“Fed Can’t Print Gold”: BofA Calls Gold “Ultimate Store Of Value”, Raises Price Target To $3,000

Back in April 2011, just before gold exploded to a record above $1,900 following the US credit rating downgrade, we first said – and Kyle Bass echoed – that the main reason behind our long-running, bullish view on gold is that the Fed can’t print gold , unlike every other asset.

Today, with a 9 year delay, Bank of America has caught up with where we were at the start of the decade, and repeating virtually everything we have said – consistently each day for over 11 years – says that while “the size of major central bank balance sheets has been stable at 21 to 28% of GDP in the past decade just like the gold price” things are changing rapidly and “as central banks & governments double their balance sheets & fiscal deficits we up our 18m gold target from $2000 to $3000/oz.” And while it’s not all smooth sailing, with the bank warning that “a strong USD backdrop, falling equity market volatility, and weak jewelry demand in India & China may remain headwinds”, it is now clear that even Wall Street’s agenda is aligned with that of all those who have been calling that the biggest beneficiary of central bank lunacy will be the “barbarous relic”, one which according to the most clueless person of the 21st century only had value because it was “tradition.” And yet here we are, when one of the biggest US banks just said that gold is the “ultimate store of value.“

Who to believe: a pathological liar (i.e., a central banker) or someone who finally sees the light?

Incidentally, the name of the BofA report was “The Fed can’t print gold”, which was a delightful flashback to what we said some nine years ago.

Here are the key highlights from the report:

Gold prices have performed well in the recent period

As the ultimate store of value, gold prices have performed well during the past 15 months, posting a rally of over 10% since the Federal Reserve did a monetary policy U-turn in January 2019. Gold has also delivered a strong performance against other asset classes YTD. Of course, it has not been a straight line up, and gold did sell off hard for a brief period in March. The swing in gold prices mirrored the down and then up move in real interest rates. Now our CTA models suggest gold positioning is light, likely because of the spike in volatility and the mechanical drop in the gold Sharpe ratio. But this constraint could change as volatility keeps falling quickly across financial markets.

Now, significant monetary, fiscal easing around the world…

Due to the Covid-19 lockdowns, US GDP could go down by 30% YoY in 2Q20, the steepest drop in modern history. Other countries like Japan will likely experience a 21.8% decline in output in 2Q20, while China just reported a contraction of 6.8% in 1Q20. As central banks rush to expand their balance sheets and backstop asset values and consumer prices, a lot of risks could end up being socialized. The size of major central bank balance sheets has been stable at around 25% of GDP for the last decade or so, just like the gold price. As economic output contracts sharply, fiscal outlays surge, and central bank balance sheets double, fiat currencies could come under pressure. And investors will aim for gold. Hence, we mark-to-market our forecasts and now project an average gold price of $1,695/oz in 2020 and $2,063/oz in 2021.

…lifts our 18m gold target from $2000/oz to $3000/oz

True, a strong USD backdrop, reduced financial market volatility, and lower jewelry demand in India and China could remain headwinds for gold. But beyond traditional gold supply and demand fundamentals, financial repression is back on an extraordinary scale. Rates in the US and most G-10 economies will likely be at or below zero for a very long period of time as central banks attempt to push inflation back above their targets. Beyond real rates, variables such as nominal GDP, central bank balance sheets, or official gold reserves will remain the key determinants of gold prices, in our view. As central banks and governments double their balance sheets and fiscal deficits respectively, we have also decided to up our 18m gold target from $2,000 to $3,000/oz.

And with that let’s dig deeper into “The Fed can’t print gold” and why BofA thinks that gold will have a 3-handle in 18 months time:

Gold prices have performed well during the recent period…

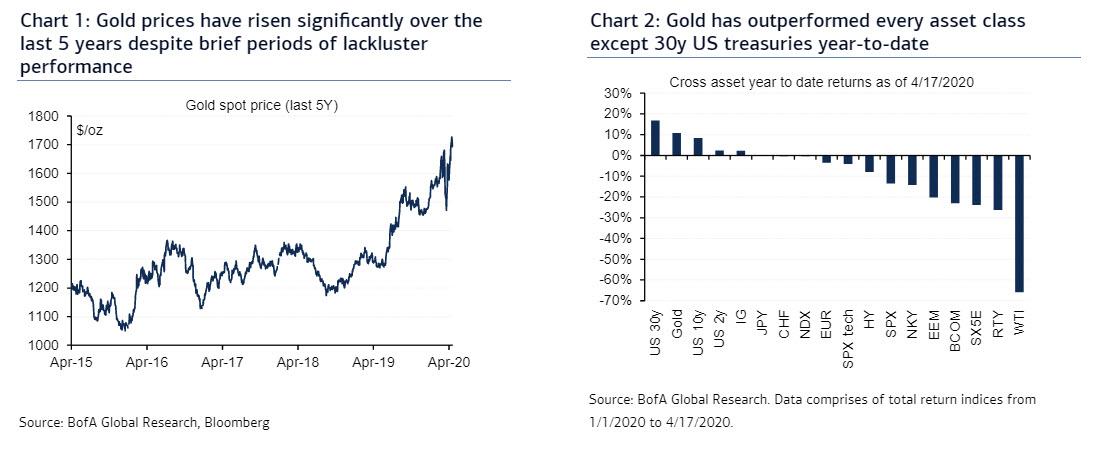

As the ultimate store of value, gold prices have performed well during the past 15 months, posting a rally of 12% since the Federal Reserve did a monetary policy U-turn in January 2019 (Chart 1). More recently, gold prices have continued to post a robust run, with returns broadly outpacing other major asset classes year-to-date (Chart 2). Only long duration bonds and high quality tech stocks have delivered comparable performance, with 30 year Treasury yields posting 16.9% and the S&P Tech Sector delivering flat returns YTD.

…except over a brief window where liquidation occurred

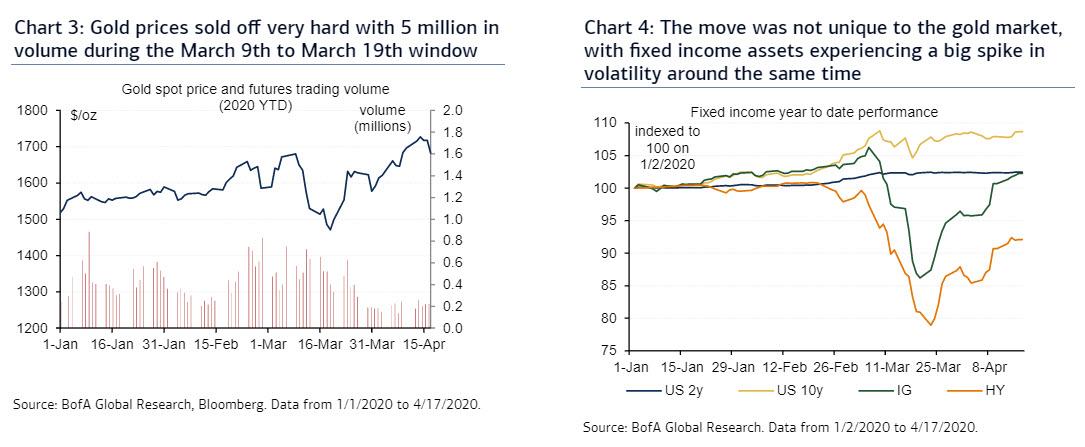

Of course, it has not been a straight line up for the yellow metal. In fact, gold prices sold off very hard with close to 5 million futures trading volume during the March 9th to March 19th window (Chart 3) on the back of a major liquidity crunch. The move was not unique to the gold market, with fixed income assets also experiencing a big spike in volatility around that time (Chart 4). The pre-March 19 peak to trough decline for gold was 12% compared to an 8% drop in the US Treasury Inflation Protected Securities (TIPS) ETF or a 22% decline in investment grade ETF values such as LQD.

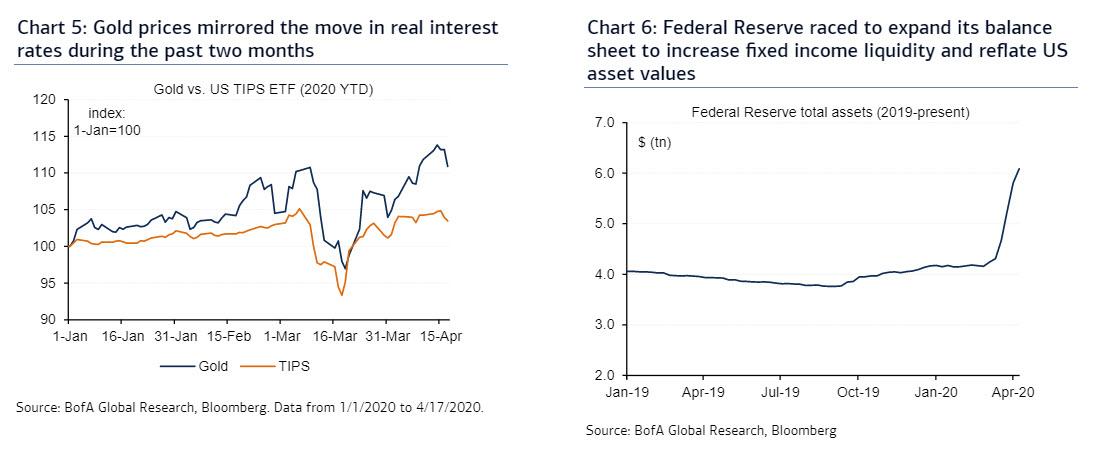

The sell-off in gold prices mirrored the move in real rates

It is worth noting too that the drop in gold prices mirrored the move in real interest rates during the past two months (Chart 5). As investors feared the extension of the China lockdown to the US and the rest of the world economy, asset values and consumer price expectations collapsed faster than nominal interest rates, triggering fears of an economic depression. Having learned the lessons of the Global Financial Crisis (GFC), the Federal Reserve raced to expand its balance sheet to increase fixed income liquidity and reflate US asset values, ultimately supporting a sharp recovery in gold prices (Chart 6).

Gold is a function on real rates, USD, commodities and risk…

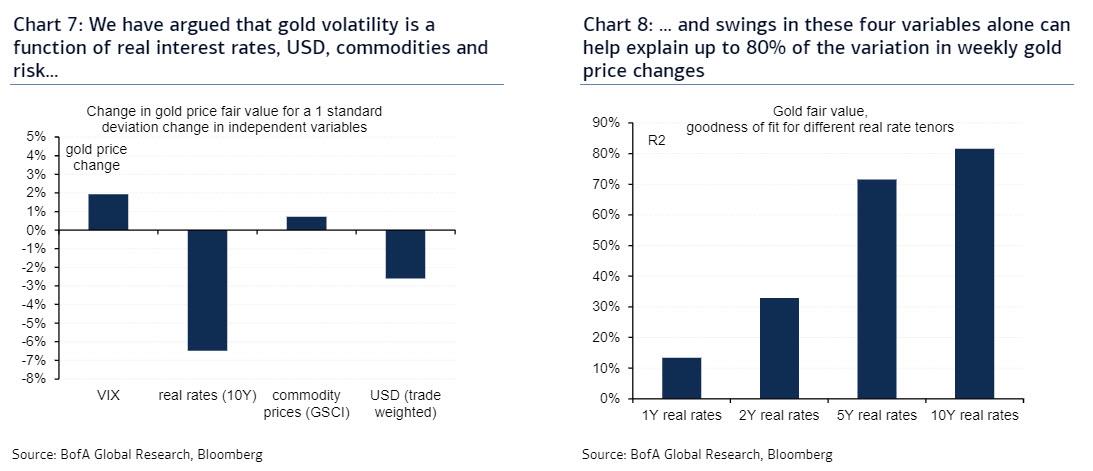

As explained above, the selloff and subsequent recovery in gold prices during March was somewhat mechanical in nature. As the ultimate store of value, gold is a reflection of market movements across all major financial and physical assets. In the past we have argued that gold volatility is a function of real interest rates, USD, commodities and risk (Chart 7). Swings in these four variables alone can help explain up to 80% of variation in weekly gold price changes (Chart 8), providing an important template to understand the direction of future gold prices.

…and gold volatility tends to follow moves in other markets

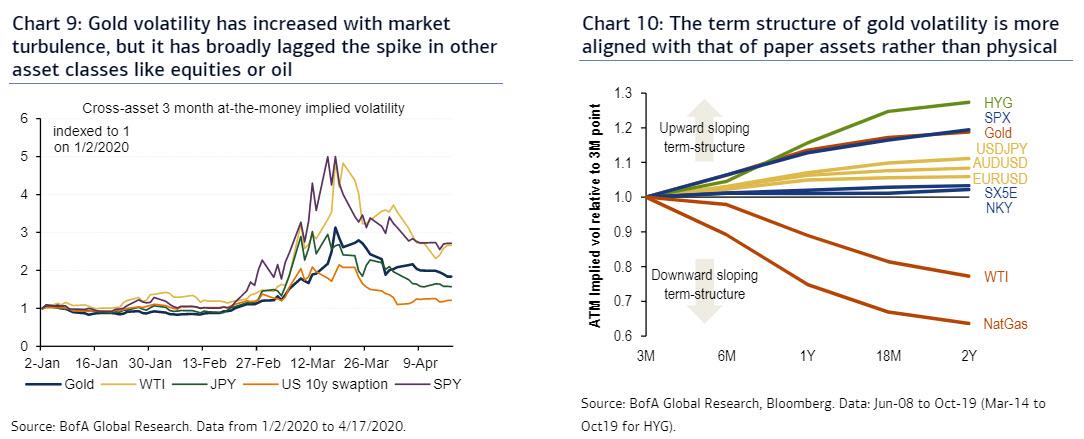

Another factor to think about in precious metals is volatility. Specifically, gold volatility increased with market turbulence, but it has broadly lagged the spike in other asset classes like equities or oil (Chart 9). On our estimates, gold volatility more or less tracked G10 currency vol in the past two months, particularly mirroring perceived safe haven currencies like JPY and CHF. Unlike other commodity markets, the term structure of gold volatility is more aligned with that of paper assets (Chart 10). In contrast to oil or natural gas, gold is not constrained by storage dynamics and its price is not necessarily mean-reverting to the marginal cost of production over the long run.

Covid-19 has also triggered physical market dislocations…

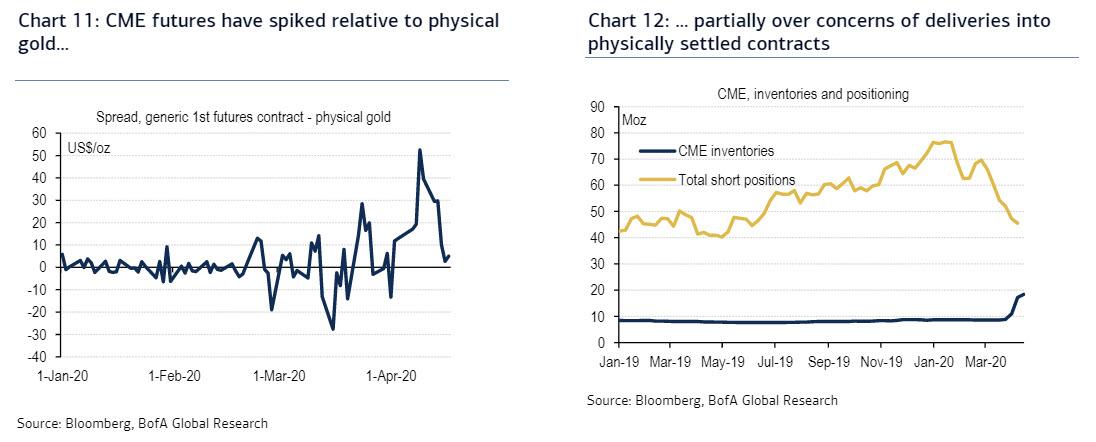

Still, the physical settlement of paper contracts means that gold has unique features compared to other perceived safe havens. In normal times, when the CME delivery mechanism functions smoothly, differences between gold futures and the physical gold market are usually quite small. Yet the margin between futures and physical prices has blown out as of late (Chart 11). In part, there have been concerns over disruptions of shipments to the US over recent travel restrictions, as the London market typically provides liquidity to New York. While futures contracts are relatively rarely held to expiry, Chart 12 shows that inventory levels in CME warehouses are well below open interest.

…leading to the launch of a new CME gold futures contract

Also, the CME contract trades in 100koz, while a London Good Delivery Bar is 400koz. This matters because around one-third of global refining capacity has been shuttered over Covid-19, which made the conversion of bars into shapes suitable for delivery into the CME challenging. Tackling these issues, CME has since launched new futures, which also accept 400oz bars. This should ultimately help alleviate liquidity concerns, although it may take some time for open interest to switch to the new contract. Beyond that, and perhaps more importantly, the Swiss refineries have been resuming operations again, while insurers now also accept charter flights to ship gold to New York, rather than just commercial connections. Not surprisingly, the differential between futures and physical gold has been narrowing.

Gold interacts with all financial markets in different ways

Beyond the volatility, physical and price change drivers discussed above, gold interacts with various financial markets in different ways. For instance, we recently noted that the correlation between gold and equities has recently turned positive (Chart 13). The positive equity/gold correlations are a possible sign that equity markets may not have fully bottomed (Chart 14) and that the gold market has further room to run, in our view. The trigger here could be an extension of lockdown restrictions over the next few weeks.

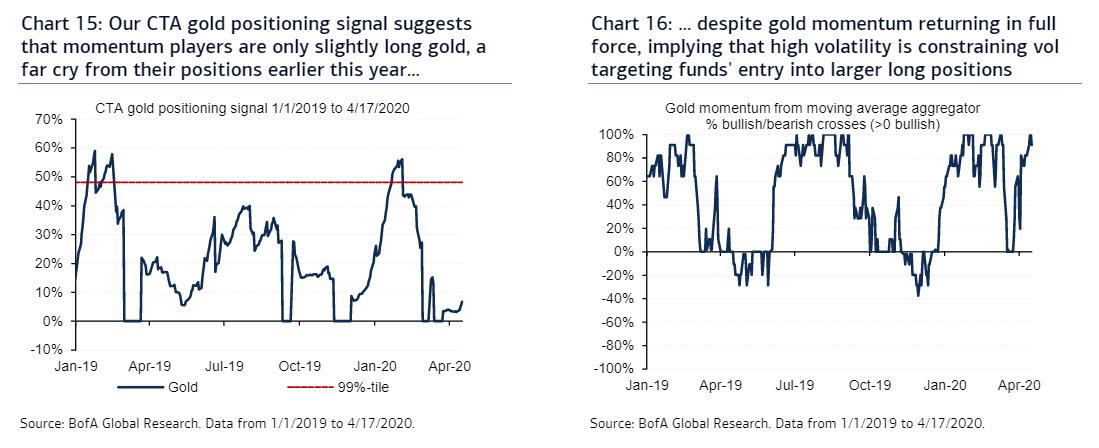

Despite the rally, gold positioning has been surprisingly weak

Another reason to be particularly constructive on gold is that our CTA gold positioning signal suggests that momentum players are only slightly long gold (Chart 15). Having peaked at 56% of their maximum length in the month of January, our models suggest that momentum players are currently holding 5.7% of their maximum allocations, well below the historical 99th percentile in history of 48%. While gold momentum is in full force following a brief collapse mid-March (Chart 16), our CTA model has only slowly crept into a long position due to the prevailing high volatility regime, a feature that is also likely prevalent in the broader class of vol targeting funds.

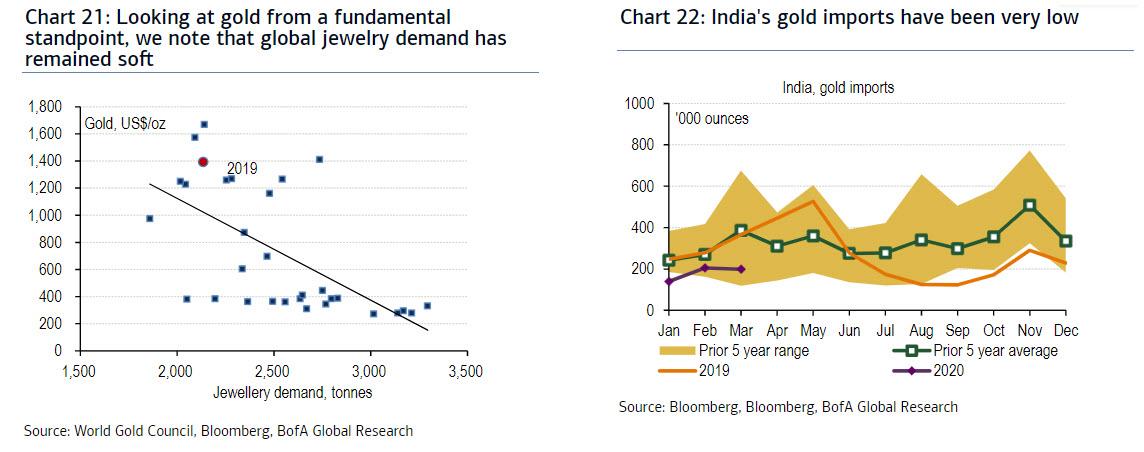

Fundamentally, EM gold demand should continue to be soft…

Also, jewelry demand usually declines when prices rally (Chart 21), as buyers in emerging markets like India often purchase on a budget. With jewelry often referencing spot market prices, this means that fewer ounces can be bought as gold rallies. Indeed, gold imports from India have been quite low (Chart 22), although this has also been influenced by low foot traffic in stores due to the recent lockdown over Covid-19.

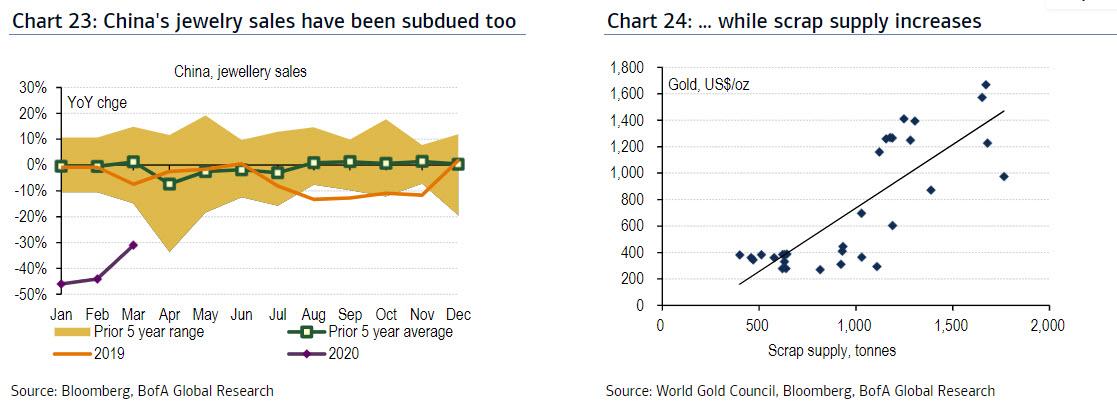

…as purchasing power in India and China is suffering

Similarly, sales of jewelry in China, the second largest physical market, have been subdued for a while, as Chart 23 suggests, on persistent headwinds to growth which have been exacerbated by the health emergency in the first quarter. Meanwhile, the scrap market correlates positively with gold quotations, with owners of old metal often incentivized to monetize the gold as prices increase (Chart 24). Of course, the dynamic in the jewelry and scrap markets highlight the importance of investors: as the yellow metal rallies, non-commercial market participants need to pick up more ounces just to keep further price upside intact.

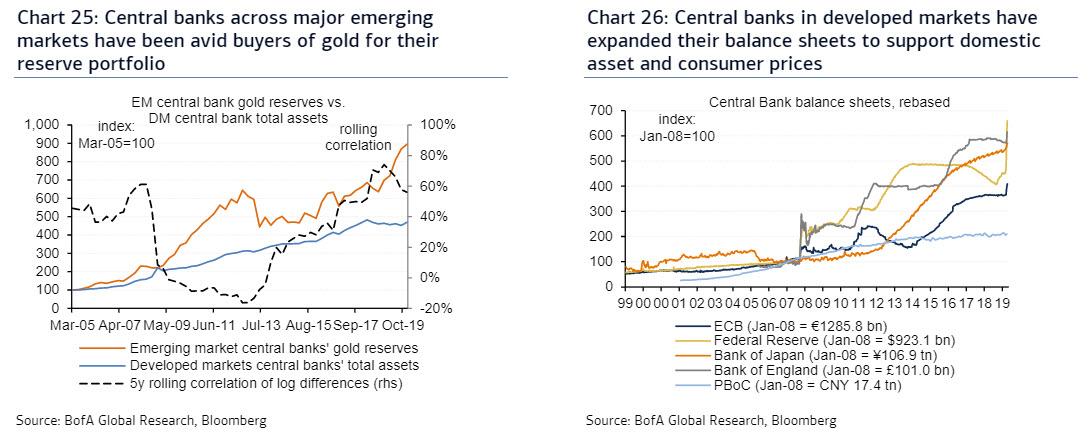

…although we expect central banks to buy some gold bars

So physical demand in traditional gold markets like jewelry looks soft and could be a drag on precious metals prices. However, central banks across major emerging markets have been avid buyers of gold for their reserve portfolio (Chart 25). As central banks in developed markets have expanded their balance sheets to support domestic asset and consumer prices (Chart 26), some EM central banks have become more proactive buyers of precious metals. In particular, Russia, China and India have opted to increase gold holdings in the past 5 years to diversify away from G-10 sovereign bond positions.

Gold may take comfort on rising inflation expectations…

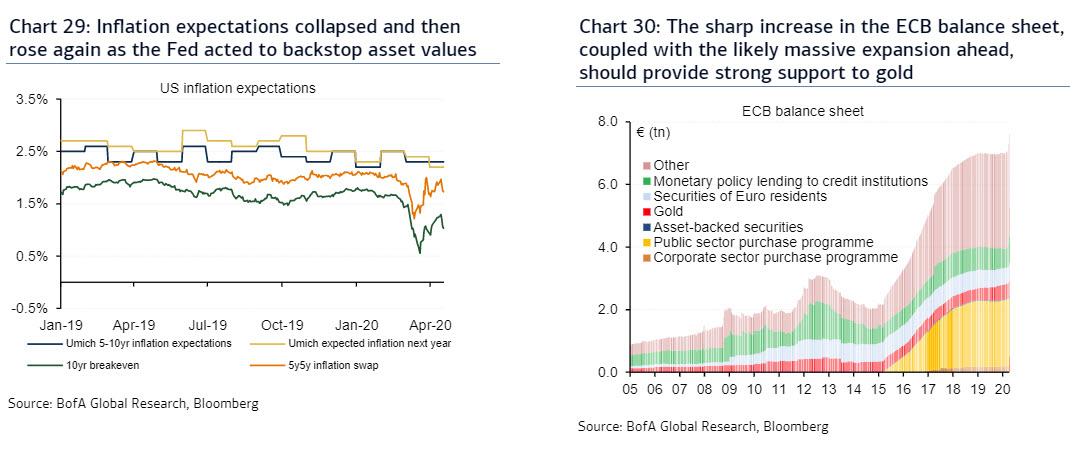

We have previously argued that inflation expectations embedded in US TIPS collapsed and then rose again as the Fed acted to backstop fixed income asset values (Chart 29) and consumer prices. Now, with the Fed committing to do whatever it takes to prevent widespread bankruptcies across the US, Congress injecting a $2tn fiscal stimulus plan, and economic growth on standstill until there is a cure or a vaccine, inflation could rise even if GDP does not. This backdrop should prove very positive for gold, in our view. Similarly, the sharp increase in the ECB balance sheet in recent years, coupled with the likely massive expansion ahead, should provide strong support to gold (Chart 30).

…driven by massive monetary easing plans around the world…

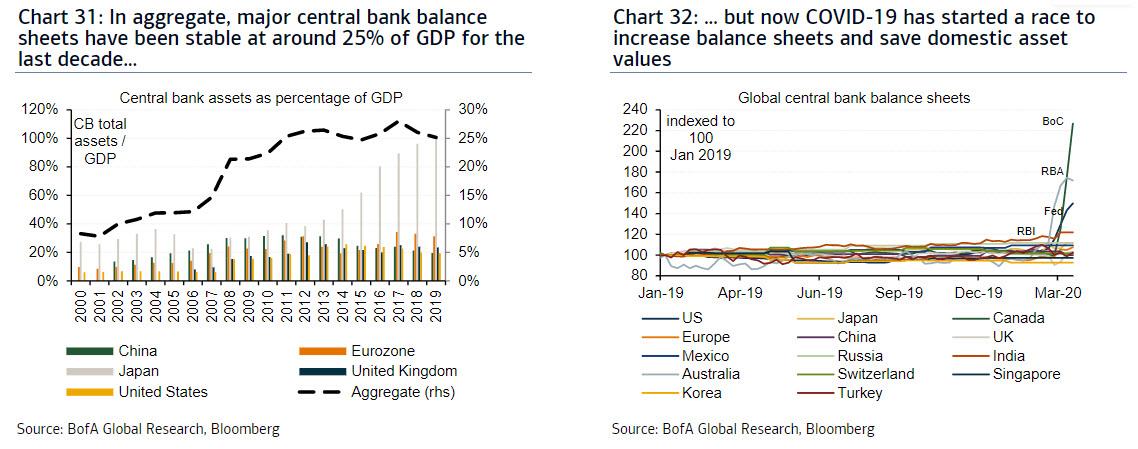

One of the most intriguing developments ahead is that US GDP could drop by 30% YoY in 2Q20, the steepest collapse ever in modern history. Other countries like Japan will likely experience a 21.8% decline in output, while China just reported a contraction of 6.8% in 1Q20. As central banks rush to expand their balance sheets and backstop the economy, a lot of risks could effectively be socialized, boosting the appeal of gold. In aggregate, major central bank balance sheets have been stable at around 25% of GDP for the last decade or so (Chart 31). But clearly Covid-19 has started a race to increase balance sheets and save domestic asset values (Chart 32).

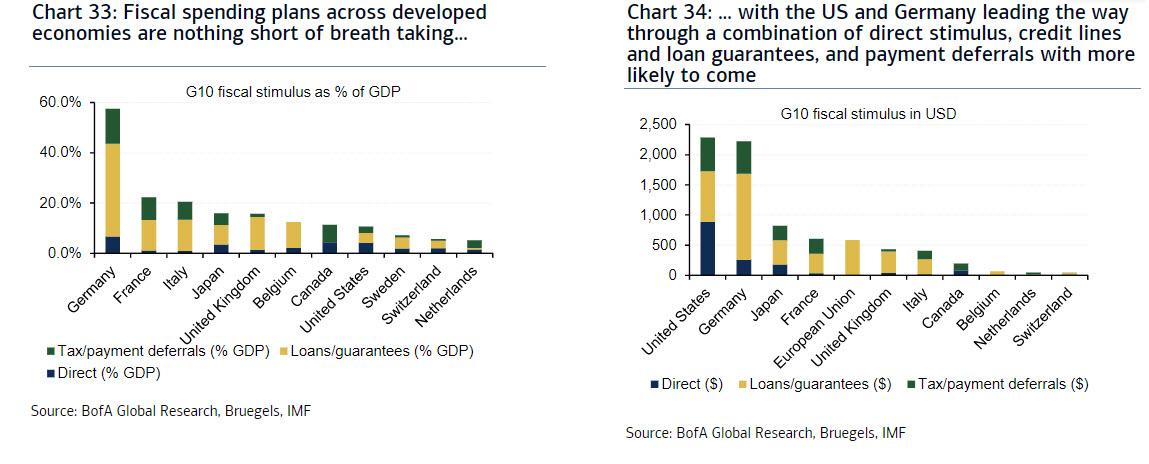

…and also by unprecedented fiscal deficits and government borrowing

Another important point to remember is that, just as central banks are socializing risk in financial markets, governments are increasing their spending like never before during peacetime. Fiscal spending plans across developed economies are nothing short of breathtaking whether we look at them in dollar terms (Chart 34) or as a percentage of each nation’s GDP (Chart 33). Of course, emerging economies do not have the domestic savings base to attempt such an extraordinary feat, but their central banks may opt to reduce DM sovereign bonds in favor of gold.

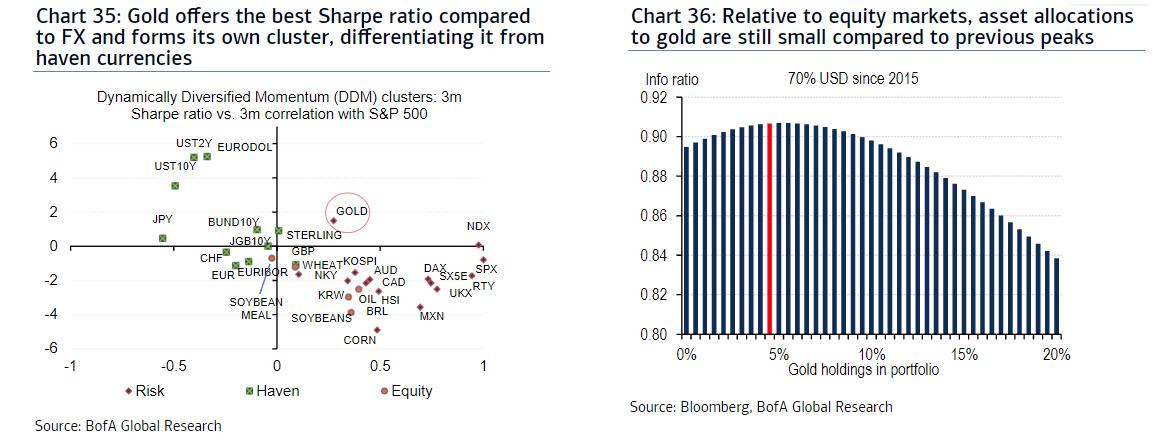

Cross-asset portfolios should increase exposure to gold…

Our Dynamically Diversified Momentum portfolio allocation tool uses a combination of clustering and Sharpe ratio momentum indicators to either add or reduce exposure to a broad range of asset classes (Chart 35). This allocation technique is representative of what some systematic cross-asset portfolios would use. In DDM, gold has generally been classified in the haven cluster, but has recently switched to the equity cluster and our tool has held a long gold position since mid-March. Also, traditional equal risk contribution portfolios, whether balanced or fixed income geared, should keep adding exposure to the yellow metal over the coming months to increase efficiency (Chart 36).

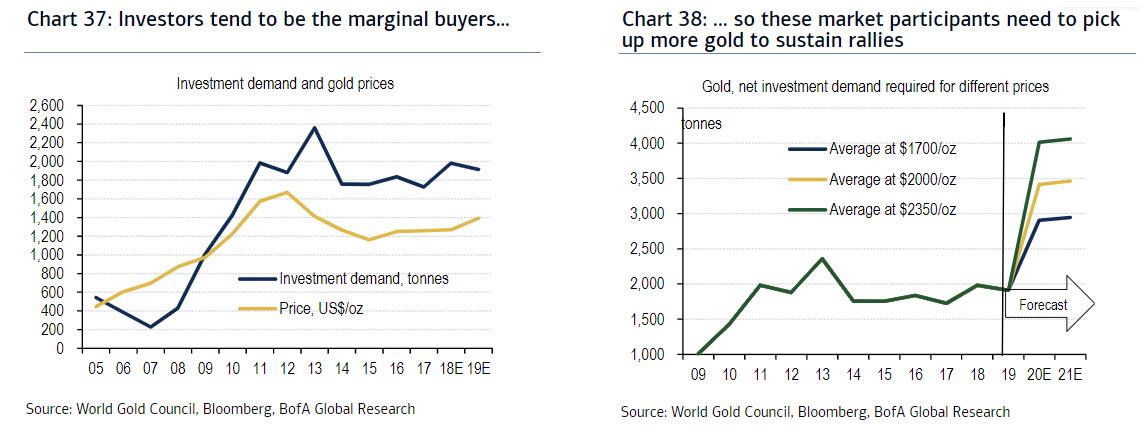

…and on our estimates investors are still underweight gold

Investment demand has correlated strongly with gold prices in recent years, and we expect precisely this group of buyers to drive gold prices higher (Chart 37). In other words, different levels of non-commercial demand are required to sustain different average price levels. Indeed, for gold to average $2,000/oz next year, purchases need to rise by 73% YoY (Chart 38). Given the current macro-economic backdrop, we believe this figure is likely to be exceeded.

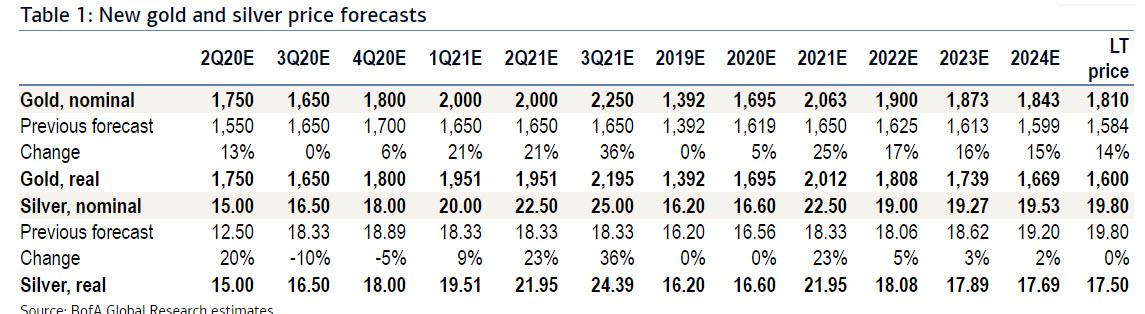

We increase our average gold price forecasts from 2020 on…

We have been long-term gold bulls, maintaining our constructive forecast even through the recent volatility. That said, gold has now hit our average 4Q20 price forecast at $1,700/oz, Hence, we are marking-to-market expectations, while at the same time anticipating further upside, largely because central banks underwrite fiscal stimulus and financial markets through money printing, with fundamentals justifying a rally to $2,250/oz in 2021. Still, strong USD backdrop, reduced market volatility, and lower jewelry demand will likely remain headwinds to gold.

…and we also up our 18m gold target from $2000/oz to $3000/oz

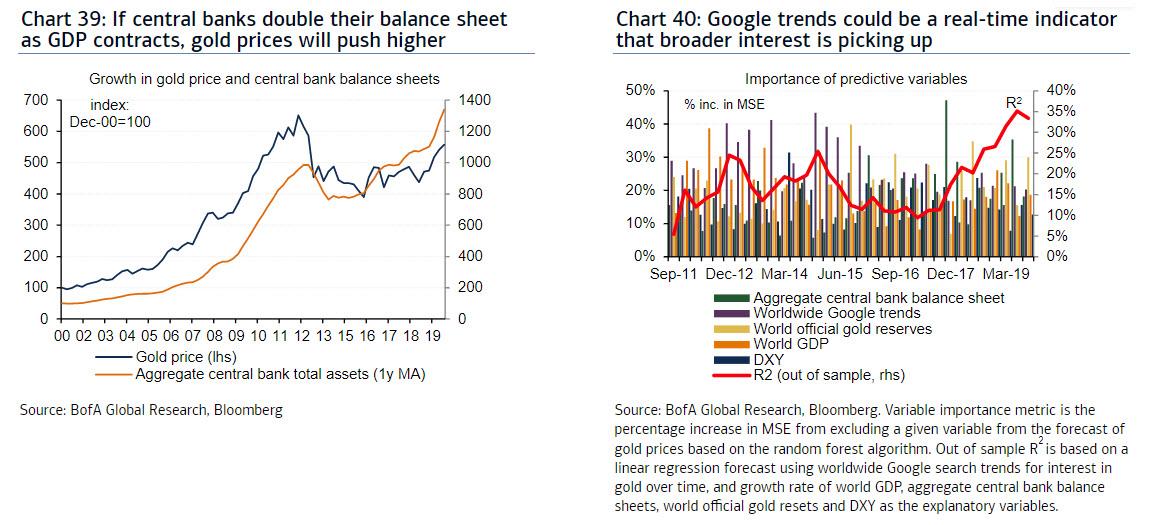

Beyond the supply/demand fundamentals, financial repression is back at an extraordinary scale. Rates in the US and most G-10 economies will likely end up at or below zero for a very long period of time, just as central banks attempt to push inflation back above their targets. Beyond flow variables such as real rates, the USD or market risk, variables such as nominal GDP, central bank balance sheets, or official gold reserves will remain key determinants of gold prices. If central banks double their balance sheet as GDP contracts, gold prices will push higher (Chart 39). Thus, we increase our 18m gold target from $2,000 to $3,000/oz. When will gold start to catch steam? Our work shows that Google trends (Chart 40) could be an early real-time indicator that broader interest is picking up.

Tyler Durden

Tue, 04/21/2020 – 12:15