Rubio Demands Banks Explain If Certain Borrowers Favored For PPP Loans

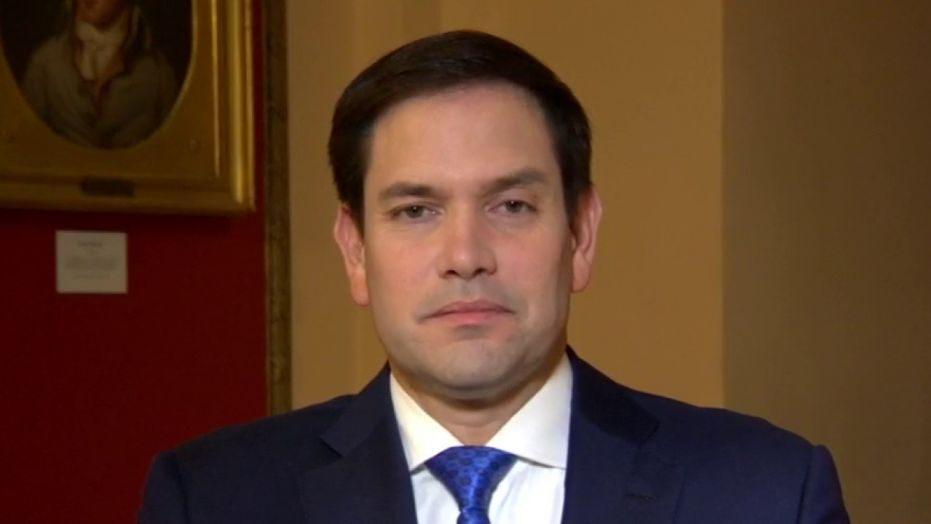

Sen. Marco Rubio (R-FL) has fired off letters to 12 bank CEOs asking for a detailed explanation of how their institutions chose which borrowers to lend money to under the Paycheck Protection Program intended to help small businesses obtain emergency funding amid the coronavirus pandemic.

If the banks favored certain borrowers in processing applications for the Paycheck Protection Program – a $349 billion carve-out from the $2.2 trillion stimulus passed earlier this month – they could be in violation of the program’s mandate for processing clients on a first-come, first-served basis, according to the Wall Street Journal.

Rubio chairs the Senate Small Business Committee.

“While I recognize the challenges of setting up a program of this size, processes to handle applications, and appropriate guidance to administer the program, it is important for small businesses and nonprofits of various sizes, regional locations, and missions to have equal access to PPP assistance,” said Rubio.

Banks whose CEOs received letters included JPMorgan, Bank of America, and Wells Fargo – all of whom heavily participated in the program. JPMorgan in particular has come under fire – and a lawsuit – for allegedly prioritizing its large commercial clients ahead of its small business clients, doling out tens of millions of dollars to often-public companies which had other avenues to capital if they needed it.

The bank claims they didn’t prioritize large customers over smaller customers, saying in a FAQ: “We funded more than twice as many loans for smaller businesses than the rest of the firm’s clients combined,” and “We have different lines of business that serve different types of clients.”

Bank of America confirmed that it received the letter and said it planned to respond. Wells Fargo didn’t immediately provide comment.

Mr. Rubio’s action comes after news reports that banks were giving preference to established customers, including an April 6 story in The Wall Street Journal.

Bank of America, for example, initially required applicants to have an existing borrowing relationship with the bank, saying it was designed to speed up the application process. The bank subsequently changed the policy. –Wall Street Journal

Rubio has asked the banks to respond by May 1.

Tyler Durden

Thu, 04/23/2020 – 17:25