Bizarre Rise In Libor Prompts Questions About One Or More Banks In Trouble

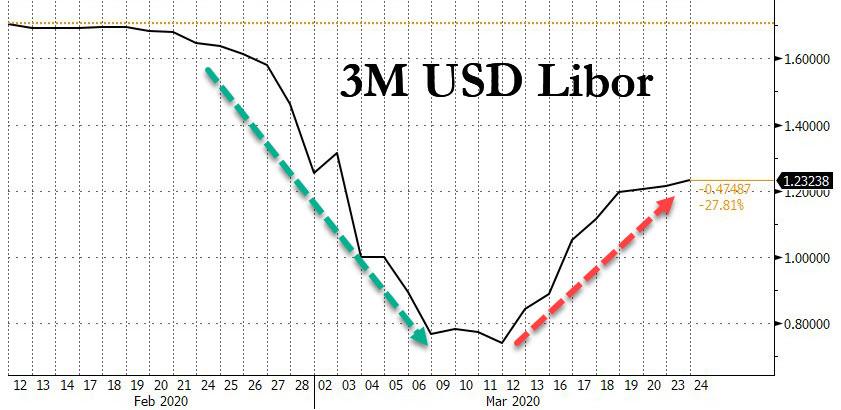

Something odd happened late last week: with the Fed unleashing an unprecedented bazooka of liquidity in the market, cutting rates to zero, and backstopping virtually every security, one of the most closely watched credit market indicators did the opposite of what it was expected to do.

We are, of course, talking about 3 month USD Libor which for better or worse (and at this point its replacement with SOFR in 2021 seems like a complete pipe dream) remains the reference rate for some $300 trillion in fixed income securities, and which instead of continuing to decline alongside other 3 month tenor securities (such as T-Bills) inexplicably proceeded to rise, and rise… and rise some more.

The main reason why the rise in Libor is prompting much head-scratching across Wall Street, is that as part of the Fed’s aggressive re-launch of Lehman-era rescue facilities, Libor was one of the key rates that was supposed to benefit and drop, resulting in easier financial conditions for all those millions of debtors whose interest rates are pegged to Libor.

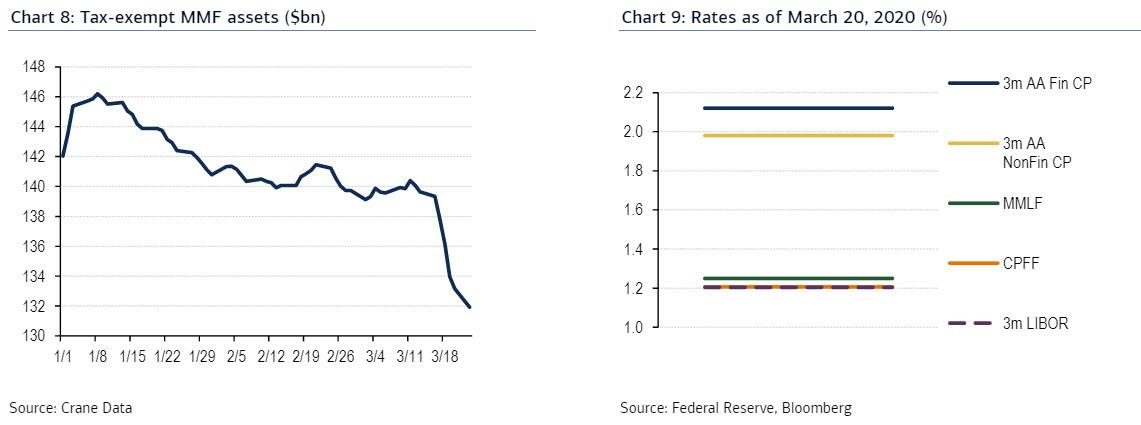

As BofA explains today, “the Fed’s CPFF & MMLF facilities are expected to assist conditions in the CP, CD, & muni markets as they become more established. CPFF will be operational in 1H April and MMLF usage has reportedly started which should assist in liquidity building even amidst outflows and market stress. In some cases MMLF has not provided liquidity fast enough and at least two MMF fund families have needed to be backstopped by their parents.”

As these facilities are more widely used we would expect CP, CD, & muni rates to converge closer to facility levels. Greater stability in CP & CD markets should lead to improved liquidity conditions and also reduce funding pressure in the XCCY basis further.

What is notable is that 3 Month LIBOR is in line with these facility rates and, at least according to BofA, should be dropping as the market prices in the full uptake of the Fed’s various bailout facilities.

And yet, so far that hasn’t happened, so what is going on?

There is where things get tricky because the last time Libor blew out – granted to a far bigger extent than currently – was during the financial crisis, when Libor would be pulled higher as one or more Libor-member banks found themselves with a funding shortage and would pay any rate to obtain Libor funding. That created a vicious circle where rising libor resulted in greater counterparty risks, which in turn pushed libor higher, and so on, until this turned into a self-fulfilling prophecy and first Bear Stearns, then Lehman collapsed.

According to at least one bank the same is happening now.

With 3M USD Libor rising for the 10th straight session as the benchmark fixed higher by 10.763bp on Thursday, the persistent increases in the London interbank offered rate “may suggest a widening gulf between those who have cheap access to funding and those who do not” – in other words, one or more banks may be scrambling for liquidity, and worse, someone is aware of this.

As a result, according to NatWest markets strategists John Roberts and Blake Gwinn, “a wedge may start to grow between Libor panel banks and broader commercial paper markets.” To wit: Libor-OIS has now blown out to 130bp, the widest since December 2008, from 118bp prior session, suggesting that despite all the Fed’s best efforts something remains badly broken in the interbank plumbing.

What is also concerning is that away from Libor, commercial paper rates continue to price higher than Libor prints and Libor-OIS has “consistently priced” below the OIS+110bp level, which is the rate on the Commercial Paper Funding Facility, according to NatWest. Meanwhile, non-financial, and some financial names might only have access to funding via the CPFF, as “the list of alternative (and cheaper) options for LIBOR panel banks continues to grow.” These include the Fed’s swap line (OIS+25bp), the discount window (25bp) and the Primary Dealer Credit Facility (PDCF) at 25bp.

In other words, it may well be the case that it is not a bank on the verge, but merely a bank (or non-bank) that is shunning libor and using other funding pathways. But any case, the rise in Libor – while not necessarily an indicator of an imminent bank failure – should not be taking place now that the Fed has unleashed virtually every liquidity facility, and we urge traders to keep a close eye on Libor and Libor-OIS for a sense if something continues to break below the market’s surface.

Tyler Durden

Thu, 03/26/2020 – 13:40