2007 Redux – Mortgage Fund Considers Asset-Sale After “High Number Of Margin Calls”

On the day when The Fed unveils it will be buying agency MBS and CMBS (along with IG corporate debt) in unlimited size “to maintain the smooth functioning of markets,” The Wall Street Journal reports that for at least one major mortgage investor – it could be too late.

For a sense of the scale of collapse in CMBS markets alone, here is CMBX Series 6 BBB- tranche (a popular hedge fund “next big short” trade that is heavily exposed to malls/retail)…

And mortgage markets are becoming notably illiquid (hence The Fed’s unlimited injections)…

And the infamous ‘basis’ trade in ETF land, is extreme…

All of which has left an investment fund focused on mortgage investments struggling to meet margin calls from lenders.

WSJ’s Greg Zuckerman reports that the AG Mortgage Investment Trust, a real-estate investment trust operated by New York hedge fund Angelo, Gordon & Co., is among those feeling pressure, the company said, and, in the latest sign of turmoil in crucial areas of the credit markets, is examining a possible asset sale.

“In recent weeks, due to the turmoil in the financial markets resulting from the global pandemic of the Covid-19 virus, the company and its subsidiaries have received an unusually high number of margin calls from financing counterparties,” AG Mortgage said Monday morning.

The company said it had met “or is in the process of meeting all margin calls received,” though it acknowledged missing the wire deadline for some on Friday.

On Friday evening, the company “notified its financing counterparties that it doesn’t expect to be in a position to fund the anticipated volume of future margin calls under its financing arrangements in the near term,” AG Mortgage said in its statement, which said the company is in discussions with its lenders “with regard to entering into forbearance agreements.”

It’s stock has collapsed…

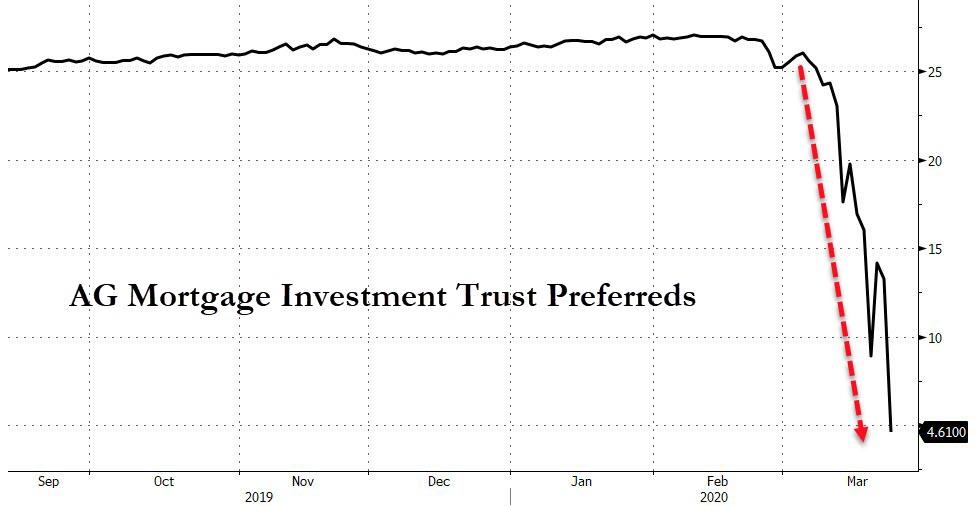

As have the Preferreds…

Concern about losses in mortgage bonds could feed turmoil in the overall mortgage market that ultimately drives up borrowing costs for consumers looking to buy homes and refinance. Mortgage rates have risen in recent weeks, despite a fall in benchmark rates.

All of which sounds ominously similar to July 2007, when two Bear Stearns hedge funds (Bear Stearns High-Grade Structured Credit Fund and the Bear Stearns High-Grade Structured Credit Enhanced Leveraged Fund) – exposed to mortgage-backed securities and various other leveraged derivatives on same – crashed and burned and started the dominoes falling…

Tyler Durden

Mon, 03/23/2020 – 12:15