“There’s No Gold” – COMEX Report Exposes Conditions Driving Physical Crunch

Early this week, we were among the first to report on the “break down” in precious metals markets.

While the demand for gold has been soaring as a safe haven asset amid the multiple global crises we are currently facing, forced paper gold liquidation (as leveraged funds scramble to cover margin calls) and unprecedented logistical disruptions created a frantic hunt for actual bars of gold.

Specifically, as Bloomberg details, at the center of it all are a small band of traders who for years had cashed in on what had always been a sure-fire bet: shorting gold futures in New York against being long physical gold in London. Usually, they’d ride the trade out till the end of the contract when they’d have a couple of options to get out without marking much, if any, loss.

But the virus, and the global economic collapse that it’s sparking, have created such extreme price distortions that those easy-exit options disappeared on them. Which means that they suddenly faced the threat of having to deliver actual gold bars to the buyers of the contract upon maturity.

It’s at this point that things get really bad for the short-sellers.

To make good on maturing contracts, they’d have to move actual gold from various locations. But with the virus shutting down air travel across the globe, procuring a flight to transport the metal became nearly impossible.

If they somehow managed to get a flight, there was another major problem. Futures contracts in New York are based on 100-ounce bullion bars. The gold that’s rushed in from abroad is almost always a different size.

The short-seller needs to pay a refiner to re-melt the gold and re-pour it into the required bar shape in order for it to be delivered to the contract buyer. But once again, the virus intervenes: Several refiners, including three of the world’s biggest in Switzerland, have shut down operations.

“I realized it was going to be an extremely volatile day,” Tai Wong, the head of metals derivatives trading at BMO Capital Markets in New York, said of Tuesday. “We watched this panic develop literally over the course of 12 hours. Having seen enough market dislocations, you recognize that the frenzy wasn’t likely to last, but at the same time you also don’t know how long it would extend.”

By the end of the week, the shorts had sourced the metal and chartered flights, reverting the spot-futures spread…

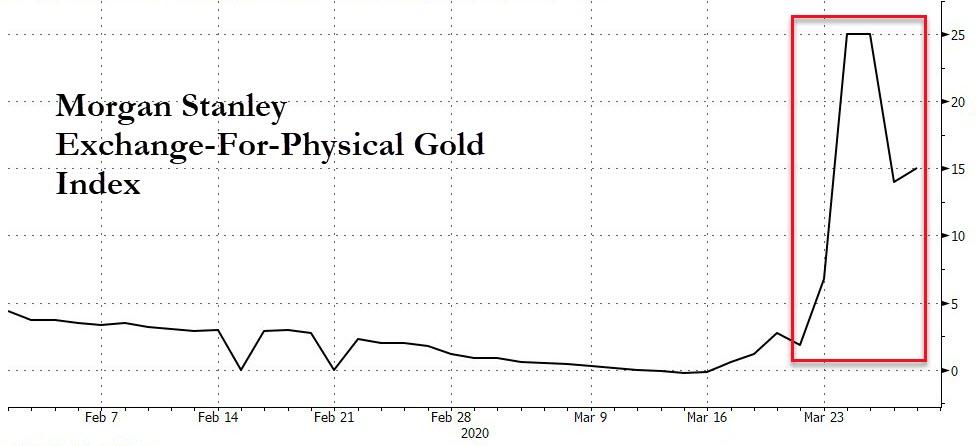

But Morgan Stanley’s Exchange-For-Physical Index shows a large physical premium remains…

The real price.. for real gold? Nearer $1,800. If you can get it.

“There’s no gold,” says Josh Strauss, partner at money manager Pekin Hardy Strauss in Chicago (and a bullion fan).

“There’s no gold. There’s roughly a 10% premium to purchase physical gold for delivery. Usually it’s like 2%. I can buy a one ounce American Eagle for $1,800,” said Josh Strauss. “$1,800!”

“The case for gold is simple,” says Strauss.

“You want to own gold in times of financial dislocation and or inflation. And that’s been the case since time immemorial. And gold behaves well in those cases. In those cases stocks behave poorly. It’s a great portfolio hedge. Gold does poorly when you’ve got strong economic growth and low inflation. Tell me when that’s going to happen. Gold held its value during 2008 and after all that money printing it tripled over the next three years.”

And in case you doubted this, the cost of an American Eagle one ounce coin at the US Mint is now $2,175…

But now we can see more details of what is behind this ‘shortage’ as SKWealthAcamdemy’s J.Kim details, the latest COMEX Issues and Stops reports expose conditions behind the COMEX physical gold supply problems. Though I have written about the various reasons why physical gold supply problems manifest many times in the past, this topic still remains one rarely discussed by financial journalists, and never discussed by the mass financial media.

For client accounts, when bullion banks stop more notices than issued, they, will lose physical inventory.

For house accounts, the opposite is true.

When bullion banks issue more notices than stops, then they will lose physical inventory as well. Normally, when bullion banks manufacture waterfall declines in paper gold and silver prices, as they did earlier this month, with the complicity of the CME’s largely unreported rampage in raising initial and maintenance margins on futures contracts many times within a 2-month period in the midst of a stock market crash, they load up on physical gold and silver for their house accounts while ensuring that their clients take almost zero delivery of physical gold and silver ounces. However, if they are unable to execute this clever strategy, this is when physical gold supply problems can manifest.

In fact, I have not seen a single news site in the entire world, except for my own, mention the relentless increase in initial and maintenance margins in gold and silver futures contracts (the 100-oz gold futures contract and the 5000-oz silver futures contract) for the past two months, in a desperate attempt to knock long positions out of the game and thereby prevent an increasing amount of physical delivery requests.

Just recently, the CME raised margins yet again for 100-oz gold futures contracts to $9,185/$8,350 for initial/maintenance margins, representing a massive 86% increase in margins, and for 5000-oz silver futures contracts to $9.900/$9,000 for initial/maintenance margins, representing a gigantic 73% increase in margins, in just a couple months’ time. Normally, such relentless increases in initial/maintenance margins in gold futures markets is sufficient to prevent physical gold supply problems from afflicting futures markets, but the fact that even this reliable manipulation mechanism failed recently is a sign of additional tectonic earthquakes to come in the global financial system.

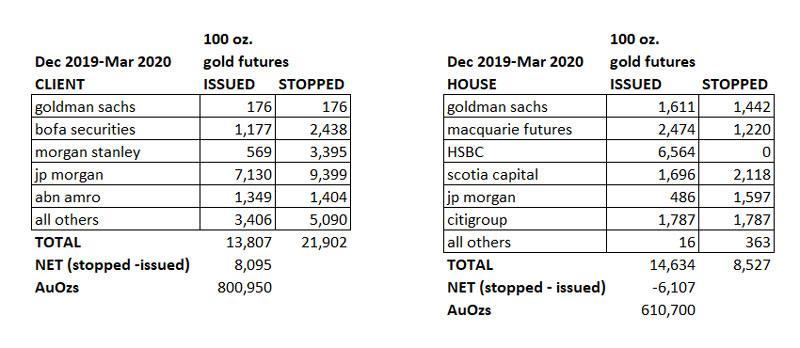

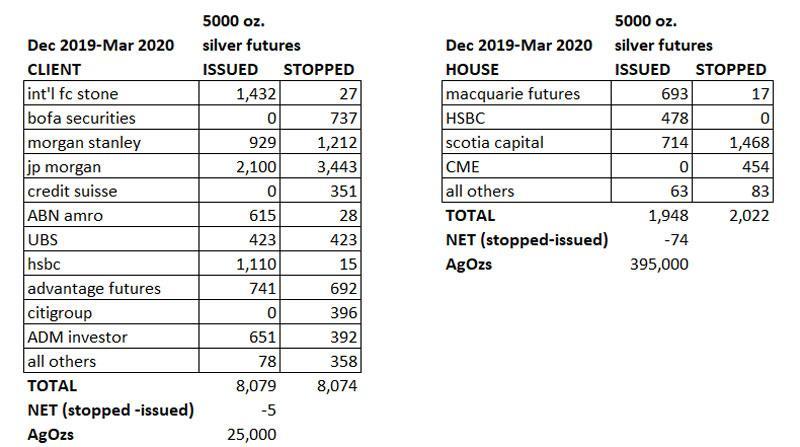

However, as you can see for the data I have compiled for the behavior of issues and stops for client and house accounts for bullion banks in gold and silver from December 2019 to March 2020, this pattern of normal behavior, in which bullion banks take advantage of their own artificially manufactured paper gold and silver price plunges to load up on physical metals at the expense of their clients, has strongly reversed during this four-month time span. I have only included data for the major gold (100-oz) and silver (5000-oz) futures contracts below and not for the mini gold (10-oz) and mini silver (1000-oz) silver futures contracts.

Furthermore, I only separated out the bullion banks by name that had several hundred to a few thousand contracts stopped or issued, and compiled all other data under the category of “all others”. For those of you that don’t understand the terminology “stopped” and “issued”, the categories refer to the number of delivery notices that were “issued” (short positions issuing notification that underlying gold/silver would be delivered) and “stopped” (long positions receiving a delivery notice).

Therefore, when delivery notices are “issued” in house accounts, the issuing bank is on the hook for delivering the physical ounces associated with the underlying contracts. On the contrary, when notices are “stopped”, then the stopping bank would receive notification of the future delivery of the physical ounces associated with the underlying contracts. The same holds true for client accounts. Thus, all bullion banks desire more stopped than issued notices for their house accounts, and desire more issued versus stopped notices for their client accounts. This way they accumulate more physical inventory during artificially engineered paper price crashes.

As you can see, the massive engineered drop in paper silver prices versus the massively higher physical silver prices for the past month backfired on the bullion banks, as it led to a frenzy of clients asking for physical delivery, whereas in the past, bankers had been able to chase client long positions out of the market without ever being on the hook for physical delivery. Thus the amount of contracts stopped versus issued for clients was nearly break even for silver futures contracts, a pattern I have not witnessed in a long time during a banker raid on paper silver prices. And in regard to house accounts, under past similar circumstances, I had always observed JP Morgan bankers taking a tremendous amount of physical silver delivery during engineered collapses in paper silver prices. However, during the last four months, this situation did not materialize, perhaps due to the stress on physical stores of silver created by so many clients asking for physical delivery. As you can see in the data I complied above, this time around, JP Morgan bankers were nearly absent in taking physical silver delivery for their house account. In fact, for the bullion bank house accounts, the amount of stopped versus issued contracts, net, was only 74 contracts, or a mere 395,000 AgOzs for their House accounts. As a basis of comparison, during similarly engineered collapses in paper silver prices in the past, JP Morgan alone was able to accumulate and take delivery of many millions of physical silver ounces.

In regard to real physical gold delivery, the situation was even worse for bullion bankers than their situation with real physical silver delivery, which likely has given rise to physical gold supply problems at the current time. In their client accounts, physical delivery requests exploded, with the net (stopped minus issued) totaling 8,095 contracts representing 800,950 AgOzs of real physical gold requested for delivery. In their house accounts, the bullion banks were unable to yield a positive net situation either, with issued contracts exceeding stopped contracts by 6,107 contracts, representing 610,700 AgOzs. Thus, when adding these two figures together, the bullion banks are on the hook for delivering more than 1.4M AgOzs.

This unexpected demand on bullion bank physical gold reserves has undoubtedly led to a disruption of physical gold delivery associated with the gold futures markets, though various COMEX spokespeople have claimed there is no shortage of physical gold whatsoever, and that the disruption of delivery is simply due to a disruption in the supply chain caused by the coronavirus pandemic, i.e., when in doubt, blame the coronavirus pandemic for all manifested stresses revealed in the global financial system. Earlier, here, on 24 February, I speculated, well before US stock markets started to crash, that the coronavirus pandemic would be scapegoated for the market crash, and I was 100% right. Is it possible that the coronavirus pandemic is now being scapegoated for shortages of physical gold as well?

Oddly, a gold analyst, Ole Hanson stated in response to the shortages of gold physical supply in the futures markets: “There is plenty of gold in the market, but it’s not in the right places. Nobody can deliver the gold because we are forced to stay home.” The explicit function of COMEX warehouses is to store the physical gold that backs gold delivery associated with gold futures contracts. Consequently, why is the physical gold “not in the right places” and in these warehouses, as if it is stored where it is supposed to be stored, and the data is accurate (1.76M registered AuOzs and an additional 6.98M eligible AuOzs in COMEX warehouses as of 26 March 2020), there should be no physical gold shortages to meet physical demand right now? Did Mr. Hanson, in his statement that gold is “not in the right places” unwittingly reveal that the reported COMEX warehouse data is fraudulent?

Secondly, some would suggest that ever since the COMEX mandate that paper gold could be used to close out physical delivery requests through EFP (Exchange For Physical) transactions by Exchange Rule 104.36 enacted on February 18, 2005, which allowed for the substitution of gold ETFs for physical gold, that no physical shortage of gold could ever result.

Since paper was allowed to replace physical, could not bullion banks just literally “paper over” any physical supply deficit? And if the answer to this question is yes, then why is the COMEX experiencing physical shortages of gold right now? Well, as I explained in an article that I published on my news site in June 2011, in which I explained how EFP transactions operate (which you can read here), “the Related Position [Physical] must have a high degree of price correlation to the underlying of the Futures transaction so that the Futures transaction would serve as an appropriate hedge for the Related Position [Physical].” Consequently, since there has been a massive price decoupling between physical and paper gold prices, perhaps this price decoupling has enabled the underlying holder of longs in gold that asked for physical delivery to reject any EFP transaction, since there is no longer a “high degree of price correlation” between paper and physical gold, and to insist on physical gold delivery with no substitution for this request. And this rejection of EFPs and EFS (exchange for swaps) as acceptable behavior is perhaps what is causing the physical gold supply problems in the futures markets right now.

Tyler Durden

Sat, 03/28/2020 – 19:35