TSY Yields Hit Record Lows, Stocks Slammed As Crude Carnage Spreads

The market… everywhere right now…

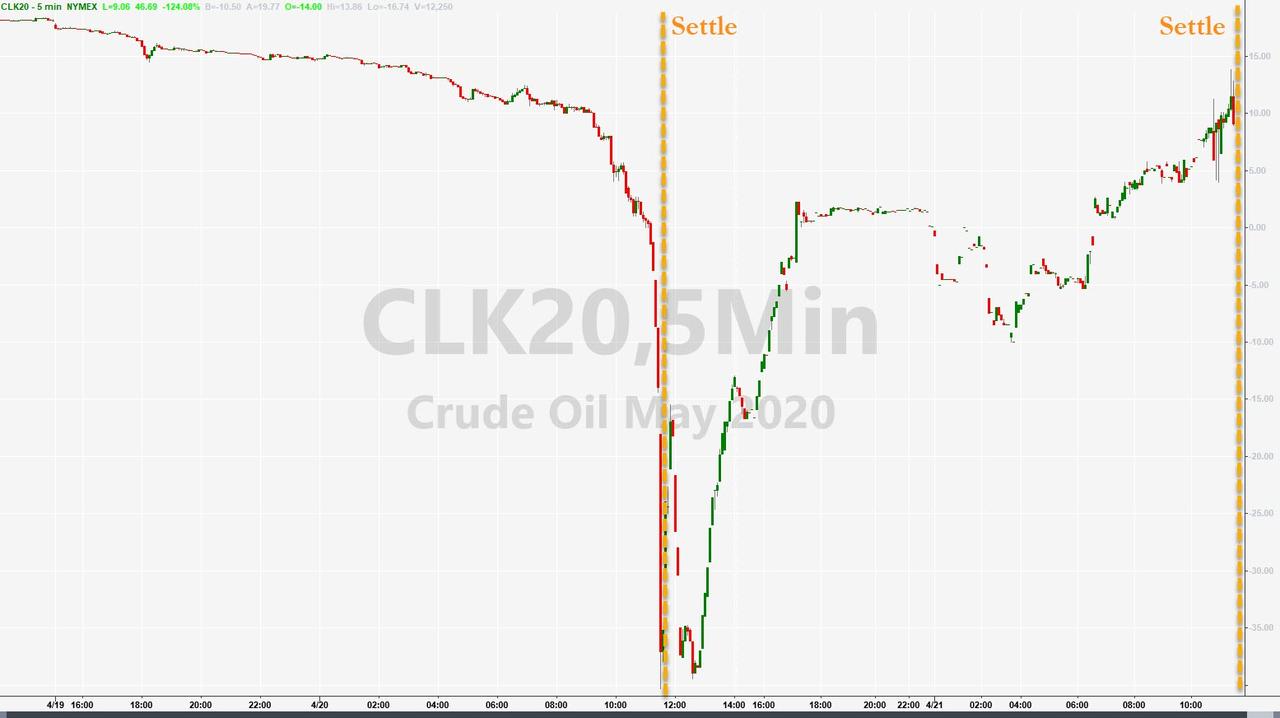

Great news (wel not really)… the May WTI contract exploded higher today…

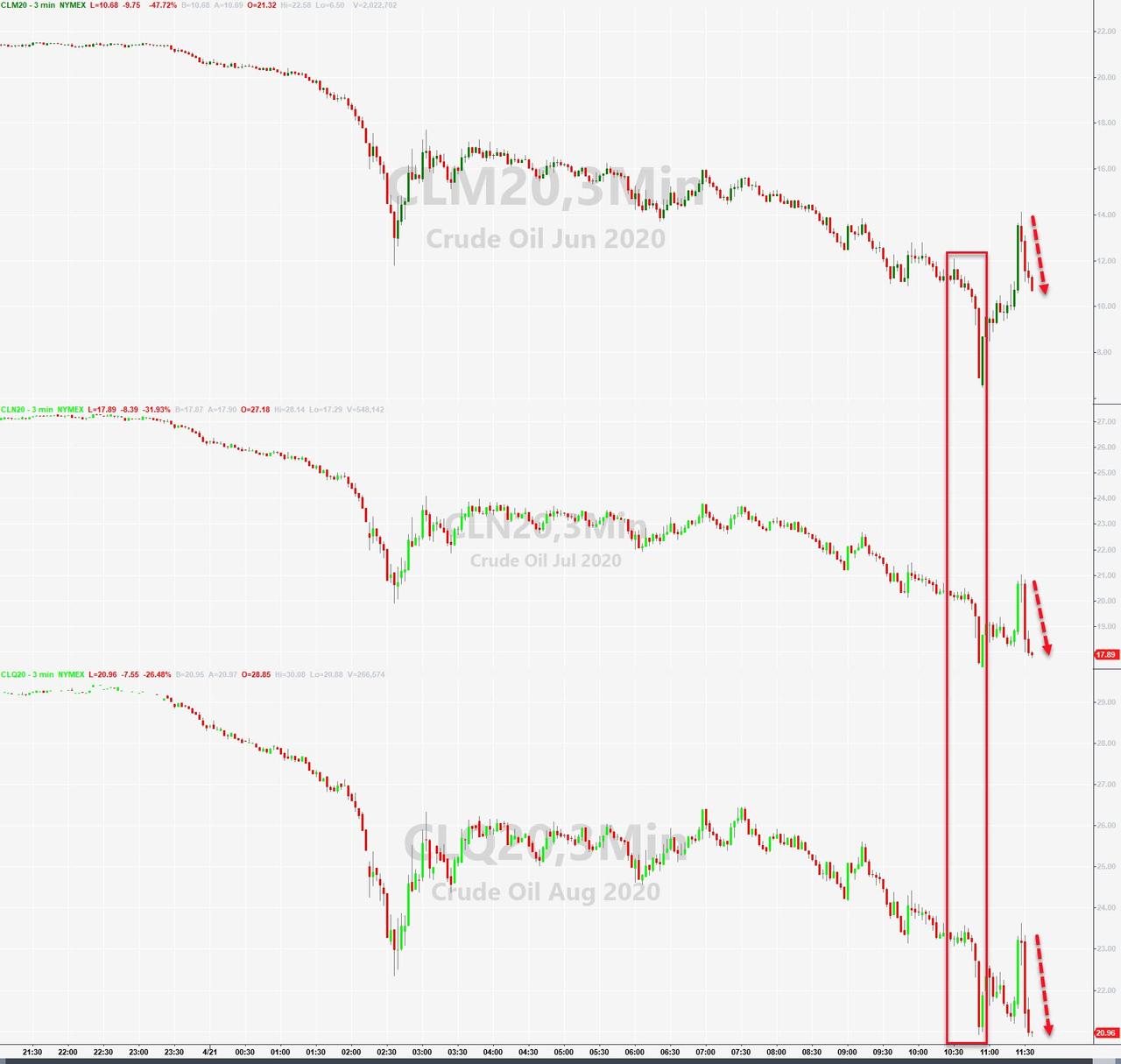

Terrible news… the rest of the paper oil market was utterly destroyed.

As May expired, the rest of the front-months were clubbed like baby seals…

As USO was total chaos…

And the Futures prompt spread screamed back up to zero as the out-month crashed down to May…

Source: Bloomberg

Remember – tonight API gives us a first glimpse at what inventories are doing in this chaos.

As Bloomberg’s Javier Blas noted:

“Yesterday was scary. Today is a lot more scary. The whole oil market is screaming oversupply simultaneously. “

And that fear spilled over into stocks (S&P’s biggest drop since April 1st)…

The Dow was unable to hold its 50% retracement level of the Feb-Mar crash…

The Nasdaq touched its 100DMA, and fell back below its 200- and 50-DMA…

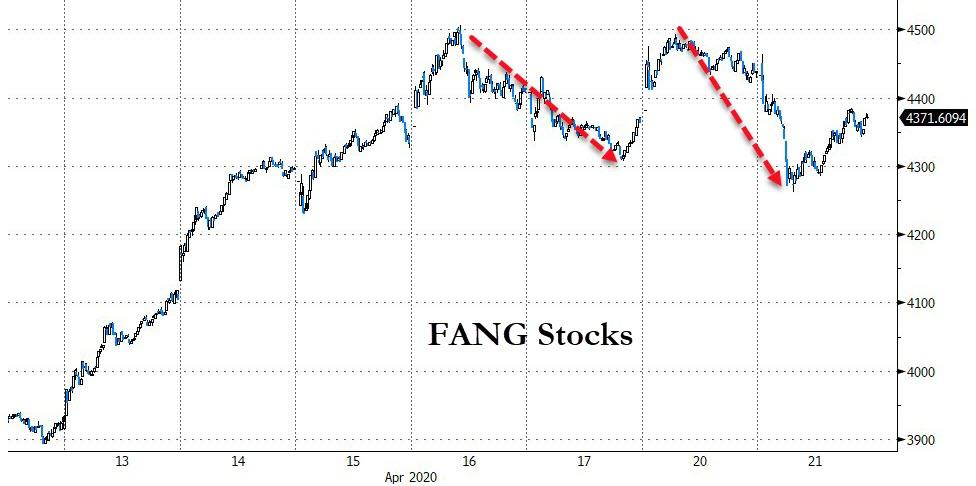

FANG Stocks dared to slide today…

Source: Bloomberg

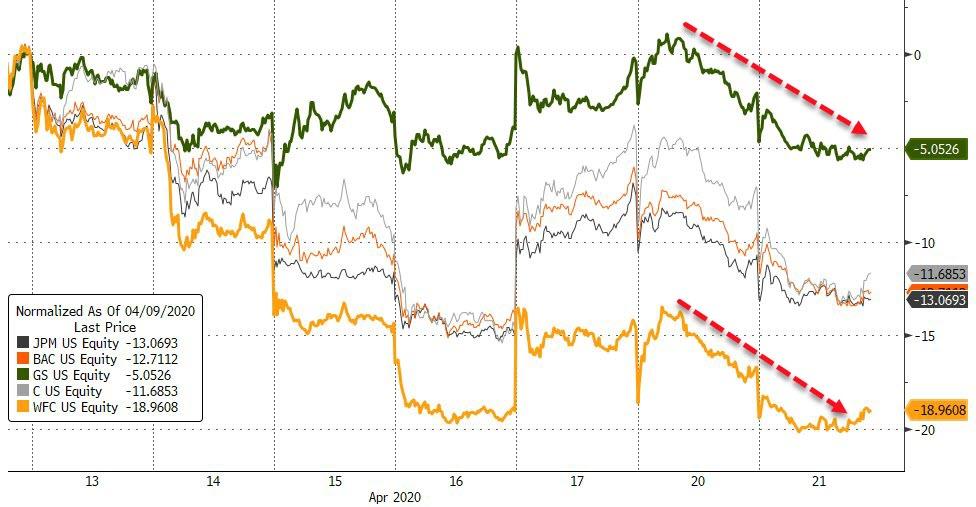

Bank stocks fell for the 2nd day…

Source: Bloomberg

For a brief moment near the open, AMZN overtook Apple in market cap…

Source: Bloomberg

And sparked a bid at the long-end of the bond curve…

Source: Bloomberg

5Y Yields hit a new record low intraday, highlighting the decoupling between the bond market and the stock market’s rebound…

Source: Bloomberg

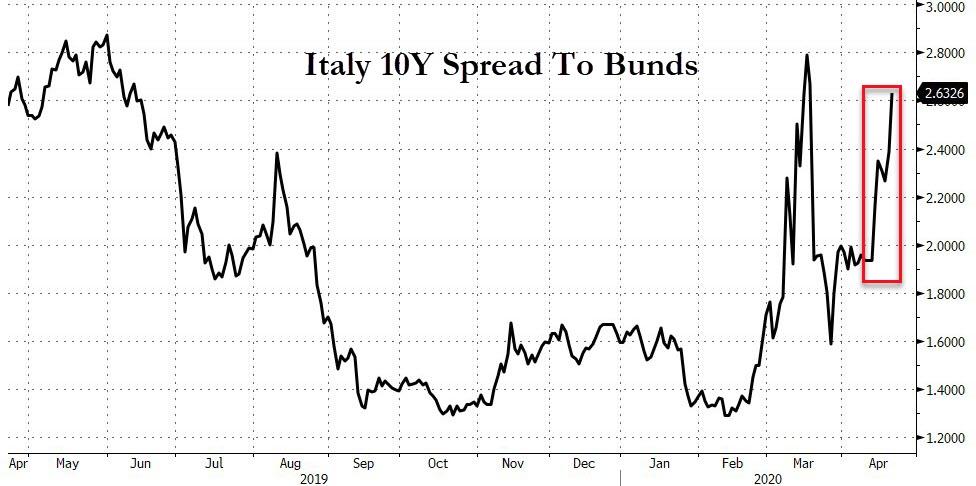

Meanwhile, in Europe, Italian bond spreads are blowing out as redenomination risks re-emerge…

Source: Bloomberg

Worryingly, given the Powell Put, HYG prices are erasing all of The post Fed gains…

Source: Bloomberg

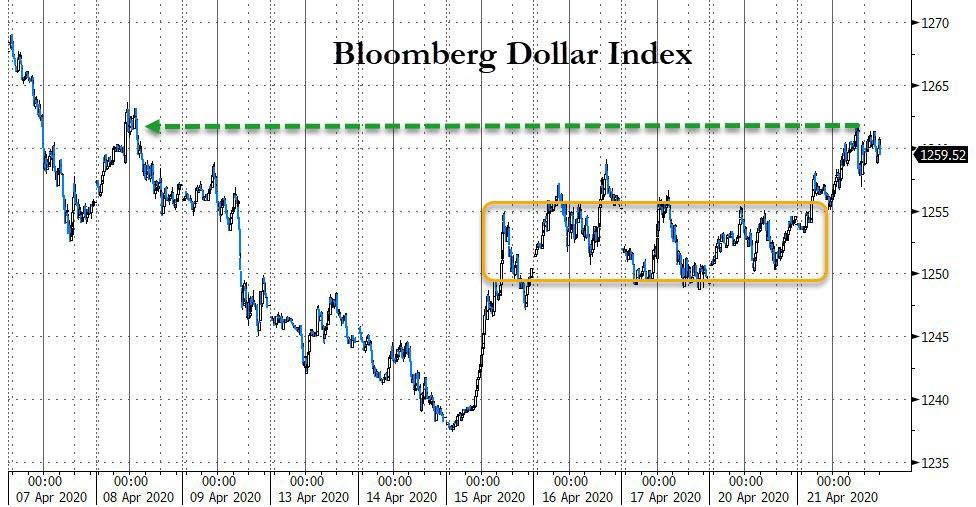

The dollar rallied out of its recent range back to two week highs…

Source: Bloomberg

Cryptos slipped lower today but Ethereum is holing on to weekly gains (barely)

Source: Bloomberg

Gold was down on the day as the dollar gained but did push back up towards $1700 (futures) into the close..

With oil dominating the headlines recently, no one has noticed the collapse in Copper…

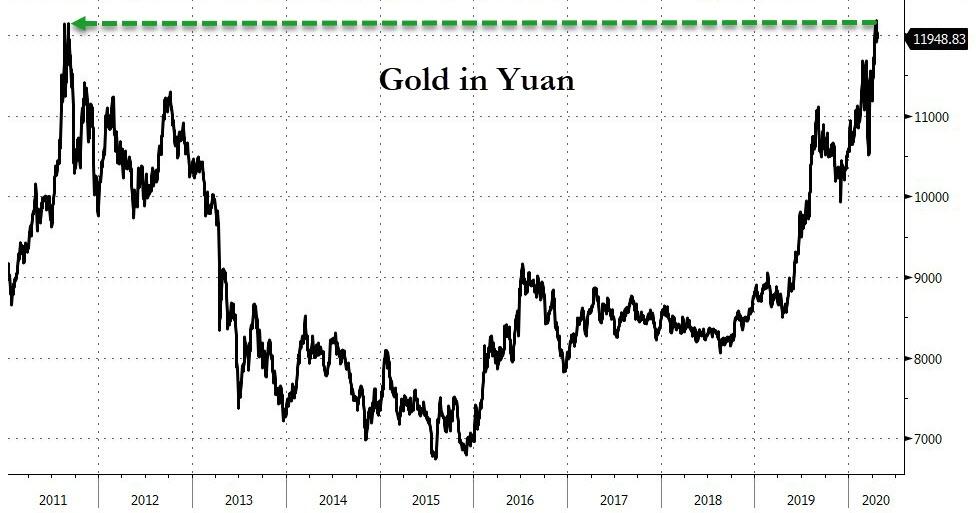

Gold is back at record highs against the Yuan…

Source: Bloomberg

Finally, just in case you thought stocks were cheap… and this 2-day drop is a dip to buy…

Source: Bloomberg

As US Macro data collapses to its worst sine Lehman…

Source: Bloomberg

Tyler Durden

Tue, 04/21/2020 – 16:01