Morgan Stanley: “We Are Underwhelmed By This Low Participation Rally”

One of the recurring laments about the longest-ever bull market which ended with a thud earlier this month, was that upside levitation was traditionally driven by low-volume moves, while selloffs were “fast and furious”, and typically involved indiscriminate liquidations.

As such, the rally of the past three days is certainly in line with what traders had grown accustomed to because as Morgan Stanley’s quants describe the move in the market in recent days, it has been a “low participation rally.”

In a note by MS equity strategists led by Robert Cronin, the bank writes that the stimulus response in EU/US/UK is now expected to be in region of $8 trillion with “market levels trapped in a tug-of-war with those offering that stimulus to plug the gap in lost growth.”

As Cronin notes, “balancing that already complex equation is made all the more difficult by the fact that impact and expiry of this event are both unknown. As such, markets will stay erratic and don’t rule out a retest of the 2400 lows” in the Stoxx 50. Furthermore, the bank reminds its clients that last week flagged “that very bearish SX5E futures positioning would allow for sharp bursts higher and that has largely played out ($20bn of a total $50bn of net shorts were covered).” But, beyond that, Morgan Stanley remains rather “underwhelmed by the lack of ‘new’ positive positioning in futures/options/cash.”

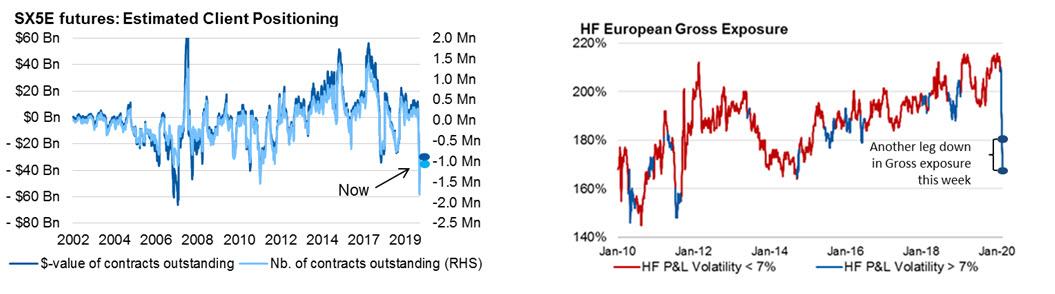

Looking at European stocks, the MS quants write that “after a strong week of covering (with almost no long additions), we estimate clients are now short $30bn of SX5E futures – longs of $12bn and shorts of $43bn (left chart).”

Meanwhile, hedge funds have once again failed to take advantage of this record short squeeze in equities, and in the cash market, there is ZERO evidence of HF re-grossing last week with the move higher. In fact, the bank writes, “gross exposure fell further (from 180% last week to 167% now. Was 155% in 2014)” and adds that “as long as HF P&L Volatility remains greater than 7v, de-grossing is unlikely to stop (10d HF P&L vol is 22v, 30d is 16v).“

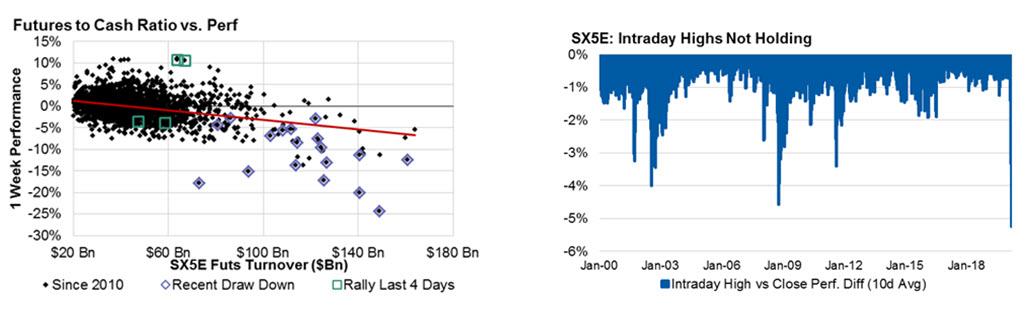

Then there is the lack of volume: as the market was in free fall from 21st Feb, SX5E futures have been printing $100-$160bn a day (vs. normal volumes of $40-60bn). In contrast, “the rally in the last week has taken place on very low volumes comparison” (green vs. purple diamonds in right chart). Shockingly, only $1.4bn traded net @ offer during the rally, which is incredibly low relative to spot move.

If that wasn’t enough, MS notes that “there is also something interesting on the inability of the SX5E to hold onto gains. Right chart shows the drop in performance from the intraday high to the close in SX5E is unlike anything we have seen since 2000.“

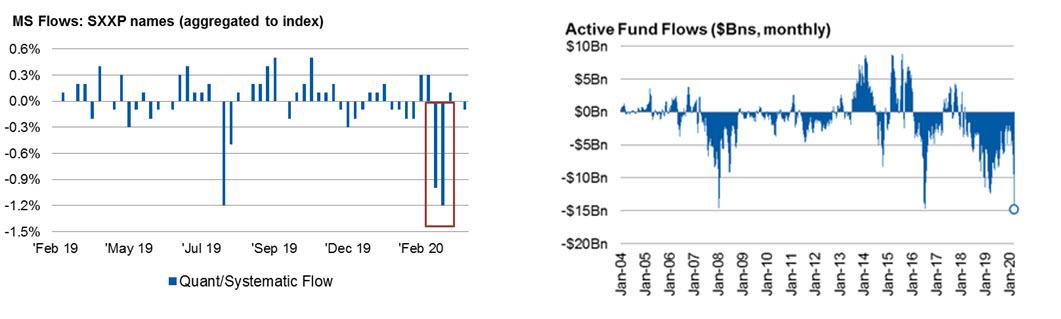

Finally, as we noted yesterday, the one place where flows are more logical is systematic funds, which sold so much they are now neutral or buying, to wit: “quantitative directional funds P&L fell -7% in Feb and was followed by the 2 biggest weeks of outflows since 2014 but those flows look to have stabilized and we have had 3 weeks of benign flows since. So systemic strategies appear to have been early to the deleveraging cycle this time (left chart below).”

However, on the fundamental/discretionary side, actively managed EU Equity Funds saw redemptions of $5.5bn – the largest week on record (since 2004) and a 4.9σ event. This takes 1 month total redemptions for EU Actively Managed Funds to $15bn, surpassing the 2 previous largest months – Jan 08 (GFC) and Jun 16 (Brexit) both of which saw a monthly outflow of $14.5bn. Right Chart below.

Tyler Durden

Thu, 03/26/2020 – 13:29