Why Did Hundreds Of CEOs Resign Just Before The World Started Going Absolutely Crazy?

Authored by Michael Snyder via The End of The American Dream blog,

In the months prior to the most ferocious stock market crash in history and the eruption of the biggest public health crisis of our generation, we witnessed the biggest exodus of corporate CEOs that we have ever seen. And as you will see below, corporate insiders also sold off billions of dollars worth of shares in their own companies just before the stock market imploded. In life, timing can be everything, and sometimes people simply get lucky. But it does seem odd that so many among the corporate elite would be so exceedingly “lucky” all at the same time. In this article I am not claiming to know the motivations of any of these individuals, but I am pointing out certain patterns that I believe are worth investigating.

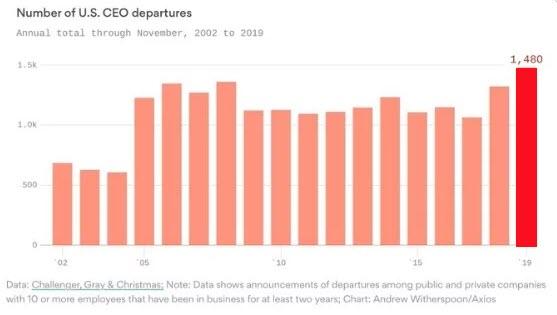

One financial publication is using the phrase “the great CEO exodus” to describe the phenomenon that we have been witnessing. It all started last year when chief executives started resigning in numbers unlike anything that we have ever seen before. The following was published by NBC News last November…

Chief executives are leaving in record numbers this year, with more than 1,332 stepping aside in the period from January through the end of October, according to new data released on Wednesday. While it’s not unusual to see CEOs fleeing in the middle of a recession, it is noteworthy to see such a rash of executive exits amid robust corporate earnings and record stock market highs.

Last month, 172 chief executives left their jobs, according to executive placement firm Challenger, Gray & Christmas. It’s the highest monthly number on record, and the year-to-date total outpaces even the wave of executive exits during the financial crisis.

By the end of the year, an all-time record high 1,480 CEOs had left their posts.

But to most people it seemed like the good times were still rolling at the end of 2019. Corporate profits were rising and the stock market was setting record high after record high.

Yes, there were lots of signs that the global economy was really slowing down, but most experts were not forecasting an imminent recession.

So why did so many chief executives suddenly decide that it was time to move on?

The following are just a few of the big name CEOs that chose to step down in 2019…

-

Dennis Muilenburg — Boeing

-

United Airlines — Oscar Munoz

-

Alphabet — Larry Page

-

Gap — Art Peck

-

McDonald’s — Steve Easterbrook

-

Wells Fargo — Tim Sloan

-

Under Armour — Kevin Plank

-

PG&E — Geisha Williams

-

Kraft Heinz — Bernardo Hees

-

HP — Dion Weisler

-

Bed, Bath & Beyond — Steven Temares

-

Warner Bros. — Kevin Tsujihara

-

Best Buy — Hubert Joly

-

New York Post — Jesse Angelo

-

Colgate-Palmolive — Ian Cook

-

MetLife — Steven Kandarian

-

eBay — Devin Wenig

-

Nike — Mark Parker

Of course the mass exodus of chief executives did not end there.

In fact, a whopping 219 CEOs stepped down during the month of January 2020 alone.

By then, it was starting to become clear that the coronavirus that was ripping through China could potentially become a major global pandemic, and I certainly can understand why many among the corporate elite would choose to abandon ship at that moment.

Some of these CEOs have made absolutely absurd salaries for many years, and it is much easier to take the money and run than it is to stick around and steer a major corporation through the most difficult global crisis that any of us have ever experienced.

The following are just a few of the well known CEOs that have resigned so far in 2020…

-

Bob Iger, CEO of Disney

-

Ginni Rometty, CEO of IBM

-

Harley-Davidson CEO Matt Levatich

-

T-Mobile’s CEO John Legere

-

LinkedIn CEO Jeff Weiner

-

Mastercard CEO Ajay Banga

-

Keith Block, co-CEO of Salesforce

-

Tidjane Thiam, CEO of Credit Suisse

-

Hulu CEO Randy Freer

It is important for me to say that I do not have any special insight into the personal motivations of any of these individuals, and every situation is different.

But I do think that it is quite strange that we have seen such an unprecedented corporate exodus at such a critical moment in our history.

Meanwhile, top corporate executives were dumping billions of dollars worth of shares in their own companies just before the market completely cratered. The following comes from the Wall Street Journal…

Top executives at U.S.-traded companies sold a total of roughly $9.2 billion in shares of their own companies between the start of February and the end of last week, a Wall Street Journal analysis shows.

The selling saved the executives—including many in the financial industry—potential losses totaling $1.9 billion, according to the analysis, as the S&P 500 stock index plunged about 30% from its peak on Feb. 19 through the close of trading March 20.

In the stock market, you only make money if you get out in time, and many among the corporate elite seem to have impeccable timing.

Perhaps they just got really lucky. Or perhaps they were reading my articles and understood that COVID-19 was going to cause the global economy to shut down. In any event, things worked out really well for those that were able to dump their stocks before it was too late.

And it turns out that several members of Congress were also selling stocks just before the market went nuts…

Sen. Dianne Feinstein of California and three of her Senate colleagues reported selling off stocks worth millions of dollars in the days before the coronavirus outbreak crashed the market, according to reports.

The data is listed on a U.S. Senate website containing financial disclosures from Senate members.

Of course most ordinary Americans were not so “lucky”, and the financial losses for the country as a whole have been absolutely staggering.

The good news is that there was a tremendous rally on Wall Street on Tuesday, and that will provide some temporary relief for investors.

But the number of confirmed coronavirus cases continues to escalate at an exponential rate all over the globe, and this crisis appears to be a long way from over.

Tyler Durden

Wed, 03/25/2020 – 11:00