Here’s What The Reopening Of The US Economy Could Look Like

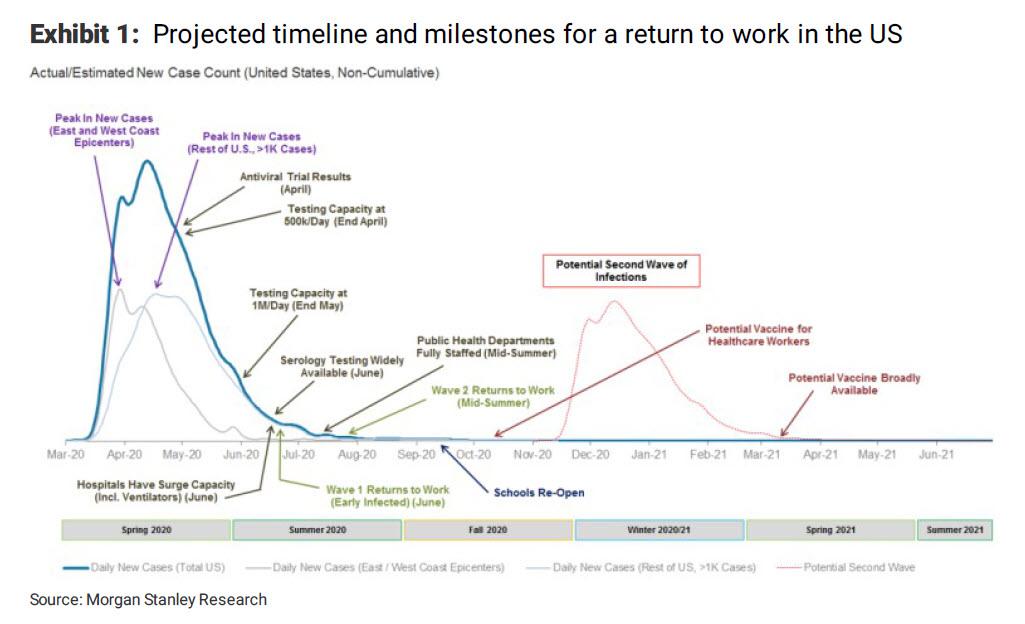

With US health data suggesting that the spread of the coronavirus may be nearing a plateau in the U.S., public officials are under growing pressure to chart a path back to normality, something Morgan Stanley did over the weekend when it laid out a projected timeline and milestones for a return to work in the US.

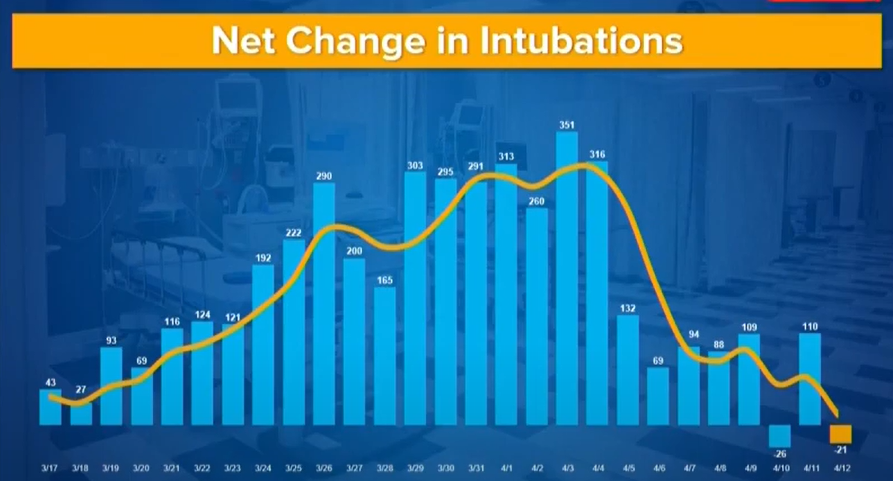

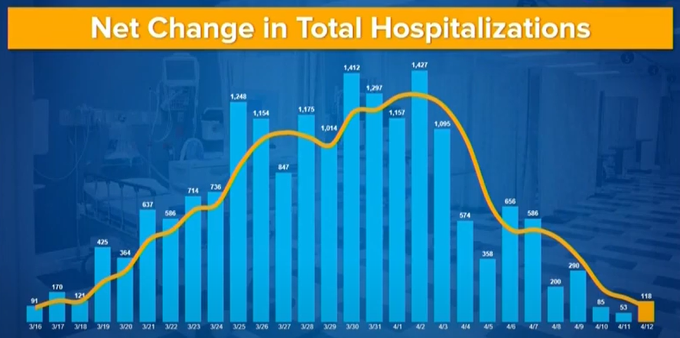

The latest data show that conditions are beginning to improve. New York hospitalizations continued to flatten, with total admissions virtually stable at 18,000 and with ICU patients and intubations declining since Sunday.

So far, those numbers have been far below the level officials initially braced for, sparking speculation that projection models were tampered with to paint a worst case scenario in pursuit of a total economic shutdown, one which would enable the Fed and Treasury to unleash an unprecedented bailout package targeting mostly Wall Street, America’s corporations and “top 1%”, with a fraction of the overall fiscal stimulus left over for Main Street America.

That said, Americans at this point will take any good news, and the NY governor provided some today: “We’ve been talking today about the fact that New York believes we have reached a plateau in the increase in the number of cases,” Cuomo said. “They’re not going down, but they’re not going up at the same rate and we believe it’s a ‘plateau.’ That is relatively good news in a world of bad options. We should start looking to ‘reopening.’”

The dilemma facing decision-makers is a familiar one: the longer the state-by-state lockdowns last, the more economic hardship there will be. But dropping stay-at-home restrictions too soon might risk a second wave of infections.

How Will A Reopening Happen?

There is also a potential political clash emerging, with some of the nation’s most powerful governors saying they would form regional alliances to coordinate reopening schools and businesses after the coronavirus outbreak subsides, setting up a potential showdown with the president, who earlier today that he alone has that authority.

That tension was on display Monday as two sets of governors – one on each coast – said they would coordinate how and when they might gradually ease their restrictions on travel and business. Shortly before both initiatives were announced, President Donald Trump tweeted that he alone had the authority to decide when states would return to normal.

….It is the decision of the President, and for many good reasons. With that being said, the Administration and I are working closely with the Governors, and this will continue. A decision by me, in conjunction with the Governors and input from others, will be made shortly!

— Donald J. Trump (@realDonaldTrump) April 13, 2020

“We will be driven by facts, we will be driven by evidence, we will be driven by science, we will be driven by our public health advisers, we will be driven by the collaborative spirit that defines the best of us at this important moment,” California Governor Gavin Newsom countered as he announced a partnership with Washington state and Oregon.

“The optimum is a geographically coordinated plan,” added New York Governor Andrew Cuomo. “This virus doesn’t understand governmental boundaries.” Coordination is critical, Cuomo explained, to avoid unintended consequences – such as having thirsty residents of a state where bars are closed driving to another where they’ve been reopened.

As Bloomberg reported, the East Coast initiative is in its early stages. Officials from those states – New York, New Jersey, Connecticut, Pennsylvania, Delaware and Rhode Island – provided few details about what criteria they might use to restart a semblance of normal life. A panel will consist of the governors’ chiefs of staff and health and economic officials from each state. Most residents in those states are nearing the one-month mark of having been told to stay home and keep their distance from others.

After the announcement, Massachusetts said it would join the alliance.

For what it’s worth, Cuomo, in his daily briefing, seemed to agree with Trump that the federal government has the authority to overrule the states. But he questioned why Washington would get to direct the reopening after it delegated closures to the states.

“Let’s see what the federal government’s plan is,” Cuomo said. Trump “left it to the states to close down, and that was a state-by-state decision, without any guidance really,” he said.

Meanwhile, California’s governor said he would unveil a framework on Tuesday for lifting the state’s stay-home order, including the metrics that would guide that process. Last week, the state’s secretary of Health and Human Services said easing the state’s restrictions would require putting in place a system to test more people for the virus, track new cases as they appear and trace person-to-person contacts that could trigger new outbreaks.

Further details about how to restart California’s economy will come later in the week, Newsom said, along with preliminary figures about how the virus would affect the state’s budget. Oregon and Washington, he said, will craft their own plans, although the basic principles guiding all three states would similar.

Asked whether Trump or the nation’s governors have final say on reopening the economy, Newsom would say only that California still had a strong collaborative relationship with the federal government on the virus fight.

“I have all the confidence in the world, moving forward, that we’ll maintain that collaborative spirit,” he said.

Trump, for his part, said in a Twitter post Monday that he has the power to overrule governors, “open up” states and relax social-distancing practices. The declaration came after economic advisers pressed concerns within the White House about the economic fallout from the shutdown, and as Trump’s patience appeared to fray after earlier ceding to health advisers’ insistence that his initial target date of Easter was too early.

He said he would make a decision “soon” on reopening, “in conjunction with the governors and input from others.” But he added that “it is the decision of the president, and for many good reasons.” He didn’t list any.

What Would A Reopening Look Like?

On Monday, governor Cuomo was joined on a conference call by the other Northeast governors. The recovery must be careful, incremental and guided by experts rather than politics, Cuomo said, and the pandemic won’t be truly “over” until a vaccine is available, which could take as long as 18 months. Ideally, a plan would also involve widespread testing, he said, to allow those without the virus – and those who have recovered and may now be resistant to it – to return to work first.

“You only get an economic recovery if it comes on the back of a health recovery,” New Jersey Governor Phil Murphy said. “As painful as the economic reality is right now, it’s not remotely as painful as it would be if we get the sequencing wrong and we get the timing wrong.”

As Bloomberg adds, the continued spread of the virus, while slowing, raises questions about what kind of infection rate would be considered acceptable under normal conditions — and whether the goal should be to prevent infections entirely or merely contain it enough so that the hospital system can handle the workload.

Cuomo said the restart has to be carried out slowly while keeping an eye on the virus rates: “You’ll start to open that valve on the economic activity, and you’ll turn that valve very slowly reopening the economy, more essential workers, do it carefully do it slowly and do it intelligently,” he said.

Meanwhile, financial markets have started to take a more positive view of the outlook. The initial improvement was mostly policy-driven, but the greater optimism of the past week seems to be at least partly related to the virus itself according to Goldman. To be clear, the health situation remains very bad in absolute terms, especially in the US which is now ahead of Italy and Spain in terms of coronavirus-related fatalities (though still much lower on a per-capita basis). However, the number of new active cases looks to be peaking globally, projections of cumulative fatalities and peak healthcare usage are coming down, and even actual new hospitalizations in hard-hit New York City have fallen sharply.

In a nutshell, optimists think this will allow us to reopen the economy soon. Pessimists counter that the main reason for the improvement is social distancing, which directly corresponds to reduced economic activity; if so, any economic rebound could result in a large second wave of infections, as well as renewed deterioration in the outlook for the death toll and healthcare overloads. Who is right?

According to Goldman, much of the improvement is probably a direct consequence of social distancing and the plunge in economic activity, and could reverse quickly if people just went back to work. But even if this means that a return to “business as usual” is off the table until we have a vaccine, it might be possible to bring back at least part of the lost output with a sharp increase in testing as well as more limited changes to business practices that lower the risk of infection. In particular, the manufacturing and construction sectors—which by our estimates account for about half of the total hit to GDP in April—might well be able to increase production from the depressed current levels quite soon. For example, the US auto industry is currently planning to go from production at just 25% of capacity in April to 70% in May, following a thorough cleaning of the plants.

One key date for global economy watchers is April 17, when China releases Q1 GDP as well as March retail sales and industrial production. Goldman’s economists expect China Q1 GDP to decline 9% year-on-year and 42% annualized. However, they see strong sequential gains in retail sales and especially industrial production, based on the partial normalization in the high-frequency indicators constructed by our Asia micro and macro teams. Although this would still leave the monthly indicators 8-10% below levels seen a year earlier, it would not only set China up for very strong sequential GDP growth in Q2 but would also increase confidence that the West may start to recover before too long.

That said, to set the stage for recovery, global economic policymakers still have work to do. At the most basic level, they need to keep the unavoidable “first-round” hit to aggregate supply from triggering a large “second-round” decline in aggregate demand that could make the ultimate downturn much worse than what’s necessary to control the virus. Some stylized numbers may be useful for illustration. Assume that the direct impact of the virus is to reduce global nominal GDP in 2020 by 5%, or about $5 trillion, because significant parts of the private sector have to be shut down for a few months. Without policy support and abstracting from real-world complications such as automatic stabilizers, this $5trn GDP hit shows up as a $5trn reduction in private-sector income, borne by businesses and workers whose firms have been shuttered. Assuming a marginal propensity to spend out of income of 60%, this $5trn income hit might result in a further $3trn reduction in aggregate demand and therefore GDP, according to Goldman calculations. In turn, this new $3trn GDP hit might show up as another $3trn reduction in private sector income. And so on, until global GDP has contracted by a multiple of the original virus-related impact.

What should policymakers do to short-circuit this downward spiral? At the broadest level, they will focus on providing all-out support, especially in countries with significant amounts of fiscal and monetary space. Governments need to replace as much as possible of the private-sector income hit, in order to limit the downward pressure on after-tax income and therefore on spending. Meanwhile, central banks will keep credit flowing, on highly attractive terms, so that households and businesses can borrow their way through whatever temporary income hit remains without cutting their spending sharply. (Eventually, concerns about inflation and fiscal deficits will come roaring back.)

So far, the policy effort has been impressive, and Goldman now estimates that global fiscal policy will deliver a discretionary easing of nearly 5% of GDP in 2020—close to the bank’s stylized estimate of the first-round hit in the example above—plus substantial loan guarantees and automatic stabilizers. Moreover, central banks have been aggressive in countering threats to the flow of credit – and generally bailing out everyone, especially those who took on undue risk and leverage to spend billions on buybacks instead creating a “rainy day” fund – via rate cuts, large amounts of additional QE, and a variety of support programs for the debt of private borrowers or lower levels of government (i.e. state and local governments in the US and periphery member states in the Euro area). That said, the response in Europe needs to be scaled up, via greater fiscal easing. At the same time, emerging economies will need a lot more help from the rich world—via bilateral loans, IMF and World Bank financing, access to dollar and SDR liquidity, and outright aid—to get through this severe crisis or else suffer catastrophic consequences as Guggenheim’s Scott Minerd wrote today.

Next steps

If policymakers can fill in the remaining holes on macro policy and manage to thread the needle between continued virus control and a gradual reopening of the economy, the level of GDP should begin to move higher in May/June, according to Goldman’s chief economist Jan Hatzius. Will the recovery look V-shaped or U-shaped? According to Bank of America, there is no chance of a V-shaped recovery. For Goldman, its forecast for US growth shows -11% in Q2, -8% in Q3, and -5% in Q4, which qualifies as U-shaped. On a quarter-on-quarter annualized basis, however, this same forecast shows -34% in Q2, +19% in Q3, and +12% in Q4, which looks rather V-shaped. Thus, Goldman’s forecast is one in which the economy recovers only gradually from the virus but nevertheless shows sequential growth rates in H2 that are unprecedented in postwar history: this will allow the bank to cover all bases, and to tell its clients it is bearish one day, as it was for much of the past months, and then to U-turn unexpectedly, and declare – as it did today – that it is now bullish and that the bottom of the market is in (even as Goldman itself had a bit of fun at its own absurd report).

Tyler Durden

Mon, 04/13/2020 – 20:25