McElligott: Shhh… It’s Working

One man’s fake market is another man’s blast off rally.

On the same day Rabobank’s Michael Every asked rhetorically what’s the point of having a market if the Fed is backstopping everything in what is a de facto nationalization of risk, Nomura’s Charlie McElligott is focused on a more practical aspect of the Fed’s wholesale intervention: today’s soaring P&L which, with the S&P blasting off more than 6% is surely in the green.

Here is how McElligott summarizes the Fed’s bazooka response which, combined with a violent systematic reversal, appears to be “working”, if only for the time being:

The Fed’s unprecedented “Bazooka” policy response escalation–where they are not just adding market liquidity-, short term lending- / financing- for corporates as well as USD funding access-; but now buying risk-assets / spread-product directly or via the new SPV—is engendering profit-taking in “long vol” monetization (over 30k UX1 futures sold yday across the VIX ETN / ETF complex), and gradually, resumption of “short vol” trades from systematic strategies; while today’s jarring “limit up” rally too will see the CTA Trend signal in Nasdaq futures return to “LONG”…

Below we lay out Charlie’s relevant thoughts for what is shaping up as a monster session, especially once the Senate passes the multi-trillion bailout bill.

First, the Nomura quant looks at the coiled technicals and the “springboard” release following last Friday’s gamma-releasing quad witch:

Monster “risk-on” overnight with Equities (OpEx “Gamma Release” nails the mkt inflection yet again), Commodities and Risk FX screaming higher…while USTs trade lower and Eq Vol is again HAMMERED for now the third-consecutive session

- Meanwhile, the nature of the particulars in European Equities this morning are telling, as it is “Deep Cyclicals” / “Value” / “Leveraged Balance Sheet” / “High Beta” which are leading the charge higher today

- Why? Both on account of substantial covering of these astronomically-pressed “shorts” in these growth-sensitive sectors (obviously rational, per the certain economic shock due to the virus shutdown)…but also too that discretionary traders are looking to play some offense and tactically play “long” in the stuff which is most-sensitive to the forward benefits of the unprecedented double mon-pol and fiscal pol stimulus being unleashed in-response to the COVID pandemic

Despite the obvious conclusion that markets want Congress to deliver a massive fiscal stimulus package ASAP (just now getting bullish reports from CNBC on a “agreement” over one the of the big stumbling-blocks btwn Dems and Reps being “oversight”), do not dismiss what the Fed and other central banks are in the process of doing—which is not just acting as liquidity-, short-term lending- and USD funding- provider of last resort…but also now as the “chief risk-taker and CIO”

Then there is the Fed, which as Rabobank earlier said, echoing what we in turn said on Monday, is “now providing backstops for pretty much everything save for President Trump’s beloved Dow Jones index.”

Not only is the Fed now “buying” risk-assets (MBS directly per initial QE, but now with Corp bond- and Credit ETF- purchases through the SPV), but more conceptually, the Fed has once-again resumed building a “short volatility” position via their now unprecedented “open-ended” UST purchases, the magnitude of which we have never seen before

- The Fed has bot 250mm dv/01 so far since the start of last week (!) in an effort to clear the market-structure / liquidity issues

- In QE1, the Fed was barely buying $45B of USTs a MONTH; now we have seen the Fed buy $75B of USTs in each of the past two DAYS alone

For many market participants, this was a de facto “green-lighting” from the Fed to take profit on “long vol” trades and now pivot towards resumption of “short vol” trades—because the Fed is going “back to the future”

At this point McElligott references something Zero Hedge first dixcovered back in early 2018, namely some very damning quotes from Powell back in 2012 when he admitted that the Fed is all that matters, admitting that “The Fed Has A Short Volatility Position.”

Fed Chair Powell knows the drill—and once again I will go back to my favorite quotations / take-aways from JaPo from the transcripts of the October 23-24, 2012 FOMC meeting (where the Fed was beginning the discussion as to eventual balance-sheet normalization, which later became 1) the taper tantrum” in 2013 and 2) the QT debacle in 2018)—point being, resumption of large-scale-asset-purchases including spread-products will eventually again engender a “short vol” trading environment

- On the Fed’s extraordinary QE accommodations and “easing of financial conditions” focus: “I think we are actually at a point of encouraging risk-taking, and that should give us pause. Investors really do understand now that we will be there to prevent serious losses. It is not that is easy for them to make money but that they have every incentive to take more risk, and they are doing so.”

- On the implications of the Fed’s massive UST / duration purchases (as they suppress term premium), where any sort of attempt to normalize the balance sheet down-the-road is akin to “…unloading our short volatility position,” stating “…it just seems to me that we seem to be way too confident that exit can be managed smoothly…markets can be much more dynamic than we appear to think.”

- And what did that lead to? “Meanwhile, we look like we are blowing a fixed-income duration bubble right across the credit spectrum that will result in big losses when rates come up down the road. You can almost say that that is our strategy.”

So as we fast-forwarding almost a decade to today, where as McElligott says “we actually see the Fed in the game of not simply suppressing the risk-free rate, and thus term-premium, as they did last time—but now buying spread-product (beyond MBS alone) with risk-assets outright / through the new SPV—it is reasonable to believe that investors will “reverse engineer” the Jay Powell playbook noted above, and go with their muscle-memory from this Fed “short volatility positioning” prior conditioning.”

Judging by today’s monster rebound – which however may just be a carbon copy of last week’s record Tuesday surge which was followed by much more pain – that’s precisely what they are doing.

Until then, however, VIX is plummeting

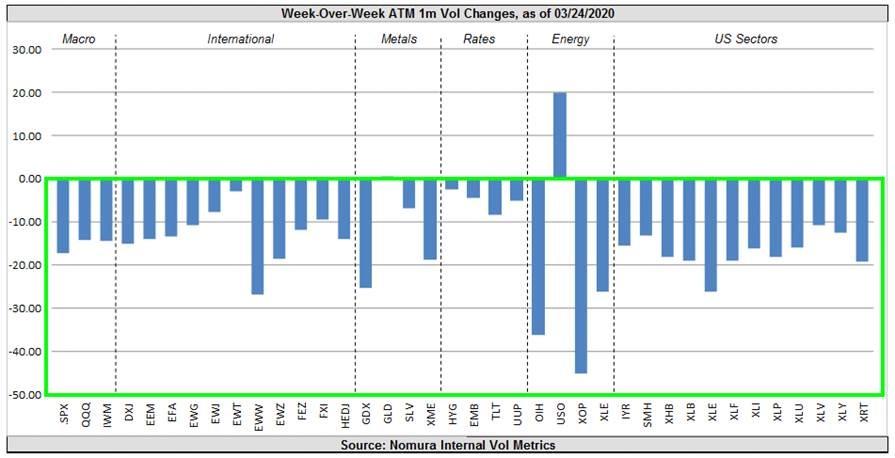

When taken into context then of the “peak of the panic” last week, which was exacerbated by the obvious (and well-documented) “stop-outs” across the VIX complex in various “short vol” positions from both buyside and market-makers –alike (thus creating a vol overshoot), “we have seen a breathtaking collapse in 1m ATM Vols over the past two-and-a-half sessions”, as the following Nomura table shows.

Following Friday’s quad witching which removed a ton of dealer gamma from the book, it is hardly a surprise that VIX tumbled on Monday even as stocks cratered, just as the Nomura quant predicted would happen last week. As such his victory lap is hardly a surprise:

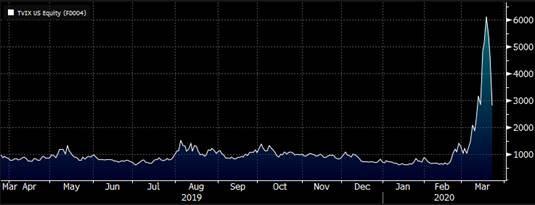

“yesterday’s CRUSH in the VIX-space (along with VVIX experiencing a -2.5 Standard Deviation drop in “Vol of Vol,” as the LEFT TAIL WAS REMOVED by the Fed’s unprecedented actions) was certainly about the gradually-slowing “stop-outs” of those caught short gamma over the past few weeks; but particularly, the acute nature of yesterday’s jarring VIX / SPX term-structure selloff was about the unwinding of “long vol” winners—particularly as expressed with the enormous profit-taking in TVIX 2x leveraged long VIX ETN, alongside other VIX products (UVXY, SVXY and VXX).”

Ironically, the collapse in vol and gamma, meant the TVIX had a near terminal event, as per Bloomberg calculations, on 3/18/20 (last Weds) TVIX had $6.1B of AUM…and as of yday’s closing level, it is now down to $2.8B

Here, Nomura estimates that TVIX alone had nearly 24k UX1 (VIX futures) to sell upon rebalancing yesterday; UVXY had ~1200 for sale; SVXY ~2200; and VXX ~3100—for a total sale of ~30,500 UX1 (VIX futures) across these various VIX-products yesterday.

The result: a nearly 30 volt drop in VIX in just a few days.

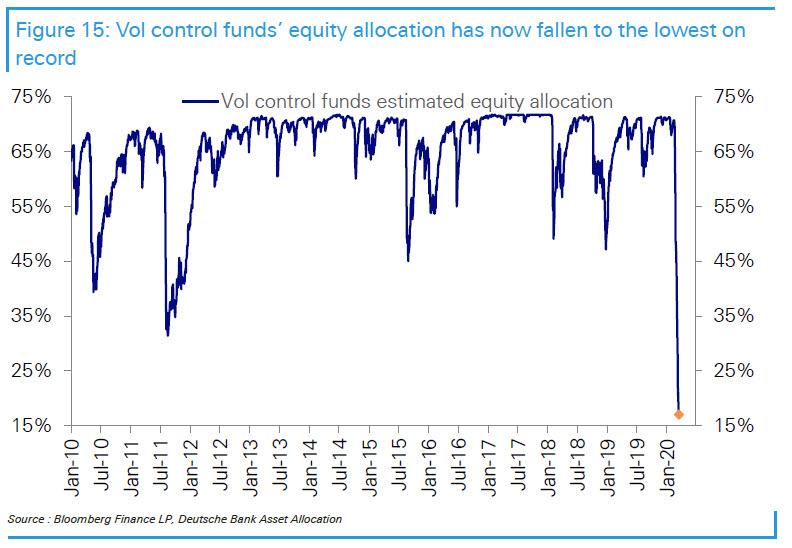

Finally, one rhetorical question from Charlie: what does a “vol normalization” lead to? The answer: “this will create a lagging RE-leveraging from those systematic investors who over the past two months been forced to de-lever after the realized vol spike blew though their price-signal and exposure triggers.”

Here McElligott makes the point about the current near-0% Equities allocations in the Vol Control- and Risk Parity- space, something we showed over the weekend, “as the current ‘nothing left to sell’ implies then conveys that they are then more-likely “incremental buyers” as next move”

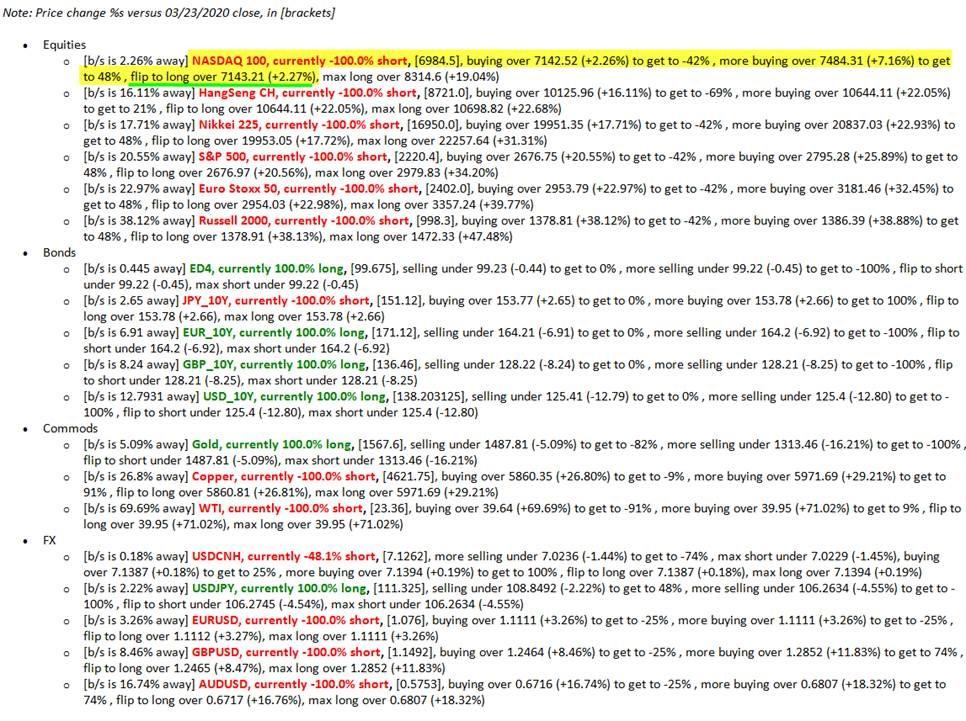

Finally, the Nomura quant suggests that this “first-movers” of the Systematic/Vol-allocation universe are back to being “chopped,” as the CTA Trend model shows that across-the-board “-100% Short” signal across Global Equities is increasingly nearing “triggers” which would dictate “short covering” today—e.g. today in the Nasdaq futures position seeing the model flip back “Long.”

Tyler Durden

Tue, 03/24/2020 – 10:55