Even Goldman Mocks The Absurdity Of Its Own “S&P To 3,000” Forecast

Late last week, we showed a chart from Credit Suisse which could be simply described as “insanity” because it demonstrated that as the US careened into a depression, with GDP crashing and the unemployment rate soaring, between the latest Fed-driven surge in stocks and the collapse in earnings estimates, the PE multiple on the broader market had eclipsed the previous record of 19.0x set during the market’s February all time high, and had now hit a new all-time high of 19.4. In other words, the market has never been more overvalued than it is right now.

This surge in implied market valuations was also an issue for Morgan Stanley’s Michael Wilson who, as we reported earlier, doubled down on his bullish stance raising his S&P500 year end base case target from 2,750 to 3,000 yet was hit by a sizable brainteaser in trying to explain how at the same time as he was cutting his base case 2020 EPS forecast (down 20% to just $130), he was also raising his overall target to 3,000, which implied a 23x 2020 fwd PE.

Wilson, who for the past two years had had a rather objective take on markets, rushed to use the most amateur and discredited deus ex machina to justify his ridiculous goalseeking: claiming that the bigger the 2020 drop, the more violent the 2021 rebound:

For 2021, the snap back is related to the severity of the decline in the 2020–the worse the decline the bigger the bounce: The net effect of this is that our EPS forecasts don’t change much for 2021 which is the year that really matters for stocks. As we have said many times, the market now views 2020 as a write off and is trying to figure out the path of earnings in 2021.

Alas, as BofA explained yesterday there will be no V-shaped recovery, and if anything it would take years before we recovered recent earnings highs, especially with tens of millions of people unemployed. This is what BofA said:

V-shaped optimists have forgotten a basic lesson of the business cycle. Recessions can be triggered by a variety of shocks-surging oil prices, central bank inflation fighting popping bubbles and now a health crisis-but the recession continues well after the initial shock fades. This is because the drop in activity triggers a nasty feedback loop in the economy that overwhelms the policy easing.

A two- or three-month shutdown will leave lasting scars on confidence. Economies will re-open to a greatly diminished demand environment, with high saving rates and very low discretionary spending. This argues for a U-shaped recovery and a persistent, large output gap, in our view.

Of course, none of that mattered to Wilson whose real agenda was clear: get clients to frontrun the Fed’s creeping takeover of capital markets, but do it so it at least sounds a bit credible and justified by numbers besides those spewed by the Fed’s money printer.

And yet the problem of plunging corporate earnings refuses to merely be “written off” as none other than Goldman also pointed out today when it too turned bullish earlier today, saying that it no longer sees 2000 as a downside case for the S&P, and instead expects the market to hit 3,000. But not due to any fundamentals. As David Kostin explained, the only reason he had turned bullish is because it was now clear the Fed won’t allow any more dips:

The combination of unprecedented policy support and a flattening viral curve have dramatically reduced downside risk for the US economy and financial markets and lifted the S&P 500 out of bear market territory. At 2790, the S&P 500 now stands 25% above its March 23rd low of 2237.

Why does Kostin go the extra mile to point out the market’s recent performance? Simple: because he is using market momentum as the catalyst for his calls. Neither we, nor anyone else, should find it surprising that three weeks ago when stocks were crashing Goldman was warning about a 2000 S&P near-term target, and then just a few days later when stocks have rebounded by 25% only then does Goldman proceed to turn bullish and tell clients to chase the rally… which as toda’s market action shows is now ending. Naturally, we eagerly look forward to both Goldman and Morgan Stanley cutting their year end forecasts in a few weeks when the market retests the lows.

There’s more: just like Wilson, Kostin decided to do some back of the envelope math in backing into his year-end S&P price target and… had some very amusing results.

Pointing out the violent recent moves in consumer confidence and policy uncertainty…

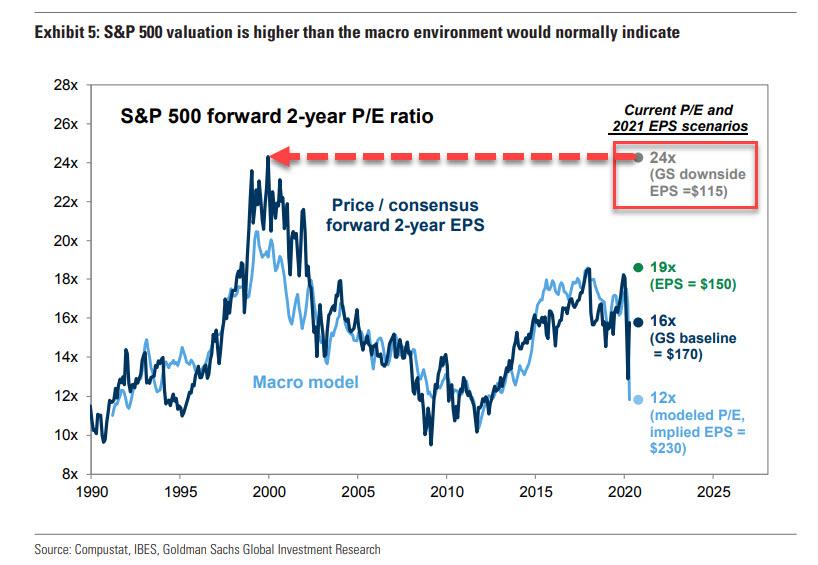

… which are two of the inputs to Goldman’s macro valuation model, Kostin notes that this model currently indicates a “fair value” P/E multiple of 12x 2021 EPS. That, of course, is a problem for a market which is expected to trade down to about 110 EPS for the full year, which on its own would suggest a “fair value” to the S&P of around 1,500!

Which is why Kostin writes that while “P/E multiples are most frequently calculated on forward 12-month EPS, we believe multiples on 2021 EPS more accurately reflect most investors’ framework in the current environment.”

Why use 2021 instead of 2020? Well… because.

But even if using 2 year forward multiples instead of 2020 year end, the accounting gets really ludicrous. As Kostin continues, while his “macro model points to an FY2 P/E multiple of 12x, the current index level and the consensus 2021 EPS forecast of $177 equate to a P/E multiple of 16x.” As a result, if consensus EPS forecasts are revised lower, as Kostin expects, “the implied market multiple will become even more elevated”… which of course is what we first said above (and last week): so much more elevated in fact, it would be the highest of all time. Put differently, Goldman’s macro valuation model indicates that “either the S&P 500 price should be 25% lower, consensus 2021 EPS should be 25% higher, or that equity valuations today are tied more closely to policy support and investor sentiment than to the traditional drivers captured in our model.”

Visualizing the above, here is the bottom line – if one assumes that there is no V-shaped recovery from the plunge to EPS of 110-115 in the S&P, and if one assumes that Goldman’s 3,000 year end forecast is valid (note this is a forecast for 2,020 even though Goldman is using 2021 EPS estimates), that would mean that the appropriate multiple to get there is 24x, a number that has never been higher, even during the insane days of the dot com bubble.

Alternatively, if one uses Goldman’s “fair value” PE of 12, EPS would have to soar about 35% to a new all time high of 230 by the end of 2021 from the pre-coronavirus baseline of 170. Needless to say, that’s not happening.

Which means that either earnings not only recover but soar, or that to hit Goldman’s target, absent a swift reversal of the recession and a miraculous V-shaped surge back, stocks will have to be the most overvalued on record to hit Goldman’s target.

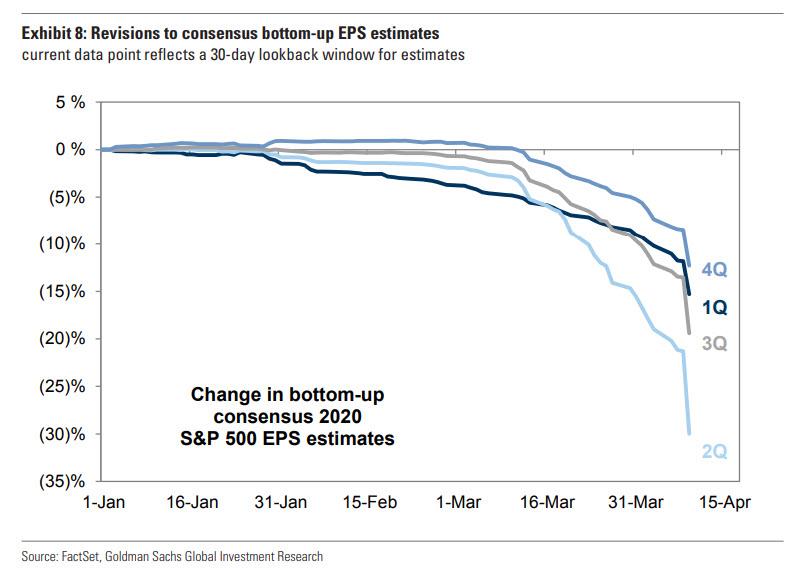

Ironically, Kostin does not disagree and in taking the overly optimistic consensus to task, writes that “we believe consensus bottom-up 2020 earnings expectations need to be lowered by at least 25%” which would that for portfolio managers, “the essential question is whether equity valuations can continue to rise to offset the reduced profit forecasts.” The irony, of course, is that Kostin himself is pitching an insane 24x valuation to justify his euphoric price target, even as he forecasts a year/year S&P 500 EPS decline of 15% in 1Q 2020:

While many analysts were hamstrung by uncertainty and the lack of management guidance for much of the last several weeks, revisions have been accelerating ahead of earnings reports. Nonetheless, we believe they remain too high.

Although first-quarter 2020 earnings reports will likely show much worse growth than consensus expects, current analyst estimates already point to the worst quarterly EPS growth since 2Q 2009. Consensus bottom-up forecasts suggest S&P 500 EPS fell by 11% year/year in 1Q.

Excluding Financials and Utilities, bottom-up estimates suggest sales grew by 2% but that net profit margins contracted by 110 bp, to 9.4%. This quarter will mark the fifth consecutive quarter of margin declines. At the sector level, consensus estimates Energy (-47%), Consumer Discretionary (-29%), and Industrials (-25%) earnings will decline the most (Exhibit 9).

And then, just when you think that Kostin is done throwing up all over the reasons behind his optimistic report, he kicks it into overdrive:

Earnings results will be even worse than we forecast if company managements decide to recognize charges and write-downs during a quarter that many investors accept will be very negative. Our top-down estimate of 15% year/year EPS decline in 1Q 2020 would reflect a 4% miss relative to consensus numbers, which would be roughly in line with the miss in 3Q 2007 leading into the Financial Crisis.

Yet despite this theater of the absurd, or tragic, or absurdly tragic, one where corporate profitability basically has ground to a halt, Goldman tells its clients to bid the S&P up to 3,000. Why (besides, of course, letting the whales offload to dumb retail investors again as the depression begins)? Because, and we quote, “1Q earnings season will not represent a major negative catalyst for equity market performance” and “investors will mostly look through reported 1Q results.”

Come again? The worst quarterly earnings report since Lehman is “not a negative catalyst?” Why? Well, because Goldman said so, and if Goldman said so, it’s now the official narrative… even if it means that the market is now completely disconnected from reality. To wit:

Despite the likely steady stream of weak earnings reports, 1Q earnings season will not represent a major negative catalyst for equity market performance. While earnings season always conveys backward-looking data, rarely has the information content of quarterly earnings reports been as outdated as the figures US companies will release starting this week. We expect investors will mostly “look through” reported 1Q results, which will capture only the start of shutdowns that began at the end of the quarter. In fact, many investors we have spoken with have discounted 2020 earnings altogether, and are focused instead on the outlook for 2021.

And visually:

At this point all one can do is laugh, but what is by far the funniest is that David Kostin also finds all of the above if not absurdly surreal, then also delisghtfully funny and in a rare moment of legend-level snark, the Goldman chief equity strategist writes that:

“surprisingly, the largest shock to the global economy in 90 years has left equities only 18% below the record highs of mid-February and roughly in line with the market price in June 2019, just 10 months ago.”

We couldn’t have possibly summarized the farce that passes for a “market” better.

Tyler Durden

Mon, 04/13/2020 – 16:25