“We’re Not Making Any April Payments” – Unprecedented Clash Erupts Between Tenants And Landlords

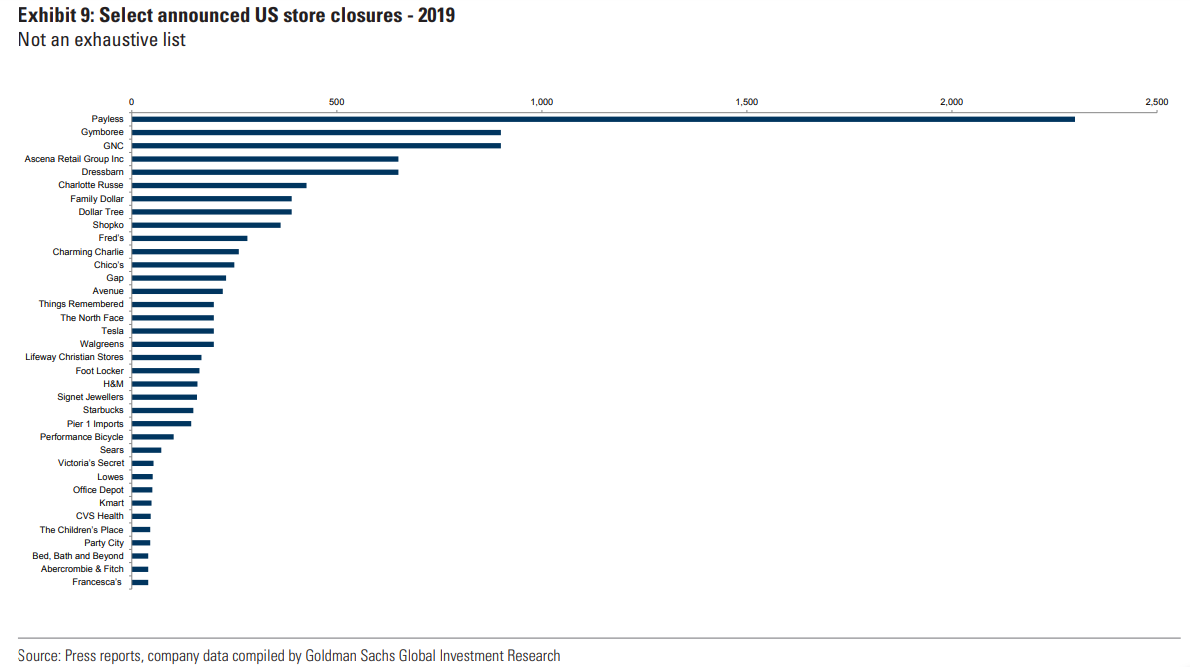

Even before the coronavirus pandemic ground the US economy to a halt, the US brick and mortar retail sector was facing an apocalypse of epic proportions with dozens of retailers filing for bankruptcy in recent years as Amazon stole everyone’s market share…

Since June 2015, retail chains have accumulated more than $45 billion in aggregate chapter 11 liabilities in connection with over 80 bankruptcy filings: pic.twitter.com/Q1XO9pSWij

— First Day by Reorg (@ReorgFirstDay) August 20, 2019

… resulting in tens of thousands of stores across the nation shuttering.

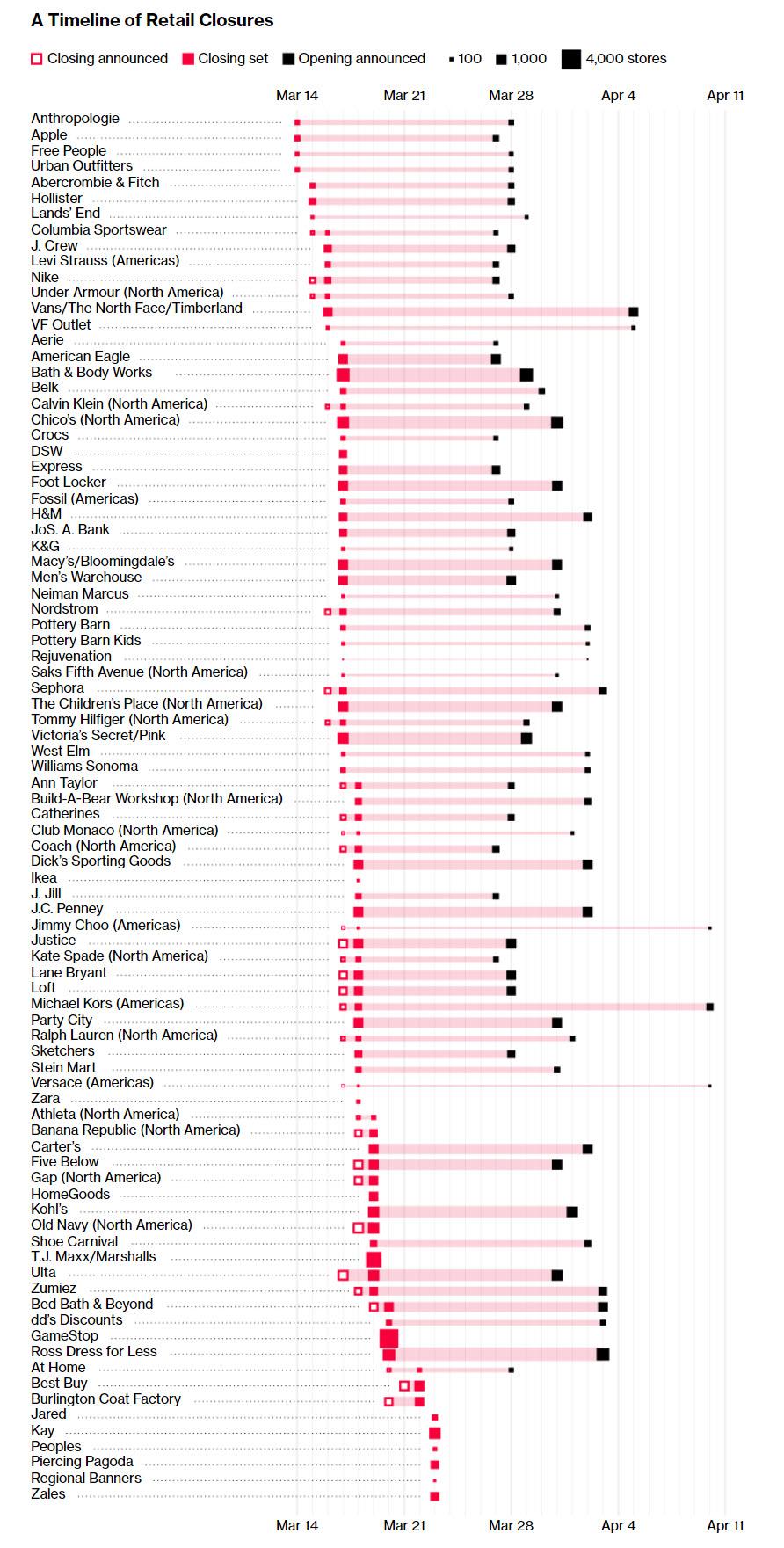

So what has taken place in the retail sector in just the past few weeks is straight out of the the 9th circle of hell. As we reported last week, in just the span of two weeks, more than 47,000 chain stores across the US shut their doors – temporarily, or so they hope – as retailers took extreme measures to help slow the spread of the coronavirus pandemic according to Bloomberg data. At least 90 nationwide retailers, ranging from Macy’s to GameStop to Michael Kors have temporarily gone dark. And while most have pledged to remain closed for at least two weeks, many if not all will likely have to stay closed for much longer, because as we showed earlier, the US is very early on the coronavirus curve, and many weeks have to pass before the peak is hit.

Needless to say, it has been an unprecedented moment for shopping in America, a country that contains more retail selling space than any other: “In the space of a week, the retail landscape has changed from being fairly normalized to being absolutely disrupted beyond what we’ve ever seen before outside of the Second World War,” Neil Saunders, managing director of GlobalData Retail, said.

With cash flows dwindling, and their survival in question every day, the total collapse in revenue has meant that firms such as (recently reorganized) Mattress Firm and Subway are among some of the major U.S. retail and restaurant chains telling landlords they will withhold or slash rent in the coming months after closing stores to slow the coronavirus, Bloomberg reports citing sources. Best Buy, meanwhile, plans to pay rent, with the possible exception of locations it was forced to close.

Aware that one way (out of bankruptcy) or another (in bankruptcy), they will end up renegtiating their leases, retail chains are proactively calling for rent reductions through lease amendments and other measures starting in April.

However, since landlords have to meet monthly obligations of their own and pay their own lenders (who in turn are looking to the federal government for help), what is emerging is an epic clash is emerging between renters and landlords and no one knows when or how it will end.

And while it goes without saying, a lot is at stake: U.S. retail landlords collect more than $20 billion in rent in a typical month, according to Bloomberg citing data from CoStar Group.

“It’s three-dimensional chess,” said Tom Mullaney, a managing director in restructuring at Jones Lang LaSalle Inc. “The battlefield is foggy.”

The dynamics are well-known: with stores shuttered around the U.S., struggling retail chains and small businesses are laying off tens of thousands of workers and trying to figure out if they can make rent. And while landlords are expecting missed payments, they are also trying to assess whether their tenants are actually in trouble or just using the crisis to get a deal on rent. In short: landlords, for the most part, are still expecting payment and they will be disappointed.

Taubman Centers and Federal Realty Investment Trust, which operate millions in square feet of retail space, have told tenants they expect rent to be paid according to lease obligations, citing their own expenses. In statements to Bloomberg, both said they are talking to individual tenants about their specific situations.

“We are attempting to navigate through this situation in the best way we can, while being as flexible as we can with our tenants in light of our ongoing obligations,” Taubman, one of the largest U.S. mall operators, said in a statement. “The tenant memo does not replace our willingness to talk to each tenant about their respective challenges.”

Something tells us that in just a few weeks, the Taubmans of the world will become public enemy number one…

* * *

Meanwhile, as Bloomberg notes, the federal stimulus bill is expected to provide some relief, both for tenants and owners, but it will take time to get the program up and running. Even then, it’s not clear the money will be enough to keep retailers afloat with their stores dark.

“All the money coming into the system from the stimulus will be good, but it won’t be enough,” said Eric Anton, an associated broker at Marcus & Millichap. “There’s going to be real losers and pain. There’s already been a lot of pain and it’s only been two weeks. Six more weeks will only bring more pain, lots of hard negotiations.”

Take the case of Anne Mahlum, founder and CEO of the Washington-based fitness chain Solidcore, which recently shut down 72 studios and laid off most of her staff. She sent letters to her landlords asking for rent abatement. So far, only a few have agreed. She owes more than $600,000 in rent for April.

“The majority of them are at least offering deferment, but some have said rent is still due, which is ludicrous,” Mahlum said. “Even deferment doesn’t help. We’re just kicking the financial can down the road.”

Landlords are getting flooded with identical requests from frantic tenants across the nation demanding rent relief. Many are trying to work out deals in private on a case-by-case basis, to avoid getting inundated with demands for similar concessions.

“If everybody asks and everybody gets, it’ll just bankrupt the landlord,” said Chris Smith, a lawyer at DLA Piper. “Everyone’s hoping to buy some time to respond intelligently as the facts start coming out.”

The first wave of bankruptcies however, will hit the tenants first, many of whom plan to withhold rent payments for April even if it they haven’t received preapproval to do so from landlowds: “You can’t work through expenses and continue to pay operating ones when you have zero money,” Mahlum said. “We’re not making any April payments.”

Those who can afford rent on some locations will likely be strategic, paying for their best-performing stores while withholding payment on the ones that were hurting before the crisis, JLL’s Mullaney said. Same goes for landlords, who were already struggling to fill their space before the coronavirus shut down the economy. Many are likely to work out deals with credit-worthy tenants who will take on a longer lease.

That partly depends on how much flexibility they can get from their lenders: “Some are taking the high road,” Mullaney said. “But the more leveraged you are, the more liquidity is an issue, and it’s not so easy to take the high road.”

Which is of course ironic considering how many years the nation’s top economists were calming the country’s nerves repeating at every soundbite opportunity, just how strong the fundamentals of US businesses were. In retrospect, all that “strength” was just debt…

Tyler Durden

Tue, 03/31/2020 – 11:50