By Tyler Durden

By Tyler Durden

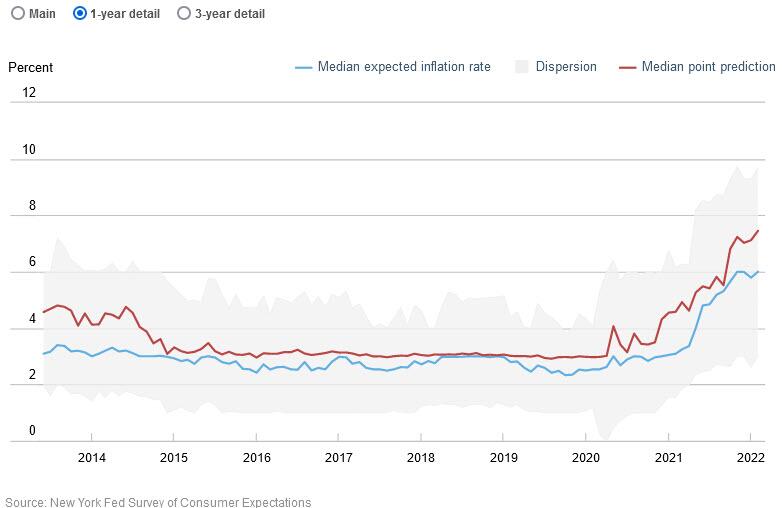

After unexpectedly sliding last month in what was the largest monthly decline since 2013, the latest NY Fed Survey of Consumer Expectations found that the median inflation expectation at the one-year horizon rebounded sharply higher from 5.79% in Jan – the lowest since October – back to 6.00%, matching an all-time high, while the median point prediction surged to 7.5% from 7.1%, also the highest on record.

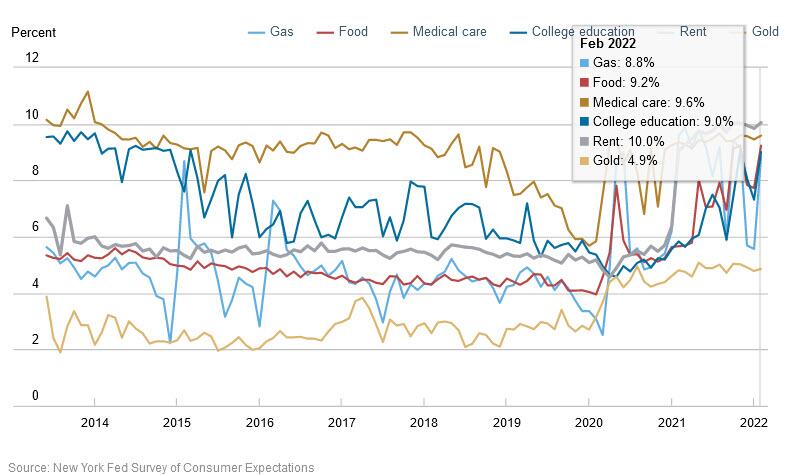

Over the next year, consumers expect gasoline prices to rise 8.82%; food prices to rise 9.23%; medical costs to rise 9.59%; the price of a college education to rise 9%; rent prices to rise 10.05%. Expect all of these to surge in coming weeks.

Older Americans were the most pessimistic about future gains in consumer prices.

The data suggest that consumers view the current elevated inflation as more long-lasting than just a few weeks ago.

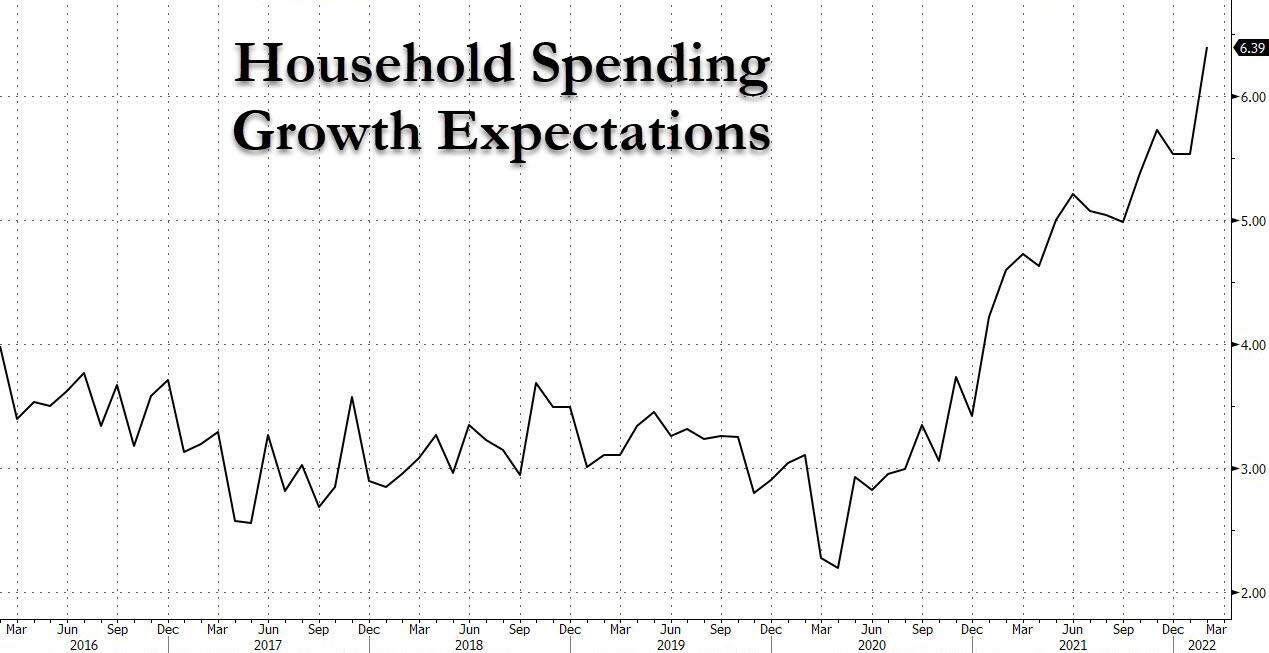

But while longer-term inflation expectations may have ebbed, it is fears about the coming commodity hyperinflation that will push near-term inflation expectations to all-time highs next month. Indeed, we are already seeing a panic rush to buy ahead of even higher prices as median year-ahead household spending growth expectations soared to 6.39% from 5.54%, the highest on record in available data going back to 2013. The increase was broad-based across age, income, and education groups, the report notes.

In the survey, respondents also anticipate solid earnings growth. But the higher wages won’t be enough to offset the surge in prices: An increasing share of respondents expect their financial situation to deteriorate in the coming year.

The perceived probability of losing one’s job in the next 12 months declined by 0.8 percentage point to 10.8%, reaching a new series low. The rate for younger workers is now below 10% — half of what it was at the start of the Covid-19 pandemic.

Among the other findings :

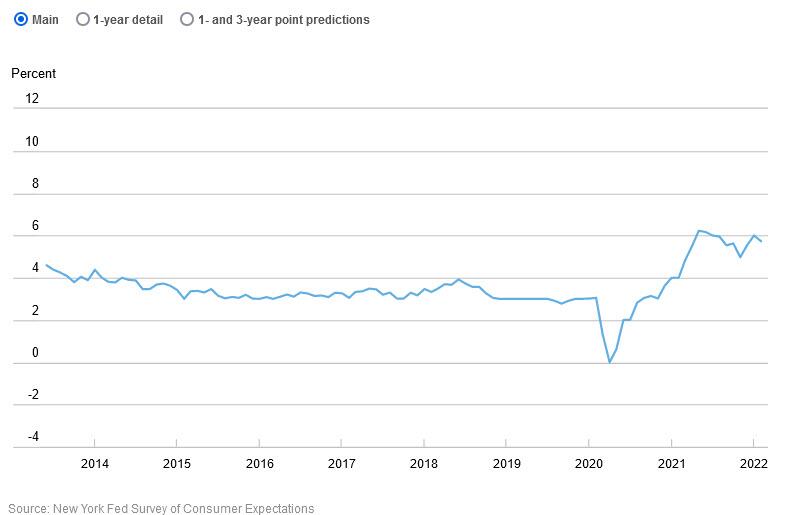

- Median year-ahead home price change expectations fell to 5.72% from 6.0%; decline most pronounced for respondents without a college education.

- A smaller percentage of consumers, 9.20% vs 10.04% in prior month, expect to not be able to make minimum debt payment over the next three months.

- Median home price expectations fell to 5.7 percent from 6.0 percent in January. This series peaked back in May 2021 and has drifted lower since.

Source: ZeroHedge

Image: Pixabay

Become a Patron!

Or support us at SubscribeStar

Donate cryptocurrency HERE

Subscribe to Activist Post for truth, peace, and freedom news. Follow us on SoMee, Telegram, HIVE, Flote, Minds, MeWe, Twitter, Gab, What Really Happened and GETTR.

Provide, Protect and Profit from what’s coming! Get a free issue of Counter Markets today.

US Households Expect Record Spending Increases As All Prices Soar