Global Dollar Buying Panic Sparks AsiaPac FX Collapse, US Equity Futures Plunge

The global scramble for dollars amid a massive shortage has rolled around the AsiaPac time-zone and is leaving a bloody trail across every asset-class.

FX is in freefall with Aussie collapsing at the fastest rate since Lehman…

Source: Bloomberg

Kiwi is back to its weakest since 2009…

Source: Bloomberg

Yen is tumbling once again…

Source: Bloomberg

And Aussie has crashed to its weakest against the offshore yuan ever and weakest against onshore yuan since Dec 1993…

Source: Bloomberg

And overall, AsiaPac FX is crashing to its weakest against the USDollar since 2004…

Source: Bloomberg

And the liquidation continues in US equity markets with Dow futures down over 500 points…

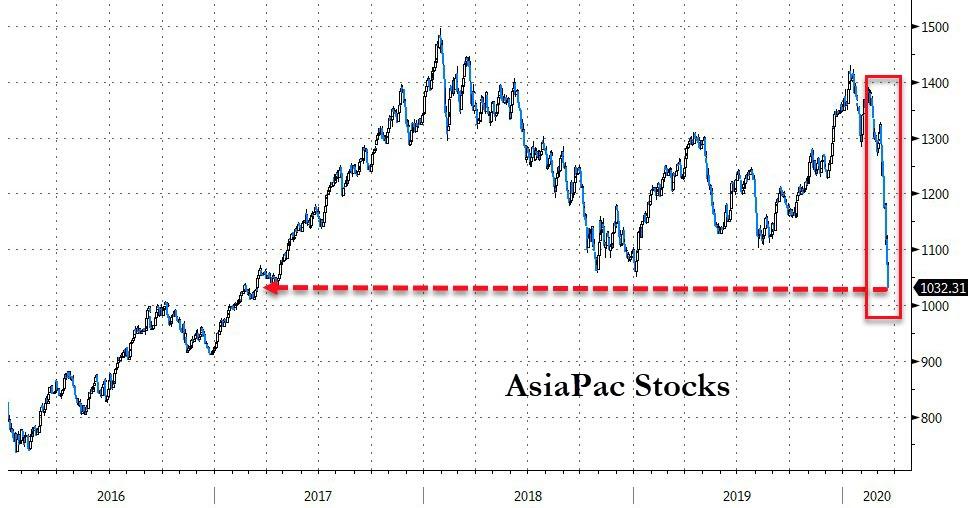

And losses in AsiaPac stocks are accelerating…down 27% from January highs

Source: Bloomberg

And JPY Basis-Swaps are signaling extreme dollar shortage continues…

Source: Bloomberg

This all has the smell of a massive global macro fund liquidation and the contagious impact of that leveraged unwind across the global risk markets.

As Bloomberg’s Stephen Spratt details, desks continue to speak of the “sell everything” mentality in markets with huge liquidations and de-leveraging taking place everywhere.

The data stacks up. Looking at the three-day change in open interest across major June bond futures as of close of play Tuesday, the reduction in positions is the equivalent to $150 billion in 10-year cash Treasury bonds ($140m/dv01*). Here’s 3-day open interest change:

-

Schatz: -135,295

-

Bobl: -45,931

-

Bund: -178,221

-

Buxl: -17,566

-

OATs: -41,475

-

BTPs: -41,176

-

Gilts: -28,055

-

US 2y: -158,991

-

US 5y: -44,059

-

US 10y: -129,381

-

US 20y: -60,865

-

US 30y: -26,798

-

JGBs: -36,534

As one veteran Aussie trader exclaimed (who happened to be on the right side of the collapse in the currency):

“I love the smell of global macro fund liquidations in the morning…”

With currencies flash crashing across Asia on Thursday, central bankers may be looking back at the remedies used then.

As Bloomberg’s Mike Wilson suggests, the tear the U.S. dollar was on back in 1985 was brought to an end when five central banks gathered in New York’s Plaza Hotel and came up with what became known as The Plaza Accord.

Source: Bloomberg

That sent the dollar into a steep slide that lasted until about the end of 1987.

With the Aussie, kiwi and won just free-falling, it looks like a similar sort of coordinated intervention may be needed to stop the dollar now, especially until the world is deemed free of coronavirus impacts.

Tyler Durden

Wed, 03/18/2020 – 22:38