The Federal Reserve’s One Last Hail Mary

Authored by Alexander Deluce via GoldTelegrapoh.com,

Over the last few weeks, the Federal Reserve has been in utter desperation mode to try to revive and keep the American economy on life support.

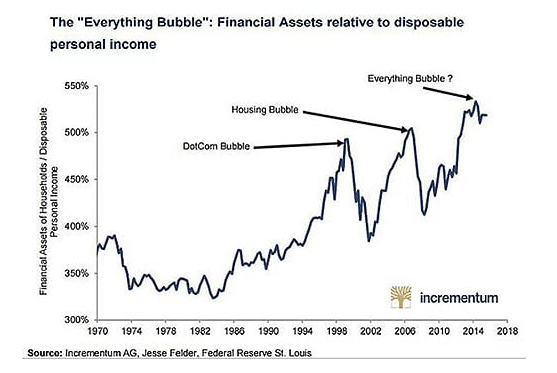

What many in the mainstream media have failed to include in this recent coronavirus economic narrative is that the virus was just the pin of one the biggest bubbles ever created, which we call the central bank bubble revolving around U.S sovereign bonds.

Before we dive deep into this, let’s start with what the Fed has been doing to combat against the coronavirus and to keep markets alive for the time being. To begin, welcome back to the era of the printing press, but this time they have made it clear they will conduct “QE infinity” if this is a prolonged depression, which it will be.

For some prospective, previous QE programs were:

-

QE1: $1.7 Trillion

-

QE2: $600 Billion

-

QE3: $1.6 Trillion

With this latest being:

-

QE4:$1.6 Trillion

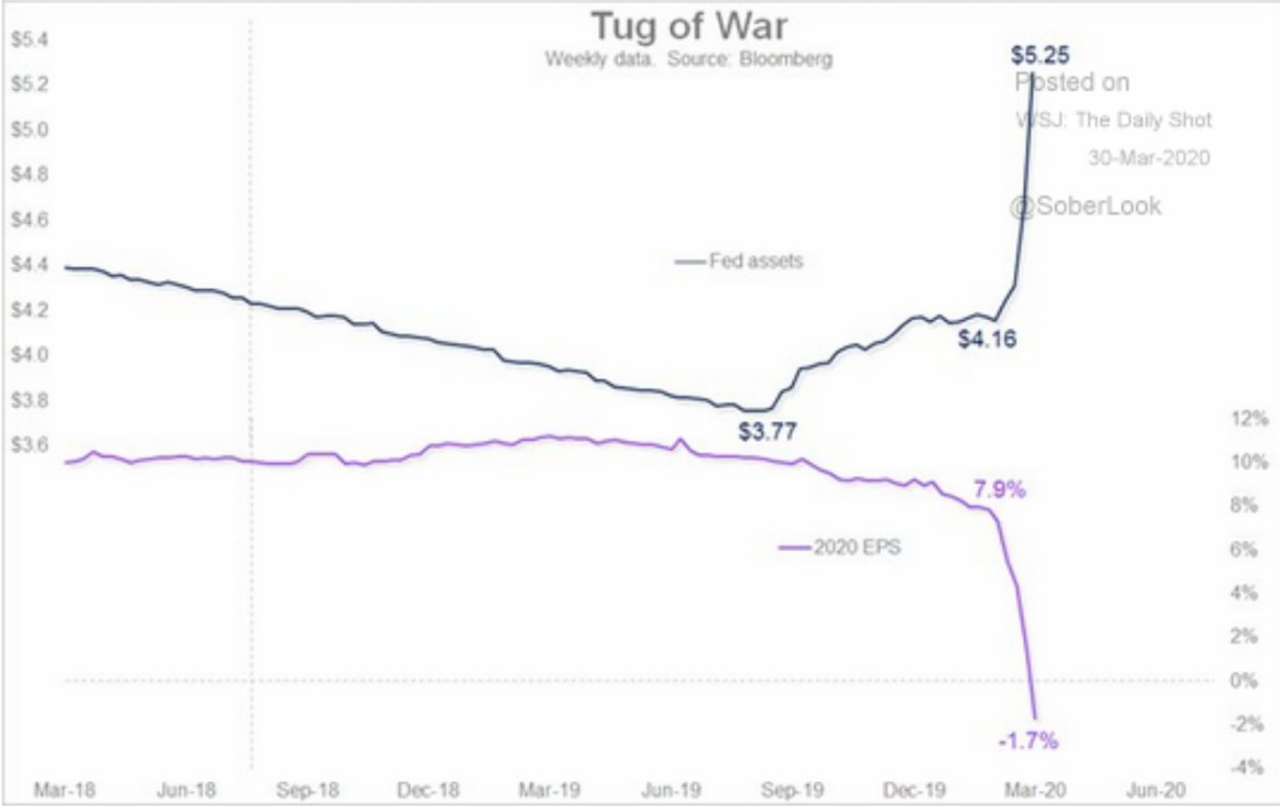

An overwhelming number in such a short period, making previous QE programs look like peanuts in comparison. In fact, the Fed printed roughly $970,000 every second last week to keep the market afloat. To validate that the Fed is artificially keeping the market alive, just look at this next chart:

This chart showcases that while the Fed balance sheet has shot up ($5.2 Trillion), corporate earnings have plummeted. The market is clearly on life support with the Federal Reserve as its temporary backstop. Presently, the aviation, hotel, and automotive industries, to name a few, are in a major crisis. This applies to all businesses, but since 2008 companies have taken advantage of prolonged zero interest rates and have gone on a total debt binge, with the majority of this debt going strictly to share buybacks and dividends to shareholders.

It is expected the Federal government will bail some of these companies out with the unprecedented stimulus package passed last week. Which displays we don’t live in a real capitalistic society, wealth effects have been the primary mandate for the Federal Reserve for the past three decades (beginning with Greenspan).

But we now face a severe issue, which resides in the bond markets. The Fed has made it very clear that they will conduct QE forever if needed to normalize things; however, the more and more they print, and as more stimulus gets announced from the U.S government, the confidence in the U.S dollar will begin to dwindle.

Many prominent investors are calling for a significant dollar rally, as they believe the USD will forever be the world’s most sought out currency given its reserve currency status. However, they fail to realize this is a much different world we are navigating through then the 2008 financial crisis.

For starters, this will not be a temporary few month recovery. There are many signals being sent to the market that we are entering a great depression type environment. As CNBC reported just two days ago, the Federal Reserve itself has made estimates public that the unemployment rate could hit 32%, which would have 47 million Americans out of a job. For comparison, during the great depression of 1933, peak unemployment was 24.9%.

It’s worth revisiting the great depression, which had devastating effects. Personal income, tax revenue, profits, and prices dropped, while international trade fell by more than 50%. The great depression lasted until the beginning of World War II.

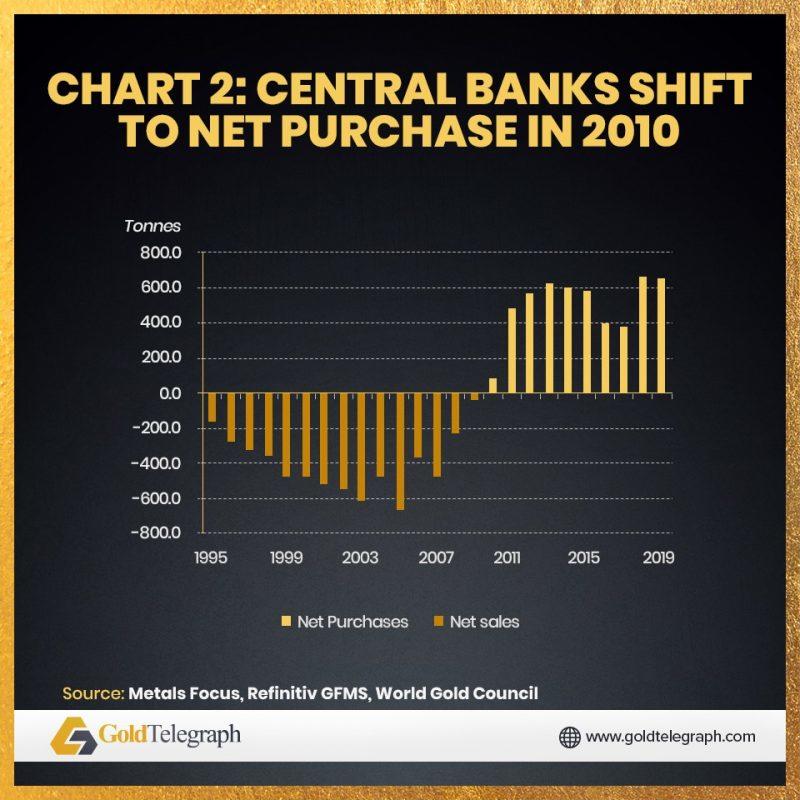

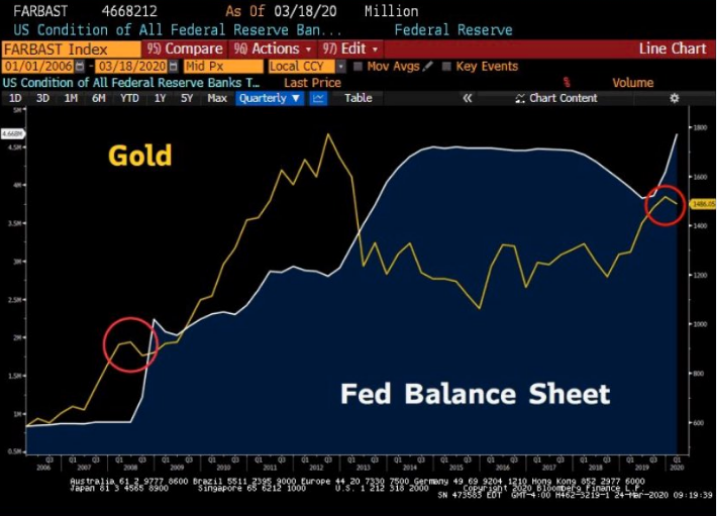

Countries have been preparing for this moment since the financial crisis as this chart showcases:

Since the 2008 financial meltdown, central banks have gone from being net sellers to being net buyers of gold as demand from central banks is currently at 50-year highs. Why might you wonder? Well, for one, it’s money which is recognized universally with zero counterparty risk. I will save why it’s money for another report. Still, one of the primary reasons why there is such unprecedented demand from central banks is because they do understand that there is historic debt circulating the global economy, which eventually has to be dealt with. I believe the grand game plan that these “academics” at these central banks are planning is to allow inflation to run hot for the foreseeable future until this debt becomes more manageable. By allowing inflation to run, debt will become cheaper to service.

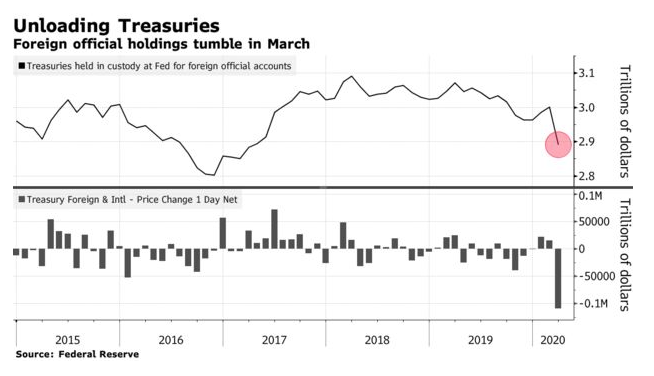

These inflation concerns could be why foreign central banks dumped more than $100 billion in treasuries in the three weeks to March 25, and it is on track to be the biggest monthly drop on record.

Countries holding U.S. Treasuries are afraid of this likely scenario as well, which explains the record dump. Remember, rampant inflation will destroy the value of the countries holdings. The continuous fire sale of U.S. treasuries is the Federal Reserve’s worst nightmare as if it becomes out of control, interest rates would skyrocket and the dollar would completely collapse on foreign exchange markets. The result of this would be MAJOR financial dislocations as mortgage costs would become much higher, and real estate would collapse.

Now the Fed is trying to stay ahead of this by implementing a backstop by introducing a temporary repurchase agreement facility. This program allows central banks to swap treasuries for dollars. It is quite evident; these central banks are in urgent need of these dollars so they can spend quickly. On top of the inflation concerns, countries are selling this due to being major oil importers and want to tap up reserves.

You might be wondering as to why the USD is currently holding up, well its because many investors and money managers have yet to realize this very fact with regards to the upcoming inflation. Many believe like in the great depression in the 1930s we are on the verge of deflationary episode due to a credit crisis.

They are failing to comprehend a very important variable at this present moment. More and more supply chains are being absolutely eviscerated by the day. Meaning, fewer and fewer goods will be produced in the foreseeable future until this pandemic gets sorted out. But before that happens, there will be much more panic economically as critical necessities that we humans need is beginning to take a hit, which is food.

Food supply chains in developed economies are beginning to become strained, and countries are already starting to stockpile food instead of exporting it to prepare for this type of food shortage. Many countries are doing this, but the primary ones I will mention are Russia and Kazakhstan.

Russia is the world’s largest wheat exporter and has recently proposed limiting grain shipments to protect its own food reserves. However, for now, things will flow as usual, but this shows governments are beginning to think about stockpiling necessities for their people vs. worrying about trade.

Kazakhstan, who is another major wheat exporter, has temporarily banned shipments of buckwheat, rye flour, sugar, carrots, and potatoes because the government is worried about domestic supply. Some major logistical bottlenecks are going on in the food supply chain that I don’t think many people will hear about until it’s a definite problem. But the supply chain destruction is one of the primary reasons why we will not have a deflationary episode like in the 1930s.

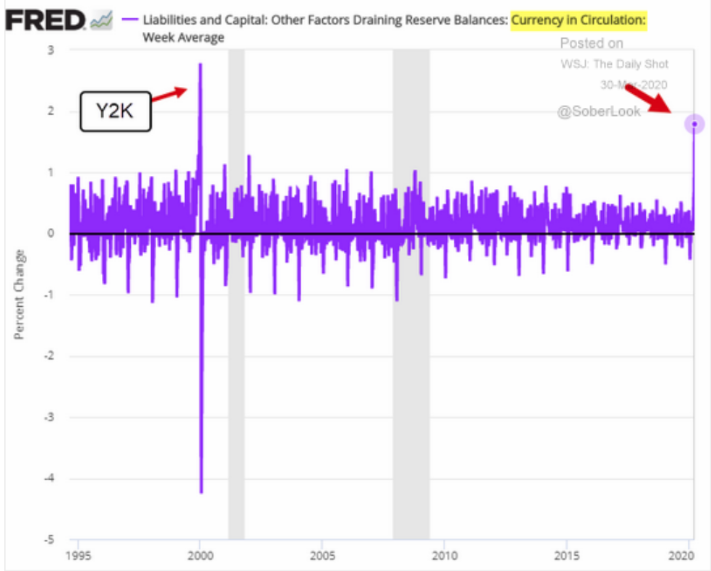

Next, on top of unprecedented quantitative easing coming from the Federal Reserve, there is a pipeline of liquidity in the form of an approved two trillion-dollar stimulus bill passed with many government officials calling for more. The American economy is currently being flooded with cash to keep things afloat.

The big story here, is looping back to the biggest bubble ever created which is the bond market and the question is, how will the Fed keep it from utterly collapsing?

The Fed has the following to worry about:

-

The $10 trillion corporate bond market

-

The $16 – 19 trillion commercial real estate market (which is shutdown)

-

The $23 trillion treasury market

The only way the Fed is going to deal with this is by printing endless amounts of money, which is going to debase the USD purchasing power in the coming years dramatically.

As more and more money is printed, one of the most important charts to pay attention to is this one:

The gold price will always be the best signal when it comes to inflationary concerns, as the metal is already at record highs in multiple currencies, and the industry is currently going through a physical supply crisis as premiums skyrocket.

The Dutch central bank summed up gold the best:

“Gold is the perfect piggy bank – it’s the anchor of trust for the financial system. If the system collapses, the gold stock can serve as a basis to build it up again. Gold bolsters confidence in the stability of the central bank’s balance sheet and creates a sense of security.”

We wish everyone good health during these difficult times.

Tyler Durden

Thu, 04/02/2020 – 13:50