Here Is What Was Behind Yesterday’s Unprecedented Treasury Dislocation

When we looked at the bizarre move in Treasury futures last night, which culminated with an unprecedented dislocation between bonds and stocks, as the ultra bond future tumbled alongside stocks and which prompted BofA today to point out that the Treasury market is on the verge of breaking, we asked if “a big macro fund got carried out”, especially after the unprecedented divergences observed between cash TSYs and the TLT ETF as well as the Treasury cash/future basis.

Incidentally, this confirms our observations from last week when we noted “Rumors Of Macro Fund Failure Amid Ultra Long Bond Explosion“, however back then we said that “the good news was that there was no blow out in the cash/futures basis yet”, although we noted that it’s “only a matter of time before the cracks do emerge, at which point the only question will be who it is that just blew up.”

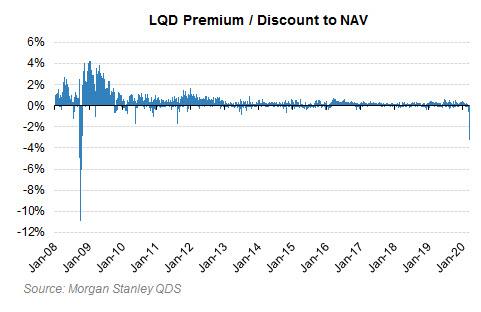

Well, yesterday the crack finally emerged, when the TLT recorded the biggest discount to fair value on record.

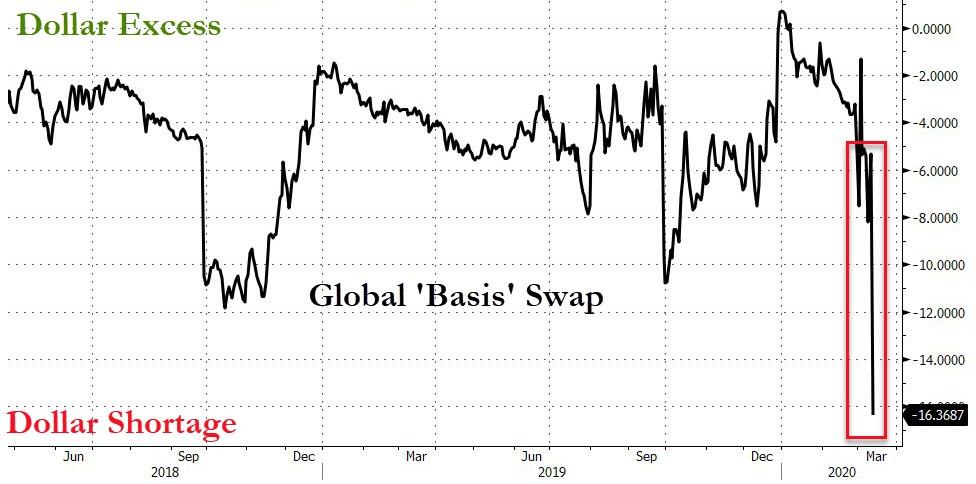

The crack got even wider today as the global basis swap exploded the most in over a decade…

… while the FRA/OIS dollar stress indicator hit levels not seen since the financial crisis.

Notably, the funding stress is no longer isolated to rates, as a similar dislocation was observed in the LQD Investment Grade credit ETF. Addressing this, Morgan Stanley said that the blowout in the basis between Treasury futures and cash bonds is reminiscent of 2008 as anything that required cash to buy traded cheap relative to synthetic / derivative exposures. Furthermore, the blowout is is putting pressure on credit as well, with the LQD trading at its steepest discount to the underlying bonds since 2008, in part reflecting the lack of trading in those bonds. And while High Yield is under pressure as well on the back of fundamental and credit stresses, especially among energy-heavy credits, the dislocation in IG indicates more risk premium and funding stresses (both bad and can compound).

Yet, while the above charts clearly demonstrate the symptoms of the collapse in fixed income liquidity, the question traders are grappling with is what precipitated this historic dislocation, and why.

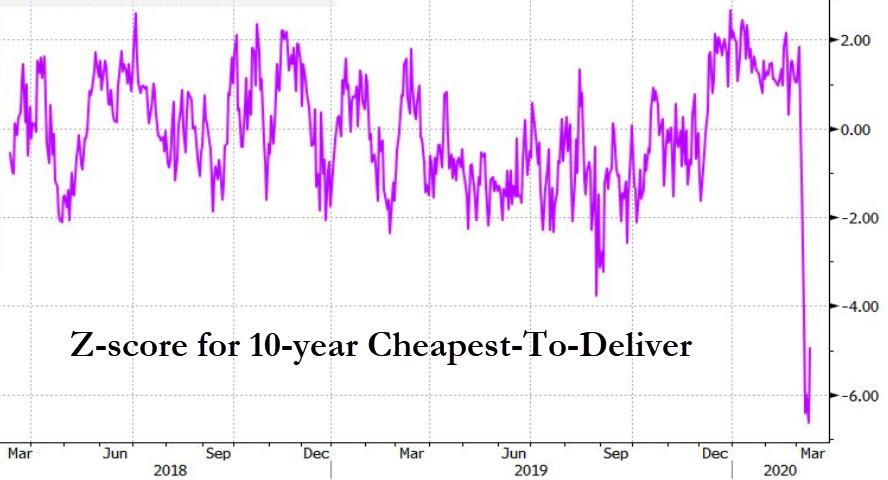

One answer comes this morning from Bloomberg’s Stephen Spratt who brings attention to “the cheapest-to-deliver bonds for Treasury futures which mounted a blistering performance on Wednesday”, noting – as we did – that there was a huge position unwind in basis… “although the reason why is a mystery.” Spratt shows the z-score for 10-year cheapest-to-deliver, a clear indication of how wild Wednesday’s move really was:

To all those who read the above as nothing more than gibberish, here is some background on how basis trades work.

As Spratt explains, “suppose 3-month general collateral is around 0.60%, you borrow the cash bonds and sell the futures at implied repo 0.70%. You roughly pocket 10bps. If you end up having to pay more to fund the cash bond, this trade can quickly become uneconomical. When this happens, funds hit eject — that appears to have happened on Wednesday.“

Incidentally, the funds that put on these massively levered basis trades are the same funds that found themselves locked out of the repo market back in September, and prompted the Fed to launch repo injections. Recall what the BIS’ Claudio Borio said back then:

“High demand for secured (repo) funding from non-financial institutions, such as hedge funds heavily engaged in leveraging up relative value trades,” was a key factor behind the chaos, said Claudio Borio, head of the monetary and economic department at the BIS.

Spratt confirmed as much, noting that that the thin margins and big size in relative value trades makes them popular with leveraged hedge funds (similar to the trades LTCM was putting on, and which resulted in its eventual collapse). So when overnight repo general collateral on the 10-year was being quoted near -3%, according to sources, it starts to make sense. It also makes some sense why the Fed announced pumped up repo operations on Tuesday, a day early of its Wednesday announcement when it again hiked the maximum size of the repo facilities and also added the 1-month term repo.

As Spratt further explains, a part of the reason why repo has been elevated in specific issues “is that recent volatility has seen VaR/balance sheet limits being adjusted, which has resulted in a pull back of the more balance-sheet intensive activities, including repo and basis trades.”

Finally, this morning none other than JPMorgan chimed in on this critical topic, with the following explainer why “we should care about the Treasury futures basis”… and its historic dislocation:

- Treasury cash/futures basis has come under significant pressure in recent days

- In normal and even reasonably stressed times, these positions exhibit very low MTM volatility and have near-arbitrage terminal payoffs …

- … and have therefore historically been held broadly and in large size as a combination of relative value and balance sheet allocation maintenance strategy

- Recent pressure combined with operational risk considerations raises the risk of a significant unwind of these positions

- As that occurs, some real money investors will be highly incentivized to shift allocations away from other short-term products, including CP and FX forwards, in favor of earning higher unlevered returns from long futures basis positions

- This creates a rather direct channel between stress in futures and other funding Markets.

- We believe the Fed has the tools to manage repo, but if this accelerates it could put more pressure on FRA/OIS and FX basis

- The potential for an escalation of this futures basis unwind is a potentially potent driver of other broader funding markets, and could keep some spreads elevated even if rates stabilize from here

* * *

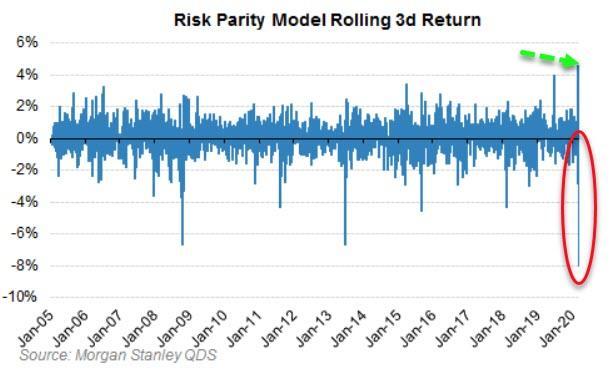

So now that we know “what” caused the historic dislocation in the bond market, the question is “why“, i.e., who/what catalyzed the move and what triggered it. While we have yet to get confirmation of one or more macro fund casualties, we can probably point the finger to the risk parity sector where one or more funds had a terrible day, following the worst 3-day rolling return in history, as noted earlier.

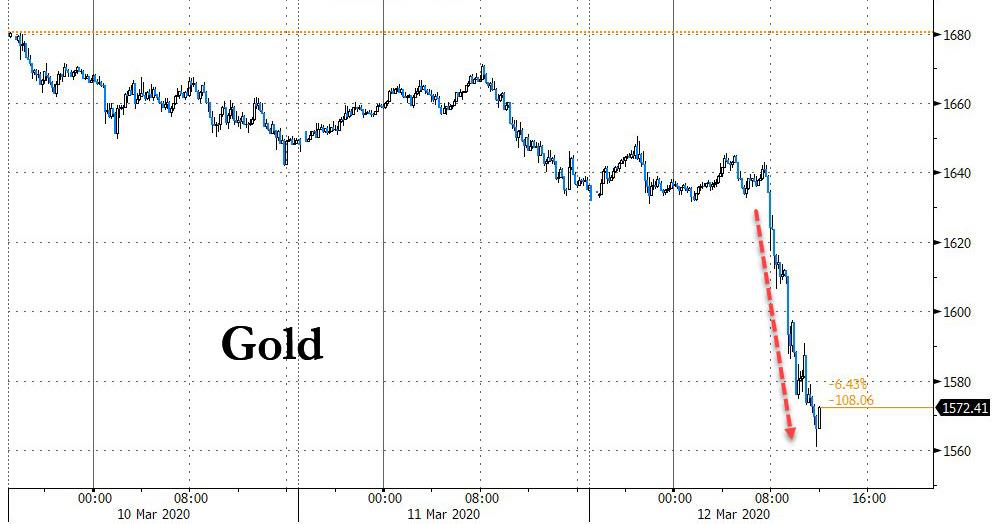

And as further evidence that the current “dislocation” move is the unwind of some macro trade which hit VaR limits, we can present the ongoing collapse in gold, which is being sold even as risk is crashing…

… suggesting that at least one fund is currently in the process of unwinding most if not all of its positions, and is meeting margin calls using “safe” instruments such as gold.

We hope to learn just which macro fund got carted out shortly.

Tyler Durden

Thu, 03/12/2020 – 12:23