Futures Rebound From Earlier Losses As Corona Optimism Returns

S&index futures reversed earlier losses as the U.S. House of Representatives passed a $484 billion coronavirus aid package, while China’s central bank cut another policy rate as expected. Sentiment was helped after US Covid-19 infections rose at the slowest pace in three weeks, and the potential easing of lockdowns in Europe.

Europe did not share US enthusiasm and the Stoxx 600 dropped after the region’s leaders failed to agree on a long-term stimulus package and news the Remdesivir coronavirus drug was a flop. Food and beverages was the only gaining industry group to advance after food giant Nestle reported its fastest sales growth since 2015 as consumers loaded up on frozen food. Travel, oil and bank shares led the decline. The banking index led the declines in European stocks after S&P cut Commerzbank’s credit rating by a notch and lowered its outlook for Deutsche Bank to negative from stable.

German’s Ifo Business Climate index plunged in April to 74.3, below the 79.7 expected and down sharply from prev 85.9 previously. The Ifo Expectation print came in at an apocalyptic 69.4 (exp 75.0; R prev 79.5), while the Current Assessment was a bit stronger at Apr: 79.5 (exp 80.5; R prev 92.9).

“It’s a negative session,” said François Savary, chief investment officer at Swiss wealth manager Prime Partners. “The market for the last week has been under consolidation after a strong rally. A lot of good news has already been priced in and news that the number of deaths had increased in the U.S. was also a warning sign for investors.”

In the latest European failure to resolve the coronacrisis, EU leaders agreed on Thursday to build a trillion euro emergency fund to help recover from the coronavirus pandemic, while leaving divisive details until the summer. French President Emmanuel Macron said differences continued between EU governments over whether the fund should be transferring grant money, or simply making loans.

“The risk exists that a concrete decision on the creation of the recovery fund may not occur before September, thereby not being operational before early 2021,” Goldman Sachs European economist Alain Durre wrote in a note.

Earlier in the session, Asian stocks also fell, led by IT and industrials, after rising in the last session. Most markets in the region were down, with Jakarta Composite dropping 2.1% and South Korea’s Kospi Index falling 1.3%, while Australia’s S&P/ASX 200 gained 0.5%. The Topix declined 0.3%, with Legs and Meiji Shipping falling the most. The Shanghai Composite Index retreated 1.1%, with Jumpcan Pharma and Jiangsu Jiangnan High Polymer Fiber posting the biggest slides. There was limited reaction to the Chinese central bank’s partial roll-over of maturing medium-term funding to banks, at a lower interest rate.

The MSCI All Country World Index was down 0.3% and heading for its worst week in three, while MSCI’s broadest index of Asia-Pacific shares outside Japan fell 0.9%.

“The recent price action in global markets has highlighted the fragility of the risk rally in the face of deteriorating global economic data and weak commodity prices,” Valentin Marinov, the head of G10 FX strategy at Credit Agricole CIB in London, wrote in a note to clients. Still, “the recent global monetary and fiscal stimulus measures have put a ‘floor’ under the risky assets,” he said.

On Thursday, the S&P 500 and the Nasdaq turned negative at the close on Thursday in the wake of a report that Gilead Sciences’s antiviral drug remdesivir had failed to help severely ill COVID-19 patients in its first clinical trial. Gilead said the findings were inconclusive because the study conducted in China was terminated early. The markets’ sensitivity to news related to the medical treatment of COVID-19 reflected investors’ desperation for a sign of when the global economy might start returning to normal, said Tim Ghriskey, chief investment strategist at New York-based wealth management firm Inverness Counsel.

“Any piece of bad news is likely to rattle the market,” Ghriskey said. “Investors are keen for a semblance of hope that they can soon crawl out of their homes and get on with some form of normal life, even if with trepidation and fear.

Business activity in the US plumbed record lows in April, mirroring dire figures from Europe and Asia as strict stay-at-home orders crushed production, supply chains and consumer spending, a survey showed. Optimism, however, was boosted after the U.S. House of Representatives on Thursday passed a $484 billion bill to expand federal loans to small businesses and hospitals overwhelmed by patients. President Donald Trump, who has indicated he will sign the bill, said late Thursday he may need to extend social distancing guidelines to early summer.

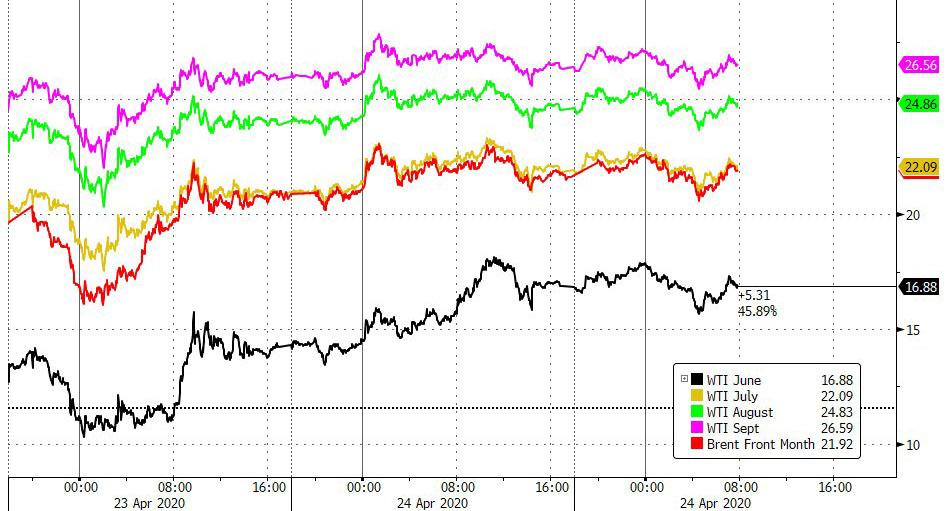

In commodities, retained their recovery from a price collapse this week that pushed U.S. crude futures into negative territory for the first time ever, helped by producers such as Kuwait saying they would move to cut output. Brent crude was up 18 cents, or 0.9%, at $21.51, after jumping 5% on Thursday. U.S. oil was steady at $16.87 a barrel, having surged 20% in the previous session.

But prices were headed for their third weekly loss and the outlook remains dim because global energy demand has evaporated due to business closures and travel curbs aimed at slowing the pandemic. In addition, some countries are running out of space to store the crude oil that they are not using.

In rates, Italian bonds dropped while bunds lead euro-area gains after EU heads fail to agree on how to finance an economic aid package to fight the pandemic. Focus is on S&P’s review of Italy’s rating later Friday, while Germany releases IFO figures. BTP-bund spread widens 12bps to 253bp, below this week’s high at 272bps. Bunds bull flattened, outperform Treasuries by 2bps. Gilts may look to an announcement at 12pm to see if BOE buyback buckets will be changed from the current GBP1.5b per operation, after Thursday’s revised bond remit was increased to GBP180b from May to July.

In FX, dollar reversed an earlier advance to trade flat as risk sentiment improved with stocks recovering ground. The Bloomberg Dollar Spot index was little changed and still set for a weekly gain of 0.9%; U.S. equity futures gained and European stocks pared losses. The euro recovered from dipping to a one-month low vs the dollar to trade up 0.1% at $1.0789; it was still set for a weekly drop of 0.8%. “USD switches between minor losses and minor gains,” said Shaun Osborne, chief FX strategist at Scotiabank, in a client note. “We look for relatively quiet trading on the session but equity trends will continue to shape intraday trading; if U.S. markets pick up, the USD should slide somewhat”

Looking at the day ahead, we get the US preliminary March durable goods orders and non-defence capital goods orders ex air, along with the final April University of Michigan consumer sentiment index. Meanwhile, the Russian central bank will be deciding on interest rates, and earnings releases include Verizon Communications, T-Mobile and American Express.

Market Snapshot

- S&P 500 futures up 0.2% to 2,788.25

- STOXX Europe 600 down 1.3% to 328.93

- MXAP down 0.7% to 141.58

- MXAPJ down 0.9% to 456.34

- Nikkei down 0.9% to 19,262.00

- Topix down 0.3% to 1,421.29

- Hang Seng Index down 0.6% to 23,831.33

- Shanghai Composite down 1.1% to 2,808.53

- Sensex down 1.2% to 31,467.29

- Australia S&P/ASX 200 up 0.5% to 5,242.62

- Kospi down 1.3% to 1,889.01

- German 10Y yield fell 3.9 bps to -0.463%

- Euro down 0.2% to $1.0754

- Italian 10Y yield fell 9.2 bps to 1.81%

- Spanish 10Y yield rose 0.2 bps to 1.051%

- Brent futures down 1.7% to $20.96/bbl

- Gold spot little changed at $1,729.60

- U.S. Dollar Index up 0.3% to 100.71

Top Overnight News

- The U.S. House of Representatives passed a $484 billion package, replenishing funding to aid small businesses and provide support for hospitals and virus testing. U.S. infections rose at the slowest pace in three weeks, and China reported no deaths for a ninth straight day

- German Ifo Insitute’s business confidence dropped to 74.3, more than economists predicted and a record low

- Germany’s sick beds continued to empty, and France and Italy showed progress in slowing the coronavirus spread in a welcome sign for European leaders ahead of further steps to ease lockdowns

- Stress in the commercial paper market is continuing to ease as prime fund inflows accelerate. The funds saw a third straight week of inflows through April 22. Total assets jumped by $19 billion — the most since October 2015 — helping to push rates lower and tighten spreads

- With the Bank of Japan accumulating bonds at a slower pace than its 80 trillion yen ($745 billion) target for years, it has faced criticism for keeping the guideline in its policy statement

- U.K. Prime Minister Boris Johnson plans to return to Downing Street as early as Monday following his bout with Covid-19, the Telegraph newspaper reported

- Treasury Secretary Steven Mnuchin will require public companies deemed critical to national security that seek a share of $17 billion in virus-related relief to offer an equity stake to the government

- China’s central bank rolled over some of the targeted funds due Friday while cutting interest rates on the loans, the latest in a string of measures aimed at ensuring sufficient liquidity. China’s 2020 economic growth is seen sliding below 2% in survey

- Oil continued to claw back losses as attention turned to output cuts in response to the demand hit from coronavirus lockdowns. New York futures for June delivery rose for a fourth day to above $17 a barrel

- New Zealand Finance Minister Grant Robertson has downplayed the prospect of the central bank monetizing government debt, saying its approach to quantitative easing is working

Asian equity markets traded mostly negative following the lacklustre handover from US where the major indices retraced their initial oil-inspired gains as sentiment soured following weak data and with anti-viral hopes dashed by disappointing results for Gilead’s Remdesivir drug in a clinical trial. ASX 200 (+0.5%) and Nikkei 225 (-0.9%) were mixed with energy front-running the gains in Australia after similar outperformance of the sector stateside due to the continued rebound in oil and as state governments are set to begin releasing a list of projects next week to spur the rebound in the domestic economy, while sentiment in Tokyo was subdued as exporters suffered from recent adverse currency flows and ongoing COVID-19 disruptions. Hang Seng (-0.6%) and Shanghai Comp. (-1.0%) conformed to the regional glum amid weak financial earnings from the likes of China Life Insurance and Ping An Insurance, while the PBoC’s CNY 56.1bln 1-Year Targeted Medium-term Lending Facility and respective 20bps rate cut failed to spur upside given that the injection was less than the CNY 267.4bln maturing and with the rate cut inline with the recent similar reductions in the 1-year MLF and PBoC Loan Prime Rate. The biggest losses in the region were seen in the Philippines PSEi (-2.2%) after President Duterte extended the lockdown for the national capital region to May 15th and warned the country was running out of funds which the Finance Secretary suggested was not the case, while India’s NIFTY Index (-1.2%) also slumped with financials pressured following the decision by Franklin Templeton Mutual Fund to wind up six of its credit funds in India. Finally, 10yr JGBs were higher amid the downbeat overnight risk tone and following recent source reports that suggested the BoJ could consider unlimited bond buying at next week’s policy meeting. Furthermore, the BoJ were present in the market today for a total of JPY 180bln of JGBs concentrated in the long to super-long end, while the Chinese 10yr yield also dropped to its lowest in 10yrs as markets had widely anticipated the PBoC’s TMLF actions.

Top Asian News

- China Cuts Another Policy Rate, Replaces Some Maturing Loans

- HSBC Pushes Back Against Claims the Yen Has Lost Haven Status

- BOJ Has Perfect Cover to Ditch 80 Trillion Yen Bond Purchase Aim

- Biotech Firm Akeso Surges 58% on Hong Kong Trading Debut

The downbeat APAC sentiment intensified as European players entered the fray (Euro Stoxx 50 -0.8%), with the failure of EU leaders to agree on a recovery package coupled with the Gilead Remdesivir pessimistic reports prompting an unwinding of recent gains. That being said, US equity futures outperform Europe after the latest coronavirus bill made smooth passage through the House. European bourses see broad-based losses, but have clambered off lows, albeit Spain’s IBEX (-1.3%) sees more pronounced downside after the country’s hopes for a grant and a joint EU debt issuance were dashed out the window at yesterday’s EU Summit. Sectors are in the red with the exception of Consumer Staples (amid Nestle earnings) and feature Energy as the laggard given the pullback in the complex. The breakdown also paints a downbeat picture as Oil & Gas, Banks, Autos, and Travel & Leisure all post losses of over 2%. Nestle’s (+3.0%) numbers see shares on a firmer footing after organic revenue topped estimates, FY20 was maintained and the Co. is exploring options for its Yinlu Peanut Milk and Canned Rice Porridge businesses in China, including a potential sale. The group expects continued improvement in organic sales growth and underlying trading operating profit margin and sees underlying EPS to increase in constant currency. As Nestle carries a 16.3% weighing in the SMI (+0.3%), the Swiss index fares better than its regional peers. Other movers are largely earnings-oriented: Air Liquide (+0.4%), Casino (-0.4%), Saint Gobain (-3.6%) and Sanofi (-0.6%); the latter conforming to the broad losses across health names induced by Gilead (-0.8% pre-mkt), despite a boost to earnings from COVID-19 stockpiling and an increase in Business EPS. Although Italy’s DiaSorin (+2.5%) bucks the trend on the back of its competitor’s failure in the COVID-19 antibody market. Signify (+14.3%) leads the gains the Stoxx 600 after announcing a strong cash position against the backdrop of the pandemic.

Top European News

- Merkel’s Stimulus Vow Sets Up EU Battle for Recovery Funds

- Italy Bonds Slide as EU Inaction Deepens Gloom Before S&P Review

- German Business Confidence Plummets Further as Lockdowns Persist

- Britons Under Lockdown Turn to Alcohol in Record Splurge

In FX, the single currency has pared some losses vs the Dollar after falling to fresh mtd lows and through a key Fib retracement level (1.0757), but remains weak overall following no breakthrough on an EU-wide fiscal recovery fund and yet more evidence of the fallout from COVID-19 via the keenly watched Ifo survey, as all metrics missed consensus and the institute described the mood of German businesses as ‘catastrophic’. Moreover, firms are said to be more pessimistic about the outlook for coming months than ever, while Germany’s IAB Labour Market Research group believes that unemployment could rise in excess of 3 mln this year. However, Eur/Usd is clinging to 1.0760, while Eur/Gbp holds above 0.8700 amidst a pull-back in the Pound from Thursday’s recovery peaks in wake of weak UK retail sales data and a broadly firmer Greenback, in part on the demise of others. Indeed, Cable has tested 1.2300 as the DXY rebounds from post-US jobless claims and Markit PMI lows to notch a new recent high at 100.860, closer to April’s best so far (100.931 on April 6).

- CAD/AUD/NZD/JPY – All softer vs the Buck, but off worst levels as aversion and disappointment over the failure of Gilead’s Remdesivir coronavirus treatment at clinical trial abates. The Loonie is holding the bulk of it’s crude induced momentum on the 1.4000 handle alongside oil, while the Aussie is pivoting 0.6350 after failing to sustain 0.6400+ status yesterday and Kiwi is hovering close to 0.6000. Elsewhere, the Yen has returned to tight confines between 107.75-55 following knee-jerk depreciation on no holds barred BoJ QE with little independent impetus from in line Japanese inflation data overnight.

- SCANDI – Somewhat mixed fortunes for the Crowns, as Eur/Sek maintains a downward bias close to 10.8500 ahead of the Riksbank policy meeting on the grounds that the repo rate looks set rigid regardless of more adverse nCoV contagion highlighted by the Swedish Finance Ministry downgrading its already recessionary assessment of Q2 GDP. Conversely, Eur/Nok is back up near 11.5000 as Stats Norway slashed its 2020 growth forecast with the entire economy already in contraction over Q1.

- EM – Aside from the ongoing vigil for the Rouble in terms of tracking Brent, the looming CBR rate verdict will be in focus along with the post-meeting press conference amidst expectations that the benchmark will be lowered to 5.5% from 6%. Usd/Rub roughly flat in the run up circa 74.6750.

- Mexico Central Bank Governor said will hold usual meeting on May 14th despite this week’s off-schedule cut and central bank will continue to evaluate as well as take actions it deems necessary, while he added the challenge is overcoming the short-term crisis and it will be important to provide liquidity and financing to those that need it as economy gradually returns to normal. (Newswires)

In commodities, WTI and Brent front month futures have yielded their gains seen in the APAC session, with both benchmarks extending losses as the final session of the week goes underway, but the complex has seen a recent pickup in-line with a improving overall risk tone. WTI posted +40% gains over the last two days as geopolitical risk premium pricing was induced by a ramp-up in US-Iranian tensions, while some argue prices were squeezed higher amid liquidation-only restrictions by some brokers. Again, there is little by way of any fresh fundamental developments to support a sustained move higher, but a relief rally may have been due given the recent detrimental losses across the complex. In terms of OPEC, despite reports of Algeria and Kuwait following the lead from Saudi to cut output early, desks believe this will do very little in the short term to offset the surplus in the market. ING analysts believe that “there is more downside risk to prices in the short term.” WTI futures rose to a whisker away from USD 18.00/bbl before receding to a current intraday low at USD 15.64/bbl, whilst its Brent counterpart printed an intraday roof at USD 22.70/bbl and base at USD 20.50/bbl thus far. Elsewhere, spot gold retraces some of its recent gains, but prices remain comfortably above USD 1700/oz at the time writing. The yellow metal is pressured by the rising Buck and sits within a USD 1721-31 intraday band, with much of the session spent at the lower end of this. Copper prices see similar price action amid the overall risk aversion across the market, alongside Dollar woes. The red metal threatens a break below USD 2.3/lb vs. yesterday’s 2.3505/lb high.

US Economic Calendar

- 8:30am: Durable Goods Orders, est. -12.0%, prior 1.2%; Durables Ex Transportation, est. -6.5%, prior -0.6%

- 8:30am: Cap Goods Orders Nondef Ex Air, est. -6.7%, prior -0.9%; Cap Goods Ship Nondef Ex Air, est. -7.0%, prior -0.8%

- 10am: U. of Mich. Sentiment, est. 68, prior 71; Current Conditions, prior 72.4; Expectations, prior 70

DB’s Jim Reid concludes the overnight wrap

European leaders won’t be able to afford a lie down anytime soon as there is still much unfinished business to sort out post the leaders’ summit yesterday. Mark Wall published a blog last night (Link here) on the outcome. While he wasn’t expecting a full agreement on the EU recovery Fund yesterday, the progress was slower than feared. Mark remains confident there will be a Recovery Fund, but beyond that, the size, speed and structure remains undecided and unclear. What is clear is that the key battleground won’t be “joint bonds”. It will be the ratio of grants vs loans. See the note for what has been agreed but with 3-4 weeks now until the EC come up with a proposal, that leaves plenty of time for events to take over here. A notable positive was Conte’s positive reaction though. If activating the ESM is politically viable in Italy it could unlock more unlimited sub 3-year buying of BTPs by the ECB.

During these deliberations, Bloomberg reported that ECB President Lagarde had warned that the Euro Area economy could shrink by 15% this year in an extreme scenario, with her baseline scenario a 9% drop in output. Furthermore, she said that the leaders risked doing too little, too late in terms of their response.

The poor data (woeful PMIs, bad as expected US jobless claims) didn’t stop markets rallying for most of yesterday but the shine was taken off the session with the EU summit failing to agree on an immediate deal and also on news that a virus treatment did not do well in phase 1 trials. Equities earlier got a boost ahead of the summit by reports of Chancellor Merkel saying that the European response must be huge, which initially boosted the Euro before it fell (-0.43%) after the disappointing end to the summit – the fourth straight daily weakening of the currency. Equities peaked just before Europe went home, with the S&P 500 falling from +1.62% to close basically flat at -0.05%. This meant that the S&P 500 did not rise for the 5th Thursday in a row of multi-million jobless claim numbers. The retreat was also potentially on news that Gilead’s antiviral Remdesivir drug did not perform well in its first randomised covid-19 clinical trial. Before the US slip and the summit conclusion the STOXX 600 was up +0.92% with the FTSE MIB +1.45%.

Sovereign debt also had a strong day, with yields on 10yr Treasuries and bunds down by -1.8bps and -1.7bps respectively. Furthermore, European spreads narrowed ahead of the summit, with the gap between Italian (-7.6bps), Spanish (-7.1bps), Portuguese (-6.5bps), and Greek (-20.7bps) yields over bunds all falling, even if they still remained at elevated levels. Oil had a relatively quiet session by the standards set this week. WTI was up +19.74% to 16.50/barrel. Brent Crude was also up by +4.71% at $21.33/barrel, while the Russian Ruble powered forward, seeing its biggest 2-day gain against the US dollar (+3.25%) since December 2016.

While US equities reacted to the failure of a possible covid-19 treatment, we saw some interesting information out of New York State yesterday. The region has been one of the hardest hit in the entire world, with just over 10% of all confirmed cases globally. The state has also been very aggressive in ramping up testing capabilities over the past month. Yesterday, Governor Cuomo announced the results of testing roughly 3,000 people across 19 counties and 40 localities. In this survey, 13.9% of individuals tested positive for antibodies of covid-19. New York City had the highest rate, with 21.2% testing positive. The Governor cautioned that this may not be entirely representative of the state, because the survey was done at grocery stores and other big box stores and therefore was not necessarily fully random. Healthcare workers particularly, could have different and potentially higher rates. Also no one under the age of 18 was tested in this study. Regardless, if the infection rate is closer to 14%, then the number of New Yorkers infected would be near 2.7 million, bringing the overall mortality rate much lower than currently cited and closer to the 0.50% that we highlighted in our pandemic piece yesterday ( link here). This is closer to that of the recent Imperial College London study we mentioned which projected this kind of fatality rate if the virus were allowed to spread unmitigated. Many epidemiologists had cited a likely mortality rates of 0.5%-1% by the time the virus has run through, but seeing evidence of this sort of number may be encouraging to those that fear it’s far higher. Still a lot of studies and testing to back this up though.

Staying with the US, Treasury Secretary Steven Mnuchin said overnight that he is considering the creation of a government lending program for US oil companies following the huge decline in the price of oil. Mnuchin said that “investment-grade companies will be able to either access the normal capital markets or will be able to access the Fed’s investment-grade facility. That’s the priority” but for companies that aren’t IG, Mnuchin said that he is discussing “alternative structures with banks.” Bloomberg has reported that the program will run out of the Fed while the administration is also considering taking financial stakes in exchange for some loans, and some firms might be asked to reduce production. Separately, the Treasury Department said, in the 10-page loan application posted on its website overnight that public companies deemed critical to national security that seek a share of $17bn in virus-related relief may be required to offer an equity stake to the government while for private companies the department “may, at its discretion, accept senior debt instruments” or other financial interests.

A quick refresh of our screens show that most Asian markets are trading lower this morning with the Nikkei (-0.66%), Hang Seng (-0.28%), Shanghai Comp (-0.63%) and Kospi (-1.04%) all down. Elsewhere, futures on the S&P 500 are down -0.54% while June WTI oil prices are up a further +7.82% this morning to $17.80. In other news, the Nikkei reported that BoJ policy makers are likely to discuss unlimited JGB purchases at their meeting on Monday. The report has also added that the BoJ would double targets for purchases of commercial paper and corporate bonds at the meeting.

Onto the data and we got another truly dire set of PMI releases yesterday, especially in Europe with the indicators once again falling right across the board. As we have discussed, because it’s a diffusion index it will always look even more extreme on the down and upside in circumstance like this. In fact we could get a PMI in the 70s or 80s at some point this year without activity being anything close back to normal.

However for completeness, the Euro Area composite PMI fell to a record low of 13.5 (vs. 25.0 expected), with the services reading at 11.7 (vs. 22.8 expected) also at a record low. The manufacturing PMI was relatively stronger at 33.6 (vs. 38.0 expected), since it’s services sectors like hospitality and restaurants that have been the biggest victim of compulsory shutdowns, but it was still deep in contractionary territory and at its own lowest level since February 2009. The country-by-country breakdown didn’t provide much respite, with the composite PMIs in Germany (17.1), France (11.2) and the UK (12.9) all falling to record lows as well. The US composite PMI was “only” as bad as 27.4 however, suggesting that for now their economy has managed to hold up slightly better than their European counterparts with shutdowns less widespread.

Against this backdrop, the initial weekly jobless claims fell to 4.427m in the week up to April 18, slightly below the expected 4.5m reading and down from the revised 5.237m the previous month. If you’re looking for the bright spot amidst the gloom, this was actually the 3rd consecutive week that the number of claims has declined, down from its peak of 6.867m, so a sign that perhaps we’re past the most rapid period of job losses. Nevertheless, this brings the total number of claims over the last 5 weeks to a cumulative 26.453m, which compares to peak nonfarm employment back in February of 152.5m. So it’s looking likely that unemployment could get close to 20% when released on May 8th.

Wrapping up with the other data releases now. In France, the INSEE’s business climate composite indicator fell to 62 in April, its lowest level since the start of the series in 1980. Meanwhile, in Germany, the GfK’s consumer confidence reading for May fell to an all-time low of -23.4. Finally in the US, new home sales in March fell to an annual rate of 627k, with the -15.4% monthly decline being the largest since July 2013.

To the day ahead now, where the data releases include UK retail sales for March, Germany’s Ifo business climate indicator for April, the US preliminary March durable goods orders and non-defence capital goods orders ex air, along with the final April University of Michigan consumer sentiment index. Meanwhile, the Russian central bank will be deciding on interest rates, and earnings releases include Verizon Communications, T-Mobile and American Express.

Tyler Durden

Fri, 04/24/2020 – 08:22