Collapsing Liquidity During End-Of-Day Rebalancing Has Led In An Unprecedented Mispricing Of Options

For the second time in two weeks, today’s Market on Close rebalance announcement at 350pm ET wreaked havoc on stocks. As we showed earlier, the publication of a notice that there were over $2BN in stocks for sale sending the S&P lower by 40 points in an unprecedented single tick.

This followed a similar but inverse reaction on March 26, when news of a $7BN MOC buy imbalance sent the S&P higher by 40 points in seconds.

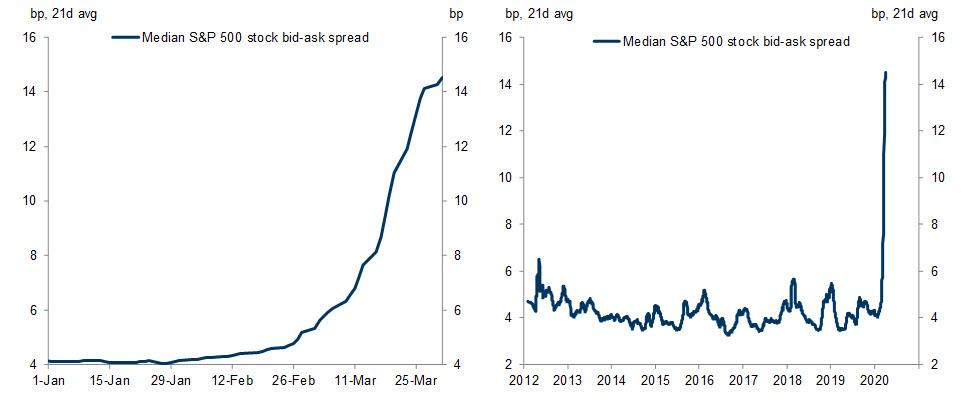

Why is this happening? Simply, there is just no liquidity in the market, something we showed last week when we visualized the record bid-ask spread in the median S&P stock.

However, as it turns out, the collapse in equity liquidity which manifests itself in ever more violent moves during the end-of-day rebalancing, is having a far broader impact.

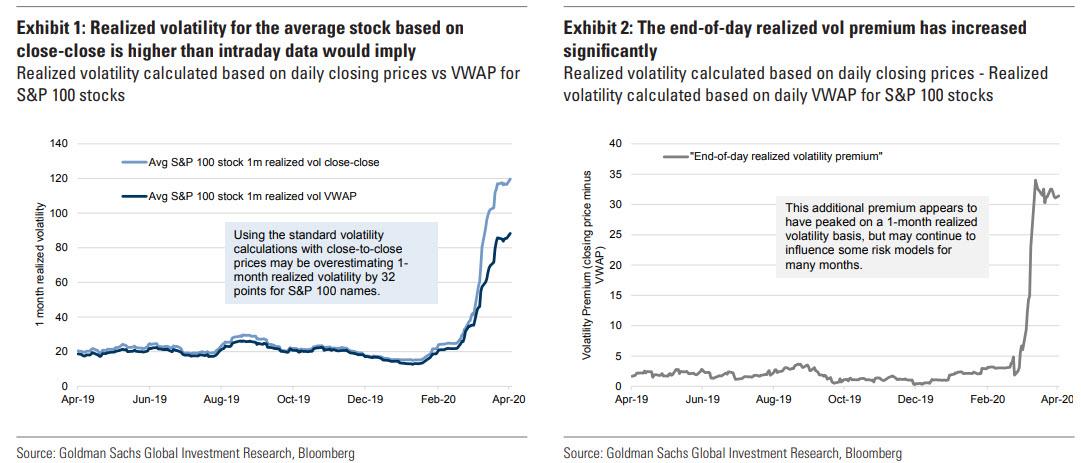

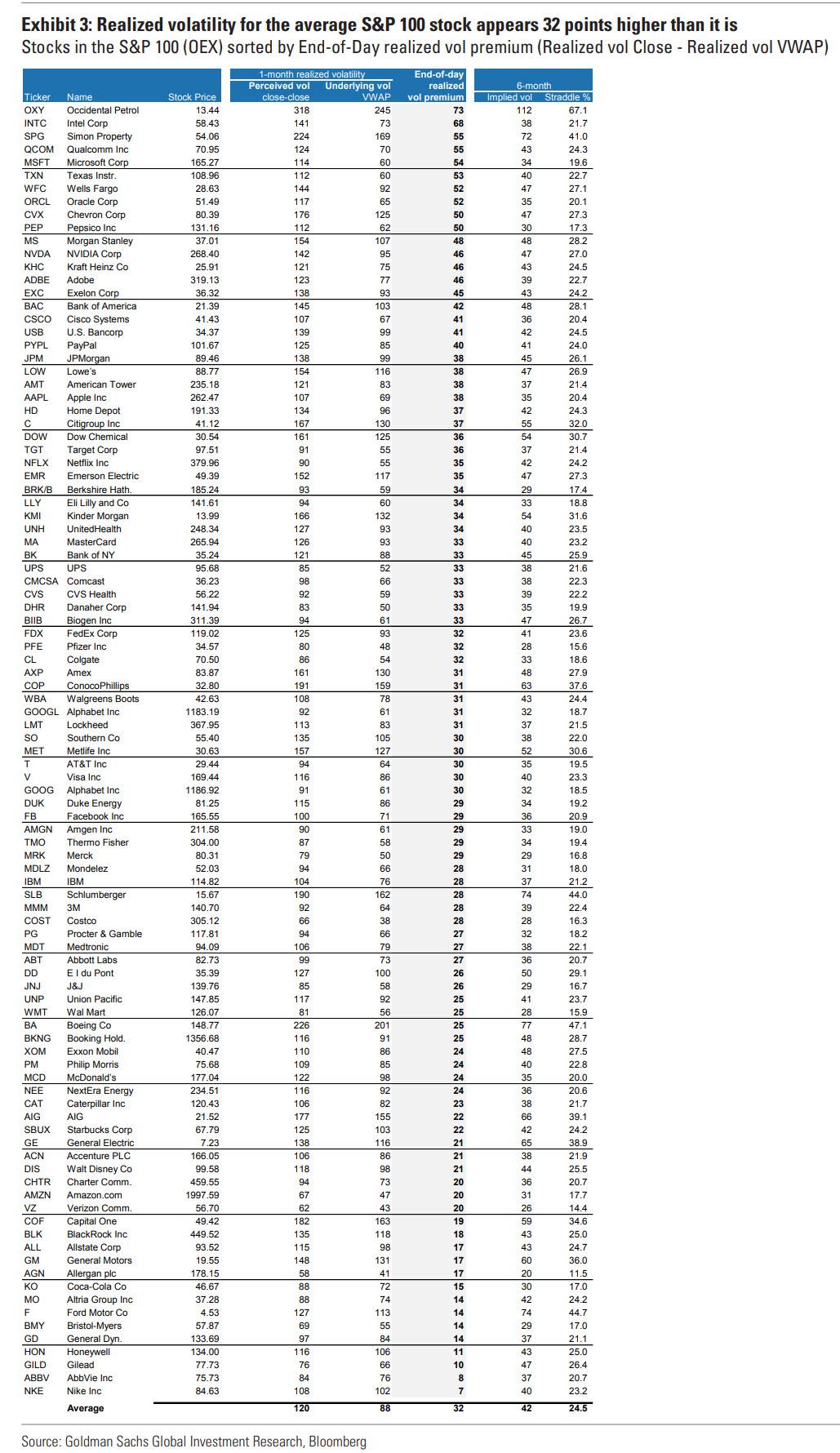

According to Goldman’s John Marshall, single stock options prices have become overvalued as end-of-day re-balancing in a low liquidity market have exacerbated common measures of realized volatility. As the Goldman derivatives strategist explains, “realized volatility for the average stock appears 32 points higher than it is.” This is how Goldman quantified the impact of what it calls the “end of day realized volatility premium”:

We calculate the “end-of-day realized volatility premium” to quantify the distortion driven by end-of-day re-balancing activity during the period of low liquidity over the past month. We use the difference between close-to-close volatility and volatility calculated with VWAP as a proxy for the “end-of-day realized volatility premium”. The average stock in the S&P Top 100 has experienced a realized volatility of 120% using close-to-close prices over the past month, but has had a realized volatility of 88% using a daily VWAP over the past month.

This suggests an “end-of-day realized volatility premium” of 32%.

This is problematic as many market models, especially vol-targeting, use close-to-close volatility as a key input and are currently overestimating the fundamental volatility of stocks by 32% over this period. This has led to overpriced options across the volatility surface and inflated levels of risk aversion in volatility based risk models. In fact, Goldman finds that the ratio of 6-month implied volatility to 1 month realized volatility is positively correlated with this “end-of-day realized volatility premium” with a 30% R-squared across the names below.

One implication of this “rebalancing anomaly” is that typical measures of volatility are likely to decline faster than history would suggest according to Goldman, which expects close-to-close measures of volatility to decline faster than other metrics which incorporate intra-day data.

This is likely to drive a decline in implied volatility across stocks and indexes that seems more rapid than casual observers of options would have expected. Several factors needed to be present for the “end-of-day realized volatility premium” to develop:

(1) fundamental driver of uncertainty,

(2) low liquidity environment, and

(3) investment products which require end of day re-balancing.

We believe the liquidity environment is likely to remain challenging; however, we see potential relief from #1 and #3. We believe there has been some reduction in investment products that require daily re-balancing as many of these investors have de-risked following the sell-off. While it is difficult to say exactly when fundamental uncertainty will decline, we know it will pass with time.

Another implication is that single stock options are pricing moves over the next 6 months that are greater than moves YTD… which also means there is a way to profit from this peculiar arb.

Straddles on the average S&P 100 stock are pricing a move of 25% over the next 6 months. This is 4% larger than their average absolute return year-to-date. For 67% of the names in this list, 6 month straddle prices are greater than their YTD absolute return. Selling straddles on these stocks implies profit if the stocks are in a 50% range of +/-25% over the next six months.

Here, Goldman recommends selling straddles on names at the top of this list where the “end-of-day realized volatility premium” is the largest and likely to be inflating options prices. That said there is a risk, namely that straddle sellers risk 1-for-1 losses with stock moves in either direction that are greater than the premium collected.

Finally, for those readers who are not as versed in the nuances of greeks trading, here is a brief appendix explaining How low liquidity has inflated realized volatility, and why is it important for stock and option investors?

- Realized volatility is an input to many risk management and option pricing models. We believe low liquidity has had a significant and temporary impact on the end-of-day realized volatility metrics used by most models. We believe this leads investors to avoid buying stocks or selling options on stocks where the distortion is the greatest. This creates increased opportunity for investors.

- How did the supply/demand of liquidity impact volatility over the past month? Demand for liquidity increased at the same time as the supply of liquidity decreased. Over the past six weeks, equity volatility has increased due to uncertainties related to COVID-19. The increase in fundamental volatility has had two effects; it has (1) increased demand for liquidity from investment products that need to re-balance based on market moves, (2) reduced the liquidity provided by market makers constrained by capital or regulatory rules. The liquidity pain point has been most acute at the close of each day, when many of the investment products demand liquidity as they re-balance (either by construction, due to regulations or by habit). This results in unusually large volatility at the close that is often reversed the next day; We have detailed this effect at the index level.

- Should daily closing prices affect the value of derivatives more than intra-day price volatility? Daily closing prices explicitly determine the value of some derivatives, such as variance swaps; however, it is less clear whether the rise in end-of-day volatility should lead to significantly higher prices for put and call options. On one hand, market makers typically replicate puts and calls by hedging their delta risk (i.e. stock exposure) at the end of every day, so there is a practical link to the closing price. On the other hand, there is no requirement to hedge at the end of the day and many investors hedge more frequently. We acknowledge that is likely that these end-of-day effects are important for valuing single stock options with a few days to expiration as they add to hedging risks.

- Single stock options with more than a month to expiration should see less impact from these end-of-day effects. While the liquidity environment has become more difficult for options market makers that delta hedge each option, the environment has improved for fundamental investors that sell 6-month options for income (and do not delta hedge). The “end-of-day liquidity premium” has inflated options prices, but are unlikely to have a significant effect on the fundamental value of a stock at expiration in 6 months.

Tyler Durden

Tue, 04/07/2020 – 20:20