As “Big Short 2” Explodes, Citi, Deutsche Bank Stuck With Billions In Unsellable CMBS Debt

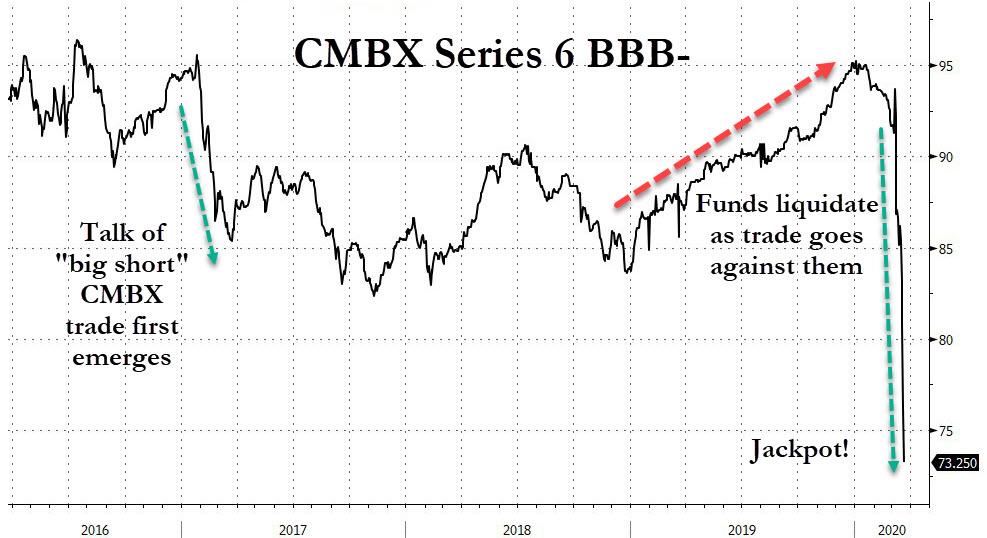

Earlier today we reported that amid a growing investor panic that the Wu Flu will be the final nail in the malls’ coffin, resulting in countless retail outlet closures and a collapse in rental payments crushing the commercial real estate space, the “Big Short 2.0” trade, shorting the CMBX 6 series which has an outlier exposure to malls, finally crashed vindicating long-term bears such as Carl Icahn and a handful of other hedge funds who were not stopped out over the past three years.

This collapse in broader CMBX indexes as “the big short 2.0” gradually comes to fruition, has led to spillover effects across the entire Commercial Mortgage-Backed space, resulting in the first hung deal.

Bloomberg reports that Citigroup and Deutsche Bank – both of which somehow tend to always be involved any time bad debt emerges – are among the bank lenders stuck with billions of dollars of debt backed by MGM Grand and Mandalay Bay properties in Las Vegas, as the coronavirus pandemic shutters casinos across the nation, hampering the banks’ ability to syndicate the loan amid a plunge in investor demand.

To help stem the spread of the coronavirus, MGM Resorts International, which continues to operate the MGM Grand and Mandalay Bay, has shuttered operations in Nevada and New Jersey.

A JV of MGM Growth Properties and Blackstone REIT used $3 billion of financing to purchase the casinos last month, and Citigroup, Deutsche Bank, Barclays Plc and Societe Generale had planned to syndicate $1.9 billion of the total as commercial mortgage-backed securities, or CMBS, according to Bloomberg. However, as gambling along with any other activity that involves social interactions has ground to a halt and it is unclear just when it will restart, the efforts to sell the CMBS were met with “tepid demand” and the sale was put on hold, leaving the banks stuck holding on to the billions in debt, although it was not clear now much of the loan each bank holds.

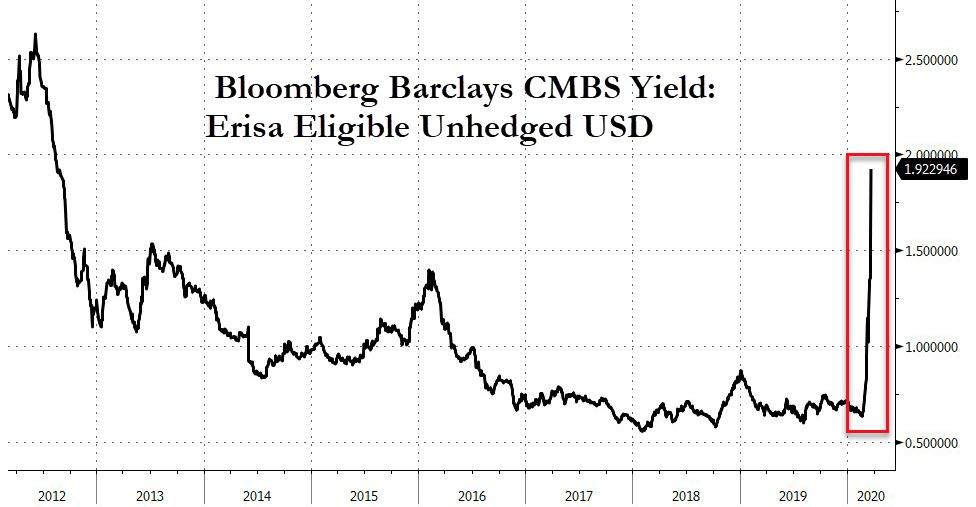

The CMBS facility has a 12 year maturity, with an anticipated repayment date in March 2030, and came to market with an interest rate of 3.308% per year. In light of the recent surge in CMBS yields and spread, that number will have to go sharply higher to spark investor interest unless somehow Jamie Dimon convinces the NY Fed to buy the whole piece.

Pricing of the CMBS was expected during the week of March 9, but obvious those plans collapsed.

When syndication deals are unsuccessful, banks typically retain loans on their balance sheets until market conditions improve and the deal can be brought back. During the financial crisis, banks ended up stuck with hundreds of billions in LBO and M&A bonds and loans and other pipeline jamming securities which they were unable to offload for years.

It remains to be seen just how bad the commercial real estate hit will be during the Global Coronavirus Crusus, however if what we described yesterday in “”Widespread Panic” Hits Commercial Property Markets: Deals Implode, Renters Disappear, Businesses Shut Down”, it will get very ugly, fast. For those who missed it, here it is again.

* * *

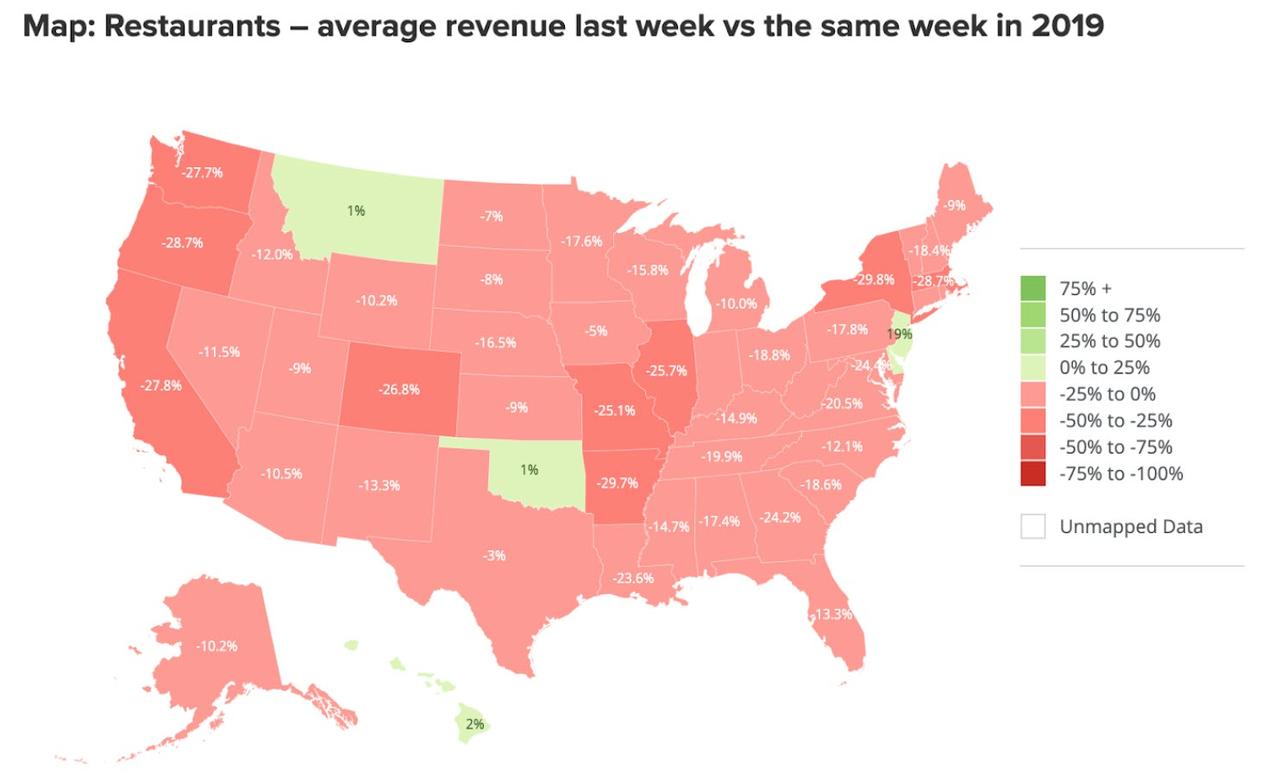

As a result of the coronavirus outbreak, and the ensuing lockdown, the commercial property market has essentially frozen.

Buildings that were used for all types of purposes: offices, diners, restaurants, hotels – they’ve all been shut down. And industries like the travel industry are forgoing $1.4 billion per week in revenue, according to Bloomberg.

The shutdown is also having an effect on apartment buildings and industrial properties. Nothing is off limits, and it’s sending the commercial property market into chaos.

Alexi Panagiotakopoulos, partner at Fundamental Income, a real estate strategy firm, said: “On the investor side, there’s widespread panic. There’s downward pressure on every aspect of every asset class.”

And there’s no way to value a market when you don’t have a bid and an offer – and you’re not sure when the market will “re-open”. Further, there’s no way to try and model the future value of such properties when everyone is unsure of what the real estate landscape will look like when everything is said and done.

Scott Minerd, chief investment officer at Guggenheim Partners said: “There will likely be long-lasting changes.”

It’s estimated that investment activity in the space could fall by 45% this year, which would be further than post-9/11 or the 2008 financial crisis.

The drumbeat of large deals has already gone silent. For example, Bloomberg reports that the Canada Pension Plan Investment Board’s planned sale of a 50% stake in the 900 million pound Nova development in London’s Victoria district collapsed on Friday. Similarly, Singapore-based ARA Asset Management Ltd., which was lined up to purchase the pension fund’s half of Nova, has balked on the deal.

Viacom also announced last week that it’s suspending its plans to sell the Black Rock building in Manhattan because potential buyers can’t visit the property. Simon Property Group’s proposed acquisition of Taubman Centers, Inc., is also now up in the air.

More than $13 billion in funds in the UK has been frozen in property funds while appraisers warn that the virus makes it impossible to assess their value. China’s office market has been devastated with plunging rents and spiking vacancy rates, which could climb as high as 28% next year in Shanghai, according to estimates.

REITs in the U.S. have been destroyed. Names like Brookfield Property Partners, which made a $15 billion bet on malls in 2018, expects “severe consequences” in coming weeks. The company’s CEO says it has $6 billion in undrawn credit lines and cash.

Matthew Saperia, an analyst at Peel Hunt, commented on the potential threat to landlords: “The implications could be far-reaching, but quantifying these is highly speculative at present.”

As the uncertainty grows, the level of credit available begins to shrink. Financing has dried up for hotel, mall and senior living projects and it’s estimated that up to 15% of loans on commercial property could default over the next couple of years if the recession continues. The value of commercial mortgage-backed securities is collapsing…

Mark Fogel, CEO of Acres Capital, commented: “Nobody knows where deals will be priced and nobody knows just how long this issue is going to affect the world and how much it’ll affect the underlying collateral.”‘

And Minerd believes there won’t be a “back to normal” once this is all over: “I think there’s going to be a permanent change. People are more comfortable at home. Why do they need to commute?”

Tyler Durden

Mon, 03/23/2020 – 17:40