Millennium Shuttering “Double Digit” Trading Pods Amid Market Turmoil

Yesterday, Wall Street traders feverishly passed around a note that without a shred of evidence claimed “that Risk Parity has blown up” (one hardly needs to be a trading wizard to figure that out after reading our post on how “the biggest VaR shock in history” has forced liquidations among risk-parity funds), and that furthermore macro funds as Bridgewater, and pod-based multi-strats such as Citadel and Millennium are on the verge of collapse. The reason why we did not publish this note is because it was made up, with the author pulling bits and pieces of fact, folklore and outright fabrication in hopes of making an exciting narrative (in that regard, he succeeded).

What is going on, is that while Bridgewater has tumbled 20% YTD (as we reported this weekend) and its risk-parity fund is certainly massively deleveraging, it is quite viable. Meanwhile, even as Citadel is hurting on its long/short funds, it is making money hand over first in its trading division while its HFT groups continue to print money. As for Millennium, which gained 0.75% in the first two months of the year, it was down a very modest 2.67% this month through to March 12, according to the FT. To anyone who has worked at Millennium, this will not come as a surprise: not only does derivatives-wizard Englander make the rounds across all his trading pods day in and out P&L in hand, but Millennium’s risk management back office is legendary in the tight leash they have all their traders on. As such the probability of a massive blow up at the 666 Fifth based fund is virtually nil, absent a roughly 12-sigma VaR shock which would probably wipe out most of Wall Street.

That said, not even Millennium is immune from the market shocks taking place now, and according to the FT, the macro fund was forced to close several of its pods run by teams of traders in response to the recent unprecedented market moves which have resulted in substantial (but manageable) losses at the fund.

Putting the Millennium “collapse” in perspective, closures of the so-called “trading pods” at the $40bn multi-strategy firm which runs about 150 to 200 pods have reached double digits, per FT sources. What is left unsaid is that quite a few of the remaining pods were massively short risk assets and have more than made up for the terminal underperformance of their (now former) colleauges.

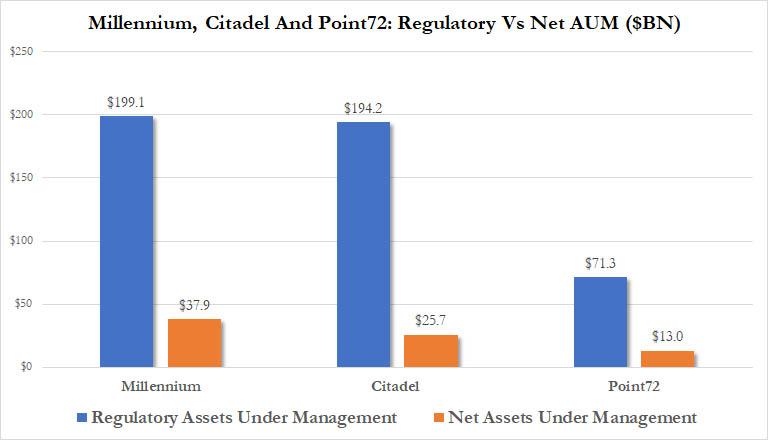

As a reminder, several months ago we reported that Millennium, along with Citadel and Point72 are some of the world’s most levered hedge funds, and has had substantial exposure to the now infamous Treasury cash/swap relative value basis trade. It was precisely the bailout of these hedge funds, that forced the Fed to scramble last september to launch repo lines, which were massively expanded last week, to make sure dealer-client liquidity pipes remain fully open.

Today the FT confirms as much, writing that “bond markets have also been hurt by the turmoil unleashed by the virus outbreak. Even the US Treasury market, usually seen as a safe haven for investors, has become less liquid than normal. Widening gaps between nearly identical government bonds, as well as Treasury bonds and Treasury futures, have hit “relative-value” hedge funds – such as Millennium – that use leverage to arbitrage and try to profit from the price differences.”

The Nikkei-owned publication also notes that “the large moves in markets have wreaked havoc on strategies such as relative value — eking out profits from small price differences in similar securities — fixed income, and quantitative trading.” Millennium, in particular, had close to 40% of its strategy allocation in relative-value fundamental equity, 19% in quant and arbitrage, and 22 per cent in fixed income as of mid-2019, according to an investor document seen by the Financial Times.”

So yes, as we warned in December, it was only a matter of time before some of Millennium’s trades were hammered, especially following the recent historic blow up in the cash/swap basis, and its problems appear to have extended to Asia as well, where relative-value trades have also been wrongfooted, and lay-offs are expected imminently according to the FT.

“That is the disadvantage of being in transparent markets,” said one person familiar with the group in Asia. “Public market securities are the first to suffer. In the private market there is no transparency and nobody knows what the right mark is. Liquidity has vaporized.”

Millennium’s founder, Israel Englander was described by the FT – accurately – as having an “eat-what-you-kill” approach to managing his army of portfolio managers, traders and analysts which is in the thousands. Successful traders can profit handsomely at Millennium, but those who lose money quickly have their risk levels cut, or are fired. And this is precisely what Millennium did: it suffered losses, and cut them off instantly, along with the associated traders who made the losses possible.

Tyler Durden

Thu, 03/19/2020 – 11:10