Going Down With The Ship: After Raging At Moody’s For Downgrade To Deep Junk, Masa Son Pledges 40% Of SoftBank Stake To Lenders

Last October, in the aftermath of the WeWork and Uber fiasco, we asked if SoftBank, that chronic seed (and not so seed) investor in cash-incinerating zerocorns startups would be “The Bubble Era’s “Short Of The Century.” Subsequent events have only made our query more pressing: with the global economy frozen, with social distancing and self-quarantine now a mandatory part of life, the “sharing economy” that is the basis of so many of SoftBank’s investments has ground to a halt, making its already unsustainable cash burn explode to obscene levels.

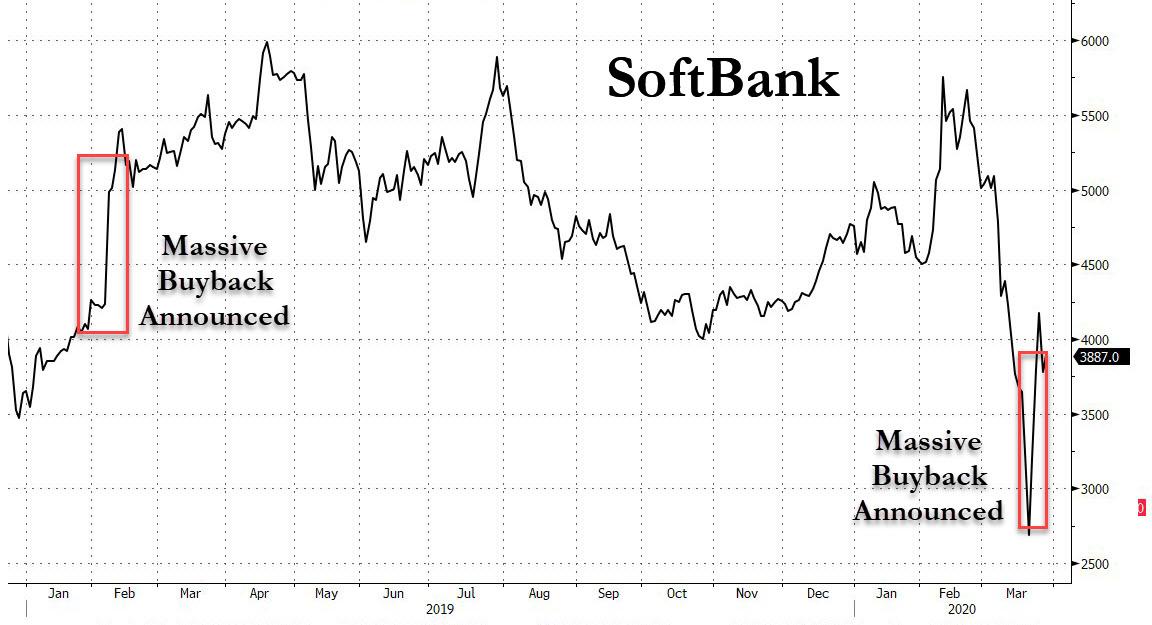

Not helping matters is that one month ago, activist investor icon Paul Singer officially engaged SoftBank, demanding a higher stock price and forcing Son to announce on Monday plans to liquidate a whopping $41 billion in viable assets ( including $14 billion of shares in Chinese e-commerce leader Alibaba) in a bid to raise SoftBank’s price by announcing another massive stock buyback, something the company did first last February when it said it would repurchase 10.3% of its stock (apparently Masa Son has learned absolutely nothing from Boeing’s PR fiasco involving tens of billions in stock buybacks over the past decade, only to come crawling for a bailout in recent weeks not surprisingly finding a hostile rececption).

The good news: news of the massive buyback helped SoftBank stock surge 55% which last week fell to a four-year low as investors panicked over its hefty debt exposure.

The bad news: unfortunately for SoftBank and Masa Son, the rating agencies noticed the company’s latest attempt to boost its stock price now at the expense of jeopardizing the company’s long term viability (see Boeing), and on Wednesday Moody’s issued a two-notch downgrade of SoftBank that cut its debt deeper into junk status.

Moody’s cited SoftBank’s “aggressive financial policy” for its decision to cut its rating from Ba1 to Ba3, saying the value of the group’s portfolio would be reduced if it sold off its lucrative stakes in Chinese ecommerce group Alibaba and Sprint during the market volatility caused by the coronavirus pandemic.

“Asset sales will be challenging in the current financial market downturn, with valuations falling and a flight to safety,” said Motoki Yanase, Moody’s senior credit officer, in a statement.

Needless to say, Masa Son was furious that someone dared to point out that Japan’s hail mary M&A, rollup and venture capital emperor was, in fact, naked, and slammed Moody’s demanding that the rating agency remove all of its bond ratings on the Japanese conglomerate.

“[SoftBank Group] believes that Moody’s ratings action is based on excessively pessimistic assumptions regarding the market environment and misunderstanding that SBG will quickly liquidate assets without any thorough consideration.”

But the damage was already done, and the downgrade led to a sharp increase in the borrowing costs on SoftBank’ massive, $55bn debt load. Yields on SoftBank’s perpetual bonds, which have no maturity date, climbed above 11% after a sell off in Wednesday morning trading.

And just like that all the investor goodwill Masa Son hoped to buy with the record upcoming buyback has fizzled, just because – this time – the rating agencies refused to keep their mouth shut and called out the company on its desperate attempt to boost its stock price while stripping it of some of its most valuable assets (not surprisingly, the rating agency corruption in Japan continues, and while SoftBank’s debt relative to cash flow mean that western rating agencies class SoftBank as junk, the group has an investment-grade rating from the local Japanese rating agency, JCR. It is unclear how much in kickbacks it costs Masa Son to keep this sole investment grade rating).

But wait, there’s more.

With the noose tightening and as more questions about the viability of SoftBank emerge, on Friday Masa Son pledged an additional 10.1 million of his own SoftBank shares to lenders in the past two weeks, regulatory filings revealed.

The latest filing means Son has now committed a total of 227 million SoftBank shares as collateral, worth about $8 billion, or about 40% of his 27% stake in the publicly traded financial conglomerate.

Call it going down with the ship.

According to Bloomberg, the newly pledged shares were worth about $360 million at Friday’s close. Son’s net worth is $12 billion on the Bloomberg Billionaires Index, which excludes the value of the pledged shares. It has fallen $3.6 billion so far this year, as Masa has increasingly tied his own fate with that of SoftBank: the Japanese billionaire has more than tripled the level of his pledging since 2013.

And if Masa is going down with the ship, so are his personal bankers, which according to Bloomberg include UBS and Nomura.

So what happens next?

Well, if the selloff continues, margin calls are next.

As Bloomberg notes, Son’s filing comes as some billionaires scramble to meet margin calls on their pledged shares. India’s Gautam Adani and his family put up an additional $1.4 billion of shares as collateral on existing debt this month, and banks like ultra high net worth caterers UBS (there it is again) and Credit Suisse have asked clients to post additional collateral, which leads to further forced selling, and perpetuates the liquidation spiral.

The worst case scenario however is not that Masa Son will be broke: we are confident he has billions stashed in an offshore bank somewhere. No, who will be hardest hit is – as usual – retail investors. Going back to SoftBank’s fabricated, and potentially criminal Investment Grade rating with JCR, the FT writes that SoftBank had repeatedly taken advantage of this higher domestic credit rating to raise debt from retail investors. Last year, the group became the biggest issuer of debt sold to “Mrs Watanabe”, i.e., Japan’s army of kamikaze retail investors, accounting for more than half of all outstanding retail bonds from companies and financial institutions in March last year.

Which means that when the bubble era “short of the century” finally collapses under the weight of its massive debt, it will once again be main street that is hardest hit. Because some things never change.

Tyler Durden

Fri, 03/27/2020 – 19:45