Mexican Standoff Continues: AMLO Claims US-Mexico Oil Deal At G-20, OPEC+ Denies Knowledge

After last night’s dramatic Mexican standoff, headlines this morning are as confused and disorienting as ever.

In a speech delivered from Mexico City, Mexican President Andrés Manuel López Obrador (AMLO) told the G-20 that it has a new deal… and the ‘standoff’ is over.

AMLO began by noting that it’s very difficult to cut output (just as it is for every nation we suspect) and explained how he has managed to reverse a 14-year decline in oil production.

Mexico will cut production by 100,000 barrels a day, as it argued for yesterday, and the U.S. will make an additional contribution of 250,000 barrels a day.

As Bloomberg’s Javier Blas notes, AMLO gave no indication of what the “contribution” of 250,000 barrels a day from the U.S. means – it could be an undertaking to buy that volume of Mexican crude for the Strategic Petroleum Reserve. Either way, it seems there’s a diplomatic fudge, with lots of creative math, to unlock the deal.

“It’s a done deal,” AMLO said.

The only problem with all this “we have a deal” talk…

Several OPEC+ delegations were completely unaware of AMLO’s “deal” with the group, delegates tell Bloomberg’s Javier Blas, who adds that AMLO claims he reached a deal with Trump and immediately informed OPEC+ at 7:30 p.m. yesterday.

“Now they know how we are contributing.”

It seems very unclear whether any deal has been agreed to… and furthermore, if Mexico has moved in any way from its position overnight (a 100k cut – which is around a quarter of the 400k cut that OPEC has demanded.. or is the US “contribution” supposed to make up for that?).

Did Trump, following his “great call” with Putin and MbS overnight, tell AMLO top say anything just to get a deal done? The question now is will the Saudis back down and accept whatever fudged compromise Trump, Putin, and AMLO may have cooked up?

And, as we noted last night, if Mexico is granted this exception, then all other OPEC members – at least the non-Saudi ones – would demand similar treatment, forcing Saudi Arabia to should all of the production cuts, which would then nearly double from 4MMb/d to 8MMb/d.

While futures markets are closed across the world on this Good Friday, IG’s spread markets (as illiquid as they may be) are open, and there has been negligible reaction to these headlines so far…

Which makes perfect sense since, as Goldman’s Damien Courvalin explains, even if the cuts were agreed today, it would still be too little and too late to prevent a decline in prices in coming weeks as storage capacity becomes saturated.

First, the equitable c. 23% country level cuts used by OPEC+ (instead of the typically higher core-OPEC share) allows for a large headline cut but also implies lower compliance.

Second, it leaves the effective voluntary cuts too small to avoid breaching storage capacity, ensuring that low oil prices force all producers to contribute to the market rebalancing with some of the shut-ins likely to prove persistent, creating a faster oil rebalancing.

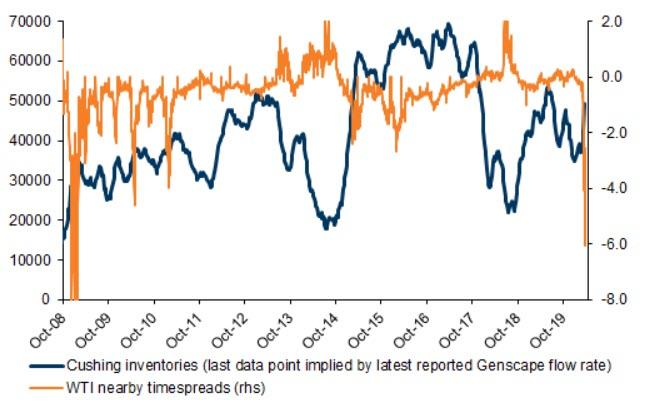

Ultimately, this simply reflects that no voluntary cuts could be large enough to offset the 19 mb/d average April-May demand loss due to the coronavirus. Such an outcome was already visible today, with the large Cushing crude inventory build reported by Genscape driving a further collapse in May-June WTI timespreads to -$6.0/bbl.

We expect further weakness in WTI timespreads and crude prices in coming weeks, with downside risks to our short-term $20/bbl forecast (especially if a deal is not reached).

Tyler Durden

Fri, 04/10/2020 – 09:08