Boeing Burns Through A Record $4.7BN In Cash As Revenue Crashes 26%, Will Fire 10% Of Workers

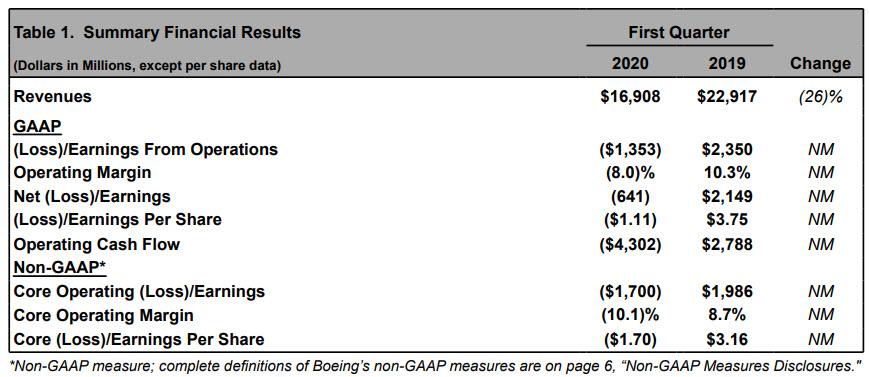

The hits just keep on coming for Boeing which last quarter was slammed with the continued grounding of the 737 MAX and now had to contend with the collapse in airline travel due to the coronavirus. As a result, moments ago Boeing reported another dismal earnings report with the following highlights:

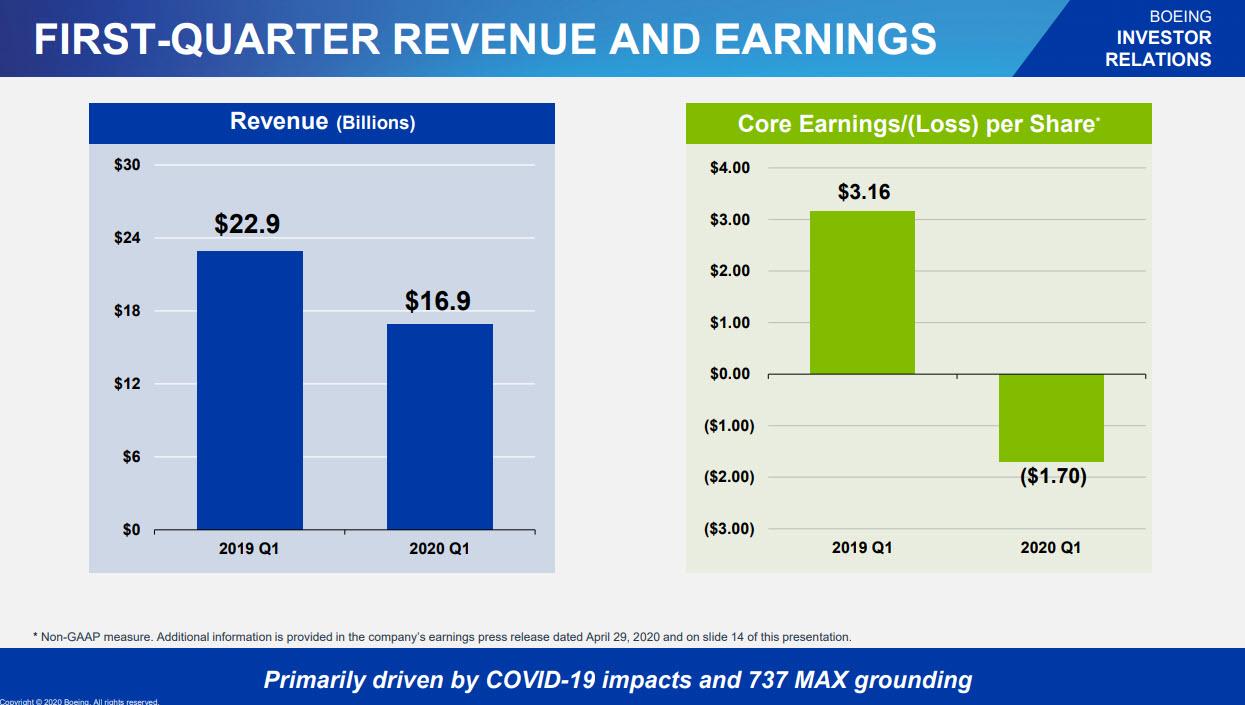

- Q1 Revenue of $16.9BN, exp. $17.3BN, and down 26% Y/Y

- Q1 EPS Loss of ($1.70), exp. ($1.61) and down from a profit of $3.16 year ago

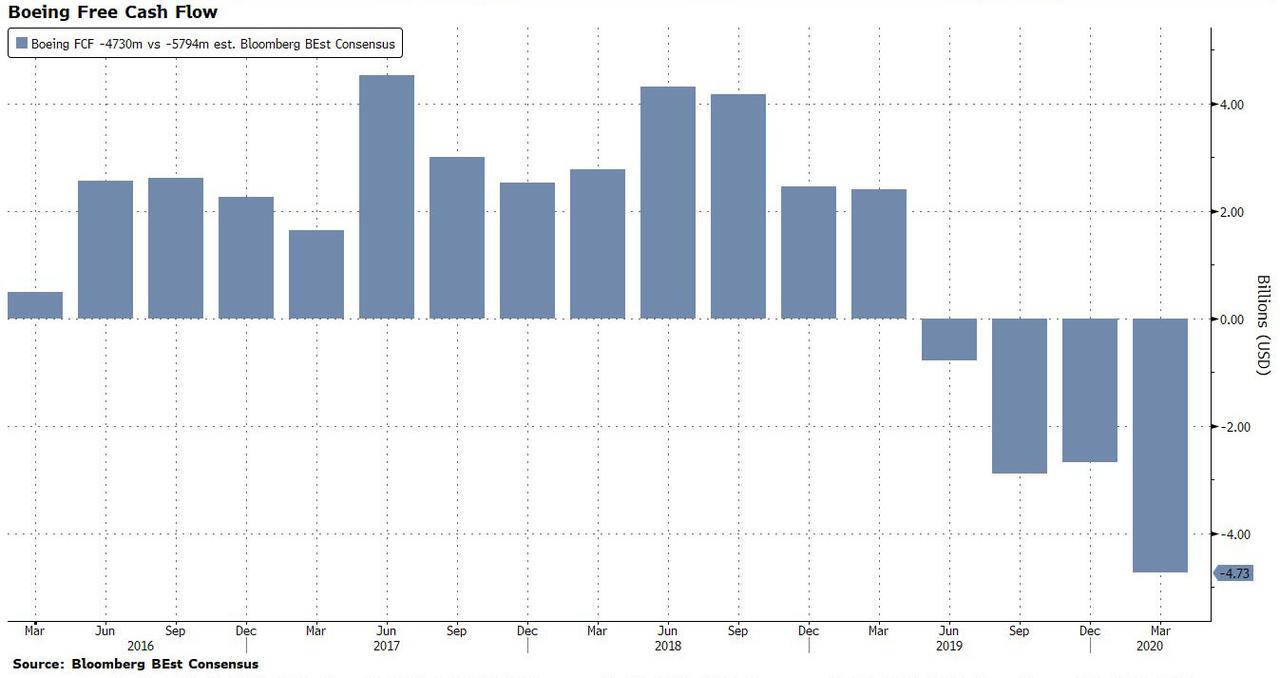

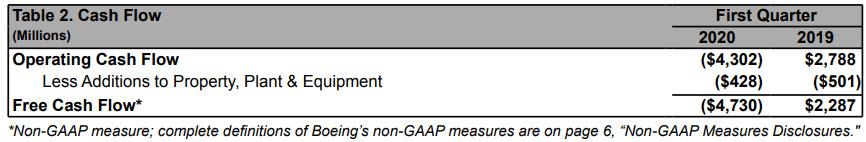

- Q1 Operating Cash Burn ($4.3BN) vs positive cash flow of $2.8BN year ago; total free cash flow was a record negative ($4.7BN)

- Q1 Core operating margin of (10.1%) vs 8.7% year ago

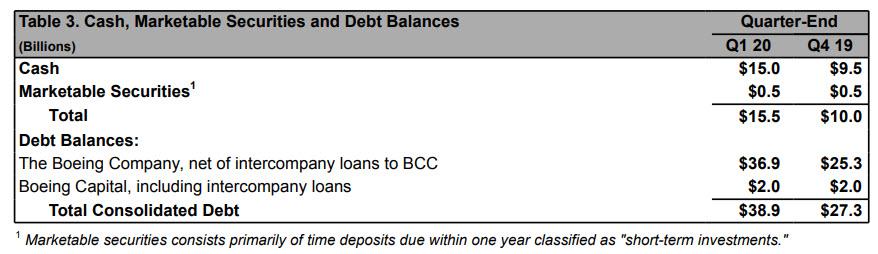

- Q1 Cash and marketable securities of $15.5BN

- Exploring All Options for Additional Liquidity

Of the above, the most notable was the record $4.7 BN in free burn.

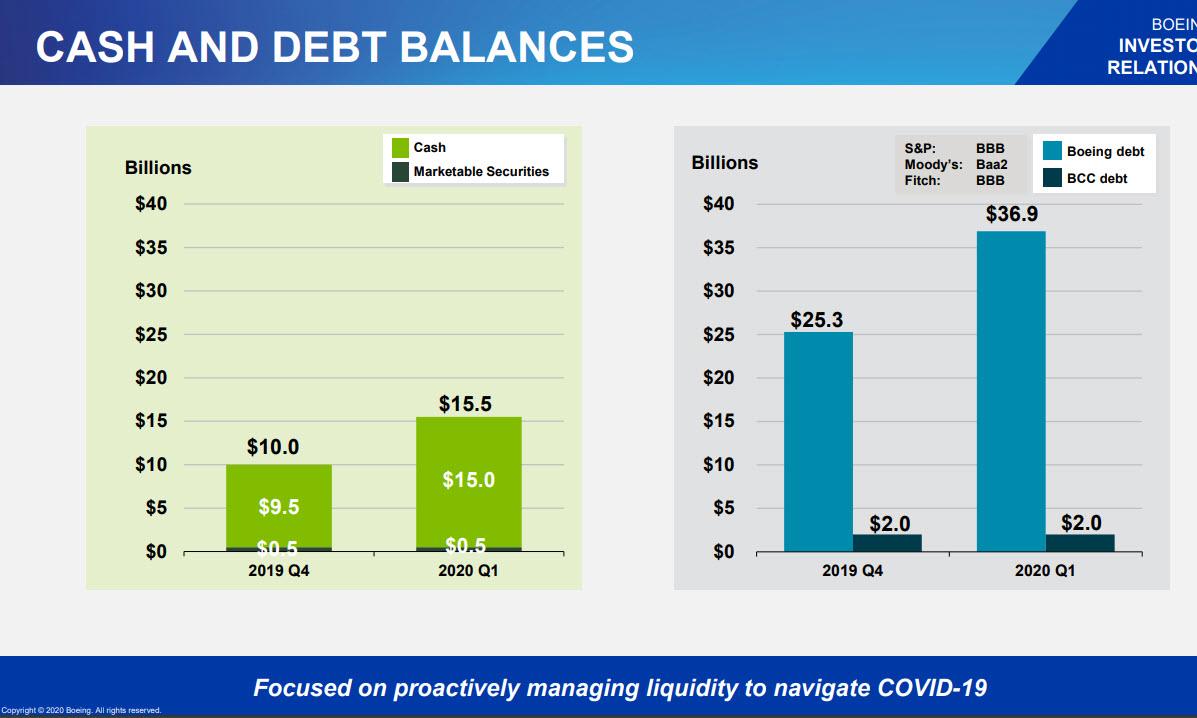

As one would expect, Boeing was quick to flag that “financial results significantly impacted by COVID-19 and the 737 MAX grounding”, something it did in the very first line of its earnings release. As a result, the company is planning to reduce commercial airplane production rates as a result of the pandemic hitting air traffic.

“The COVID-19 pandemic is affecting every aspect of our business, including airline customer demand, production continuity and supply chain stability,” said Boeing President and CEO David Calhoun. “Our primary focus is the health and safety of our people and communities while we take tough but necessary action to navigate this unprecedented health crisis and adapt for a changed marketplace.”

Additionally, Boeing sent out a separate letter to employees just as it reported earnings. CEO Dave Calhoun said the company is targeting a 10% cut through voluntary layoffs, natural turnover and “involuntary layoffs as necessary.” The reduction will be even deeper – with a 15% employment drop – at the company’s jetliner and services units, as well as in its corporate functions operation.

In his message to employees, Calhoun calls the news on job cuts “a blow during an already challenging time.” He goes on to say, “I regret the impact this will have on many of you. I sincerely wish there were some other way.” As a bright spot, he also points to Boeing’s defense and space businesses, which will provide a measure of stability while the jetliner market collapses.

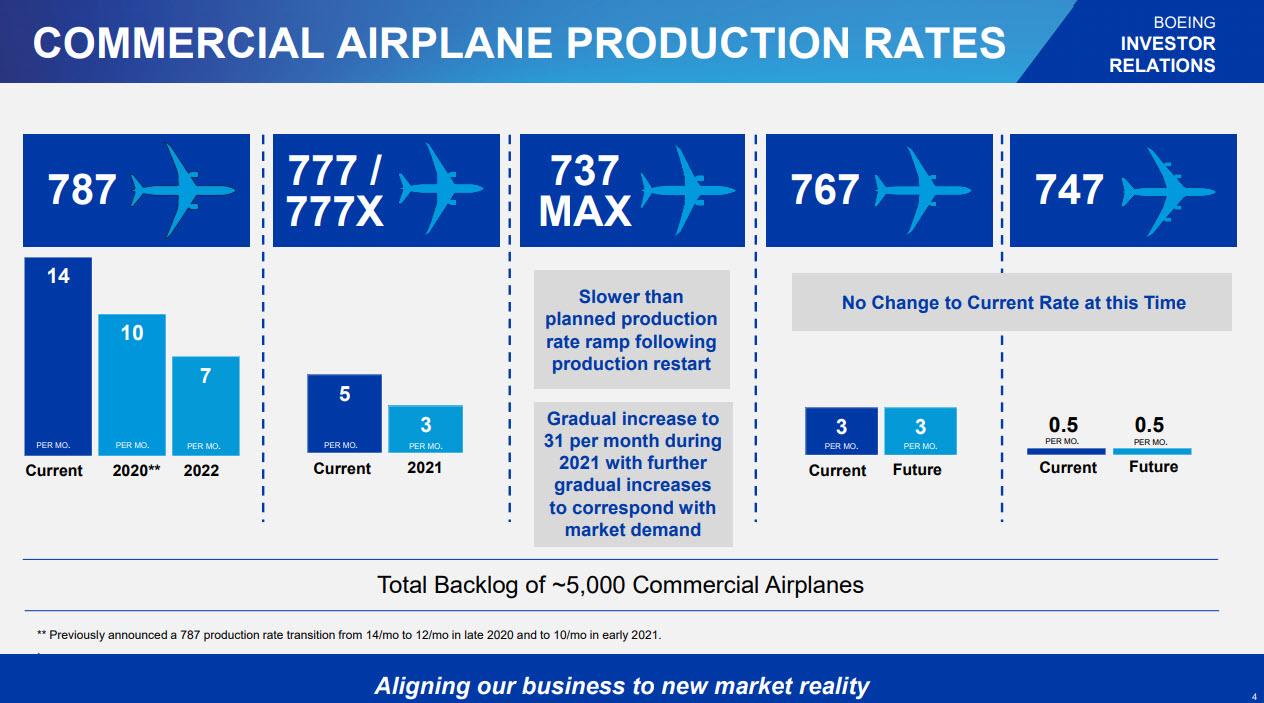

As the pandemic continues to reduce airline passenger traffic, Boeing saw significant impact on the demand for new commercial airplanes and services, with airlines delaying purchases for new jets, slowing delivery schedules and deferring elective maintenance. To align the business for the new market reality, Boeing is taking several actions that include reducing commercial airplane production rates. The company also announced a leadership and organizational restructuring to streamline roles and responsibilities, and plans to reduce overall staffing levels with a voluntary layoff program and additional workforce actions as necessary.

“While COVID-19 is adding unprecedented pressure to our business, we remain confident in our long term future,” said Calhoun. “We continue to support our defense customers in their critical national security missions. We are progressing toward the safe return to service of the 737 MAX, and we are driving safety, quality and operational excellence into all that we do every day. Air travel has always been resilient, our portfolio of products and technology is well positioned, and we are confident we will emerge from the crisis and thrive again as a leader of our industry.”

Boeing said the slower-than-expected ramp-up of the 737 Max will add about $1 billion to so-called “abnormal” costs that the company booked for shutting down and restarting production. It now expects to report $5 billion in those costs.

- Other commercial charges include:

- $797 million in abnormal Max costs

- $137 million for virus-related factory closings

- $336 million for 737 picklefork repairs

A look at commercial airplane production rates from the presentation slides:

With attention focusing on Boeing’s liquidity, the company reported that operating cash flow was ($4.3) billion in the quarter, primarily reflecting the impact of the 737 MAX grounding and COVID-19, as well as timing of receipts and expenditures. Adding $428MM in capex, total cash flow was a negative record $4.7BN…

… resulting in $15.5BN in cash and marketable securities, as total debt soared to a new record high of $38.9BN.

The company remains investment grade at Baa2/BBB but one wonders how much longer.

The company provided the following details related to the continued grounding of the 737MAX

- Progressing Toward Safe Return to Service of 737 Max

- 787 Production Rate Cut to 10 Per Month in 2020

- 787 Production Rate Reduced to 7 Per Month by 2022

- $797M Abnormal Prod. Costs 1Q From 737 Max Suspension

- 737 Max Production Will Resume at Low Rates in 2020

- Boeing to Gradually Boost 737 Max to 31 Per Month During 2021

- Estimated Abnormal Costs 737 Max Have Increased ~$1B

- Est. Total Abnormal Prod Costs From Max Suspension ~$5B

Of note: baked into the Boeing’s results is the assumption that the “timing of 737 Max regulatory approvals will enable deliveries to resume during 3Q20,” the company says in its earnings slides. Boeing has been waiting for regulators to complete their review of redesigned software systems and lift a flying ban imposed on the Max in March 2019 after two fatal crashes.

Commenting on the results, Bloomberg Intelligence Senior analyst George Ferguson notes that “Boeing’s liquidity will be improved by the termination of its joint venture with Embraer, which eliminates a $4.2 billion payment to acquire 80% of the E-Jet franchise.” But was it a missed opportunity?: “The price would likely have been materially lower today due to a dramatic decline in air travel.”

Despite missing across the board, and reporting a record cash burn, investors for some inexplicable reason – perhaps because it means more government grants – like what they see as Boeing moves to shrink its operations to contend with crumbling demand for its commercial planes. The shares are up 4.8% to $137.55 ahead of regular trading. By way of context, Boeing has plunged 60% this year — the biggest drop on the Dow Jones Industrial Average.

Tyler Durden

Wed, 04/29/2020 – 08:21