Italin, Greek, Spanish Bonds Soar After ECB Starts Buying Under Emergency Program

One can time almost to the dot the moment the ECB started buying European (mostly peripheral) bonds under the central bank’s latest QE facility.

At just around 4am ET, a wave of buying pushed European peripheral debt sharply higher, sparking speculation that the central bank was in the market.

And sure enough, moments later the European Central Bank confirmed that it started buying bonds under its €750 billion emergency plan to combat the coronavirus outbreak on Thursday.

The ECB said while Greek debt is eligible for the plan, there will be no “catch up” purchases.

“The ECB will explore all options and all contingencies to support the economy to counter this extraordinary shock,” the central bank said.

Greek bonds extended their rally after the statement, sending the yield on five-year securities down more than 40 basis points.

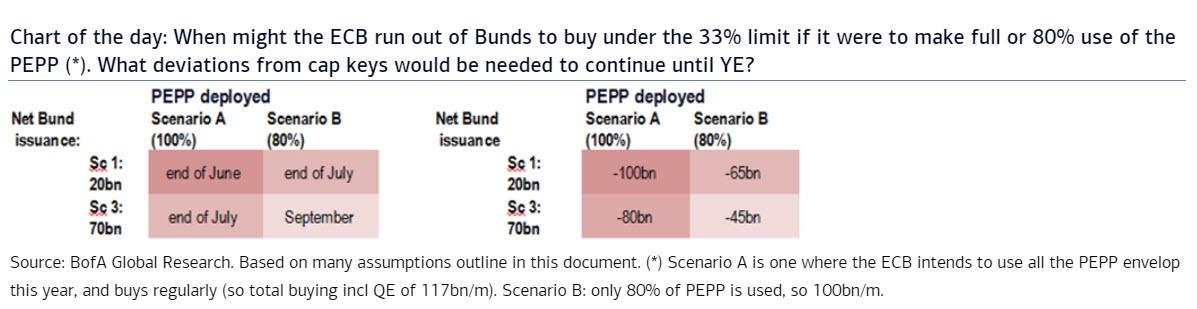

And while the ECB debates whether or not to launch its unlimited, unconditional monetization bazooka, the OMT, which as Bloomberg reported yeseterday may be up next in Europe’s arsenal, the central bank removed one of the key limits that hobbled its existing QE: earlier in the session bonds jumped after the ECB announced that it suspends the 33% ISIN and issuer limits on PEPP purchases, removing a key hurdle as calculations saw the ECB hitting its purchase limit as soon as this summer.

Tyler Durden

Thu, 03/26/2020 – 08:25