Here’s Why 2/3rds Of US Oil & Gas Companies May Not Exist A Year From Now

Authored by Bryce Coward via Knowledge Leaders Capital blog,

Energy companies are facing a life or death moment in 2020 with the price of WTI crude oil falling to $13.64/barrel as of this writing. Indeed the collapse in energy prices combined with poor fundamentals leading into the COVID crisis make most of the oil and gas sector vulnerable to takeover or bankruptcy in the not too distant future.

For example, a simple analysis of the 96 companies in the US Integrated Oil & Gas companies, E&P companies, Drilling, Equipment & Services sub-industries shows that 67% of these firms have total liabilities in excess of equity as of their latest reporting period. That would be strike one in any situation, but with oil prices about 80% below the price that prevailed at the beginning of the year, the ability of these companies to meet debt payments or pay suppliers is further brought into question.

If that wasn’t enough, we ran a simple extrapolation to estimate how many of these companies will have enough cash on hand to pay current liabilities this year. We simply take 2019 EBITDA and estimate what 2020 EBITDA will be if WTI prices average $25/barrel in 2020 and assume total 2020 consumption will be 85% of 2019 consumption.

If this situation comes to pass, then 71% of these firms will have 2020 EBITDA + Cash that is less than 2020 Current Liabilities. Now, maybe these assumptions are wildly off the mark and WTI will average $35/barrel or higher. Maybe these businesses will be able to access vast sums of new capital to stay afloat. I suppose they could sell assets, too, if there were willing buyers. If that’s the case then it would certainly take some pressure off, but even then the bulk of these firms would be under severe distress.

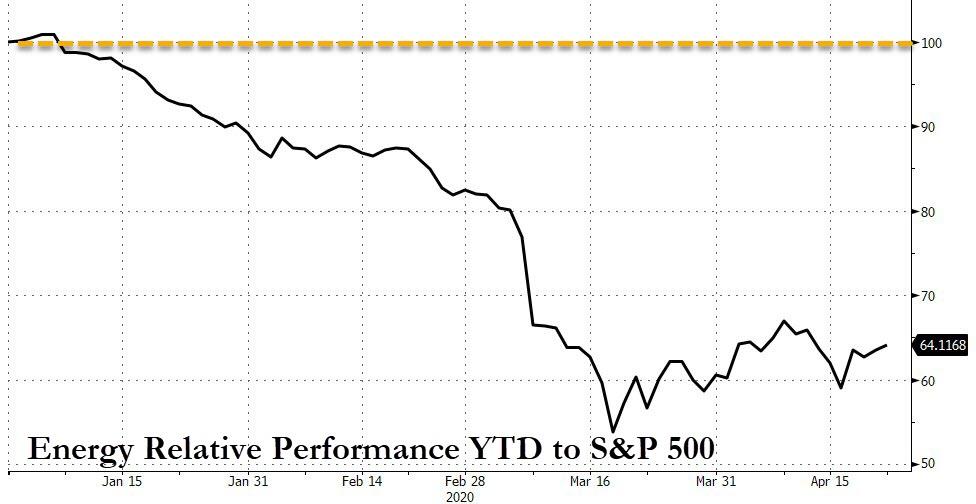

Now, to be fair, even though oil prices have absolutely collapsed in recent days, the equities themselves as well as their credit risk seem to be hanging in there. For example, the energy sector has actually outperformed the S&P 500 by about 9% since March 16th.

High yield energy spreads also peaked in mid-March (blue line below) as the WTI near-term futures contract (red line, right inverted axis) traded in the $20 range. These credit spreads have backed off considerably since then even though they have turned back up modestly as WTI has collapsed.

So, the message from the fundamentals tells us that unless something changes and fast – like energy prices rise a lot and/or consumption rebounds to pre-crisis levels and/or these companies get a Federal bailout – much of the US energy sector is going to pursue restructuring in 2020 or get purchased by a stronger hand.

Yet, the price signals from the market are telling us it’s all good. You be the judge. We suppose the next several weeks will be telling.

Tyler Durden

Wed, 04/22/2020 – 20:40