30Y Auction Prices Just Off All Time Low Yield Amid Stellar Buyside Demand

After two consecutive mediocre auctions, when the sales of 3Y and 10Y debt earlier this week tailed modestly, moments ago the Treasury concluded this week’s coupon issuance (which comes alongside a biblical flood of Bill and CMB sales), when it sold $17BN in 30Y paper (technically a 29-Year, 10-Month reopening) in what was a very strong auction.

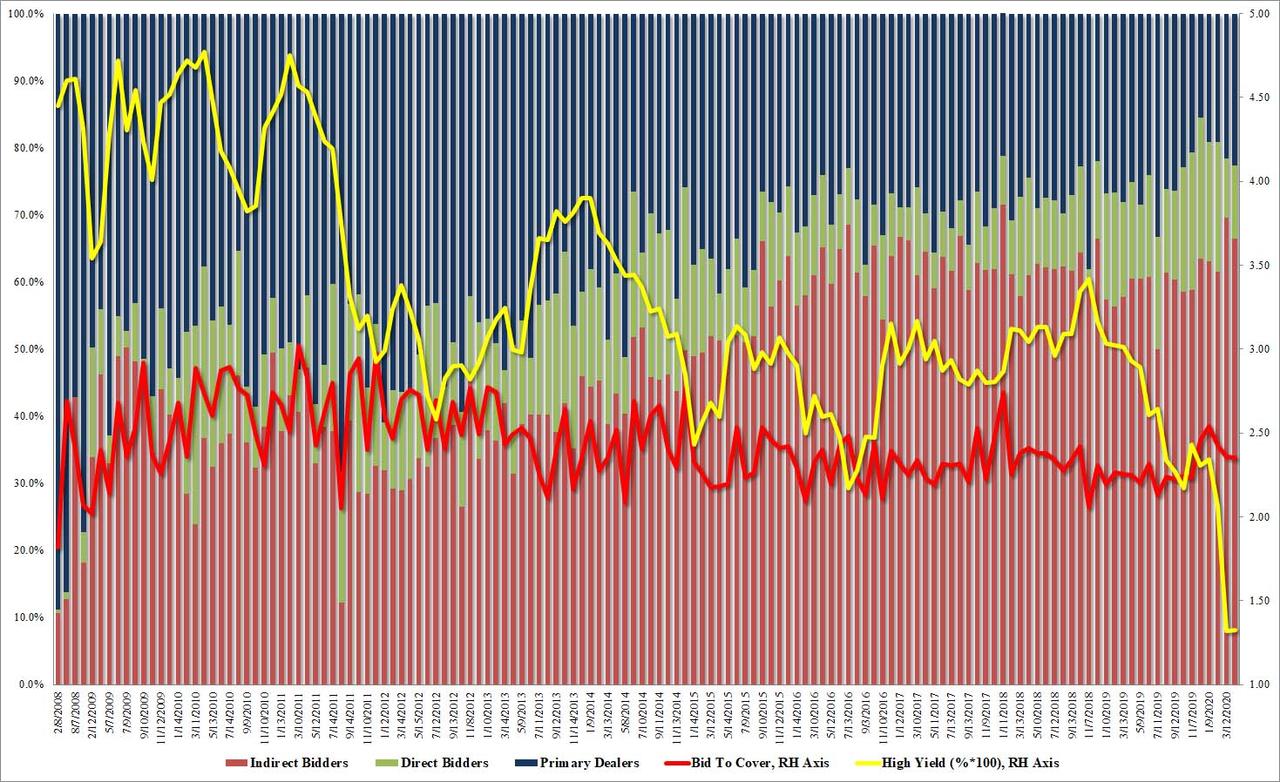

The high yield of 1.325% was just 0.5bps above last month’s record low yield of 1.32%, and also stopped by 0.5bps through the When Issued.

The bid to cover was almost unchanged from last month’s 2.358, dripping fractionally to 2.352%, which was also just below the 6 auction average of 2.377%.

The internal was also a bit softer than last months, as Indirects took down 66.4%, down from 69.5% which however was above the 62.5% recent average, and with Directs taking down 11%, more than the 8.9% in March, Dealers were left with 22.6%, a slightly higher than average number, and one which Dealers will promptly make sure eases as they sell the long end back to the Fed.

Overall, this was a solid, stopping through auction and one which underpinned the long-end of the curve.

Tyler Durden

Wed, 04/08/2020 – 13:19