COVID-19 Could Change Travel Behavior Forever… Putting 3 Million b/d Oil Demand At Risk

Authored by Daniel Klein via S&P Global Platts Inisghts blog,

Global air, road and rail travel have been massively reduced as governments attempt to limit the spread of coronavirus, taking a heavy toll on short-term oil demand.

Clearly, the mandated restrictions will lift when the pandemic eases and low oil prices will further aid in stimulating oil demand. However, it is possible that consumer behavior could be altered structurally, with impacts that persist even once the pandemic has ended.

For oil demand, the two sectors most at risk from a potential change in behavior are light-duty transportation and aviation. These risks are investigated in depth in the report Quantifying Risk: How COVID-19 could change consumer behaviors and impact long-term oil demand, issued by S&P Global Platts Analytics’ Scenario Planning Service on March 24.

For light duty transportation, a key risk is reduced oil demand from fewer workers commuting if there is a structural shift towards working from home. After mandated restrictions are lifted, businesses may question the cost of physical offices and offer more flexible working from home arrangements or even mandate employees to work from home.

Clearly, the potential to work from home is limited to certain segments as many industrial and service sector employees have virtually no flexibility to work from home. Even some white collar workers may not be able to work from home due to a lack of ubiquitous telecommunications and home computing.

Based on country-specific employment data and an analysis of commuting patterns, Platts Analytics estimates that 5% of commuting vehicle miles travelled are at risk from a structural shift to more of the labor force working from home. Over the long term this could wipe out as much as 193 billion miles travelled globally by 2030.

Aside from commuting to work, other light duty transportation activity has declined due to the COVID-19 outbreak. Consumers are being forced to reduce the number of trips to grocery and other stores and purchase goods online during the outbreak. These behaviors may persist after restrictions are lifted, particularly if cost savings are identified. Most major online retailers have made great strides in using big data and algorithms to predict consumer behavior to optimize supply and delivery chains. On balance, a shift to online shopping will lower overall vehicle miles travelled.

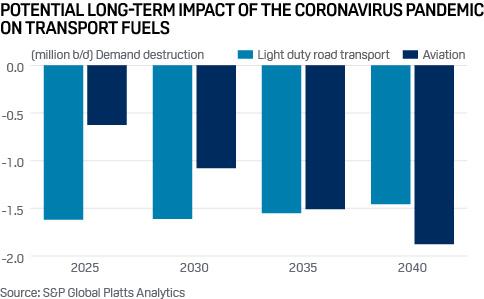

Additionally, many of these retailers have their own delivery fleets, and there is a shift toward electrifying these delivery trucks, illustrated by the landmark partnership between Amazon and EV manufacturer, Rivian. This has the potential to further compound overall oil demand losses. Platts Analytics estimates the resulting potential loss in oil demand in road transportation from a greater prevalence in working from home and changing shopping patterns at 1.9 million b/d by 2040.

The aviation sector has also been severely impacted by the coronavirus outbreak and is susceptible to structural behavioral changes after the crisis is over if there is a desire to fly less. Like road transportation, a portion of aviation demand is secure from a potential change in consumer preferences, such as air freight.

For passenger aviation, recent surveys suggest that 40% of airline passengers travel for business purposes. Businesses are currently being forced to experiment with ways to conduct operations without travel, and may make long-lasting changes to travel policies to push more vigorously for virtual meetings to reduce costs, lower CO2 emissions and, improve environmental, social and governance (ESG) scores.

Platts Analytics believes that business travel is the most susceptible to a change in behaviour from the COVID-19 outbreak. For leisure travel, virtual tourism and voice or video calls with distant loved ones are poor substitutes for the real thing, and this segment of air travel may prove to be the most secure.

The aviation sector has been on a strong upward trend due to a rising middle class, particularly in Asia. Before coronavirus struck, Platts Analytics assumed long-term oil demand growth in aviation at 2% per annum due to prevailing economic and travel trends. A scenario where aviation growth is half this original expectation would result in 1.8 million b/d less oil demand by 2040.

The impacts of coronavirus will ultimately be determined by the length and severity of the outbreak. However, the longer consumers and businesses adjust to restrictions and identify potential cost savings, the greater the probability these changes will become structural and long-lasting.

Tyler Durden

Sat, 04/18/2020 – 19:45