and for a few brief minutes this morning, stocks went red). But as positive stimulus headlines struck, stocks accelerated higher… Dow ended over 1100 points higher and this was the S&P’s biggest day since Dec 2018.

Confirming that…”all is well”

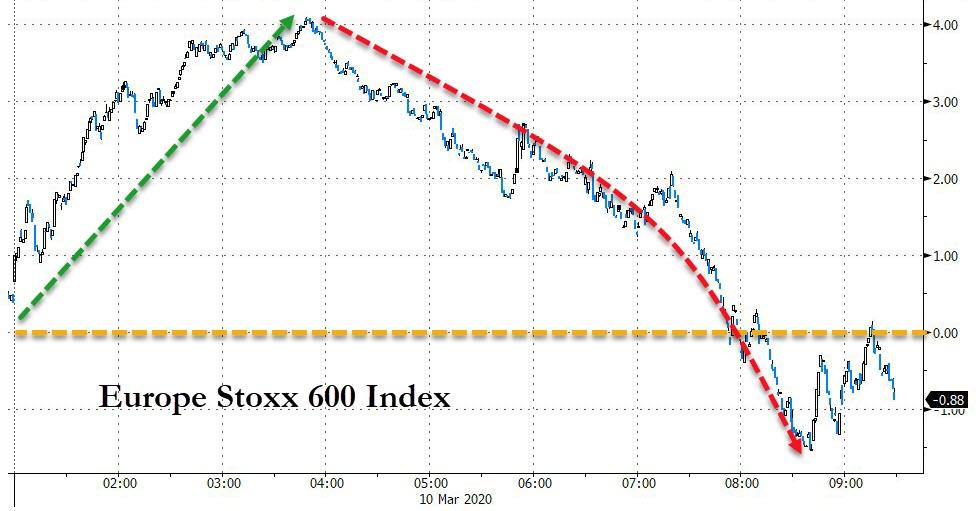

European stocks followed the US and bounced hard from yesterday’s losses, but by the close had erase all those gains as early optimism faded about measures to contain the coronavirus outbreak and provide economic stimulus to counter its impact.

Source: Bloomberg

The Stoxx Europe 600 Index fell 1.1% by the close to the lowest level since January 2019, wiping out gains of as much as 4.1%.

Source: Bloomberg

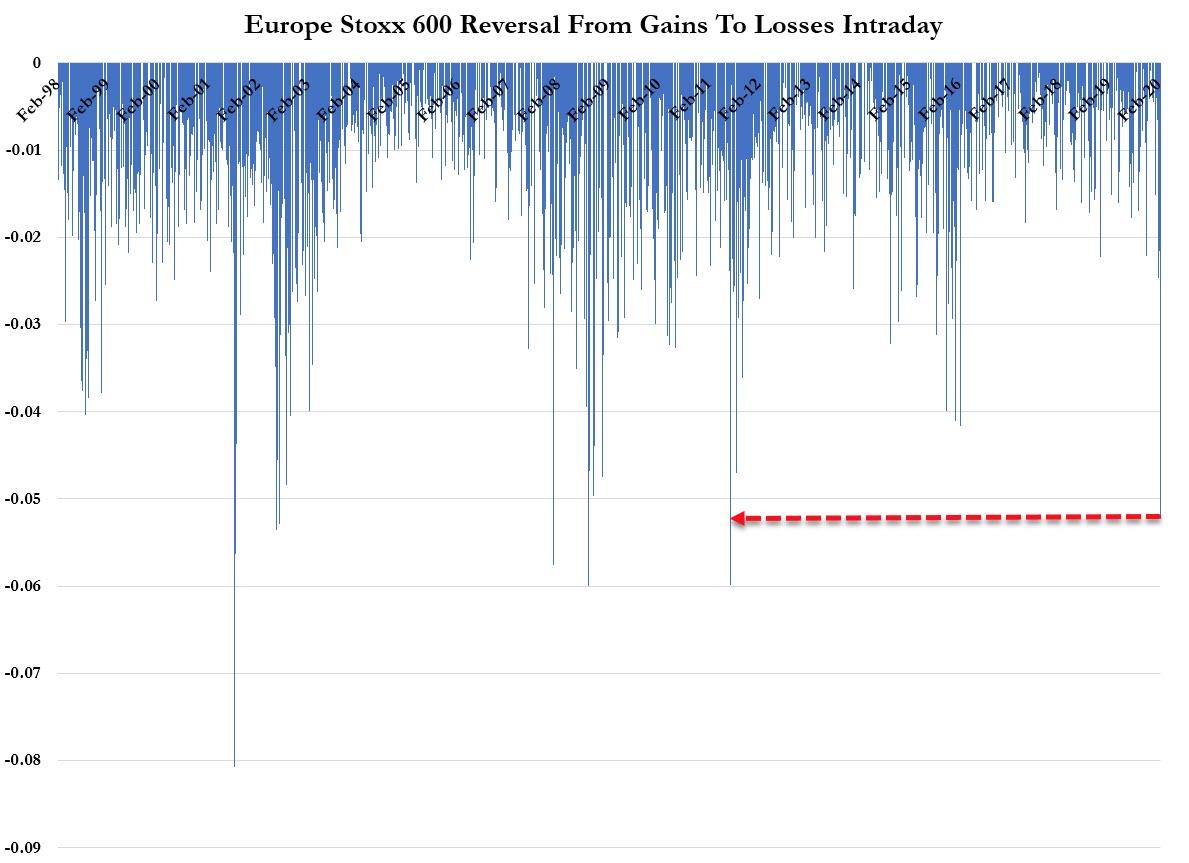

That turnaround was the biggest intraday reversal since August 2011.

While today’s bounce was very exciting, in context with yesterday’s drop, it;s not quite as impressive…

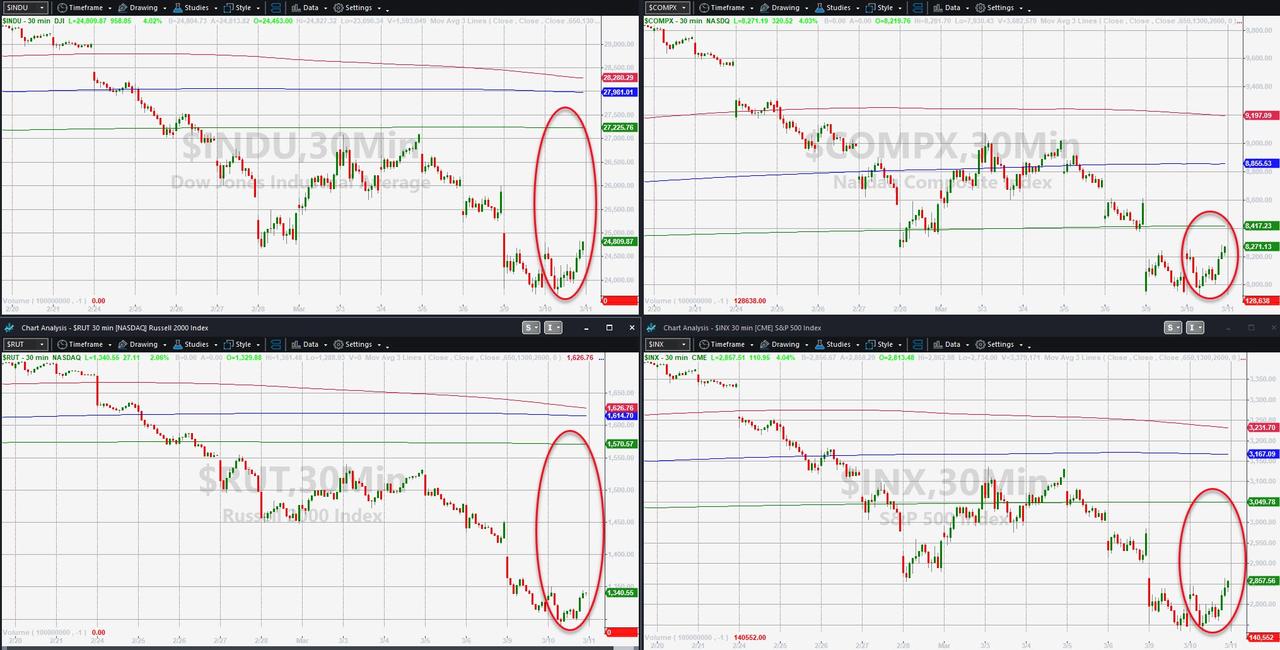

Be very careful trusting this as sustainable – one look at the level at which the machines ramped to suggests this move was extremely technical/algo-driven…

US markets all remain below their 200DMAs…

Bank stocks bounced along with everything else but remain well below Friday’s close…

Source: Bloomberg

Virus-related sectors rebounded hard today with Airlines erasing yesterday’s losses…

Source: Bloomberg

Factor-wise, markets were relatively untilted today – i.e. it was just systemic buying…

Source: Bloomberg

The energy sector ended green… but given oil’s rebound, the bounce was barely notable..

Source: Bloomberg

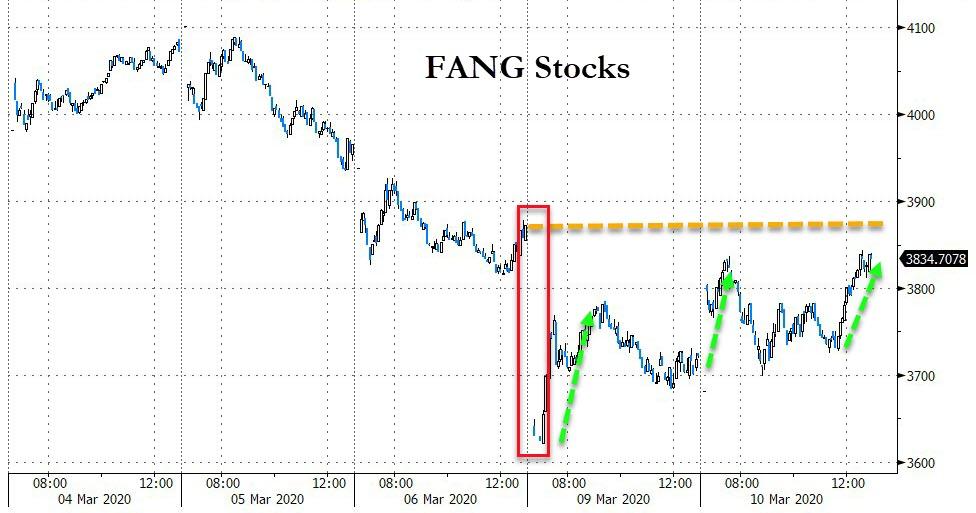

FANG Stocks rallied back but failed to clear yesterday’s losses…

Source: Bloomberg

Options markets ‘broke’ today, which briefly triggered a ramp in the underlying indices…

Source: Bloomberg

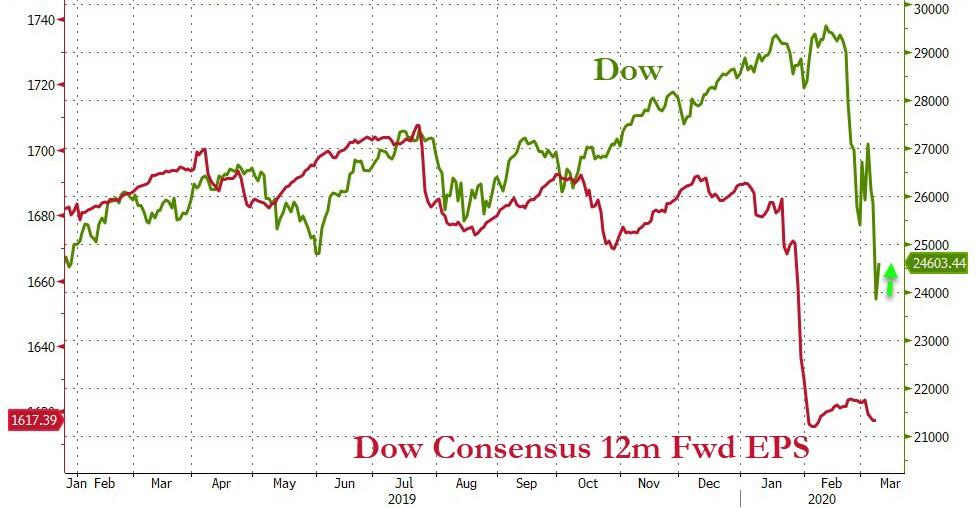

And before we all get too excited about today’s bounce, remember – fun-durr-mentals…

Source: Bloomberg

VIX pushed back below 50 today (after testing positive on the day briefly), but remains extremely elevated…

US credit markets were not playing along with stocks at all today… And despite VIX’s explosive move, credit protection costs have moved even more…

Source: Bloomberg

And just to ensure readers are not paying attention to malarkey like this overheard on CNBC: “IG bond yields have fallen which is the opposite of what happens in a crisis” – said in a way that was supposed to reassure you that everything is fine… except IG credit spreads are utterly exploding higher (even as yields slide due to the collapse in risk-free rates)…

Source: Bloomberg

Treasury yields exploded higher today, with dramatic steepening of the curve (30Y +29bps, 2Y +11bps)

Source: Bloomberg

10Y surged back to breakeven from Friday’s close…

Source: Bloomberg

The yield curve steepened dramatically – back to erase yesterday’s flattening…

Source: Bloomberg

The dollar soared higher today, erasing its losses since The Fed did an emergency 50bps rate-cut…

Source: Bloomberg

USDJPY also erased its drop from the weekend…

Source: Bloomberg

Cryptos were relatively flat on the day…

Source: Bloomberg

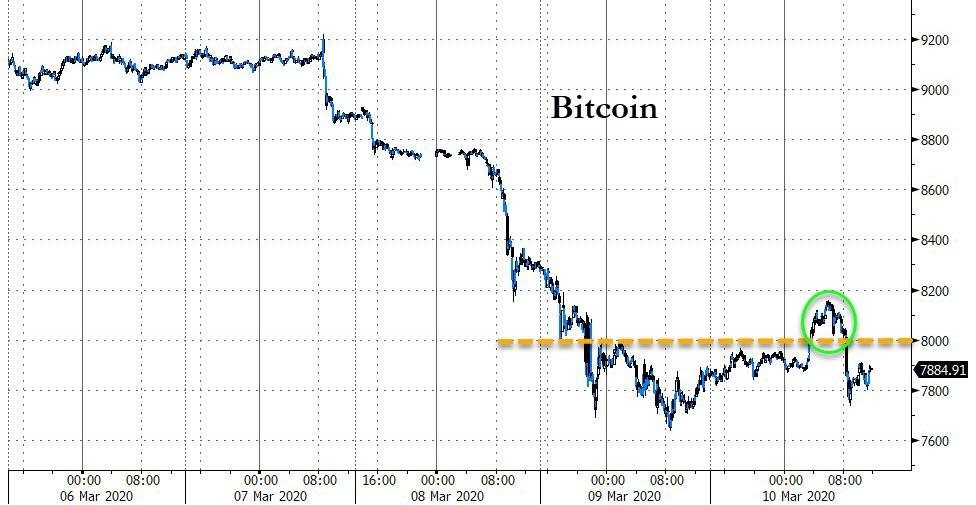

Bitcoin briefly pushed back above $8000, but quickly fell back…

Source: Bloomberg

Commodities were mixed today with PMs lower and crude and copper making gains…

Source: Bloomberg

Gold slipped lower today, with futures finding support at $1650…

And WTI soared 11% – though in context it’s got a long way to go…

Finally, US markets are now screaming for more than 3 rate-cuts by the time of the March meeting (in 10 days)…

Source: Bloomberg

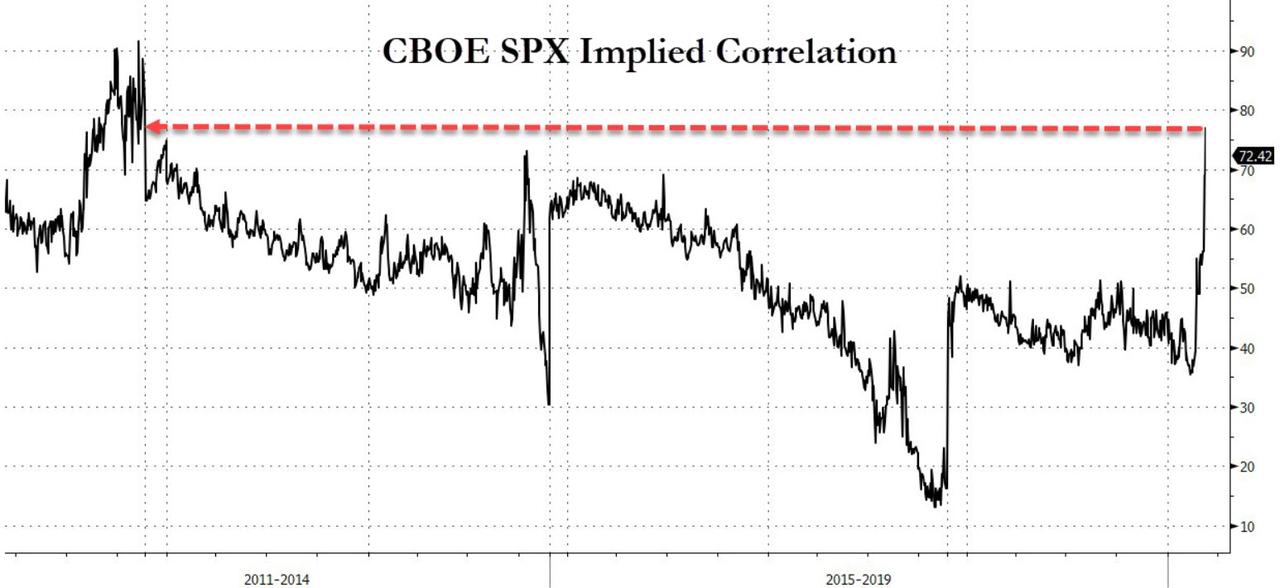

And for a sense of the panic – the implied correlation of the S&P’s 500 components has soared to its highest since Nov 2011 – signaling ‘correlation-one’ regime is here, just as it was during the Lehman crisis and the European crisis.

Source: Bloomberg

Tyler Durden

Tue, 03/10/2020 – 16:00