The Liquidity Crisis Is Quickly Becoming A Global Solvency Crisis As FRA/OIS, Euribor Soar

One month after turmoil was unleashed on capital markets, when the combination of the Saudi oil price war and the sweeping impact of the coronavirus pandemic finally hit developed nations, what was until now mostly a liquidity crisis is starting to become a solvency crisis as more companies realize they will lack the cash flow to sustain operations and fund debt obligations.

As Bloomberg’s Laura Cooper writes, cash-strapped companies are finding little relief from stimulus measures, and from Europe to the US, cash in hand has been hard to come by even as governments pledge funds for small businesses to bridge the financial gap until lockdowns are lifted:

-

US: The March NFIB survey of U.S. small businesses noted challenges in submitting loan applications and the urgent need for federal assistance

-

UK: A British Chamber of Commerce survey showed only 1% of companies reported being able to access funds dedicated for business. A complex application process for the U.K. Coronavirus Business Interruption Loan Scheme comes as 6% of U.K. firms say they have run out of cash while nearly two-thirds have funding for less than three months

-

Canada: A proposed six-week roll out of emergency funds is unlikely to prevent 1 in 3 companies from laying off workers. More than 10% of the labor force has already filedemployment claims

-

Europe: existing structures are aiding in the deployment of funds, but concerns remain that more is needed with EU leaders failing to reach agreement on further initiatives

As we have noted previously, small businesses – everywhere from China, to Europe, to the US – make up the majority of firms in advanced economies and account for a sizeable share of private sector employment. Quick delivery of stimulus measures is needed to curb widespread insolvencies. This could mean the difference between a short, yet sharp recession and a prolonged erosion to the labor market and economy regardless of containment of the health crisis.

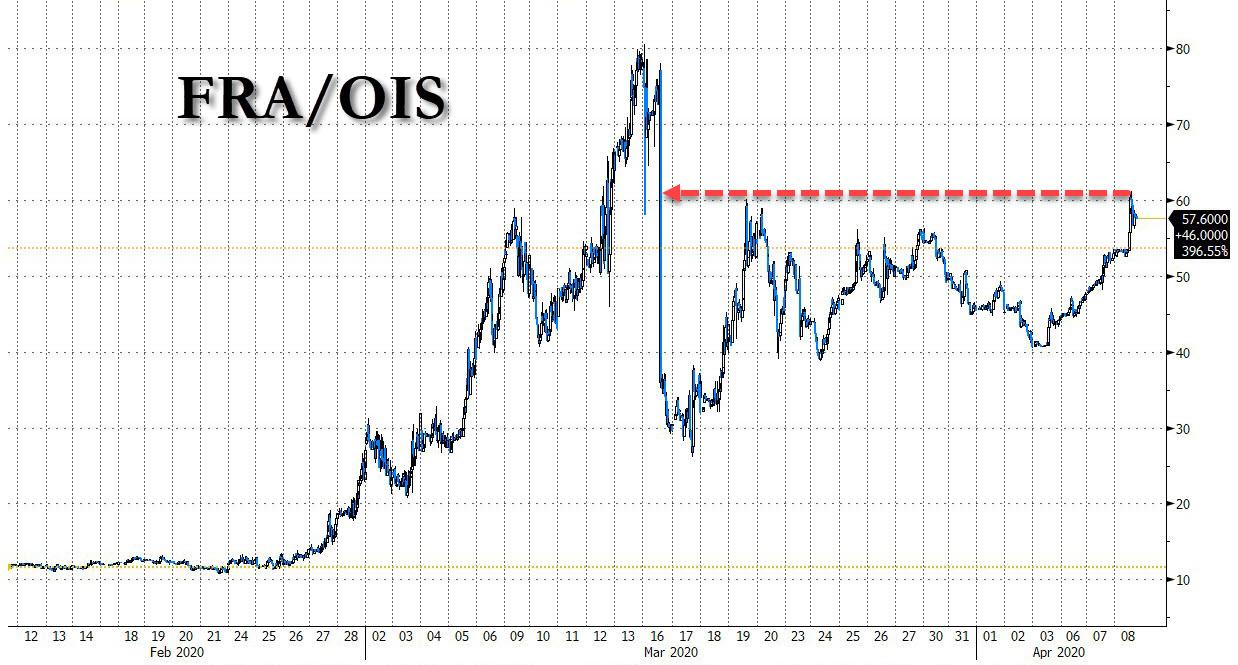

Meanwhile, as we get increasingly more urgent reports that the lack of available funding is starting stress corporate solvency, liquidity itself is getting worse, and on Wednesday the closely watched June FRA/OIS – an indicator of intrabank funding stress – spiked, reaching 61.2bp, the highest level since its March 16 collapse after the Fed’s emergency rate cut.

The spread was as much as 6.5bp wider on the session with most of the move occurring after 3-month dollar Libor fixed 0.85bp lower than Tuesday at 1.31138%, its third straight decline.

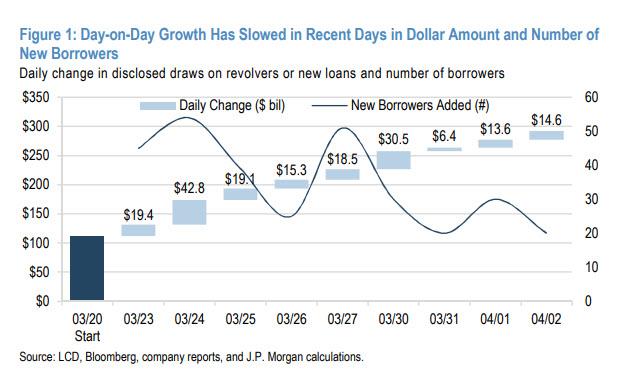

One possible reason for the accelerating shortage of bank liquidity is the sharp rise in demand from corporates, which as we reported over the weekend, has manifested itself in a record $293BN in credit facility dradowns as of last Thursday…

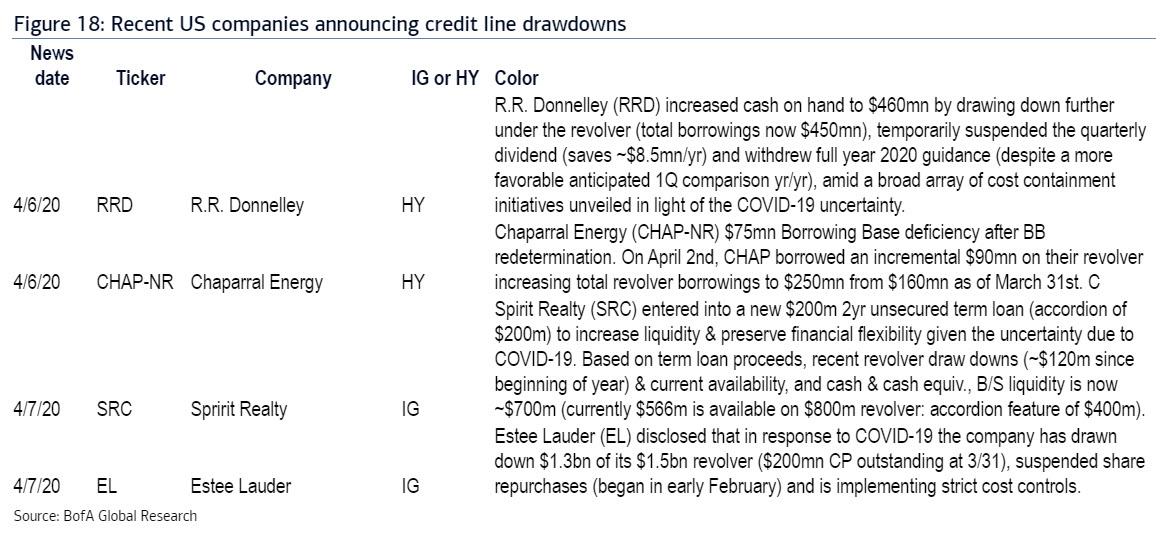

… a number which has only risen following several prominent revolver drawdowns so far this week.

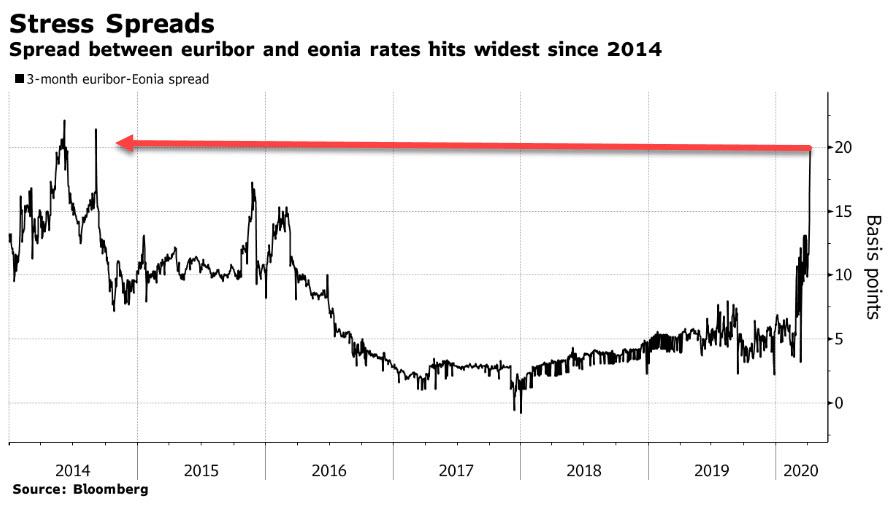

At the same time, coupled with the fact that some investors have been borrowing in euros and swapping them into the dollars, euribor’s rise to the highest since May 2016 was also inevitable, and as of Wednesday morning, the three-month Euro Interbank Offered Rate advanced a third day to minus 0.254%.

The increase comes despite the European Central Bank relaxing its collateral rules on Tuesday, which didn’t really channel “new money” to banks, according to Frederik Ducrozet, global strategist at Banque Pictet & Cie.

As Bloomberg adds, there’s also evidence in European markets that corporates are stockpiling cash. Not only did the three-month Euribor climb 3.9 basis points to minus 0.254%, but its spread over OIS rates jumped to over 20 basis points, the highest since 2014. It also signals companies have increased their activity in funding markets over the past month.

At the same time, accessing cash in Europe’s commercial paper market is becoming more expensive for corporates. There’s been a modest widening of where new issues in commercial paper markets are pricing.

There was some good news: 3-month A1/P1 rated commercial paper rates dropped another two basis points on Tuesday, a fourth consecutive decline. Spreads over OIS tightened as volumes and activity in the underlying markets improve. That suggests current Fed measures are supportive and the prospect of looming Commercial Paper Funding Facility on April 14 is boosting sentiment.

Tyler Durden

Wed, 04/08/2020 – 15:00