Moral Hazard Is Back: Fed To Bail Out Commercial Paper Market

Early on Sunday afternoon, just two hours before the Fed unveiled its ZIRP/QE bazooka, we wrote that the “Fed Is Expected To Announce CP Bailout Facility Within Hours Or Risk Money Market Panic.”

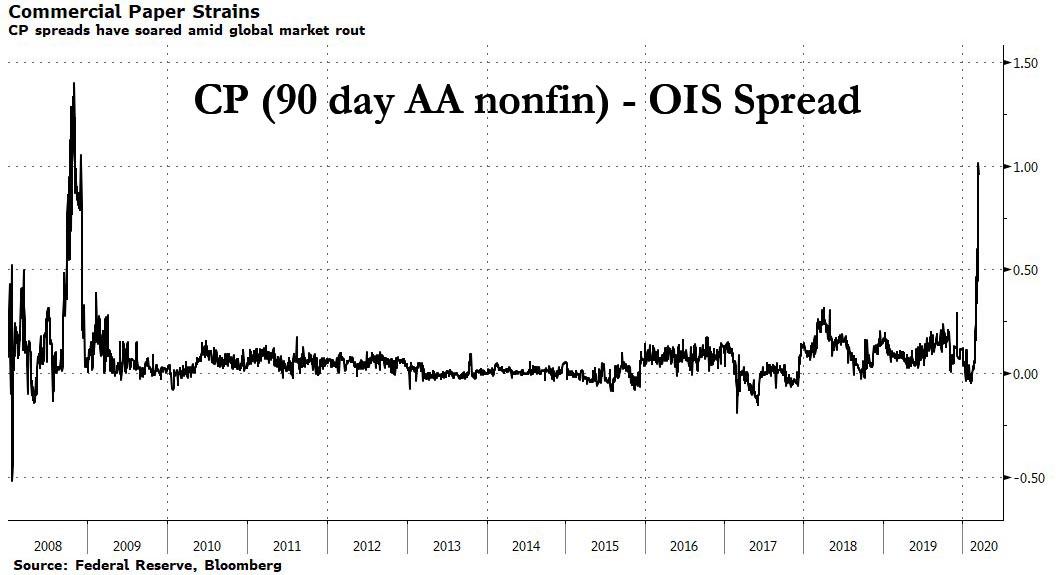

That, however, did not happen – perhaps the Fed was hoping that QE, ZIRP and enhanced swap lines would be sufficient to calm the market – even though the Commercial Paper market, so critical in funding short-term corporate liquidity, was the one most in need of a Fed backstop (one can debate the moral hazard of once again bailing out corporations at a different time) as the blow out in the 90 Day AA nonfin CP – OIS Swap spread to financial crisis levels demonstrated.

Meanwhile, in the absence of a CP backstop, the commercial paper market ground to a halt while rumors of money market runs only made things more challenging. It also forced cash-strapped companies to fully draw down on secured credit facilities as they were suddenly locked out of the CP market.

And so, with funding markets freezing up even more on Monday despite the Fed’s bazooka, this morning first Steve Liesman, and then Reuters, both reported that the Fed would, as many had expected, reinstate the Commercial Paper funding facility…

- *FED TO REINSTATE COMMERCIAL PAPER FUNDING FACILITY: REUTERS

An announcement about a reintroduction of the Commercial Paper Funding Facility (CPFF) could be made as early as Tuesday, Reuters reports, citing unidentified people familiar

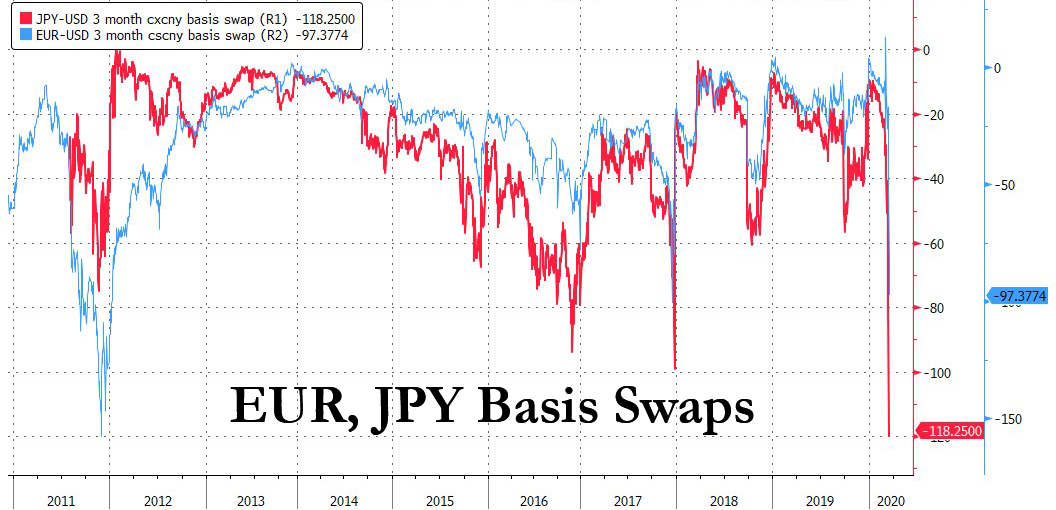

In other words, the Fed is about to reintroduce moral hazard by bailing out pardon backstopping Commercial Paper market in hopes of easing the dollar funding shortage which materialized in a continued blow out in the FRA/OIS and various currency basis swaps…

… of which the Yen specifically exploded the most since 2011.

And now we wait for the Fed to make the official announcement as it continues blindly throwing gobs of liquidity at a problem it ultimately is powerless to fix as the collapse of funding chains (which are simply supply chains in reverse) amid a crisis in confidence can not be resolved with even an unlimited amount of Fed bailout/backstop/rescue facilities.

Tyler Durden

Tue, 03/17/2020 – 10:00